|

|

Inside … STUNNING PREDICTIONS FOR 2017-2022

|

Less than six weeks from today, the strongest historic cycles known to science will converge, forming a giant supercycle.

It will happen at the end of October 2017. It will bring together four massive financial cycles with the rising cycle of war. And it will have enormous power.

When cycles like these came together in the early 1930s, the world was plunged into a Great Depression that lasted more than a decade.

This time around, they will trigger the end of one major epoch in human history … and the beginning of a terrifying (and enormously profitable) new one.

The age we have all known all our lives — an era in which governments amassed $275 trillion in debts and obligations — is about to end. And a new era — the age in which all of us pay the price for our leaders’ reckless spending schemes and the obscene debts — is about to begin.

We will witness the collapse of the societies, currencies and investment markets that have been built on those debts. Everything about how you earn, spend, save, and invest your money — and about how you live your life — will be altered forever.

This is your moment of truth.

What you do in the next few minutes, hours and days could determine your financial destiny for the rest of your life. This forecast is clear and unhedged: We are in for five years of chaos in the global economy, turmoil in world markets, and spreading conflicts — all of which will impact our investments and personal lives.

As this supercycle courses through the world in the months ahead, the lenders and investors that governments count on for loans will snap their wallets shut.

Smart investors are already reading the handwriting on the wall: The clouds of war are turning darker. And even if a single shot is never fired, governments are getting set to ramp up their defense spending like never before. Bloated budget deficits will be bloated even more.

But government debt is already simply too massive. It can never be repaid. It would be financial suicide for investors to continue loaning their money to Tokyo, London or Washington; insane to throw good money after bad. And so, governments — including our own — will simply run out of lenders, and then … run out of money.

More than 39 million government employees and contractors of the most indebted governments of the world will find that their paychecks have been postponed or cancelled altogether.

Over 300 million more worldwide who depend on government retirement plans like Social Security and health programs like Obamacare will awaken to the same disturbing reality.

And hundreds of millions across the globe who count on welfare, food assistance and other government-sponsored assistance programs will find themselves unable to feed themselves or their families.

As the news reverberates, currencies, stocks, bonds and other investments will simply collapse. The wealth and retirement savings of generations will be vaporized in the twinkling of an eye.

Angry citizens will take to the streets. Local, state and even national law enforcement will be overwhelmed. In several countries, law and order will break down as riots erupt. No man’s life or property will be safe.

Before it’s all over, many governments, equally desperate to survive. They will have no choice but to confiscate wealth from their own citizens. Our world, and ultimately, our own nation will be changed forever.

Admittedly, this is the most severe warning we have ever issued.

Make no mistake: I fully understand just how shocking this forecast is. I also understand that most people who hear it will dismiss it as being “too extreme.”

That’s to be expected. It’s what happened when we warned that the stock market was about to collapse in 1987.

It happened again when we warned that tech stocks were due to crash in 1999.

And it also happened in 2007 when we told anyone who would listen that the U.S. real estate market was about to plummet, plunging the economy into one of the most severe recessions ever.

But please understand; this is no idle prediction. We have no interest in frightening anyone. We are simply following our research where it takes us.

And it is taking us to a terrifying place. Those who are unprepared for this great crisis risk losing everything: Your income, savings, investments, your properties, your personal and financial security are all at risk.

We do not want that for you.

To warn investors of crises like these is the main reason I founded my company, Weiss Research 46 years ago. It’s why I hired renowned cycles experts Larry Edelson and Sean Brodrick more than two decades ago. And it’s why we’ve written this urgent report for you right now.

The plain truth is, the most powerful cycles forecasting tools we have ever used are virtually screaming that all hell is about to break loose in Japan … then in Europe … and ultimately right here in the United States.

If that’s hard for you to believe, I certainly understand. After all, despite the dangerous chain of events we’ve been writing about, things still seem pretty normal today. But the fact is …

The same forecasting tools that accurately predicted the Great Depression — and every major economic event since — are now warning that the most severe financial crisis any of us has ever seen is about to begin.

It may help you to understand why I trust this research so completely. Or why I am changing everything in my own financial life to prepare for the events it predicts.

The forecasting tools we use … that have enabled us to accurately predict all the major events we just mentioned … and that are now warning of the most severe financial crisis any of us has ever seen … are not new.

Most were actually discovered by an American economist 85 years ago. The year was 1932. That’s when U.S. President Herbert Hoover ordered one of his economists, Edward R. Dewey, to determine what caused the Great Depression.

What Dewey found was shocking: Very powerful economic cycles that govern the rise and fall of economies, currencies and investment markets.

It made perfect sense: All of creation moves in cycles — from the lifecycle of stars, the ebb and flow of the tides, changing of the seasons, human respiration and even to our beating hearts.

Just as cycles govern the physical universe and our physical bodies, they also govern the affairs of man. Such as the rise and fall of empires, nations, societies, economies, currencies and investment markets. All of these things and many more are ruled by regular, predictable financial cycles.

Dewey’s ultimate conclusion was a shocker: Anyone who studied the charts depicting these cycles could have known about the approaching Great Depression well in advance.

The Depression happened because it was TIME for it to happen.

Cycles research has accurately predicted nearly every major

financial event in our lives.

Believe me, as the founder of Weiss Research and the man who has worked so closely with Larry and Sean for so many years, I know: Their knowledge of cycles is what allowed us to accurately warn of the stock market crash well in advance and nearly every major move in U.S. stocks since then.

In fact, Sean is the first person at Weiss Research who introduced us to the what he calls “The Great Supercycle.” He has followed and predicted cycles with amazing accuracy. Plus, he and I worked very closely together to write this special report.

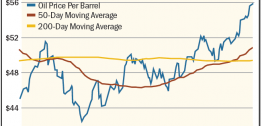

Take a look at the chart to the right, an example of our work. It is the product of our cycles research in 2006 and 2007 — work we did well before the U.S. real estate market cracked.

Take a look at the chart to the right, an example of our work. It is the product of our cycles research in 2006 and 2007 — work we did well before the U.S. real estate market cracked.

The red line is the cycle we were following — the cycle that caused Weiss Research to predict a major catastrophe ahead. The black line is what actually happened.

As you can see, the cycle clearly predicted that the U.S. economy would peak in 2007, then suffer a massive crash.

RESULT: The Great Recession of 2008-2009 struck right on time, just as we predicted, and the S&P 500 crashed nearly 60%. Anyone who bought the 3x inverse ETF of the S&P 500 on our forecast could have seen nearly a 180% gain.

And that’s only the beginning of the story. That same chart I just showed you also predicted that the bottom in the stock market would come in March of 2009. It forecast that after that month, the economy and the stock market would begin a long-term recovery.

So on March 16 of 2009 — while other analysts were still licking their wounds and terrified to even touch a stock — we announced that the worst was over; that stocks were about to catch fire again.

RESULT: Since that forecast, the S&P 500 is up a whopping 240%; enough to turn every $10,000 invested into $33,234.

And if you had used our forecast to invest in the 3x S&P 500 ETF, you could be up as much as 720% — enough to turn every $10,000 you invested into nearly $82,000.

Plus our cycles research has also helped us call every major move in the gold market since 1999 — including the beginning of the bull market when gold was just $255 per ounce and the end in September 2011 when it hit $1,925.

Our study of these cycles also made it possible for us to accurately predict the collapse of the U.S. dollar that began in 2000 as well as the huge dollar rally we saw in 2014-2015.

And even the historic plunge in oil that began in 2014.

Then, in 2015 we predicted the world would enter a new era of financial and political turmoil. It did.

That’s also when we first warned that the end of the European Union was in sight. Since then, millions of migrants have flowed into Europe, pushing social services to the breaking point and beyond. Worse, they are forcing those governments to spend billions of dollars that they don’t have. Pushing them deeper and deeper into debt.

Great Britain shocked the world by voting to leave the European Union, while powerful new separatist movements in Greece, Spain, Germany and France are pushing the Union to the brink of oblivion.

In 2015, we also warned about flight capital from Europe and Japan that would drive U.S. stocks to unimagined new levels.

As a result, we predicted that the Dow Jones Industrial Average would surge well past the 20,000 mark. Since then, trillions of dollars have flowed into the United States and the Dow has surged by 6,000 points, topping 22,000.

Now, our cycles research is sending us a new message — a message that no wage-earner, retiree or investor can afford to ignore.

Powerful financial cycles

— and the war cycle —

are aligning even as you read this …

In late October 2017, just weeks from now, we will see the next major convergence of five of the most powerful forces known to man — the same kind of convergence that triggered the Great Depression in 1929:

In late October 2017, just weeks from now, we will see the next major convergence of five of the most powerful forces known to man — the same kind of convergence that triggered the Great Depression in 1929:

- The time-honored Kondratiev Wave, which is signaling an armageddon for massively indebted governments … soaring unemployment … skyrocketing interest rates … massive defaults on public and private debt … and more.

- The 7-to-11-year Juglar Cycle, which is signaling hoarding of cash by businesses … plunging re-investment of earnings … job destruction … and a comatose economy.

- The 40-month Kitchin Cycle, which predicts slower business formation … extremely weak consumer demand … slower inventory turnover … chronic unemployment and worse …

- The 20 and 60-year economic cycles, which are also signaling that a great depression and economic catastrophe with tremendous financial pain is directly ahead.

Plus …

- The rising cycle of war that now threatens Japan and Europe … and which is turbocharging the debt cycle and driving a flood of flight capital to the United States.

The facts on the ground in Japan

are especially disturbing.

I’ve just rushed home from Japan. I have lived there on and off since 1979. Studying Japan’s history, economy and future has been a lifelong endeavor for me. And I can tell you flatly: Japan is at the center of two of the most threatening conflicts on the planet today — twin threats that could be more dangerous than Russia’s threat to Europe:

1. Japan faces a fierce battle with China over the Senkaku Islands in the East China Sea, plus, at the same time …

2. Japan is in the cross-hairs of North Korean dictator Kim Jong-un.

The chances that China will invade Japan or that North Korea will bomb Tokyo are still small. Fortunately! But there’s no chance Japan can escape the economic impacts of those threats. Even as I write these words, Prime Minister Abe is moving swiftly to push through a massive defense buildup that Japan simply cannot afford.

And long before this latest crisis began, the Japanese government was already struggling with not just one, but two economic crises:

And long before this latest crisis began, the Japanese government was already struggling with not just one, but two economic crises:

The first is debt. Just consider the terrible facts:

Japan’s government is saddled with the largest debt in the world: More than ONE QUADRILLION YEN in debt. That’s a “one” followed by FIFTEEN zeros. And it means that even if Japan had a yearly budget surplus of one trillion yen, it would still take 1,000 years for the country to pay off its debt.

Tokyo’s debt is nearly two-and-one-half times the size of the entire Japanese economy and far larger than the debt load that pushed Greece, Ireland and Portugal to the brink of collapse.

Japan’s debt is still skyrocketing. Social welfare spending in Japan, which is already one-third of its 106-trillion-yen budget, is rising automatically by about one trillion yen every year.

Japan’s second crisis is that consumers are NOT spending — and for good reasons:

Because their prices have fallen for over a decade and a half, Japanese consumers and companies believe that everything they want to buy will be cheaper tomorrow. So they have little reason to spend money.

Japanese citizens are hoarding cash because they fear that Tokyo will cut their retirement checks and other government benefits. They’re saving as much as they can for the rainy days they believe are coming. And the new threat from North Korea is now adding to their fears.

This is an extremely dangerous situation. It is slashing government revenues, even as the nation’s debt and the cost of servicing that debt is about to surge.

This is an extremely dangerous situation. It is slashing government revenues, even as the nation’s debt and the cost of servicing that debt is about to surge.

OUR FORECAST: Japan’s already-bulging budget deficit will explode. Debt load will strangle the economy. The bond market will collapse. And all of the powerful economic cycles will converge six weeks from now to begin the supercycle that will signal its decline.

Plus, for reasons I’ll explain in a moment, exports — still the lifeblood of the Japanese economy — will plunge. The economy will crater. Tax revenues will evaporate.

Meanwhile …

Every day, the news coming

out of Europe CONFIRMS what the cycles are telling us: This great

crisis has already begun!

The coming new costs of defense spending in Europe will make the costs expected in Japan look small by comparison.

Moreover, the debt crisis you saw a few years ago in Greece and other PIIGS countries was only the tip of the iceberg.

Europe is deeper in debt than ever:

- Despite repeated bailouts, 22 of the 28 EU member states — including the largest states; Spain, France, Italy and the UK — are deeper in debt now than ever before.

- In Spain and France, it would take nearly all the money generated by their economies in an entire year to equal their national debts.

Portugal owes 29% more than its economy produces. Italy owes 33% more.

Portugal owes 29% more than its economy produces. Italy owes 33% more.- The Greek government, still in the worst shape even after six huge bailouts, owes 76% more than its economy produces.

This has led governments to take desperate measures:

In Spain, the government has begun taxing bank deposits. You pay an income tax on your paycheck, then pay another tax when you deposit it in the bank.

In France, police routinely search travelers, looking for large amounts of cash that’s being smuggled out of the country to avoid taxation.

In Cyprus, the government literally robbed its own banks. Depositors with more than 100,000 euros watched helplessly as the government seized up to 40% of their money.

France’s economy remains stagnant, and President Macron’s attempts to revive it are already running into stiff political resistance.

Even Germany, the economic engine of the EU, has just gotten a big whiff of bad news: German exports have plunged abruptly, adding to signs that global demand is starting to sink, especially in Asia. What’s worse, Germany will now have to pile on much more debt to defend itself against Vladimir Putin.

OUR FORECAST: The European Union will not survive. It will disintegrate. This will serve as a second blow to Japan, one of Europe’s biggest trading partners.

And right now, these powerful economic cycles will converge in October of THIS YEAR, forming the supercycle that will signal Europe’s collapse.

The U.S. is the world’s

safest safe haven … for now

Believe it or not, there is some good news in all of this — especially for investors in the United States.

The first bit of good news is that there’s still time — not much time, mind you, but some time — to prepare.

The second piece of good news is that, the troubles in Japan, Europe and other hot spots around the world have wealthy investors seeking safe havens. And at this juncture, the world’s safest safe haven is the United States of America.

That’s why savvy Japanese and European investors recently dumped trillions of yen and euros, driving those currencies lower. It’s why they bought trillions of U.S. dollars, driving the greenback sharply higher. And it’s why they used those dollars to buy assets here: Stocks. Real estate. Bonds. Even collectibles.

But if history and our cycles research proves anything, it’s that this trickle of flight capital we’ve seen coming to our shores so far is just a sneak preview. It is about to become a massive flood.

It’s crucial that everyone who owns stocks … everyone with a retirement account … understands this. Because at a time like this — with the world burning down around you — growing rich is your ONLY real defense. And here’s more good news. Our research shows …

This crisis will unfold in four, distinct phases,

giving you the opportunity to amass

not just one, but FOUR impressive fortunes:

Investors are delighted when they can make one fortune. But thanks to four entirely separate and clearly defined phases, this crisis will give you the opportunity to build four fortunes:

Fortune #1: Phase 1 — Happening right now, as money continues to flow to the U.S. from the hottest trouble spots overseas.

Fortune #2: Phase 2 — In 2018, as Japan implodes, and as the flow of money into U.S. stocks and other investments becomes a flood.

Fortune #3: Phase 3 — In 2019, as the European Union collapses and the euro resumes its epic plunge, triggering another monstrous tidal wave of capital headed for U.S. investments.

Fortune #4: Phase 4 — From 2020-2022, when this crisis comes to America, and as the United States pays the price for the largest orgy of debt in more than 5,000 years of human history.

Because with each passing day, America’s final reckoning is drawing nearer.

The same fate suffered by Japan and

Europe ultimately awaits us as well.

Donald Trump is doing a good job of boosting the U.S. economy right now. And the flow of capital from overseas is also helping. But no one can make America’s huge debt problem disappear. And Washington debts are far larger than most people realize.

Everyone worries about our $20 trillion national debt; that it equals 107% of the value of all the goods and services the U.S. produces. Let me tell you: That’s a drop in the ocean.

In addition to that debt, according to the latest statistics from the U.S. Treasury Department, our government owes close another $100 trillion that it never wants to talk about.

These are what it politely calls “unfunded liabilities” — the money it owes primarily to veterans and to seniors in pensions, Social Security and Medicare payments.

Altogether, Washington is on the hook for more than $120 trillion. That’s more than six times the size of the entire U.S. economy. A line of 120 trillion dollar bills would reach around the Earth at the equator more than 494,000 times. It would reach all the way to the sun and back more than 60 times.

Altogether, Washington is on the hook for more than $120 trillion. That’s more than six times the size of the entire U.S. economy. A line of 120 trillion dollar bills would reach around the Earth at the equator more than 494,000 times. It would reach all the way to the sun and back more than 60 times.

And what’s worse, some economists say the real number is much higher — well over $200 trillion. Plus, hundreds of billions more dollars in additional debt and obligations are piling up with every passing year.

Sorry — but I have to ask: Who are we kidding here?

Everyone knows Washington will never make a dent in that debt. What most economists know, but don’t say, is that Washington won’t be able to even service that much debt for much longer. Any significant surge in defense spending or decline in the economy could ultimately push Washington into default of some kind.

It could be a default on the sly (via inflation), a default via an outright dollar devaluation or perhaps even an outright default forced by a government shutdown. And long before that happens, U.S. government’s bonds will have collapsed in value.

The bottom line is that our government, our economy and our society are living on borrowed time. It will all come crashing down.

The great debt collapse

this supercycle brings with it

is as certain as death and taxes.

We’ve always known there was no way Washington could tax, print and spend forever. That kind of insanity is simply unsustainable. We’ve always known that the day would come when it would all come crashing down. The only question has been “WHEN?” Now, we have an answer.

Our study of cycles — the most powerful forces in the economic universe — has provided it.

The great global government debt collapse that will begin in Japan … that will spread to Europe … will inevitably strike America as well.

When that happens, only those who are prepared will have a prayer of protecting their loved ones; let alone preserving their wealth or their quality of life.

And those who prepare will also have the opportunity to make a lot of money — with the handful of crisis investments that explode in value at times like this.

We’ve already begun preparations to protect our own wealth and to profit.

At this moment, we have our eye on three broad categories of investments for this crisis:

Category A — Assets that cannot be confiscated. Remember, the coming debt crisis will hit our governments. And the government will seek every devious way it can to gain control over your wealth, even confiscating assets directly or indirectly.

Ironically, U.S stocks are the least likely to be confiscated. No one is going to take away your shares in the bastions of capitalism, in Google, Facebook or IBM. Foreign investors know that. And that’s the type of asset foreign investors will be chasing.

We first began alerting investors to the massive influx of “Fear Money” in 2015. And since that time, flight capital has already driven many U.S. stocks through the roof. If you had owned the right stocks since 2015, you could have seen life-changing gains from that capital flight in just the past two years, such as

- A 91% gain with Adobe Systems …

- A 98% gain with Raytheon …

- A 139% gain with Applied Materials …

And a whopping 743% gain with NVIDIA, enough to multiply your money more than eight times over.

And soon, the trickle that has caused these spectacular gains already will become a flood, and the gains we’ve already seen will pale in comparison. If you own the stocks foreign investors want, you can rake in a fortune. We will own the stocks foreign investors will be chasing come October BEFORE they do.

Category B — Alternative assets you should own as hedges against a government crisis — and capitalize on the flood of fear capital.

Gold and silver have served as mankind’s ultimate crisis hedges for 5,000 years. We see gold bullion prices soaring to well over $5,000 per ounce. That would be about a 330% increase. Meanwhile, we see silver going to $125, a 700% increase.

And when bullion prices skyrocket, the shares of companies that produce them go even higher.

For example, from October 2008 to September 2011, gold bullion prices almost tripled in price.

For example, from October 2008 to September 2011, gold bullion prices almost tripled in price.

But if you bought shares in gold miners, you could have seen gains of four times your money in Goldcorp.

And you could have seen a profit of five times your money in Yamana Gold. In Eldorado Gold, the profits were even better — nine times your money.

Moreover, those remarkable gains posted by the “big boys” of the mining world often pale in comparison to small cap miners — Sean’s particular area of expertise.

Sean has personally visited small cap miners in Mexico, the Arctic and all over the Americas. He prides himself on getting his boots dirty and investigates these investment opportunities on the ground.

He meets regularly with mining executives from all over the world. And the money those companies have made for investors is even greater than the profits I just told you about.

Small and junior mining stocks to go for

gains of 974%, 1,481%, or even more.

Investing in small-cap miners and developers gives you the benefit of leverage that’s just as powerful as the leverage of call options.

But you can do it without any options at all, without risking more than a tiny fraction of your capital … without using debt or margin accounts … without expiration dates (no time limit on your opportunity), and … without in-and-out trading!

Consider this: In 2008, gold bottomed at $700 on a pullback and proceeded to rocket to $1,900 over the next two years … a pretty impressive 171% gain.

But in that same time, if you’d been investing in junior miners, you could have seen gains like …

- 324% on Premier Gold

- 455% on Richmont Mines

- 502% on Chesapeake Gold

- 723% on Oceana Gold Corp

- 937% on High River Gold

- 974% on China Gold

- 1,245% on Midway Gold

- 1,481% on Centerra Gold

- 2,295% on Allied Nevada, and

- A staggering 5,237% on Kaminak Gold

That last one is 30-times more money than simply holding gold … and enough to turn every $500 into $26,685 … every $1,000 into $53,370 … and every $25,000 invested into $1,309,250 — on just one stock!

Companies that produce these “white metals” can give you gains of 566%, 719%, 1,076% and more.

There’s one sector in particular that practically nobody is paying attention to: Industrial metals. But the convergence of cycles — and the global megatrends born as a result — are driving these metals through the roof. Sean calls it the “Secret Rally” — and it is part and parcel of the supercycle coursing through the world economy.

This year alone, lead is up 15%. Zinc is up 19%. Copper is up 21%. And aluminum is up 22%. Meanwhile, companies that produce these metals are giving investors many times those returns. Between January of 2016 and today …

Solitario Zinc surged 114%. Century Aluminum is up 566%.

Silver Bull Resources, which is a big supplier of silver and zinc, has surged 719%.

Starfield Resources, a developer of copper and nickel, has skyrocketed 1,076%, and …

Sarissa Resources, which develops copper and uranium, is up a whopping 1,214%.

It’s no coincidence that these companies are making investors vast fortunes RIGHT NOW. It’s all part of the supercycle in commodities that Sean first wrote about many years ago. Plus, now …

The powerful cycle of war is

turbocharging the economic cycles!

As I explained, the rising threat of war adds new power and momentum to the debt cycle. It drives spending — and borrowing — for defense through the roof.

Plus, nearly all the conflicts we see around the world today are a grab for natural resources:

Russia seizing Crimea to control the massive oil reserves deep in the Black Sea …

China grasping for islands in the South China Sea, which has around 266 trillion cubic feet to natural gas reserves …

North Korea, desperate for resources, lashing out not only at Japan and the United States, but also at its only ally in the region, China.

This is bad for the world. But it’s a fountain of massive profits for investors who know which commodities — and which commodity companies — to buy. Here are some of my favorites …

Why metals used for energy

are now white-hot

Shortly after the turn of the last century, we saw the world shift from horses to internal combustion vehicles. Now, a similar shift is going on, from internal combustion vehicles to electronic vehicles.

Two metals, lithium and cobalt, are integral components of the batteries that power electric vehicles. And now, flight capital from fearful investors — plus rising demand — is driving the price of these metals through the roof.

The price of cobalt is up 157% since January 2016. And it’s up 86% this year alone.

The cobalt market is in a 5,500-ton deficit, with global supply contracting 3.9% in 2016.

Supply is down and annual cobalt demand is projected to increase 34% until 2026. That’s a recipe for sending this metal through the roof — and gives you the opportunity to make a fortune.

Lithium is also on a rocket ride. It has more than doubled since 2012.

Look. Just because there was a Great Depression in the 1930s, the world didn’t stop switching over from horses to the internal combustion engine. It’s the same thing today.

That’s why the shares in companies that benefit the most from this trend are going to surge. And flight capital from overseas is turbocharging this trend:

Just since January of last year, American Lithium Minerals is up 588%. Geovic Mining is up 700%. First Liberty Power is up 1,260%. And as you can see from our chart, these are not even the biggest winners.

Category C — Leveraged Investments. If there ever was a time to use leverage, THIS IS IT! The fact that these cycles have been so amazingly accurate over the past 80 years gives us an enormous amount of confidence right now.

So much so, that we’re not going to be content to settle for only ordinary investments.

Since we truly believe this is the profit opportunity of a lifetime, in special cases, we will recommend using leverage to multiply your profit potential: To go for profits of $2, $3 or more for every $1 in profits an ordinary stock might generate.

And given the historical accuracy of these cycles, we recommend not just one, but THREE kinds of leverage:

And given the historical accuracy of these cycles, we recommend not just one, but THREE kinds of leverage:

The first kind is the relatively conservative leverage available through ETFs. Many of the funds we just mentioned give you two and three times leverage. So for every $1 in profit other investors make, you can make $2 or even $3. You make up to triple the profits.

Example: In just 13 months, the “Plain Jane” ETF that owns U.S. Treasuries — iShares 20+ Year Treasury Bond ETF (TLT) — posted a 36.9% gain.

Meanwhile, the double-leveraged ProShares Ultra 20+ Year Treasury (UBT) produced a 92.7% gain … and the triple-leveraged Direxion Daily 20+ Yr Treasury Bull 3X Shares ETF (TMF) could have made you 166% richer.

Likewise, if stock markets in Europe plunge 60% (about as much as our own S&P 500 fell in 2008 and early 2009), a leveraged ETF could deliver a pre-commission profit of 120% to 180%.

The second kind of leveraged investment we recommend from time to time is somewhat more aggressive: Options on stocks and ETFs. I’m talking about buying call options on select U.S. stocks that foreign investors want to own and also on ETFs that own those stocks.

This is important since, instead of paying you $2 or $3 for every $1 made in the underlying investment, options can pay you $10 … $25 … $50 or even more.

Of course, all investments involve risk — and that includes options. The good news is, it’s not hard to guard against losses with appropriate risk-management techniques.

Indeed, with the purchase of options, while your profit potential is virtually unlimited, your risk is strictly limited to the small amounts you invest.

The third kind of leverage we use is not really leverage at all — even though it does offer the potential to go for astronomical gains quickly: Small-cap mining shares.

You simply buy their stock, no different than buying a share of Facebook or Google. But these companies’ values are tied at the hip to the price of the metal they produce.

In fact, during the last major gold rally, mining shares in this category rose $68 for every $1 move in bullion!

And as the convergence of cycles sends the value of industrial, energy, and precious metals through the roof, small companies that mine them will likely do exponentially better.

A Speculator’s Dream

The next five years are going to be a speculator’s dream — not just for veteran speculators but for ANY investor in the know.

And as fear money rushes to the United States, it will turbocharge megatrends that are already beginning to take the world by storm. Here are just a few on Sean’s radar screen:

Massive defense spending: Unless peace breaks out suddenly (very unlikely), massive new spending on defense is absolutely inevitable.

And select leveraged investments in one of his favorite defense companies have recently posted gains of 329% in 195 days, 463% in 200 days, and 670% in 200 days!

That’s enough to multiply your wealth more than seven times over.

The mass conversion to electric cars: Select speculative investments in Tesla could have given you gains 388% in 91 days, 579% in six months, and 881% in just seven months. That’s enough to turn every $10,000 into almost $991,000!

But our research proves that it’s not just the car companies that will make you rich. It’s the companies that develop the materials that make these vehicles possible.

Just recently, Sean’s favorite leveraged investments on LIT, the lithium ETF, could have made you 231% in 91 days or a whopping 4,100% in just 5 months! That’s enough to turn a $5,000 grubstake into a $205,000 fortune!

Shift to U.S. energy. In tandem with the shift of capital to the United States, we’re seeing a massive shift from Middle Eastern crude oil to U.S.-produced oil and natural gas.

By simply buying ordinary common stock in select companies like Marathon Oil, you could have seen gains of 45% in just 40 days in late 2016-early 2017. But with judicious use of leverage, you could have seen gains of …

- 425% in 40 days …

- 1,422% in 42 days, and …

- 2,150% in 40 days — enough to turn a $10,000 investment into $225,000 in just over one month!

And here’s the BEST news:

All of our cycles research indicates that these megatrends are just beginning. The biggest profits will come during Phases Two, Three and Four of this crisis!

And because the timing of these megatrends is tied to predictable cycles, we have the confidence to use leverage and go for the biggest gains possible.

All of these investments are perfect for Phase One of this crisis (now), Phase Two (2018) and Phase Three (2019). But then, when this great crisis strikes Washington D.C., we will make a major change of strategy.

Until that time, America will still be considered the safest safe haven in the world. So huge amounts of fear money will flow to our shores.

But after that time, investors everywhere will awaken to the fact that America is the greatest debtor of all. That it is no longer a safe haven. That it is, in fact, among the most dangerous of all these heavily indebted nations.

At that point, it will be time to close out your long position on U.S. investments and use inverse ETFs and put options to go for a fourth and final fortune in this crisis.

These would include funds like the ProSharesUltraShort S&P 500 ETF … ProShares UltraShort QQQ ETF … ProShares Short Dow 30 ETF … and the ProShares UltraShort Russell 2000 ETF.

And you can also use options on these ETFs to go for gains of 400% … 500% and even more.

When my father, Irving Weiss, saw a major depression on the way in the early 1930, he borrowed $500 from his mother to follow a similar strategy. By the time the market hit rock bottom, he had transformed that small grubstake into $100,000, the equivalent of $2 million in today’s dollars.

Two of his contemporaries, Jesse Livermore and Bernard Baruch, invested far larger sums and made the equivalent of billions of dollars.

In Phase Four of this crisis, thanks to our ability to time the markets with our cycle research, you should be able to follow a similar path — all with strictly limited risk and by investing just a small portion of your money.

14 Supercycle Investment

Opportunities Set to Multiply

Your Money in 2017-2022

In the next two phases of this crisis, we’re going for windfall profits of 500% or more as …

1. Debt and war crisis drives trillions of dollars in flight capital into America’s most prosperous blue-chip companies

2. The crisis drives even more money into companies that are leaders of sweeping megatrends — defense, electric cars, and the U.S. energy boom.

3. The Japanese yen and the euro resume their crash …

4. And as Japanese and European stocks

collapse.

In Phase Four, we aim to grow even richer as …

5. The U.S. dollar crashes …

6. U.S. stocks collapse …

7. And as U.S. government bonds implode.

And throughout this crisis, we will go for still greater profits as this massive wave of flight capital drives precious metals and commodity prices through the roof in …

8. Gold

9. Silver

10. Platinum

11. Palladium

12. Energy

13. Food

14. Industrial materials

And more!

To help you survive and profit,

I want to give you access

to our “Buy” and “Sell” signals

EVERY DAY throughout this crisis …

This special report may be enough to help you get through this. But if you want more … if you’d also like the timing information my cycles research produces …

Not just WHAT we’re recommending you buy or sell … but the precise moments WHEN you should act on each investment …

So you can protect yourself and go for substantial profits with a minimum amount of work and worry …

Then I have a solution I think you’ll like.

It’s called “Supercycle Investor” — the new service Sean Brodrick and I have created to help you maximize your safety and profits as this great crisis strikes.

We built Supercycle Investor to help you accomplish two very important objectives:

Objective #1: To protect every dollar you have saved and invested right now; so you can get through this with your wealth and financial security intact, and …

Objective #2: To help you harness the awesome power of this great crisis to grow even richer; by going for windfall profits in each phase.For starters — as soon as you join — you get …

1. Our Supercycle Investor Quick-Start Guide with everything you need to get the most out of your new membership — and also to begin seizing supercycle profit opportunities right away.

1. Our Supercycle Investor Quick-Start Guide with everything you need to get the most out of your new membership — and also to begin seizing supercycle profit opportunities right away.

2. Unrestricted 24/7 access to the Supercycle Investor website where you can review all our issues, all our recommendations and view all of our online video briefings any time you like.

2. Unrestricted 24/7 access to the Supercycle Investor website where you can review all our issues, all our recommendations and view all of our online video briefings any time you like.

3. The Supercycle Email Hotline for quick answers to any questions you have about your membership or any recommendation we give you. And you get so much more …

3. The Supercycle Email Hotline for quick answers to any questions you have about your membership or any recommendation we give you. And you get so much more …

You get Urgent Trading Alerts INSTANTLY whenever it’s time

You get Urgent Trading Alerts INSTANTLY whenever it’s time

for you to make a move.

Once you decide that the trade is right for you. You will have all of the information you need on what to buy, why to buy it, when to buy it, how much to pay and even how much money we think you stand to make on the trade.

And whether it’s an individual stock, a garden-variety ETF, an inverse ETF, a leveraged ETF or an option on an ETF, we give you everything you need in plain English.

You’ll get step-by-step instructions on how to make the trade online or on the phone with your broker. If you like you could simply call your broker and read the Trading Alert aloud on the phone.

Ditto for when it’s time to sell. We’ll make sure you have everything you need to make the trade quickly, easily and with confidence.

THE BOTTOM LINE: We will never leave you hanging. You will never be left wondering what you should do. If you can read an alert and dial the phone (or make trades online), all the profits this opportunity offers you are within your grasp!

And you get so much more …

You get regular updates in weekly issues of Supercycle Investor.

You get regular updates in weekly issues of Supercycle Investor.

Each issue of this weekly letter will keep you up to date on every investment we own as well as the global developments that are impacting them.

Plus, we’ll also use this forum to answer the questions we’re getting most often by our members.

And you get so much more …

You’ll meet with us for LIVE online strategy sessions every quarter.

At these hour-long meetings, we’ll show you what we’re seeing in the charts and you’ll see how actual events on the ground are bearing out our cyclical forecasts.

Plus, since these events will be LIVE, you can ask us anything you like about the investments or strategy we recommend as well as our views on breaking events.

And we’ll meet for live online emergency summits when warranted.

In fact, I am so confident in this forecast … so concerned that you protect yourself … and so eager to help you go for your share

of the windfall profits that will be available as this supercycle courses through the global economy …

I will gladly pay most of your

membership fee for you.

Normally, Supercycle Investor will be sold for $2,500 per year. But here’s the thing: The cycles driving this crisis say it’s going to be with us for five years — until 2022. And five years times $2,500 per year is $12,500.

That’s more than fair if you think about it. After all: Your first winning options trade alone could deliver a lot more than $12,500.

But frankly, a $12,500 price tag could deprive good people of the recommendations they need to protect themselves and profit.

So I sharpened my pencil and — for Early-Bird members only — I got the annual rate down to just $1,497. Not bad, but five years times $1,497 per year is $7,485 — still beyond the reach of many.

And after much soul-searching and pencil-sharpening, here’s what I’ve decided to do:

If you join us for two years now, I will pay for the final three years of your membership.

You’d pay for just two years — just $2,994 — and you get five full years of membership. You get three years — a $4,491 value — FREE.

Important note from customer service: Great news! Since you are a member of The Edelson Institute, you are entitled to a whopping, additional $1,000 off. Instead of the $2,994 that everyone else will pay, your cost for the ENTIRE five years is only $1,994!

You not only get membership benefits through 2022, you also get a huge EXTRA discount. — Stan Pyatt, Customer Service Manager

With these one-time-only discounts, your Supercycle Investor is a mere $1.09 per day — less than half the price of one gallon of regular gasoline — and you get news, analysis and “Buy” and “Sell” signals designed to multiply your wealth many times over.

There’s more:

You must be thrilled with the

money you make, or you can get

a refund for any reason,

anytime in the next two years.

You don’t even have to make your final decision now. You can wait until then to do that. Click here to join us today and I’ll pay for three years of your five-year membership. Then, just follow our recommendations for the next few weeks, the next few months, or even for a full year or more.

In the unlikely event that you decide Supercycle Investor isn’t right for you, just let us know any time and I’ll promptly refund every penny on the balance of your subscription.

That way, I take virtually all the risk out of your membership: Either our forecasts prove accurate now and you make a ton of money … or you cancel and get a refund any time for any reason.

This is THE watershed moment of your financial life.

Your entire life as an investor — and as a student of the economy and the investment markets — has led you to this moment.

You’ve always known that the obscene debts our leaders were amassing were unsustainable.

You always knew that sooner or later, the end of this great debt cycle would come one day — and that there would be hell to pay.

Now, in late October, the same cycles that accurately predicted the Great Depression — and every major economic or investment event since 1929 — will converge to form a powerful new supercycle …

A supercycle that marks the end of the era in which our leaders could amass mountains of debt without suffering the consequences …

And the beginning of a dangerous new era in which we all pay the price for that debt.

As we’ve seen, the facts on the ground are 100% in sync with this forecast. They confirm and validate every warning our cycles research is giving us.

The die is cast. The handwriting is on the wall.

These facts leave us with two choices — and ONLY two:

We can do nothing; knowing full well that as these events unfold, they will likely destroy everything we have worked for.

Or, we can do what is necessary to protect our wealth — and better yet, harness the awesome power of these events to go for windfall profits with stocks, ETFs, leveraged ETFs, and some options.

Please remember what’s at stake: Over the past year or so — well before the worst of this crisis will begin — many of these investments have posted actual, real-world profits of 719%, 1,076% and 1,214% (industrial metals) … 1,260%, 1,275%, and 1,536% (metals used for energy) … plus 1,422%, 2,150%, and 4,100% (electric vehicles).

But beginning in just a few weeks, the convergence of cycles will threaten to wipe out millions of investors who fail to prepare … and send the investments we’ve named in this report into high gear, with the potential to make you a fortune.

I’ve made my choice; I’m doing what’s necessary to protect my family’s wealth.

You have nothing to lose and everything to gain: Just click here for your Early Bird discount.

Or call us toll-free at 800-291-8545.

Remember: I am so confident in this forecast … so concerned that you protect yourself … and so eager to help you go for your share of the windfall profits that this supercycle is making available to you … I will gladly pay most of your membership fee for you.

Plus, with my refund guarantee, I take virtually all the risk. That should tell you something about how committed I am to making this work for you. Just remember: These savings expire soon.

Please let me hear from you right away. Call us at 800-291-8545 or get for your discounts on this special Early Bird page.

We look forward to welcoming you aboard!

Good luck and God bless!

Martin D. Weiss, PhD

Founder, Weiss Research

Co-founder, The Edelson Institute

with

Sean Brodrick

Senior Editor, The Edelson Institute

and Economic Cycles Expert

Big Early-Bird Enrollment Savings! Expires soon!

Weiss/Edelson Members Get $1,000 EXTRA Bonus!

Yes!

I understand that, in addition to my big early-bird price discount for a two-year subscription to Supercycle Investor (normally $5,000), you will give me THREE extra years. Plus, since I am a Weiss Research/Edelson Institute member, I will get an ADDITIONAL discount of $1,000. So my bottom-line cost for five years is only $1,994! (To get your Early-Bird discounts, just click here or call 800-291-8545.)

I get the news, analysis and buy/sell signals designed to multiply my wealth for the full duration of the 5-year supercycle. And my very first profitable trade could easily pay for my entire subscription cost many times over.

(To get your Early-Bird discounts, just click here or call 800-291-8545.)

Guarantee: I must be thrilled with the money I make, or I can get a refund on the unused balance of my subscription for any reason and at any time in the next two years.

Please select a payment option:

Please bill my:

Card #:__________________________Expires: __________

Enclosed is my check/money order made out to Supercycle Investor

for $_________.

Name: _____________________________________________

Address:____________________________________________

City: _____________________ State: _________ Zip: ________

Email Address: _______________________________________

I’d prefer to try Supercycle Investor for just one year. I still get a big Early-Bird discount plus an extra $500 bonus, and I pay only $997. (Same guarantee.)

Four Easy Ways to Join:

Call 800-815-2917

Call 800-815-2917

Go to store.weissinc.com/

order/supercycle-rwre

Fax this page to 561-625-6685

Or mail to: 4400 Northcorp Parkway,

Palm Beach Gardens, Florida 33410