OPEC’s Revenge … Why it Means More Upside for Energy!

I alerted you in the July issue of Real Wealth Report that the beleaguered energy sector was poised for a major bounce. This was right after the S&P 500 energy sector plunged nearly 14% over the first six months of 2017. Sure enough, a big upside reversal emerged in mid-summer — right on cue with my cycle forecast.

Energy stocks have already jumped nearly 12% from the August low. But you ain’t seen nothing yet! In fact, the energy sector is just now starting to break out again. And it’s poised to deliver its next round of profits. Here’s why …

At the end of this month, the Organization of the Petroleum Exporting Countries (OPEC) will meet again to officially announce the future of its agreement to cut oil production.

Recall that last year at this time, the cartel moved away from its so-called “pump-at-will” policy. This policy was introduced in 2014, and designed to crush American shale oil producers. Their actions left the world awash in oil, with a glut that kept a bearish lid on prices for two long years.

During the first six months of this year, OPEC and other producers (including Russia) agreed to cut production to 32.5 million barrels per day (bpd) in a bid to support crude prices. And in June, they pledged to do “whatever it takes” to support oil prices. That meant extending their production cuts of 1.8 million bpd until the end of March 2018.

This helps explain why energy stocks have been rocking-and-rolling higher in recent months. Saudi Arabia, and other oil-rich nations in the Middle East, caused plenty of damage to their economies while oil prices plunged in 2014 and 2015. They still haven’t fully recovered from that self-inflicted financial wound.

If crude oil prices drop again, things will only get that much worse for economies in the region. This has already caused massive capital flight out of the Middle East. That’s why OPEC probably won’t let up on its campaign to limit crude production.

Of course, U.S. producers aren’t restrained by OPEC’s production cuts. And they have been taking full advantage of the situation — striking back at OPEC by ramping up domestic output.

In fact, the U.S. Energy Information Agency (EIA) forecasts U.S. crude oil production will average 9.4 million bpd in the second half of 2017. That’s 340,000 bpd more than in the first half of the year.

Production in 2018 is expected to average 9.9 million bpd, surpassing the previous high of 9.6 million bpd set in 1970.

Domestic production is becoming more efficient with each passing day thanks to the ingenuity of the U.S. shale industry. Thanks to advancements in drilling technology, shale oil companies are tapping reserves that were pretty much out-of-reach just a decade ago.

These companies are more profitable than ever before, even with low oil prices. In fact, the average well in Texas’ Permian Basin is very profitable today even with $50-a-barrel oil, according to Bloomberg. And as I pen this issue, oil prices are pushing $60 a barrel!

But in spite of this increased domestic production, U.S. crude oil inventories keep falling. That tells me the demand side of the story has the upper hand, and the “glut” in oil supplies is rapidly getting worked off.

U.S. crude oil inventories fell 2.4 million barrels during the first week of November, a much larger than expected draw. And at the current pace, domestic stockpiles could drop by as much as 25 million barrels over the next year!

Meanwhile, global crude oil consumption is more difficult to track than production. Which is why the market focuses more on the demand side of the equation. But it’s clear that global oil consumption is growing rapidly … Worldwide oil consumption rose by 1.6 million bpd in 2016; that’s on top of a 2 million bpd increase in 2015.

According to forecasts from the International Energy Agency, consumption should increase by another 1.6 million bpd this year, and by 1.4 million bpd in 2018, according to the IEA’s latest Oil Market Report.

At the same time demand is on the rise at home, U.S. refineries have been exporting record quantities of fuel to markets in Latin America and the rest of the world. This reflects strong demand overseas.

U.S. exports of crude and refined fuels were approximately 750,000 bpd higher in the three months from June to August than the same period in 2016.

Add it all up, and one thing becomes crystal-clear: Oil is firmly back in a cyclical upswing. And you can expect that the supply-demand balance will tighten even more next year.

Global consumption is now running faster than production. And the so-called oil “glut” everyone was wringing their hands about just a year ago is quickly vanishing.

The energy sector is on track to post the biggest annual profits since the oil market crashed three years ago. The surviving companies aggressively drove down costs to boost earnings even at lower prices. This means the oil industry’s cost structure is finally back in line with lower crude prices.

But the thing is, most investors haven’t caught on yet to the big turnaround in the U.S. oil patch. And this combination makes for an attractive buying opportunity, in my book.

Now is the time to add another domestic oil & gas company to your portfolio. The name I have in mind got hammered during the oil bear market. But it’s possible this stock could easily double in price from here!

For all the details and specific order instructions, please see the Materials Energy and Agriculture section of this month’s issue on page 2.

Grab a Gain, Buy Franco-Nevada, Cancel One Order

First, we recommend you grab your gain on Vantiv (NYSE: VNTV). We track an open gain of about 19.8%. This stock seems to have run out of momentum, so ring that cash register.

Sell all your shares of Vantiv (NYSE: VNTV) at the market, to close.

Now you can turn around and put those profits right back to work.

The precious metals market is inching closer and closer to a turn the Edelson Institutes has long predicted. This next rally in gold, silver and miners could go higher and farther than most can imagine. So, it’s time to stop dilly-dallying. It’s time to fish or cut bait, as my grandad would say.

We suggest you “go fish” on Franco-Nevada. You have an open order to buy this precious metals royalty and streaming company at $76 or better.

Now, the time has come to buy Franco-Nevada at the market. I’ll show you why on this weekly chart …

You can see that Franco-Nevada pushed through overhead resistance. Then it came back and tested that former resistance as support. Now, it is headed higher again.

Franco-Nevada reported third-quarter earnings recently. It turned in earnings of 30 cents per share. That beat estimates by 5 cents. Revenues came in at $171.5 million. This also beat expectations.

The stock is helped by the fact that it collects royalties, or streams, from 47 different producing mineral assets. In the most recent quarter, 89% of its revenues came from precious metals. The rest were from oil and gas or “other” sources.

And 81% of Franco-Nevada’s revenue comes from the Americas. This gives it some stability in a world that feels less stable every day.

And it had all-in sustaining costs of $300 per gold equivalent ounce (GEO) in the third quarter. That is a FAT profit margin.

The company continues to make deals. In the third quarter, it increased its stake in the Cobre Panama project. That’s one of the largest repositories of copper, gold, silver and molybdenum in the world.

Generally speaking, Franco-Nevada got new streams and royalties in gold, silver, oil and gas. It has $632 million in working capital, so it can continue to make more deals.

Finally, there’s the fact that Franco-Nevada outperforms the Van Eck Gold Miners ETF (NYSE: GDX). And it leaves gold itself in the dust.

You can see that in the short term, GDX can outperform Franco-Nevada. But for the long haul, there is little that will beat this super-efficient streamer.

So put it all together, and you can see why investors find Franco-Nevada more appealing than many other stocks in the industry. We do, too.

Cancel your order to use 5% of your funds allocated to the survival section, to buy Franco-Nevada (NYSE: FNV) at $76 or better. Replace it with an order to buy Franco-Nevada at the market, to open. When filled, place a 25% good-till-canceled stop.

Position Update

You should have been filled on recent recommendations to buy B2Gold (NYSE: BTG), Coeur Mining (NYSE: CDE), New Gold (NYSE: NGD) and First Majestic Silver (NYSE: AG). These are all solid stocks that are in the sweet spot for the next rally.

You are most likely not yet filled on your open order to Osisko Gold Royalties (NYSE: OR) because it moved up beyond the buy-limit. Cancel this open order immediately, and we will wait patiently for another opportunity.

In other portfolio news, Goldcorp (NYSE GG) handily beat earnings estimates in the third quarter. In fact, earnings surged 33% year-over-year.

And Hi-Crush Partners (NYSE: HCLP) showed us why it bottomed in August. It turned in a great third quarter. Profits widened thanks to demand from America’s oil patch. The company’s profit margin soared 331% to $19.39 per ton of sand this quarter, up from just $4.50 a year earlier.

And the company reinstated its cash distribution. Management said it will begin with a 15-cents-per-share distribution for this quarter.

Speaking of solid natural-resource plays that pay you to own them …

One More Way to Profit from

OPEC’s Revenge!

I have a special treat for you today. I’ve invited Matt Badiali to weigh in with his take on oil. Matt is a trained geologist and uses his on-the-ground expertise to help investors to drill for natural resource values at

Banyan Hill Publishing. He’s offered to share with you one of his favorite picks in this exciting, and very lucrative, space.

“We are poised for a rebound…”

On March 22, 2017, John Paisie, executive vice president of oil industry research firm Stratas Advisors, spoke these words to a collection of U.S. oil industry executives at the Midland Country Club in Midland, Texas.

And I believe he was correct.

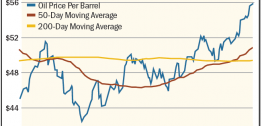

The Organization of the Petroleum Exporting Countries (OPEC) forced its member nations and some key allies into cutting production for 2017. As Mike pointed out in the lead story, they agreed to a cut of 1.2 million barrels per day. That should have been enough to push crude oil prices higher. And it did … crude rallied from around $27 per barrel in January 2016 to a sustained price around $50 per barrel for the latter half of 2016 and most of 2017.

However, that could end soon.

See, the rally in oil prices allowed many U.S. producers to open the spigots again. U.S. production bottomed in August 2016 at 8.6 million barrels per day. It has climbed back up to 9.3 million barrels per day and the Energy Information Administration estimates that production could top 10 million in 2018.

That bump in U.S. oil production will likely push prices down slightly … which is great. Lower oil prices in the short term provide a perfect opportunity to buy an oil producer at an even better price.

You see, our speculation isn’t about the short-term oil price. We’re buying because the industry’s costs are finally falling, and the price of oil will go up in the next year or two.

By lowering costs, the producers become more profitable. So when oil prices begin to rise again, the companies’ profit margins will increase even further. And I’ve identified a key area that speculators should be watching.

The Permian Basin — U.S. Shale’s Next Big Thing

The Permian Basin is a huge geologic structure that sits under West Texas and Southeastern New Mexico. It’s a giant, 86,000-square-mile basin — nearly a third of the size of the Lone Star State itself! — with a ridge in the middle.

It was historically a prolific oil-producing region. In 1921, the Santa Rita No. 1 well became the first commercial oil well in the area. It flowed for 70 years.

From 1921 to 2012, conventional oil fields in the Permian Basin produced about 29 billion barrels of oil and 75 trillion cubic feet of natural gas.

However, in 2012, when the industry moved to unconventional shale, the basin exploded with untapped resources.

The Permian Basin contains not one, but seven, shale units rich in oil. In 1995, the U.S. Geological Survey estimated that the basin holds over 100 billion barrels of oil. However, the CEO of Pioneer Natural Resources believes the Permian Basin could hold 75 billion barrels of oil. That would put this basin second only to Ghawar in Saudi Arabia on the list of the world’s largest oil fields.

The Delaware Basin comprises the western side of the Permian Basin. It’s a nearly mile-deep bowl of shale layers — roughly 4,800 feet thick. It contains nine discrete shale layers full of oil. The larger Midland Basin makes up the eastern side of the Permian basin. A central platform separates the two sub-basins. The Midland Basin is only about 2,800 feet thick. However, it contains 15 shale layers.

The Permian Basin will likely remain a major oil producer for another century at the least. That’s what makes it the oceanfront real estate of the oil industry: It’s expensive to lease ground there, which means it’s hard to break in.

Rental rates for land in the Permian Basin ran to $60,000 per acre earlier this year. That’s a 4,900% increase in just four years. Imagine if the value of your house went from $50,000 to $2.5 million between 2013 and 2017.

That high cost of entry puts up a huge moat around the companies already working in the Permian.

The problem is that the oil price isn’t giving us that big lift yet. Companies in the Permian are drilling. Iraq and Iran continue to fight with Saudi Arabia, putting even more barrels on the market. So far in 2017, the oil price has stayed relatively flat.

But U.S. production isn’t. Oil production in the Permian and other U.S. shales is up 8% so far in 2017.

One of the best ways to play this today is with companies that do the work — the companies that drill the wells, put the wellheads on and hook them up to the pipelines for production. These are the drilling service companies.

The single-best drilling company in the Permian — and in the U.S. — is Helmerich & Payne (NYSE: HP). Helmerich & Payne is the most active U.S. land driller. It operates 30% of the active alternating-current, aka AC drive, rigs — the most modern style of drill rigs.

These modern rigs need less maintenance. They’re also faster and lighter to move. That means lower operating costs. AC rigs remain in high demand, with 80% to 90% of them working today. And the ones that aren’t working are older models that aren’t up to the current specifications.

The proof is in HP’s fleet schedule: In 2018, over 80% of the company’s rigs will be working. Nearly all of its rigs are under contract for 2018.

That means we have a comfortable cushion of work and earnings for the company. It could take that long for the oil price to stabilize.

In addition, the company has modest debt and lots of cash. Revenue and earnings are up from last year. From the end of 2016 to the end of 2017, the company should grow revenue by 47%. That’s great news.

I believe we easily double our money in HP with a small move higher in oil price. The great thing about HP is that it pays us to wait. It paid out 70 cents per share for the last five quarters. That works out to $2.80 per year, a 5% yield to hold this driller and wait for the oil market to improve.

Clarification regarding the October 2017 Real Wealth Report: In last month’s Real Wealth Report we cited that gold reached a high price of $2,451. This price is adjusted for inflation. Not taking inflation into account, the high price for gold spot reached $1,920.70 while gold futures reached $1,923.70. We apologize for any confusion in this matter.

— The Real Wealth Report Team