We have an opportunity that is both an income play AND a great way to cash-in on rising U.S oil production. It could fatten your wallet A LOT!

Let’s start with the fact that OPEC is its own worst enemy. Remember back in December, when the cartel announced production cuts? Someone had to fill the gap, and it was U.S. oil producers.

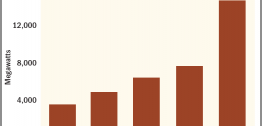

Since then, U.S. crude oil production has risen by more than 734,000 barrels per day. And all that oil must be transported.

There are roughly 2.5 million miles of pipelines crisscrossing America. And more are being built every day, as America’s oil and gas production rises.

Also, I like income investments. And I really like a company that has a 22-year-history of annual dividend increases and a yield around 9%!

That company is midstream partnership Buckeye Partners LP (NYSE: BPL). It owns pipelines and oil terminals. It recently sported a dividend yield over 9%. And it has raised that dividend for 22 years.

Does 22 years sound like a long time? This company can trace its roots back 130 years! It was part of Standard Oil, and became independent when Standard ran afoul of the trust busters. The company has been a Master Limited Partnership (MLP) since 1986.

An MLP has unitholders rather than shareholders, and it pays distributions rather than dividends. MLPs pay regular distributions. They receive special tax treatment for doing so.

Just be aware that as an MLP unitholder, you’ll have to report its distributions on a special form at tax time. (The amount can vary, especially if it’s held in a tax-sheltered account.)

So, we want an MLP that’s worth the extra trouble. And dividend-rich Buckeye is one of those.

You see, Buckeye has 6,000 miles of pipeline, and is one of the largest independent liquid petroleum pipeline operators in the U.S. Its assets are located primarily in the Northeast, Midwest and Southeast, and the Gulf of Mexico.

Only 25% of Buckeye’s product capacity is crude oil. Another 13% is condensate. And 62% is refined products. That’s fine. It will still be exposed to rising North American crude production.

The refined products it transports include gasoline, jet fuel, diesel fuel, heating oil, kerosene, propane and butane. It also transports refinery feedstock and blending components!

Better yet, Buckeye is much more than just pipelines. It also has 120 liquid petroleum products terminals. That makes it one of the largest independent storage and terminalling operators in the U.S., in terms of capacity.

Buckeye’s flagship marine terminal in the Bahamas is called Buckeye Bahamas Hub. It is one of the largest marine crude oil and refined petroleum products storage facilities in the world.

Since 2010, Buckeye has acquired over 75 domestic and international terminals. These give it more than 130 million barrels of storage capacity.

On Jan. 4, Buckeye completed its 50% acquisition in VTTI B.V. The $1.15 billion deal was announced last year. VTTI is a worldwide storage and terminalling company. It operates 13 terminals in 11 countries across five continents, with about 54 million barrels of storage. This gives Buckeye added diversification and a broad global reach, in a world that is shipping more and more oil.

A majority of VTTI’s cash flow comes from take-or-pay storage agreements with Vitol, the world’s largest oil trader. Buckeye said the deal would add to its distributable cash flow per limited partner unit this year.

When it announced the VTTI deal, Buckeye entered a period of underperformance compared to its benchmark, the Alerian MLP ETF (AMLP). Good! That means we’re getting it at a discount. And I don’t expect this discount to last too much longer.

So what don’t investors like about the deal? They may think Buckeye paid too much (10 times EBITDA) for half of a company that will remain a standalone entity. And there is foreign currency exposure to the euro. (VTTI is based in the Netherlands.)

There’s also the fact that the deal affected Buckeye’s distribution coverage, which I’ll address in just a bit.

I believe these fears are overblown. And an opportunity for investors who can see the bigger picture.

The Most Important Ratio for any MLP

The most important ratio for MLPs is the distribution coverage ratio. This ratio is the distributable cash flow (DCF) available to the company, divided by the cash handed out to the MLP’s unitholders. In other words, can its cash coming in cover the cash it is going to pay out?

With Buckeye, that hasn’t been a problem.

In the fourth quarter of last year, DCF per unit decreased due to the VTTI transaction. The distribution coverage ratio dropped to 0.85 in the first quarter. While this is recovering, it remains 1.01 for the first half.

That goes along with net income per unit falling to 80 cents in the quarter from $1.07 in the same period of 2016. The company also lost of a key customer at one of its facilities.

In fact, like many energy-focused MLPs, the company’s quarterly coverage is a roller coaster. But it has plenty of free cash flow; $138 million in the last quarter. It can go for quite some time without this being a problem.

The company targets a long-term ratio of 1.1x. So, it’s working to improve that.

Let’s Talk Distributions

The main reason to own an MLP is to get those big, fat payouts. Buckeye paid $4.88 in distributions last year. In its most recent quarter, it paid $1.2625 per unit. That was a rise of 4% over the year-earlier period.

Buckeye’s distribution has grown 4.3% per year over the past three years. Looking forward, it is projected to grow 4.2% per year.

Looking Forward

I also like energy companies with exposure to the fast-growing Permian and Eagle Ford shale regions. Buckeye is planning a new crude oil pipeline from the Permian Basin to Corpus Christi, Texas. The proposed South Texas Gateway system will have total capacity of up to 400,000 barrels per day. It will deliver crude and condensate to the company’s refining and export facilities in Corpus Christi. The new pipeline will enter service in 2019.

This is just the first in a series of potential Texas projects where Buckeye is planning to expand its existing capabilities.

A Solid Payer with Oil Production Upside

Bottom line: Buckeye is a well-run partnership with a strong history behind it, but it is very focused on the terminals and storage business. It has a long corporate history, and a solid track record of growing its dividend.

And if U.S. oil production increases, that oil will have to be transported, refined and exported. Buckeye can help every step of the way. That gives it excellent potential upside. Still, you should be protected from the worst gyrations of the oil price rollercoaster. And you collect a hefty dividend while you wait.

Finally, and importantly, with a market cap under $9.51 billion, I think Buckeye has the potential to be taken out by another player. It has a nice “moat” around its oil and refined products terminal business that makes it very attractive.

Here’s what to do:

Place an order using 5% of the funds allocated to the Income Investments section to buy Buckeye Partners LP (NYSE: BPL) at the market.

There are risks, as there are with stocks generally. But the big risks for most MLPs – that they will cut their dividend or issue a flood of equity – seem lower than average for Buckeye. It has a long history of doing the right thing.

As for your portfolio, hold your existing positions. If you’re not on board already with any of these positions, for whatever reason, see the position tracking table on page 8 to see what to do.

Also, be sure to look at our bonus issue. It shows how our cycles research has identified a dangerous crisis coming our way, and 14 ways you can go for windfall profits while many risk losing everything.