You should be filled on last month’s recommendation to buy more shares of Gamco Global Gold Natural Resources & Income Trust (GGN). Nice!

Sure, GGN drifted lower in late-June. But it’s since bounced from stiff support at the $5.40 area. That’s a very bullish sign pointing to further capital appreciation directly ahead. Additionally, GGN currently sports a yield of 10.7%.

Turning to black gold…

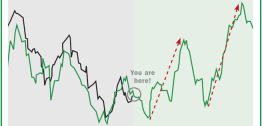

Oil sold off into an intermediate bottom on June 21. Since then, the market is showing signs of a meaningful turn higher back toward the $50 area.

And to take advantage of the lower pricing, as well as the excessively negative sentiment in the oil market, I recommend buying Alerian MLP ETF (AMLP).

This MLP is like GGN: It offers a healthy yield and doesn’t issue annoying K-1 tax forms. Plus, AMLP offers diversification and greater exposure to pipelines — a key source of revenue.

While there’s some concern that the June swoon in oil may resemble the early 2016 washout, the U.S. oil industry has since undergone significant changes. Consider:

Resilience of U.S. shale industry to ramp up production in the face of lower prices.

Stronger corporate balance sheets, with less debt and a lower cost of capital.

Industry more competitive in lower oil-priced world, with greater economies of scale and better distribution channels.

And for these reasons, purchasing AMLP offers potential for both dividend income and capital appreciation.

My recommendation:

Using 5% of the funds you have allocated to the Income Investments section, buy Alerian MLP ETF, symbol AMLP, at the market. I will monitor the risk for you, via a mental stop that I will hold.

Finally, your position in Westlake Chemical Partners LP (WLKP) is showing open gains of 24.3%. This comes at the same time it’s throwing off a hefty 5.7% dividend — 2.5 times greater than U.S. 10-Year Notes.

WLKP releases second-quarter earnings in early August. Forecasts are for earnings-per-share of $0.40, which is up 3.6% from the year-ago quarter, while revenues are anticipated to be up a whopping 69% to $356 million.