New artificial intelligence program

lets you make 5 years’ worth of stock

market gains in the next 11 months.

PLUS: How to know when to get out before the

next big crash.

Dear Friend,

Today, I’m going to tell you about a proven system that has consistently handed us double and triple-digit winners.

I’m also going to tell you what that proven system is saying right now about the stock market and where it’s headed.

If you’re like most investors, you’re probably wondering whether this bull market is finally coming to an end. And you’re probably wondering what you should do with your money. Should you stay invested, and risk losing it all in the next crash? Should you get out now, and risk missing out on bigger and bigger profits? Should you take some profits and keep the rest of your money in the market and “let it ride?”

Well, in this letter, I’m going to tell you exactly what to do.

And what I’m going to tell you is not based on opinion, theory, or speculation. It’s based on proven, real-world results.

These results come from a proprietary computer program that uses the latest breakthroughs in artificial intelligence (AI). Our proprietary AI program not only tells us what investments to buy … it also tells us when to get in and out of those investments.

For example, our computer algorithm told us to buy NXG and sell it a year later. Subscribers who acted on that recommendation could have realized a 272% gain.

It told us to buy AWC and sell it 6 months later for a potential gain of 103%.

It told us to buy ESLR and sell it 3 months later for a 76% gain opportunity.

It also told us to buy gold puts and sell them a month later, a potential 103% gain for those who acted on the recommendation.

This is just a small sample of the results we’re getting. I’m going to share more of my results with you in a moment. I’m also going to tell you how my artificial intelligence program works … and why it’s so accurate.

But first, let me answer the question about what’s going to happen to the stock market and why.

The Truth About the Bull Market

The bull market has been going for over 9 years now. And in that time, the Dow has more than quadrupled. That makes this the second-biggest bull market in history.

You’d think that the economy would be roaring along with the stock market. But the fact of the matter is that during the entire 9 years, annual GDP growth has never even reached 3%. Not once!

How can this be? How can such a spectacular bull market have been accompanied by such piddling economic growth? The answer has to do with money and inflation. Let me explain …

Since the financial crisis of 2008, the U.S. government has printed $4 trillion that didn’t exist before. That’s a near-doubling of the money supply in just 9 years.

Now, you don’t have to be a genius to understand that if you create that much money out of thin air, you’re going to create inflation. If you have twice as much money chasing after the same goods and services, the prices of those goods and services are going to go up. It’s simple supply and demand.

And yet, the official inflation rate is only 1.7%. How can this be?

One reason is that the government is “cooking the books.” They’ve changed the way they calculate the Consumer Price Index so they can make the inflation numbers look lower than they are.

But even if we calculate inflation the old way, we still only get an inflation rate of about 5.8%. That’s a lot more than 1.7%, but still nowhere near what you’d expect from a doubling of the money supply.

So how could printing $4 trillion out of thin air only cause 5.8% inflation? I’ll tell you how: Money doesn’t just chase goods and services; it also chases investments. And when money chases after those investments, the prices of the investments go up.

It’s plain and simple: When money chases after goods and services, it creates price inflation. And when money chases after stocks, it causes stock-market inflation.

And that’s what we are getting today, stock-market inflation. Stock prices are reaching lofty levels. The P/E ratio of the S&P is now 25.87, which is 72% above the historical average of 15.

Does that mean you should get out now, before the bubble bursts?

Yes, you should always get out before the bubble bursts. But no, you should not get out now.

I repeat, you should NOT get out now.

Why? Because the biggest profits in a bull market come at the end, after prices are already inflated. And the bigger the bull market, the more this is true.

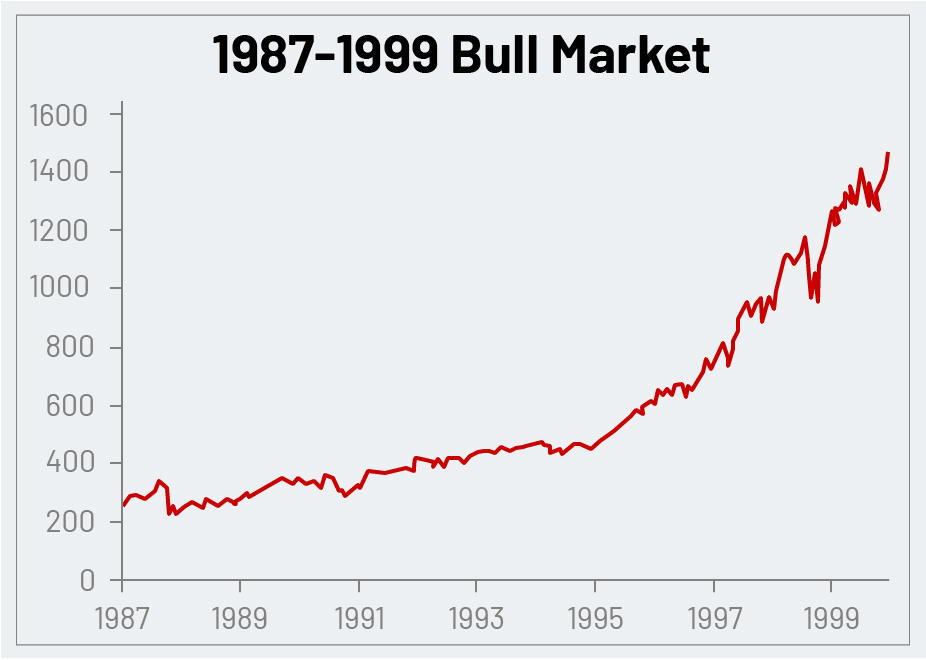

Let’s look at the biggest bull market in history, the one that ran from December 1987 to 1999. During that time, the Dow went up more than six-fold.

Take a look at this chart:

That bull market lasted 12.8 years. Yet 44% of the total return — nearly half — came during the last 19 months!

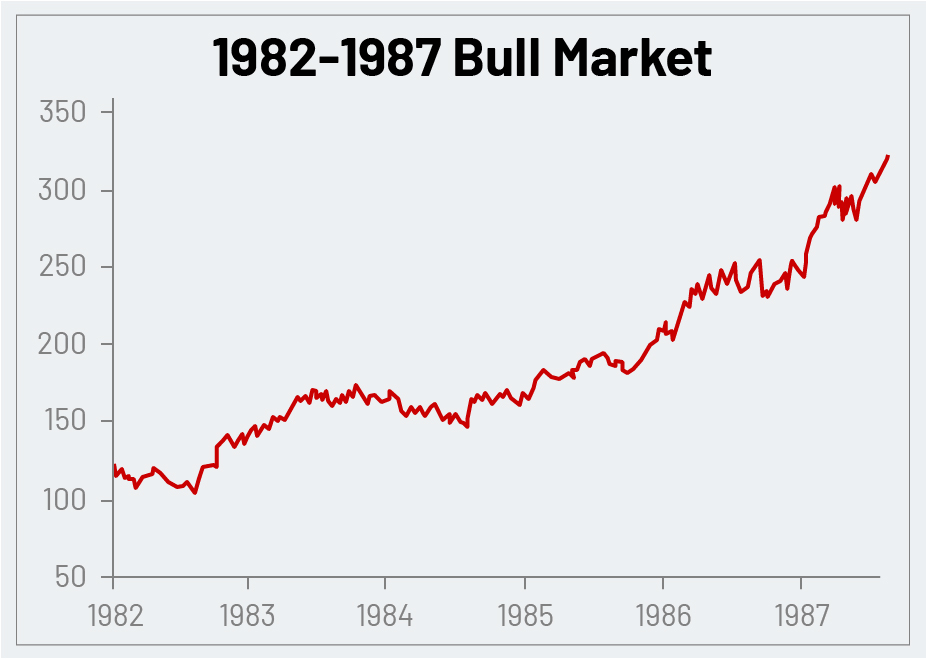

Now let’s look at the second—biggest bull market in history (other than the current one). It ran from 1982 to 1987. During that time, the Dow more than tripled.

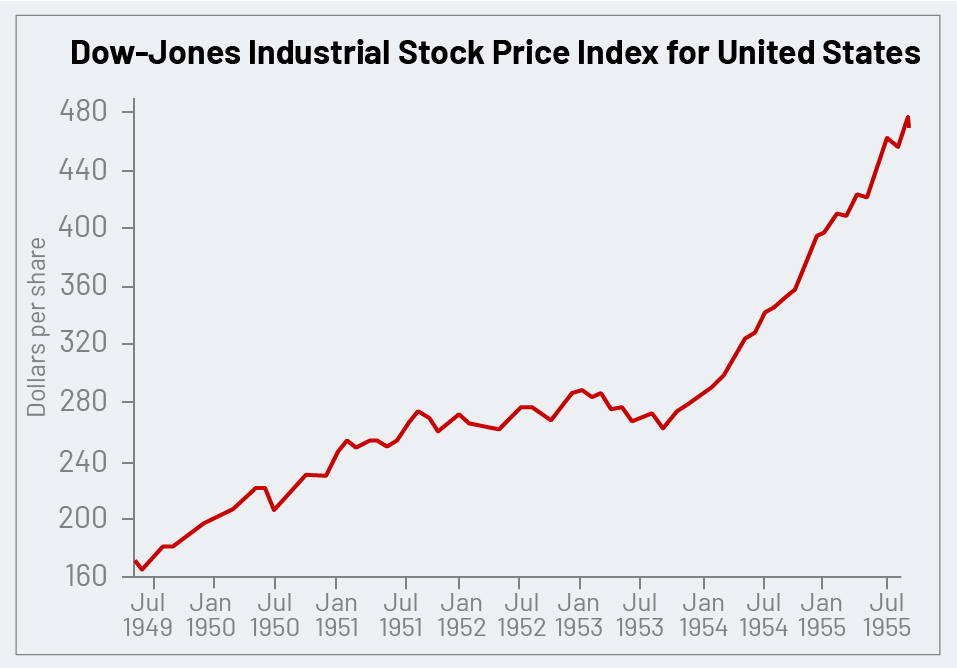

Now let’s look at the third—biggest bull market in history (other than the current one). It ran from 1949 to 1956, with stocks nearly tripling.

That bull market lasted 6.25 years. Yet 68% of the total return came during the last 24 months!

I think you get the idea.

This is a pattern that gets repeated over and over, all the way back to the Roaring 20s and beyond.

Now take a look at the chart below of the current bull market.

As you can see, the rocket phase of this bull market has yet to occur. Why? Because all the money the government printed is not yet invested in the market.

According to the World Bank, there are still 6.4 trillion dollars sitting on the sidelines in savings accounts and money markets. When that money starts going into stocks, we’ll see the same rocket ride we always see.

In fact, our algorithm shows that this money will propel the Dow to 45,000 over the next 11 months. That means you have the opportunity to make serious money when the rocket ride launches.

It Happens Every Time

How do I know that more money will enter the stock market? Because it’s human nature. Human nature causes people to be greedy when they should be fearful and fearful when they should be greedy.

We see this play out during every bull market/bear market cycle. During a bear market, people are afraid. They remember the pain of losing their money in the crash. So they stay out of the stock market, even though it’s the best time to buy.

It’s during this phase that value investors like Warren Buffett scoop up the bargains. This causes prices to inch higher. As the prices inch higher, the upward trend is confirmed, and more investors come in. And a new bull market is born.

During this new bull market, more and more money comes in. Prices continue to rise, and institutional investors continue to buy. But many regular-guy investors remain on the sidelines. They still remember the pain of loss, and they fear losing what little they have. So they stay away.

But as the bull market continues to churn, these investors feel like they’re missing out. They hear friends talking about how they’re making a killing. They see that their idiot brother-in-law has a boat in his driveway and they don’t. They watch media reports about the Dow hitting one high after another. Finally, they can’t stand missing out anymore and they jump in.

Newbie investors jump in, too. Waiters, plumbers, cab drivers. Remember the dot-com bubble of the 1990s? The most unlikely people transformed into “stock experts.” In fact, it seemed as though you couldn’t get your hair cut without the barber giving you a stock tip!

This is a sure sign of a market top. Yet most people ignore it.

Even the professionals get caught up in the mania. They become intoxicated by all the money they’re making. They start to believe their own PR, and pat themselves on the back for being such geniuses. They begin to think that somehow the rules don’t apply to them. Or that maybe that the old metrics don’t apply in today’s “new economy.”

The mania continues, until some people wake up from their trance and start taking profits. The selling begets more selling. What starts as a ripple turns to a tidal wave. And people get wiped out.

So how can you make sure you don’t fall prey to this cycle and get wiped out? By taking human emotions like greed and fear completely out of the equation.

And that is where artificial intelligence comes in.

The Proven System That Could Make You Rich.

Hi, my name is Sean Brodrick. I’m Executive Director of The Edelson Institute. For almost two decades, I’ve been an investment analyst, a tech entrepreneur, and a director of the Sovereign Society.

But the greatest thing I’ve ever done was to team up with an investing genius named Larry Edelson.

Unlike many investment analysts, Larry didn’t make his fortune by collecting management fees. He made it by investing his own money. And then leveraging his amazing ability to call market tops and bottoms.

In 1980, for example, Larry told his clients that gold had peaked and that it would go into a twenty-year bear market.

In 1987, he predicted that the stock market would crash. He said that it would be a temporary thing and that the Dow would go on to new highs by 1989.

In 2000, he predicted the tech wreck and told people to get out of stocks.

In 2004, he told people to invest in China and other emerging markets, and had them ride those markets up to the highs of 2008.

In 2008, Larry warned that we were in a housing bubble here in the US, and that when the bubble popped, it would take the stock market and the economy with it.

In 2009, he called an end to the bear market and told people to get back into stocks.

And in 2011, he issued a “sell” signal for gold, just days after it had crossed $1,920 an ounce.

Indeed, if you look at Larry’s complete track record over the last 25 years, you’ll see that he had been amazingly accuracy at calling major turning points. I’ve never seen anyone with that kind of track record.

So how did Larry get these amazing results? He did it by studying cycles and patterns that occur over and over again. These cycles and patterns are the result of human behavior. And human behavior is largely predictable.

A moment ago, I talked about how human behavior plays out in the bull market/bear market cycle. This is just one of the cycles that Larry studied. There are many others, some of which you are familiar with.

Take the business cycle, for example. During an upswing in the economy, consumers buy more goods and services. So companies increase their production of those goods and services. They hire more employees … or buy more equipment … or borrow money.

But at some point, the supply of goods exceeds the demand. So companies lower their production. They stop buying equipment, which causes the equipment manufacturers to lower their production.

The lowered production causes companies to start laying people off. And the layoffs result in even less demand for goods and services, because the people who lost their jobs can’t afford to spend money. It’s a downward spiral.

The spiral continues until supply and demand finally catch up with each other. And then companies start ramping up production again, and the whole business cycle begins anew.

Of course, every analyst follows the business cycle. And every analyst follows the stock market. But these are not the only cycles that are important. There are literally dozens of others.

There are cycles for real estate development … government regulation ... income inequality. There are even cycles for war and peace!

Some of the cycles tend to run opposite to each other, and some of them tend to run in the same direction. But rarely do they run exactly in sync. For example, while the stock market and economic expansion tend to go hand in hand, they do not peak and trough at the same time.

Larry Edelson’s genius was that he was able to take dozens of cycles and overlay them on top of each other. He was then able to look at where the cycles converged … study what happened historically whenever those converges happened … and then use that information to predict what would happen next!

You see, Larry didn’t just use his methodology to study the markets. He also used it to study individual asset classes … and even individual stocks!

For each asset, he would do hundreds of different calculations. In the old days, it used to take Larry three days to analyze a single market. But as computing power increased, Larry was able to do it in just minutes.

And then, Larry took advantage of the greatest computing breakthrough of all ...

The Artificial Intelligence Breakthrough.

I’m sure you’ve heard of artificial intelligence, or AI. AI enables machines to learn from their past successes and failures. In essence, the machines are able to “think” like a human — but without letting human emotions come into their decision-making.

To create his artificial intelligence program, Larry hired one of the leading AI experts in the world. And to find him, he went all the way to Russia.

I can’t give you the name of our shadowy Russian computer genius. Let’s just call him “Sergei.” Sergei went to work with all the data Larry had given him and he created an AI program that learns from itself.

When Sergei was done, Larry and the rest of the team got to work. We added massive streams of real-time data which can be run through our AI program. This data covered over 20,000 stocks, 4,000 ETFs, and 7,000 mutual funds. By the time we finished, we had decades of cyclical price data on each investment class.

Soon, this artificial intelligence program was learning and adapting to the markets. And it was producing extraordinary results.

Larry was as excited and happy as I’d ever seen him, as he talked about how our AI program was going to give little-guy investors an edge over the big institutions.

Sadly, Larry passed away last year, not long after his dream AI program was realized. His death came as a shock to all of us who worked with him.

But typical of Larry, he had looked to the future and created a plan to be followed in the event of his death.

I am honored and humbled to be chosen as Larry’s successor. And I am proud to introduce you to his artificial intelligence program, known as the Wealth Wave.

Your Unfair Advantage to Market Profits.

Not only has Wealth Wave forecast major market moves with incredible accuracy, it has also pinpointed the specific investments to buy and sell.

That’s because Wealth Wave artificial intelligence has no emotion. It doesn’t get greedy or fearful like human beings. It simply makes decisions based on cycles of mass behavior.

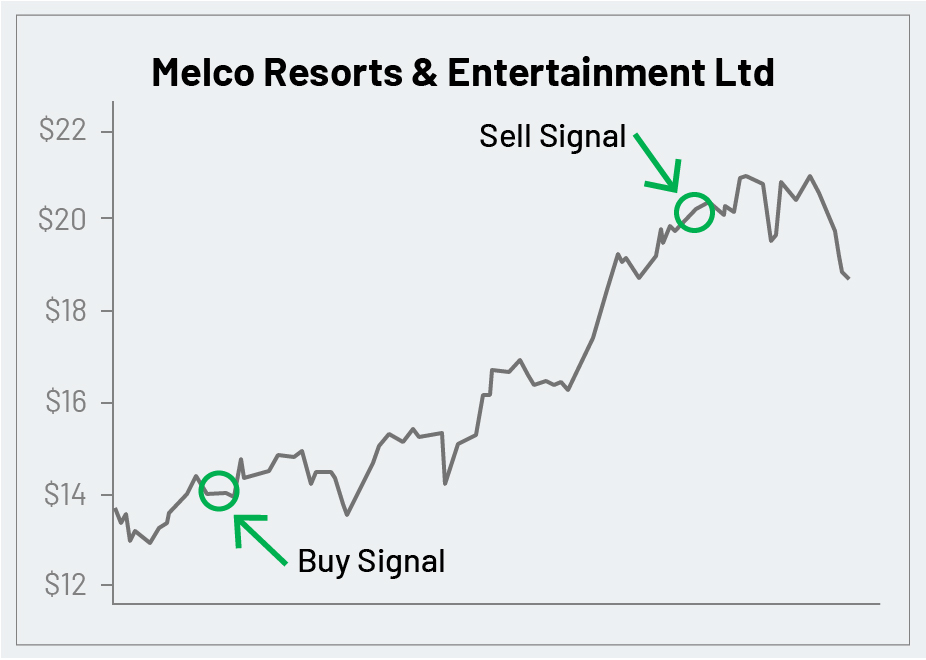

Remember how I told you earlier that cycles are everywhere? Believe it or not, one of the industries that is cyclical is gambling. Recently, our model showed that the casino industry was set to rise. They also showed a convergence of gambling growth and Chinese economic growth.

So we recommended to our subscribers one of the largest casino operators in Macau, Melco Crown Entertainment Ltd. The shares shot up by 44% in just 3 months. Our mode then flashed a sell signal and our readers who acted on the recommendation were able to pocket the profits and move on to the next opportunity.

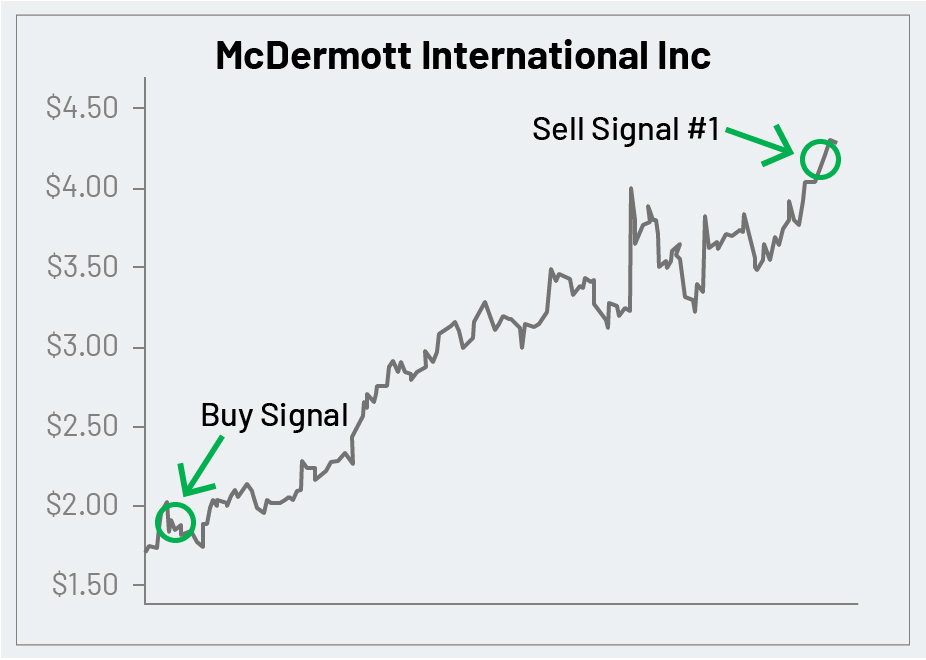

Construction is another cyclical business. When our model showed construction activity rising, we recommended that our subscribers buy construction and engineering giant McDermott International. After 8 months, the stock was up almost 63%, and our models indicated it was time to sell half of the position.

Two months later, our models issued another sell signal and we recommended that our readers sell the other half for a potential gain of near 90%. Combined, those who acted could have made 76% in 10 months.

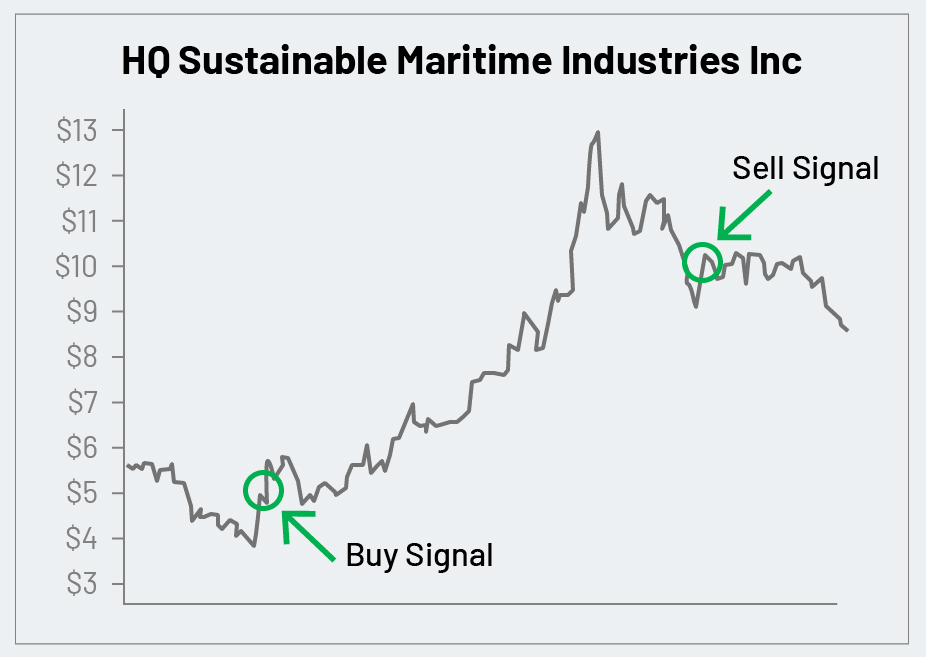

Even food prices are cyclical. When our model showed that food prices would climb and that there was increasing demand for seafood, we recommended purchasing shares in HQ Sustainable Maritime Industries. After 7 months, the model showed food prices would be plateauing, so we issued a sell alert for a potential 97% return.

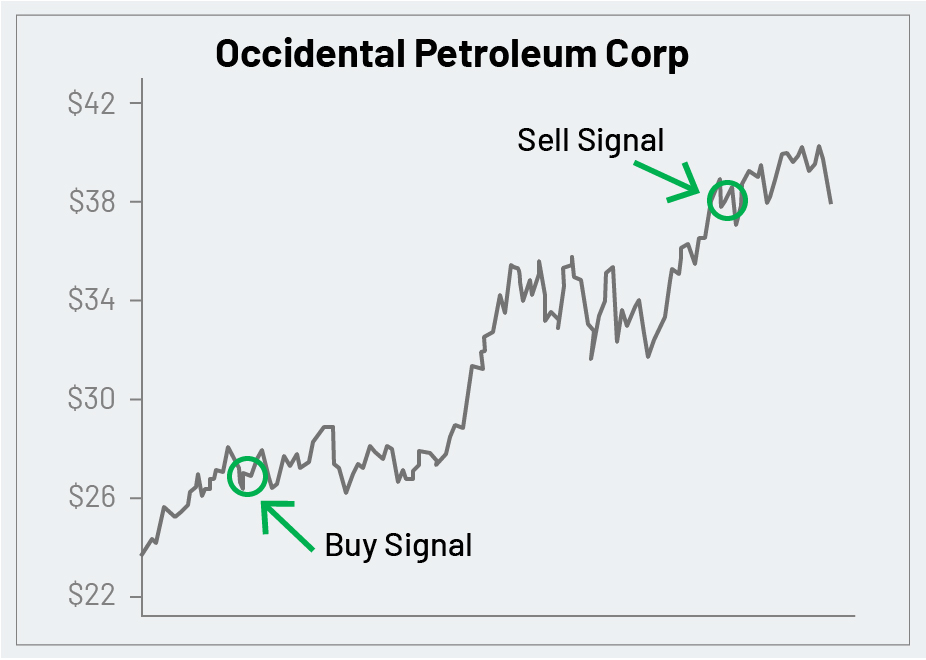

Not long ago, our models spotted changing conditions in the energy markets. So we recommended that our subscribers buy oil and gas developer Occidental Petroleum, (OXY). Eight months later, the model indicated a peak. So we issued a sell recommendation into strength for a potential 38% gain.

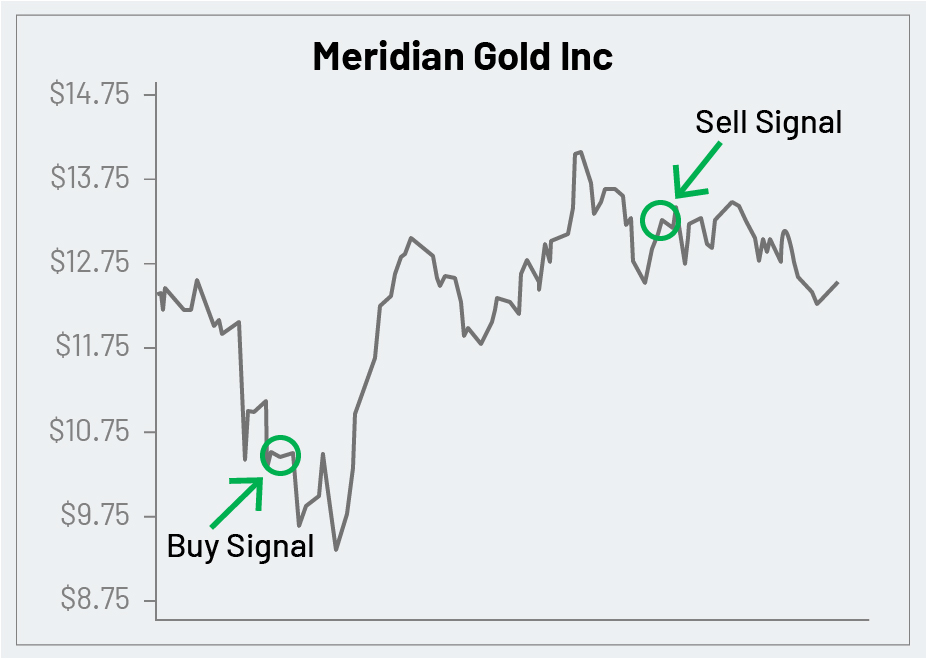

Gold prices are easy to forecast with Wealth Wave. So when our models showed a coming spike in gold prices, our system analyzed dozens of mining companies and told us to recommend that our subscribers buy Meridian Gold. Three months later, the model flashed a sell signal and we issued a recommendation that our readers cash in for a quick 30% profit.

But that’s not all. Our Wealth Wave model also recommended winners like these …

- A 234% gain on NXG.

- A 139% gain on ACH.

- A 108% gain on ZSL.

- A 106% gain in less than a year on SNP.

- A 46% return in 3 months on AEM.

- A 103% gain in 6 months on AWC.

- A 42% gain in 4 months on BCRX.

- A 50% gain in 6 months on CEO.

- A 40% gain in 8 months on PSE.

- A 68% gain in 7 months on miner ANV.

- A 76% gain in less than 3 months on ESLR.

- A 68% gain in under 3 months on ION.

- A 46% in 3 months on AEM.

- A 36% return in one month on VLCCF.

That’s just a small sample of our winners. And the good news is that I expect the late stages of the current bull market to give us bigger and faster gains. Because, as I showed you earlier, the late stages of a bull market are historically where the lion’s share of money gets made!

In a moment, I’m going to tell you about the top 5 stocks that our model suggests are poised to skyrocket over the next 11 months. But first, I have to warn you that making all that money won’t do you any good if you’re still in stocks when the market finally crashes. And that’s where Wealth Wave would help you protect your gains.

Earlier, I mentioned how Larry’s models were able to predict the stock market crashes of 1987, 2000, and 2008. In each case, the sell signals flashed months in advance, giving his readers plenty of time to get out.

Today, our models are telling us that the Dow will rocket to 45,000. And Wealth Wave is the best way we know to try and play the stock market’s rocket ride and make your fortune.

And we believe you need Wealth Wave right now because this could be …

Your Last Chance for Stock-Market Riches.

What happens after the Dow hits 45,000? According to Wealth Wave, all the cycles point to the mother of all crashes. In fact, the last time all the cycles converged like we’re seeing today, the rocket ride ended with the Crash of 1929 and the Great Depression!

It took 32 years for the Dow to recover after the Crash of ’29. If a similar scenario plays out today, we will not see prices recover for decades!

That is why you have little time to waste. You must act now, so you can position yourself to catch this final rocket ride. Sit on the sidelines and you could miss the last great wealth-building opportunity of your life!

I don’t know what your personal situation is. Maybe you’re already fully invested. Maybe you’re reading my predictions about the Dow and thinking “I’ll just keep my investments the way they are.” After all, a rising tide raises all boats, right?

Not exactly. If you have the typical “diversified” portfolio that most financial planners recommend, it could end up costing you big. There are two reasons:

Reason #1. Not everything will go up. Some investments will get creamed. Bonds, for example. During a rocket ride, investors chase returns. Which means they will flood to stocks and dump bonds.

But it won’t only be bonds getting creamed. A lot of stocks will get killed too. (I’ll tell you more about those stocks in just a moment, so you can see if you have any of them in your current portfolio.)

Reason #2. Make no mistake about it; the market WILL crash. It always does. And the steeper the rise, the greater the fall.

Right now, my Wealth Wave model is forecasting the greatest late-stage rally in history, followed by a severe crash and economic depression.

When the crash is imminent, Wealth Wave will flash a clear sell signal so that we can alert our readers that it’s time get out of the market. Until then, I advise you to accumulate as much wealth as you can. And the best way to do that is by buying the best investments that are set to rise the highest.

Yours Free: The 5 Best Rocket-Ride Stocks.

I’ve prepared a special report for you called “The 5 Best Rocket-Ride Stocks.” You can have it in your hands in just a few minutes from now. And it’s yours, free.

Inside, you’ll find my top 5 stock recommendations for the coming rally. I expect all of them to outperform the market by a wide margin. Let me tell you a little about each stock ...

Stock #1: The Oil Company That’s Really a Tech Company — Did you know that the price of oil has doubled since its low in 2016? It’s true. And my Wealth Wave models show that it will continue to rise.

So what’s the best way to profit from this move? Should you invest in Exxon Mobil? Royal Dutch Shell? BP? Actually, my answer is “none of the above.”

Why? Because none of these companies really stand out in the marketplace. They’re all offering essentially the same product … and all competing for market share. In fact, industry leader ExxonMobil has a market share of only 3.2%!

Personally, I don’t like to put my money behind “me-too” companies in a crowded field. I’d rather put money behind companies with strong competitive advantages … companies that will totally dominate their markets. And that’s why I’m recommending Stock #1.

Stock #1 is a leader in the oil-drilling industry. It has a fleet of oil rigs ready to be deployed. And it has the best balance sheet … with plenty of cash and lower debt than any of its competitors. It was making a profit even when oil was at $30 a barrel and the oil companies were losing money.

But that’s not what has me most excited about this company. What has me most excited is that it just acquired two disruptive technologies that are going to help it dominate its industry.

The first of these technologies is called 3-D magnetic variation modeling. Quite simply, it’s like taking an MRI of the earth. It offers a detailed, 3-D picture of where the oil is. Take a look at these two images:

Image using old technology

Image of same area using new technology

Notice how much more detailed the second image is. This detail prevents a driller from drilling in the wrong spots. That results in greater efficiency, greater safety, and tremendous savings that go right to the bottom line.

And that brings me to the second technology, which is called “multi-directional smart drilling.” “Multi-directional” means that the drill can go vertically, horizontally, diagonally, or any other direction. And “smart drilling” means that it uses supercomputers with artificial intelligence. The supercomputers do millions of real-time calculations, finding the optimal drilling path. Again, this saves a fortune in costs and gives this company a competitive advantage over the other drilling companies.

Why is this so important? Because in today’s world, companies with disruptive technologies go on to dominate their industries.

Look at giants like Google and Facebook and Amazon. All three of those companies spent a fortune acquiring smaller technology companies. They then used those technologies to totally dominate their markets.

Remember how I mentioned earlier that ExxonMobil has 3.2% market share? Well, let’s look at the market shares of Amazon, Google and Facebook. Google and Facebook account for 60% of all online advertising in the US! And Amazon, all by itself, accounts for nearly 44% of all e-commerce! These numbers are staggering!

I expect Company #1 to do something similar in the drilling industry. Which means that investors who get on board now could make a fortune. You’ll get complete details on the company, including the name and ticker symbol, in your free report.

Stock #2: Harvard University’s Secret Weapon — A friend of mine described Harvard as “a giant hedge fund with a little school attached to it.” There’s a lot of truth to that statement. Harvard’s endowment is worth a staggering $36 billion. And its investment returns are legendary.

But here’s something you may not now: A whopping 10% of Harvard’s assets are invested in timber. Yes, timber.

Like many other industries, timber is cyclical. And my models show that the sector is about to skyrocket. That’s because construction is booming and lumber prices are up, while production costs remain stable.

My top timber pick is a leader in the industry. It owns almost enough timberland to fill the entire state of West Virginia. It has twice the operating margin of its leading competitor. And it’s structured as a REIT, in order to legally avoid income taxes.

And here’s the clincher: The Trump Administration recently slapped anti-dumping duties on Canadian lumber companies. That means that customers that were buying Canadian lumber are now going to buy American … which means that the share price of this company is likely to soar! But you’ll have to act fast. You’ll get complete details in your free report.

Stock #3: Profit from the Biggest Demographic Shift in History — No, I’m not talking about Baby Boomers or Millennials. I’m talking about the rising middle class in China.

Most people don’t know this, but China’s centrally-planned economy resulted in a whole lot of income inequality. The Chinese population consisted of rich people and poor people, but not much in between.

But this is now changing. China has an emerging middle class of 770.4 million people! And those people are going to want the same luxuries that the rest of us have.

One of these luxuries is smart phones. Smart phone sales in China are exploding. And stock #3 is my favorite way to profit from this trend. It has the highest market share … the most modernized network … and terrific fundamentals and technicals. Plus, it’s listed on the New York Stock Exchange, so it’s easy to buy and sell.

Some savvy investors are going to get rich from the demographic changes in China. Will you be one of them?

Stock # 4: The Future of Energy — I’ve made a lot of money by investing in oil and gas. So you may be surprised to hear that one of my top picks today is in solar energy. Yes, solar energy — an industry that’s notorious for relying on government handouts to stay afloat.

Well, there have been a lot of changes in the solar industry that most people don’t know about. The cost of solar-generated power has plummeted from $3 to below $2.

Demand for solar is rising fast. The number of solar installations will set a record high in 2018. And 2019 will be even better. We’ve already guided our subscribers to 76% profits on my previous solar recommendation, Evergreen Solar. I expect this one to do even better.

Stock #5: The Money Machine — What would you say if I told you there’s a company that generates $4.5 billion in sales with only 275 full-time employees? You’d probably say that it sounds like a wildly profitable company. And you would be right. In fact, this company is so profitable that it’s rewarding its shareholders with a 10% dividend!

That’s right. If you buy this company and the share price goes nowhere, you’ll still collect 10% a year on your money. Where else can you get a 10% yield these days?

But of course, I don’t expect the share price to stay where it is. My models are predicting that the stock will rise by 15% in the next 12 month period. I urge you to get in now, while the going is still good.

As I said, you can get all the details on these stocks in a few minutes. All you have to do is click the button below to claim your free copy of this confidential report.

When you do, you’ll also receive …

Free Gift #2:

“Zombie Stocks” You Should Sell Now!

Do you remember how I told you earlier that some stocks will get killed in the coming months? This is what happens at the late stages of every bull market. The most vulnerable stocks start tanking before the rest of the market does.

In 2000, it was high-flying tech stocks that were the first to crack. In 2008, it was companies that held subprime mortgages. And today, there is a whole new set of toxic assets that will come tumbling down. Indeed, my Wealth Wave model shows that when the next crisis strikes, it could make the sub-prime crisis look like a day in the park.

Why? Because this new crisis involves thousands of stocks that look perfectly healthy!

I call these stocks “Zombie Companies.”

Let me explain what a Zombie Company is. Zombie Companies have all the appearances of healthy, growing companies. But upon closer inspection, they are not healthy at all.

Look at the pharmaceutical sector for example. Do you own shares in Merck, Abbott Labs, or Pfizer? Then you should know that one of those stocks is a Zombie Stock! And if you own it, you need to sell it now. Let me explain.

Over the last few years, Abbott Labs has been gorging on long-term debt. In fact, between 2014 and 2016, Abbott’s long-term debt went from $3.9 billion to $20.6 billion!

In a way, you can’t blame them. After all, debt is absurdly cheap right now. The problem is that debt won’t stay cheap forever. And when interest rates go up, Abbott will get slammed. That’s because Abbott’s earnings have been flat over the past three years. It won’t take much to get them into trouble.

If Abbott Labs can’t service their debt, they could be forced to default. Which means bankruptcy. What happens to your stock in Abbott Labs if the company declares bankruptcy? Simple: You’re LAST in line in bankruptcy court!

That’s why I want you to ruthlessly chop zombie companies out of your portfolio. I don’t want you to be one of the many who will lose their shirts! So I’ve prepared a list of Zombie Companies you can use to protect yourself.

Inside your free report, you’ll find 100 NYSE and NASDAQ companies that meet the Zombie Company profile. (I guarantee that some of the names on the list will shock you.) I’ve listed them in alphabetical order, so it will be quick and easy to dump them before it’s too late.

Will all 100 of these stocks go down before the next crash? No, of course not. Frankly, it’s impossible to know for sure which ones will be the first to go. But why take a chance? Why not dump all the Zombie Stocks from your portfolio and replace them with high-quality stocks that will go up the most during the rocket ride? That way you can position yourself to get richer faster, while also protecting yourself.

You’ll also get …

Free Gift #3:

The Airtight Case for $5,000 Gold.

Not only are we about to see a rocket ride in the stock market, but gold is about to soar. In fact, my proprietary AI forecasts a momentous move in the gold market. And this move will last longer than the rocket ride in stocks.

In The Airtight Case for $5,000 Gold, I’ll show you the smartest strategies for safely playing the soaring price of gold. For example, I’ll show you an investment that stands to make you $7 for every $1 increase in the price of an ounce!

Plus, I’ll also share a safe and secure way for you to store your physical gold. That way, if the government ever decides to confiscate it again, you’ll be sitting pretty. You’ll get all the details in your free report.

Your Risk-Free Invitation to Wealth Supercyle

As you can see, my three special reports give you everything you need to get started. And you can get all three reports absolutely free. All you have to do is try a no-risk subscription to my service, Wealth Supercyle.

With Wealth Supercyle, you’ll be getting up-to-date information on all my recommendations, including the latest target prices, market forecasts, and other breaking news.

“I was making all the wrong stock picks before I subscribed. I didn’t have time to do enough research. Now with your guidance I’m killing it!”

— John G, Simpsonville, SC

Here’s what you get with your trial subscription:

First, you’ll get a detailed, monthly research dossier. Each dossier contains essential forecasts, and buy and sell recommendations. Plus it gives you details on holdings and a model portfolio with all our existing recommendations. You’ll know what to buy, what to sell, and what to hold.

Second, you’ll get “Flash Alerts” whenever time is of the essence. Each “Flash Alert” gives you the complete story on every move. So if buy and sell recommendations come up between monthly issues, don’t worry. I rush all urgent buy and sell details right to your email inbox.

Third, you’ll get a special V.I.P. Invitation to my private online briefing sessions every 90 days. Not only do I share new forecasts in these meetings, I also answer any questions you may have.

“Love the gains seen in my portfolio! Keep them coming!”

— Ken N., Valparaiso, IN

And finally, you’ll receive my e-letter, Wealth Wave, each Tuesday,Thursday and Saturday. Inside, my team and I share our latest insights on stocks, gold, commodities, energy, real estate and more. Plus updates on cycle forecasts and how world events may impact your investments.

Here are 5 Ways You’ll Benefit When You Join Me.

-

You’ll have plenty of opportunities to get richer faster. I’ve never been satisfied with piddling results. I’m more interested in the kinds of windfalls that can change your life.

Remember, my system is the same system that routinely gives us double- and triple-digit gains in a year or less.

-

You’ll be positioned to start making money from the get-go. I don’t like to wait around for some beaten-down “value stock” to turn itself around. Especially during the later stages of a bull market, when the clock is ticking. As far as I’m concerned, every month you sit on a non-performing stock is a month that’s been wasted.

My proprietary Wealth Wave model finds the sectors that are poised to make major moves now. It then analyzes all the stocks in that sector and picks the best. As a result, the model often generates recommendations that would result in gains of 20%, 30%, or more right out of the gate. And when you join us, you will have the same opportunities too.

-

You’ll know when to buy and when to sell — and you’ll never second-guess yourself again. Have you ever held onto an investment too long and watched it come crashing down? Or sold one too soon and watched it continue to soar?

With our proprietary model, we never agonize over these decisions. That’s because our system makes them for us — automatically. When our model flashes a “buy” recommendation, we immediately send an alert out to our subscribers. And when it flashes a “sell” recommendation, we send that alert out too. Period.

-

You’ll sleep better at night. Many people think that the only way to get faster, greater, gains is by exposing yourself to greater risk. Nonsense! At Wealth Supercyle, we invest in historically safe companies with strong, blue-chip stocks.

We run every stock through our rigorous fundamental analysis to screen out hidden Zombie companies and industry laggards. And of course, everything goes through our E-Wave artificial intelligence model, which analyzes dozens of cycles and only invests in companies and industries that are in an uptrend.

-

You’ll be able to multiply your wealth and protect your loved ones. As I’ve mentioned, we are entering the biggest bull run in history … which will be followed by the biggest crash in history.

Most investors will make bad choices. They’ll buy high and sell low … and then struggle through the ensuing downturn.

But you’ll be able to ride the crest of the wave, multiplying your wealth until it’s time to sell. You’ll be able to maintain the lifestyle you want. You’ll be able to help your loved friends … and the causes you choose to support. You may even be able to build a legacy for future generations.

“This has been the best performance newsletter ever for me.”

— Michael S., Houston, TX

My goal with Wealth Supercyle is to give you all that and more.

Special Introductory Offer

By now, you’re probably wondering what a subscription to Wealth Supercyle costs. Many of our members have told us that they would gladly pay $200, $300, or more. But you won’t pay even half as much … or even a quarter as much. As part of this special introductory offer, you can have a one-year trial subscription to Wealth Supercyle for just $29! That’s about 8 cents per day.

Why am I pricing it so low? Because I’ m sick and tired of seeing individual investors end up on the wrong side of the bull/bear cycle.

“I’ve read a lot of newsletters over the years, and never thought I would say this, but I’m up $24,000 in 4 months. Wow!”

— Steven T. Riverside, IL

I want to continue Larry Edelson’s mission of helping regular-guy investors get an edge over the big institutions. To that end, I am offering Wealth Supercyle at an introductory price that is accessible to everyone.

And to show you how confident I am that Wealth Supercyle will help you, I’m putting my money where my mouth is. In fact, I’m wiling to put $1.2 million on the line to prove it …

My Better-Than-Risk-Free Guarantee

I’m going to make this really easy for you. Try Wealth Supercycle for a full 12 months without risking a penny. That’s right. You have 12 whole months to decide whether you like my service or not.

If Wealth Supercycle doesn’t make you a ton of money in those 12 months …

…if it doesn’t give you greater peace of mind …

… if it doesn’t make investing fun again …

… if it doesn’t meet and exceed all your expectations …

… or if you don’t like it for any reason at all, simply let me know. I’ll give you a full refund of your purchase price … plus let you keep all 3 free reports.

“You have made investors like myself have fun again in the market.”

— William M, Baldwinsville, NY

I am estimating that this guarantee puts me on the hook for over $1.2 million if I don’t deliver for you.

Sound fair? Then click the button below.

Yours for greater profits,

Sean Brodrick

Executive Director — The Edelson Institute