Oh, humbled are the mighty. AT&T (T) is the original king of U.S. telecommunications. But now it is fending off competitors on all sides. And it took a tumble after the latest earnings report. Ouch!

Now, it’s lying, battered and bruised, in the gutter. We aren’t buying AT&T for its price action. We are buying AT&T for its income stream. It pays a sweet dividend — which, at nearly 6%, at an incredible bargain.

What’s more, this company has a 25-year history of raising its dividend. How sweet that is.

Sure, the last quarter wasn’t good. But AT&T’s total revenue increased from $127 billion in 2012 to $167 billion in 2016. Indeed, it’s the largest U.S. telecommunications firm by total revenues.

Operating expenses declined from 46.47% to 38.19%, and net income rose from 5.7% to 7.92%. Best of all, net income from continuing operations was up from 5.92% to 8.14% over the same time period.

So why is the stock so low? The company lost 89,000 video subscribers in the last year. This can be confusing because AT&T has satellite TV customers (251,000 ended their subscriptions), U-Verse TV (a loss of 134,000 customers) and DirecTV NOW (an increase of 296,000 subscribers).

It’s apparent people are swapping around and finding the service that suits them.

Importantly, AT&T has successfully raised prices for its linear TV services to maintain slight revenue growth.

AT&T is also working on a merger with Time Warner. Some anti-trust worries have been raised. But I can’t see the Trump White House giving this deal a thumbs-down.

Then there’s the dividend. It was recently at 5.96%. It’s projected to grow 2% per year for the next three years. Importantly, AT&T has the cash flow to cover its dividend.

So, you’re getting a strong stock with a giant and growing dividend. It has some problems, but nothing that can’t be overcome with time. And this company was founded in 1882. Time is definitely on its side.

Here’s my recommendation:

Using 5% of your funds allocated to the income section, buy AT&T (NYSE: T) at the market, to open. When filled, place a 25% good-till canceled stop.

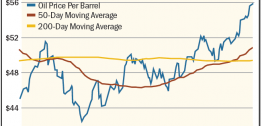

In the meantime, keep holding your Buckeye Partners LP (BPL) … Westlake Chemical Partners LP (WLKP) … GAMCO (GGN) … Goldman Sachs MLP and Energy Renaissance Fund (GER) … and Alerian MLP ETF (AMLP).