You should be filled on last month’s recommendation to buy the Alerian MLP ETF (AMLP). Excellent! This fund thrives and makes money by transporting, storing and processing energy commodities. It’s a longer-term investment in U.S. energy infrastructure, and it pays a handsome annual dividend of 8.3%.

Oil MLPs — being paid to wait

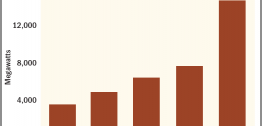

The fundamentals for energy MLPs improved significantly in recent years, aided by …

- Upgraded bond ratings that lower borrowing costs.

- Stronger corporate balance sheets.

- U.S. now the world’s swing (oil) producer thanks to surge in shale production.

- Technological advances lowered breakeven prices that increase profitability.

- Easier U.S. regulations toward new project and pipeline approvals.

In the meantime, oil-market fundamentals are improving. Consider these bullish forces:

- OPEC members committed to balance

the market and the oil revenues vital to their survival.

- U.S. crude supplies down six consecutive weeks, while oil drilling activity stabilizes.

- Weaker U.S. dollar boosting overseas demand for U.S. supply.

- Record U.S. refining activity.

And this bodes well for your AMLP and Goldman Sachs MLP and Energy Renaissance Fund (GER) positions.

Meanwhile, I’m monitoring a couple of headwinds in the oil market. Those include increased risk aversion across global markets and the impact of greater producer hedging as oil prices move higher.

Your position in Westlake Chemical Partners LP (WLKP) is showing open gains of 18.9%. This comes at the same time it’s throwing off a hefty 5.5% dividend — more than 2.5 times greater than U.S. 10-Year notes. Nice!

WLKP’s second-quarter earnings missed top- and bottom-line estimates. Yet, business revenue increased 37.6% compared to the same period last year. Plus, higher production volume and lower maintenance costs lifted distributable cash flow and paved the way for a 12% distribution increase from year-ago levels.

Good news for you!

Finally, the gold market benefits from growing safe-haven demand caused by geopolitical tensions between the U.S. and North Korea. Additionally, doubts that Congress will be able to raise the debt ceiling in a timely and orderly fashion provides near-term support. These uncertainties bode well for your GAMCO Global Gold, Natural Resources & Income Trust (GGN) position.