Investment capital is flowing into the energy industry. Just at a considerably lower rate than previous years.

But that hasn’t stopped analysts from issuing “Buy” ratings on one of my favorite crude oil investments: Parsley Energy (PE). [Disclosure: In September, I recommended my Natural Resource Investor subscribers buy shares of Parsley Energy.]

Piper Jaffray Companies’ price target is $34 per share, roughly 27% higher than current levels. That’s on the conservative end of analysts’ estimates.

And mine.

My initial target is also $34 per share. But based on indicators and price patterns I use, Parsley has room to run to $50 over time — an 85% jump!

A quick look at Parsley justifies such a move …

They are a pure play on Permian shale where potential reserves are valued at $3.3 trillion based on current oil prices. Their acreage in the Permian lets Parsley earn a 60% rate of return on wells at $50 oil. The company can beat a 100% rate of return if oil hits $60!

They have superior capital efficiency as well as an excellent balance of cash and debt.

Parsley saw output rise 11% in the third quarter and 66% over the previous year.

Parsley employees’ talk of a “collaborative culture and its management team’s positive influence” speaks to the success of what Parsley considers its “melting pot of solutions.”

Whatever is in the melting pot, it’s not too hot or too cold … but just right.

Same goes for investor sentiment in this industry — it’s just right for us to bet on Parsley …

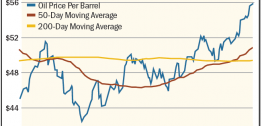

Bulls have been driving the price of oil lately. However, the long-term potential of the oil industry is not being fully embraced yet.

But it should be soon.

Mike Burnick revealed in the lead article how the industry has adapted to low oil prices. Breakeven production costs are down considerably since the days of $100 oil. And companies intend to bring these costs down further.

This means well-run oil companies like Parsley can operate profitably, even without a major spike in the price of crude oil.

Investment capital should return in a big way as the crowd recognizes the many factors leading to industry rebalancing. Parsley Energy is a good place to be when that happens.

With 5% of the funds allocated to the Materials, Energy & Ag portfolio, buy to open shares of Parsley Energy (PE) at the market.