We’ve told you, with no punches pulled, about the financial turmoil overseas that’s driving a tsunami of flight capital to U.S. markets.

We’ve told, with conclusive evidence, about the political turmoil and conflicts overseas that are driving still more fear money our way.

In this double-length gala edition of Real Wealth, we show you 14 ways to profit from this megatrend.

Plus, there’s another not-so-hidden reason why foreign investors are attracted to our shores: It’s solar power, and it’s not just for tree-huggers anymore!

During the past few years, solar power generation has gone mainstream.

It’s now the world’s fastest-growing alternative energy source. It has finally found its place in the sun. And big profits will be made in this sector over the next decade and beyond.

How do I know? Because mainstream utilities, Silicon Valley tech giants, and even major oil & gas companies are investing big bucks in solar as the leading alternate-energy source.

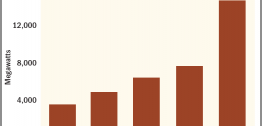

Solar energy has been surging. In 2015, solar power installations worldwide grew by over 30%. Then last year, new solar capacity nearly doubled again, to a record 14.6 gigawatts of installed capacity in the U.S. alone.

That makes solar the largest source of new electric-generating capacity for the very first time. In 2016, it accounted for nearly 40% of all new power generation projects.

But there is still plenty of room for growth. That’s because renewable energy sources of all types account for just 15% of total electricity generated in the U.S. today. Plus, there is a growing cost-incentive to spur added solar capacity.

Natural gas is still the No. 1 source of electricity generation in the U.S. But at 34% of the total, renewable energy sources have more than doubled over the same time frame. And in the past five years alone, renewable-energy projects have accounted for two-thirds of all new electrical-generating capacity in the U.S.

Last year, in fact, solar installations surpassed natural gas and wind power for the first time ever. Utility-scale solar projects are ramping-up fast, with installed capacity more than doubling last year (compared to 2015).

Solar provides a lot of bang for the buck. Costs keep plunging — even faster than oil, natural gas and other fossil fuels. This makes sun power cheaper than ever, compared to fossil fuels and other alternatives alike.

You see, like most technology, the cost to produce solar photovoltaic (PV) modules has a steeply declining cost curve. In fact, the price of PV modules has fallen about 26% for every doubling of installed solar capacity.

In 2016, the estimated average cost of PV modules declined to just 41 cents per watt. That’s down sharply from over $3 per watt in 2008!

As a result, it makes a lot more sense today for big electric utilities to build large-scale solar facilities. The cost to construct a utility-scale PV project has fallen by more than two-thirds since 2010 alone. And sure enough, utilities are jumping headfirst into solar, with large-scale projects increasing by a whopping 145% last year alone!

For smaller-scale solar projects — those used in residential, plus commercial and industrial applications — PV installations also set another record in 2016. Some 3.4 GW of solar capacity was installed in U.S. homes and business.

That’s nearly 2.5 times the number of small-scale solar installations just four years ago.

Just like their large-scale solar project brethren, residential and commercial applications are benefiting from a steeply declining cost curve. Costs to build commercial-scale PV facilities have fallen by 62% since 2010. Residential PV installation costs have fallen by nearly 60% over the same time frame.

At the end of last year, solar power became the cheapest form of new electricity, for the first time ever. That’s according to Bloomberg. And they project solar energy costs will continue to decline even more steeply over the next two decades.

Based on their forecasts, solar energy costs will drop another 66% by 2040. By that time, renewable energy sources combined — mainly solar and, to a lesser extent, wind — “will take almost three-quarters of the $10 trillion the world will invest in new power generating technology,” according to Bloomberg.

Needless to say, this represents a huge energy sector investment opportunity. One that’s ripe for the picking today.

The cost of electricity from the sun, which is now just one-fourth of what it was just eight years ago — will drop by 66%. Put another way, a dollar will buy 2.3 times as much solar energy than it does today.

That’s the real reason why the coal industry is getting put out of business. It’s simply not cost-competitive anymore, given the innovations in solar power technology.

Here’s a sign of the times: Deep in the heart of American coal country (Eastern Kentucky) is a big coal mining company, Berkeley Energy. Berkeley is working with EDF Renewable Energy on plans to build the very first utility-scale solar project in Appalachia.

Just outside Pikeville, Ky., they’re planning a 50- to 100-megawatt solar farm on a mountaintop that used to be a working coal mine. That space is now abandoned. But not for long.

This Berkeley-EDF partnership wants to produce energy more efficiently. On top of that, they plan to put unemployed coal miners back to work. Times are indeed changing in the energy industry, both globally and here at home in the U.S.

Look, solar is already cheaper than coal and natural gas in many developed nations. That includes Germany, Spain, Italy and the U.S. But the real catalyst for explosive growth in solar power is emerging markets.

Within the next four years, solar power will be cheaper than coal in China, India, Mexico and Brazil. This should usher in about 3 trillion potential new customers for solar in these fast-growing developing nations.

In fact, China and India alone are accounting for the lion’s share of growth in solar power. China already has the world’s largest base of solar power installations. It has nearly twice as much installed capacity as the U.S.

By 2040, China will account for nearly 30% of the world’s total investment in power-generating capacity, from all sources. (Fossil fuels and renewables combined.) India will account for 11% of the world’s total.

By that time, the entire Asia-Pacific region will account for almost as much energy investment as the rest of the world combined!

About one-third of this investment will go to solar PV installations. Another 30% will go to wind energy, and almost 20% to nuclear. And just 10% of the total will be invested in traditional fossil fuels like coal and natural gas.

Now, I know what you’re probably thinking: Solar, wind and other renewable energy sources are all well and good. But they’re unreliable. What happens when the sun doesn’t shine and the wind doesn’t blow?

Well, that’s where technology comes to the rescue once again.

Innovations like roof tiles that do double-duty as solar panels, solar film applied to skyscraper windows that generate electricity and breakthrough advances in battery technology promise to even out the fluctuations in solar power generation.

Perhaps the best indication of all that solar will shine in the years ahead? The simple fact that big business is investing in solar in a very big way. Just follow the money …

Apple (AAPL) is partnering with First Solar (FSLR) to build an $850 million solar farm in Monterey County, Calif. It will provide enough energy to power 60,000 homes. The company also has a new $2 billion data center in Arizona that will run on solar power.

Elon Musk’s Tesla (TSLA) recently began promoting its Solar Roof, textured glass roof tiles that double as discreet solar panels. The company’s Powerwall battery technology turns sunlight into electricity, which is stored and made available as needed. And last year, TSLA acquired SolarCity, the largest residential solar company in the U.S., for $2.6 billion.

Bottom line: After several false starts over the years, solar energy is finally shinning bright, and likely to be a money-making sector for investors for decades to come. An easy way to take advantage of this long-term growth potential is with a basket of leading solar energy sector stocks.

The Guggenheim Solar ETF (TAN) invests in a diversified group of 30 solar stocks. These companies are capitalizing on the fast-growing solar power industry, with holdings in every segment of the solar food chain, including: solar power equipment producers, solar power system installers, and companies that sell power generated by the sun to electric utilities.

Here’s what to do right away …

Using 5% of the funds you have allocated to the Materials Energy & Ags section, place an order to buy Guggenheim Solar ETF (TAN), at market.

Basic Survival Strategies

Buy Franco-Nevada

We recently saw gold hit one-year highs. In fact, while the metal may zig and zag, gold is in a big bull market. We talked about the cycles driving gold higher in a recent Edelson Wave column.

But one thing’s for sure. You want more exposure to rising gold prices. That means buying the highest-quality miners on the next pullback.

Therefore, I recommend you target one of the best big gold and silver streamers. A streamer provides miners with cash up front for the right to buy gold and silver in the future at reduced rates.

My top pick is Franco-Nevada Corp. (NYSE: FNV).

The company just had a great second quarter. Year-over-year, revenue increased 8%, gold-equivalent ounces increased 8.6% and net income increased 7.8%. Operating income, gross margin and gross profit were all up.

Franco-Nevada has over $600 million in cash and equivalents, plus another $1.1 billion in available-credit facilities.

Finally, Franco-Nevada has increased its dividend every year for 10 consecutive years.

So here’s what to do …

Place an order using 5% of the funds allocated to the Basic Survival Strategies section to buy Franco-Nevada (NYSE: FNV), at a limit price of $76.00 or better, good-till-canceled.

Along with adding shares of Franco-Nevada on the next pullback, here is an update on some of your existing positions.

First, if you acted on the Sept. 5 flash alert, you banked gains on HALF your Palladium Bullion (XPD) for a nice gain.

Second, hold your other physical metals as recommended. That includes Gold Bullion (GOLDS), Silver Bullion (XAG) and Platinum Bullion (XPT).

Third, you own a bunch of gold-sensitive stocks. They’ve been soaring along with the metal. So, keep holding them and raise the stops. Hold …

Your shares in IAMGOLD Corp. (IAG). Raise your protective sell-stop to $5.05, good-till-canceled.

Your shares in Goldcorp Inc. (GG). Maintain your protective sell-stop at $11.49, good-till-canceled.

Your shares in Kinross Gold Corp. (KGC). Raise your protective sell-stop to $3.50.

Your shares in Sibanye Gold (SBGL). Maintain your protective sell-stop at $4.05.

Your shares in Freeport-McMoRan (FCX). Raise your protective sell-stop to $13.60.

Fourth, you have a nice fat gain in Vantiv (VNTV). Raise your protective sell-stop to $65.90.

Fifth, you should keep holding the following stocks, and keep the stops the same. These include: Hecla (HL), Hi-Crush Limited Partners (HCLP), EQT Corp. (EQT), Cameco Corp. (CCJ) and Textron Inc. (TXT).

If you’re not on board with any of these positions already, for whatever reason, see the position tracking table on page 8 to see what to do.

Sixth, be sure to check our special gala edition by clicking here for a solid preview of the 14 other amazing ways to profit coming our way.