Crude oil, natural gas and other energy-sector commodity markets are notorious for their volatility.

In the first six months of 2017 alone, West Texas Intermediate Crude, the U.S. benchmark, plunged another 14.3%. That brings oil’s bear market decline to a whopping 76.2% since the peak in mid-2014. Ouch!

Natural gas has performed even worse so far this year. It plunged 10.7% on the very first trading day of 2017, and never looked back, down a jaw-dropping 18.5% year-to-date, as of June 30th.

What can you expect from cyclical markets that are so hyper-sensitive to economic data, geopolitical events and so many other “headline” risks?

Energy stocks have been shellacked as well. The S&P 500 Energy Sector Index is down 13.8% year to date, by far the worst-performing sector in the blue-chip index.

No fewer than 224 oil and gas producers, and oil field service companies went belly-up in 2015 and 2016. These companies owed investors and creditors $93 billion in combined debt.

In short, the energy sector is a mess right now.

If you believe the naysayers, energy stocks are on death’s doorstep, with more bankruptcies looming industry wide. In fact, some reports claim the U.S. has lost 200,000 oil and gas jobs since the peak in 2014.

Yes, the energy sector, perhaps more than any other commodity, is subject to thrilling bull-market rallies, and chilling bear-market declines. But don’t lose sight of the fact that energy is also a long-term growth industry.

Most investors wouldn’t touch energy stocks with a ten-foot pole today. But that’s precisely the best time to buy this cyclical sector. That’s because when the stars align — as they have recently for energy — it’s a recipe for huge potential profits with little risk, for two important reasons…

Reason #1: Right now, it is dead, low tide for the energy sector. Oil, natural gas and energy stocks are all at a cycle low point and poised to turn higher again. It’s just a matter of time.

Reason #2: At the exact same time, powerful demographic forces are at work that make the energy sector a bullish growth story for many years to come.

Combined, that’s a dynamic one-two punch that tells me to expect a major upside move in energy. Let me explain…

For a start, the demographic growth that will propel energy much higher longer term is a big story. So, I’ll cover that in detail in just a few minutes.

Right now, the more immediate reason why energy is poised for a bullish change of trend has everything to do with the point we are at in this cycle. So, let’s take a closer look at this factor first.

As I mentioned above, the highly cyclical nature of commodity markets in general, especially energy, leads to regular boom and bust cycles in oil, natural gas, and energy stocks.

These sharp reversals of fortune, both up and down, occur so regularly in the energy sector that you can practically set your watch by them.

Ever since oil prices peaked at $123-a-barrel in 2014, we’ve seen them decline steadily. Picture a clock reading high noon. That was 2014. Today we’re at the six-o’clock-low position on the clock and about to turn up again.

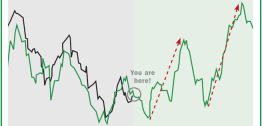

You can see what I mean in this E-Wave cycle chart of oil …

As you can see above, there is a cycle-low turn-date forecast in late July for crude, followed by a substantial rally into late August. Then after a brief pullback in September, expect oil to surge higher again into October.

A two-step rally that should propel oil, and energy stocks, substantially higher in the months ahead.

In addition to the intensive cycle analysis that he pioneered, my friend and colleague, Larry Edelson, who founded the Real Wealth Report was also a keen student of history.

Larry always insisted on searching for confirmation of his cycle-forecast trends both with his unique brand of technical analysis and with extensive historical validation.

Looking at historical seasonal patterns in markets can be especially useful at key turning points like right now. And sure enough, confirming our E-Wave cycle analysis, the seasonal pattern for oil is moving into a bullish phase over the next several months.

Over the past 30 years, crude oil has typically trended higher in the last summer months, typically making its seasonal price high in early October, right on cue with our current E-Wave cycle forecast.

Over the past 15 years, the seasonal peak in crude prices has come a bit earlier on the calendar, in late August. But oil still has a strong tendency to reach seasonal highs again in October. So right now, we’re just coming into the seasonal sweet-spot for light-sweet crude!

Now, let me brief you on the second reason why energy is poised for a major comeback: Demographics — which equals growing demand for oil in the developing world for many years to come.

In spite of today’s depressed prices, the global supply-demand balance for oil is pretty tight, without much margin for error. Current global oil production is about 98.5 million-barrels-a-day, while demand equals about 97 million barrels. But in the next few years, oil demand is going to absolutely skyrocket. Here’s why …

Today, the U.S. is the largest consumer of oil on the planet. We use about 20 million-barrels-per-day. Europe is the second largest at roughly 15 million-barrels-a-day. Meanwhile, China, the world’s second-largest economy, is in third place at just 12.8 million-barrels-per-day. And India consumes just over 4 million-barrels-a-day.

The thing is, both China and India have massive populations — China’s is five-times the size of the U.S. population — yet they still consume far less oil today. That’s about to change in a big way due to the much faster-growing, upwardly mobile middle-class population in China and India, not to mention the rest of the emerging world.

In fact, a recent report from the U.S. Energy Information Administration (above) projects petroleum demand in China to increase by 14.2% by the end of next year. That’s more than twice the growth rate in the U.S. (6%). And India’s petroleum consumption will skyrocket by 32% — that’s FIVE-times domestic growth, a staggering pace.

And it’s easy to see what’s driving increased energy demand in China and India: Demographics — specifically, a fast-growing middle class with an insatiable thirst for oil to power their cars, scooters, power plants, factories and stores.

By 2020, China will be the No.1 middle-class consumer, with $4.5 trillion in purchasing power, pulling ahead of the U.S. India will be No. 3 on the list, at $3.7 trillion. Think about that for a moment: In just over ten years, China’s middle-class buying power rose five-fold, while U.S. consumption was pretty much stagnant. What’s powering the rise in consumer spending in China is skyrocketing income growth. China’s urban household income will double by 2022, from its 2012 level.

India’s middle-class growth story is even more upbeat than China. India had roughly 50 million people in the middle-class demographic bracket in 2015, accounting for just 5% of its population. But India’s middle class will accelerate rapidly in the years ahead, growing to 475 million by 2030, adding more people than even China to the ranks of the global middle class.

By 2030, India’s middle class consumption should overtake both China and the U.S., with $12.8 trillion in spending!

Bottom line: India and China’s combined population is 2.7 billion, compared with 250 million in the U.S. What do you think will happen to the price of oil when nearly 3 billion people begin to consume energy at the same rate as in developed economies like the U.S.?

Energy demand goes through the roof benefiting nearly every energy producer, not just oil, but everything from nuclear and natural gas to solar- and wind-power producers.

It’s a bullish long-term growth story for energy, in spite of today’s depressed prices.

Here are two ways to take advantage: One an undervalued large-cap energy company, and another more speculative play tied to the innovative U.S. fracking industry.

First, EQT Corp. (EQT) is an integrated energy company focused on exploration, production and transmission of natural gas. EQT has estimated proved reserves of 13.5 trillion cubic foot equivalent.

Their oil and gas wells have comparatively low rates of annual decline in production, low production costs per well, high energy content and small maintenance costs.

This means EQT has tremendous upside leverage when oil and gas prices do turn decisively higher again — these shares will soar!

I recommend you buy shares of EQT with 5% of your Basic Survival Strategies funds at the market.

Second, a hat-tip to my friend and colleague JR Crooks for doing excellent research on this speculative stock with huge upside potential: Hi-Crush Partners LP (HCLP).

Sand is propping up the oil industry. Literally.

There is a small handful of companies that mine silica sand, which is in very high demand by U.S. oil producers to fracture and prop open shale oil deposits.

HCLP is uniquely positioned to benefit from the hottest area in global oil production: U.S. shale. The fundamentals for “frac sand” are hugely encouraging.

Rising U.S. oil-rig counts suggests new (or renewed) demand for sand.

Rising U.S. oil-rig counts suggests new (or renewed) demand for sand.

Hi-Crush acquired a sand reserve “on location” in the America’s Permian oil basin where sand consumption is growing fastest.

Hi-Crush acquired a sand reserve “on location” in the America’s Permian oil basin where sand consumption is growing fastest.

Sand prices are rising as demand outstrips supply, set to surpass the previous annual demand record from 2014.

Sand prices are rising as demand outstrips supply, set to surpass the previous annual demand record from 2014.

Frackers are using more sand per well, in some cases double or triple the levels of recent years.

Frackers are using more sand per well, in some cases double or triple the levels of recent years.

Shares of Hi-Crush were beaten down along with the oil sector despite a business that’s only going to grow in importance. Industry trends are already turning up again, and HCLP shares are poised to soar. In fact, these shares have the potential to double before 2017 is over.

That’s why I recommend you buy shares of HCLP with 5% of your Speculator funds at the market.

Basic Survival Strategies

In addition to adding shares of EQT, here is an update on your existing positions …

FIRST, continue to hold your physical gold as recommended. If anything changes, or I decide you should hedge your current holdings, rest assured I will notify you immediately in Real Wealth, or via a Flash Alert if necessary.

Continue to hold your …

- Core Gold Bullion (GOLDS), up 215.6% since originally recommended

- SPDR Gold Shares (GLD), up 173.5% since our initial recommendation.

- The Tocqueville Gold Fund (TGLDX), up 16.8%.

SECOND, hold your Platinum Bullion (XPT) and Palladium Bullion (XPD), which should be very minor in holdings.

I will be looking to add to both the platinum and palladium bullion positions very soon, but wait for my signal.

THIRD, for spot silver: You should have 5% of your Basic Survival Strategies funds invested in Silver Bullion (XAG). Hold. I will let you know when to add-to, or hedge the position if need be.

FOURTH, regrettably you should have been stopped out of your Yamana Gold Inc. (AUY) position, when it hit my recommended protective sell-stop at $2.34 recently. That stinks — but that is what stops are for, to limit the risk. I recommended that you stand aside for now, I will let you know when it’s a good time to get back into AUY.

In the meantime, add shares of this high-quality miner …

NEW RECOMMENDATION: Using 3% of your Basic Survival Strategies funds buy Hecla Mining Co., symbol HL, at the market. When filled, place a good-till-canceled sell-stop at $4.48.

Also, continue holding …

Your shares in IAMGOLD Corp. (IAG) with a good-till-canceled sell-stop at $3.05.

If you’re not on board already, for whatever reason, use 3% of your capital allocated to Basic Survival Strategies to buy IAMGOLD Corp., symbol IAG, at the market. Place a good-till-canceled sell-stop at $3.05.

Your shares in Wheaton Precious Metals Corp. (WPM) with a good-till-canceled sell-stop at $18.40.

If you don’t own it, for whatever reason, use 3% of your capital allocated to Basic Survival Strategies to buy Wheaton Precious Metals Corp., symbol WPM, at the market. Place a good-till-canceled sell-stop at $18.40.

Your shares in Goldcorp Inc. (GG) with a good-till-canceled sell-stop at $11.49.

If you don’t own these shares, for whatever reason, use 3% of your capital allocated to Basic Survival Strategies to buy Goldcorp Inc., symbol GG, at the market. Place a good-till-canceled sell-stop at $11.49.

Your shares in Kinross Gold Corp. (KGC) with a good-till-canceled protective sell-stop at $2.25.

If you’re not on board already, for whatever reason, use 3% of your capital allocated to Basic Survival Strategies to buy Kinross Gold Corp., symbol KGC, at the market. Place a good-till-canceled sell-stop at $2.25.

I’ll be looking to add to these positions soon, but for now, be patient. Our time to load up on more miners is fast approaching.

FIFTH, last month I recommended that you add three new high-quality non-gold-focused mining stocks to our holdings in the Basic Survival Strategies portfolio.

Keep holding your shares in Freeport-McMoRan Inc. (FCX) with a good-till-canceled sell-stop at $9.20.

If you’re not on board already, for whatever reason, use 5% of your capital allocated to Basic Survival Strategies to buy Freeport-McMoRan Inc., symbol FCX, at the market. When filled, place a good-till-canceled sell-stop at $9.20.

Keep holding your shares in Cameco Corp. (CCJ) with a good-till-canceled sell-stop at $7.35.

If you don’t own it, for whatever reason, use 5% of your capital allocated to Basic Survival Strategies to buy Cameco Corp., symbol CCJ, at the market. When filled, place a good-till-canceled sell-stop at $7.35.

Keep holding your shares in Sibanye Gold Ltd. (SBGL) with a good-till-canceled sell-stop at $4.05.

If you don’t own it, for whatever reason, use 5% of your capital allocated to Basic Survival Strategies to buy Sibanye Gold Ltd., symbol SBGL, at the market. When filled, place a good-till-canceled sell-stop at $4.05.

SIXTH, keep holding your shares in Vantiv Inc. (VNTV) with a good-till-canceled sell-stop at $49.74.

Earlier this month, VNTV agreed to buy Britain’s Worldpay for $10 billion. The combination would create a payments-processing giant with a market cap of over $20 billion. The acquisition of gives VNTV much needed international e-commerce exposure.

If you’re not on board already, for whatever reason, use 3% of your capital allocated to Basic Survival Strategies to buy Vantiv Inc., symbol VNTV, at the market. Place a good-till-canceled sell-stop at $49.74.

SEVENTH, keep holding your shares in Textron Inc. (TXT) with a good-till-canceled sell-stop at $42.68.

If you’re not on board already, for whatever reason, using 3% of your capital allocated to Basic Survival Strategies to buy Textron Inc., symbol TXT, at the market. Place a good-till-canceled sell-stop at $42.68.