The Mosaic Company (MOS) produces and markets concentrated phosphate and potash crop nutrients worldwide. They operate through three segments: Phosphates, Potash and International Distribution.

The best part: Mosaic benefits from the latest turnaround in many agricultural commodities.

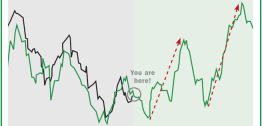

While MOS struggles against falling Potash and Phosphate pricing, it’s become leaner and better positioned to profit from improving conditions and an upswing in demand.

In fact, CEO James O’Rourke recently noted that …

Realized product prices are rising and demand remained strong.

China is in the process of restructuring its industry.

Sees margin improvements in their phosphate business ahead.

Here’s what I recommend …

Using 5% of the funds you have allocated to the Materials, Energy and Ags section, buy Mosaic Company, symbol MOS, at the market. When filled, place a good-till-canceled protective sell-stop at $18.35.

Meanwhile, your position in Range Resources (RRC) is bottoming just above stiff support at the $21 area. But more upside is on the way as weather in key U.S. demand areas turns hotter. And the increased air-conditioning use is worthy of boosting power-generation demand for natural gas. Continue to hold.

Finally, your position in PowerShares DB Agriculture Fund (DBA) is appreciating, aided by a surge in grain markets. This sector holds a 36% weighting in DBA and is expected to push higher as it contends with extreme hot and dry conditions in key Northern Hemisphere growing areas.

And crop conditions are deteriorating. In early July, USDA weekly crop conditions for corn and soybeans fell to a five-year low. Wheat is even worse, with the spring wheat crop experiencing the poorest quality since 1988.

Meanwhile, soft commodities represent 39% of DBA and appear to be the next sector to follow grains higher. Supporting this view is near record net-short money manager positions in coffee and sugar, which leaves these markets increasingly vulnerable to explosive short-covering rallies.

And the fundamentals are improving, with industry forecasts calling for a drop in Brazil’s coffee production and talk that the surplus in sugar might not be as large as expected.

Hold for more upside!