The great debt

collapse of 2020-2025

Shield your money and go for windfall profits

as government debt implodes in Europe,

Japan and the United States

In this report:

-

Shocking Forecast for 2020-2025: "A Roller-Coaster Ride Through Hell” ...

-

The Great Convergence: Why everything in your life is about to change ...

-

FOUR FORTUNES: The four phases of this crisis; your opportunity to build four new fortunes ...

-

Grow six times richer: 14 Supercycle investments set to multiply your money; 500% profits available NOW ...

-

Much more.

Dear Fellow Investor,

This is your moment of truth. What you do in the next few minutes, hours and days could determine your financial destiny for the rest of your life.

For the first time since 1929 four massively powerful financial cycles have united, forming a "Supercycle" with enormous destructive power.

The last time these cycles converged — nine decades ago — the world was plunged into a Great Depression that lasted more than a decade.

This time around, they will trigger the end of one major epoch in human history ... and the beginning of a terrifying (and enormously profitable) new one ...

The age we have all known all our lives — an era in which governments amassed $275 trillion in debts and obligations — is ending.

And a new era — the age in which all of us pay the price for our leaders' reckless spending schemes and the obscene debts — is beginning.

As we witness the collapse of the societies, currencies, and investment markets that have been built on those debts ...

Everything about how you earn, spend, save, and invest your money — and about how you live your life — will be altered forever.

A 60-month-long roller-coaster

ride through Hell:

My forecast is clear and unhedged:

We are in for five years of chaos in the economy, the markets and in our business and personal lives.

As this Supercycle courses through the world economy in the months ahead, the investors our governments count on for loans will snap their wallets shut.

Even now, investors are reading the handwriting on the wall: Government debt is simply too massive. It can never be repaid. It would be financial suicide for them to continue loaning their money to Brussels, Tokyo or Washington; insane to throw good money after bad.

And so, governments — including our own — will simply run out of money.

More than 39 million government employees and contractors in Europe, Japan and the U.S. will find that their paychecks have been postponed or cancelled altogether.

Over 320 million more worldwide, who depend on government retirement plans like Social Security and government health schemes like Medicare and Obamacare, will awake to the same disturbing reality.

And another 127 million globally, who count on welfare, food stamps and other government-sponsored assistance programs, will suddenly find themselves unable to feed themselves or their families.

As the news reverberates, currencies, bonds and finally stocks, will simply collapse. The wealth and retirement savings of generations will be vaporized in the twinkling of an eye.

Millions of angry citizens will take to the streets, overwhelming local, state and even national law enforcement. In many countries, law and order will break down as thousands of riots erupt around the world. No man’s life or property will be safe.

Some governments, equally desperate to survive, will have no choice but to wage war on their own citizens.

Revenue agents will seize passports, private savings, homes and other property on the flimsiest of excuses.

Battle tanks, armored personnel carriers and heavily armed soldiers will patrol the streets.

Our world, our nation and our lives will be changed forever.

Admittedly; this is the most severe warning I have ever issued.

Make no mistake: I fully understand just how shocking this forecast is.

I also understand that most people who hear it will dismiss it as being “too extreme.”

That’s to be expected.

It’s what happened when we warned that the stock market was about to crash in 1987 ...

It happened again when we warned that tech stocks were due to collapse in 1999 ...

And it also happened in 2007 when we told anyone who’d listen that the U.S. real estate market was about to collapse, plunging the economy into one of the most severe recessions ever.

But please understand; this is no idle prediction. I have no interest in frightening anyone. I am simply following our research where it takes me.

Get Sean’s “buy” and “sell” signals for your supercycle investments!

You can own the investments that Sean recommends to protect and grow your wealth

— PLUS, get clear signals on when to buy and sell:

And it is taking me to a terrifying place: Those who are unprepared for this great crisis risk losing everything: Your income, savings, investments, your home and other property, your personal and financial security are all at risk.

I do NOT want that for you.

This message is so urgent ... so important ... I insisted on delivering it in person to Dr. Weiss ... to Weiss Rating’s analysts ... and most importantly, to you.

It is also why I created this urgent report — and why I’m inviting millions of people in the U.S. and around the globe to access it free of charge.

The plain truth is, the most powerful forecasting tools we have ever used are virtually screaming that all hell is about to break loose in Europe, Asia, and ultimately right here, in the United States.

If that’s hard for you to believe, I certainly understand. After all: Things still seem pretty normal today. But the plain reality is ...

The same forecasting tools that accurately predicted the Great Depression — and every major economic event since ...

Are now warning that the most severe financial crisis any of us has ever seen has begun.

It may help you to understand why I trust this research so completely; why I am changing nearly everything in my own financial life to prepare for the events it predicts.

The forecasting tools I use ... that have enabled us to accurately predict all the major events I just mentioned ... and that are now warning of the most severe financial crisis any of us has ever seen ... are not new.

They were actually discovered by an American economist 87 years ago.

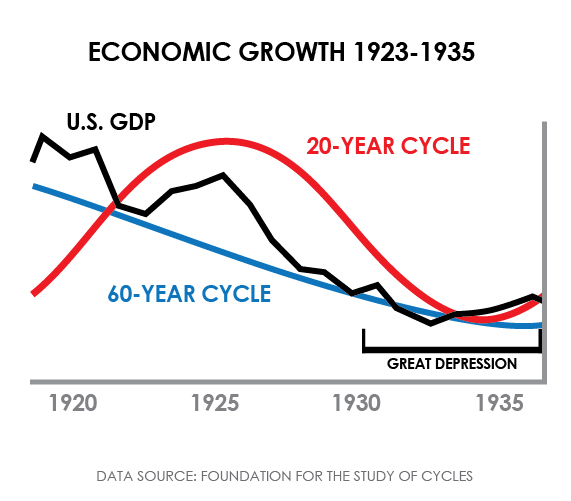

The year was 1932. That’s when U.S. President Herbert Hoover ordered his chief economist, Edward R. Dewey, to determine what caused the Great Depression.

What Dewey found was shocking: Very powerful economic cycles govern the rise and fall of economies, currencies and investment markets.

It made perfect sense: After all, the entire universe moves in cycles; from the lifecycle of stars, to the ebb and flow of the tides, to the changing of the seasons, to human respiration and even to our beating hearts.

Cycles research predicted The Great Depression years in advance!

Just as cycles govern the physical universe and our physical bodies, they also govern the affairs of men: The rise and fall of empires, nations, societies, economies, currencies and investment markets.

All of these things and many more are ruled by very regular, very PREDICTABLE financial cycles.

Dewey’s ultimate conclusion was a shocker: Anyone who even casually glanced at charts depicting these cycles could have known about the approaching nightmare well in advance.

The Great Depression happened because it was TIME for it to happen.

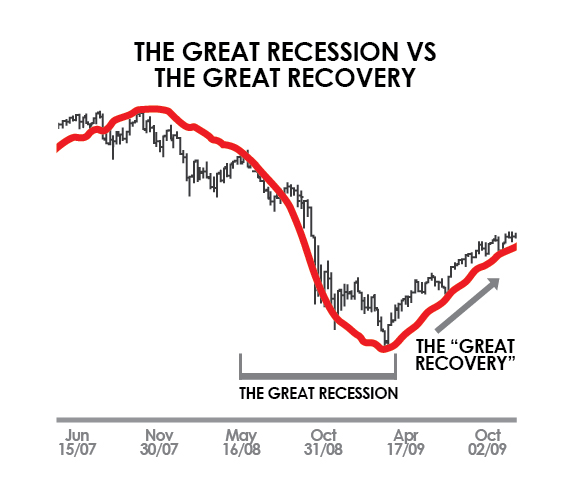

Since Dewey’s discovery, cycles research has been used to predict virtually every financial event in our lives. That includes the painful real estate crash, credit crisis and Great Recession of 2007-2008 and the massive bull market that followed.

Knowledge of cycles is what allowed our experts to predict the Great Recession of 2008-2009 AND the beginning of the recovery well in advance!

Believe me; I know: They accurately warned of the 1987 stock market crash several months in advance and every major move in U.S. stocks since then.

Here’s a great example:

The chart above is an example of our work. It is the product of cycles research we did in 2006 and 2007 — work we did well before the U.S. real estate market cracked.

The red line is the cycle we followed — the cycle that caused us to predict a major catastrophe ahead.

The black line is what actually happened.

As you can see, the cycle clearly predicted that the U.S. economy would peak in 2007, then suffer a massive crash.

RESULT: The Great Recession of 2008-2009 struck right on time, just as we predicted and the S&P 500 crashed nearly 60%.

Anyone who bought the 3x inverse ETF of the S&P 500 on that forecast could have seen nearly a 180% gain.

And that’s only the beginning of the story. The chart above also showed quite clearly that the bottom would come in March of 2009. After that, the economy and the stock market would enter a powerful recovery.

Specific "when-to-buy" and "when-to-sell" recommendations from Sean Brodrick to help you grow richer as the EU disintegrates:

Investments designed to make you up to six times richer when the euro plunges and European stocks crash, and ...

U.S. investments that multiply your money as European flight capital drives them higher:

So on March 16 of 2009 — while other analysts were still licking their wounds and terrified to even touch a stock — we announced that the worst was over; that stocks were about to catch fire again.

RESULT: After that forecast, the S&P 500 rose a whopping 357%; enough to turn every $10,000 invested into $45,700.

And if you had used this forecast to invest in the 3x S&P 500 ETF, you could be up 1,070% — enough to turn every $10,000 you invested into nearly $117,000.

Plus, the cycles have also called:

Every major move in the gold market since 1999 ... including the beginning of the bull market when gold was just $255 per ounce ... and the end in September 2011 when it hit $1,925...

The collapse of the U.S. dollar that began in 2000 as well as the huge dollar bull market we’ve seen in recent years.

And even the historic plunge in oil and grain prices that began in 2014.

Then, in 2015 we predicted the Dow would surge to 20,000 beyond and it did. But we also wrote that the world would later enter a new era of financial and political turmoil.

We warned that the end of the European Union was in sight. Since then, millions of migrants have flowed into Europe, pushing social services to the breaking point and beyond.

Worse, they are forcing those governments to spend billions of dollars that they don't have. Pushing them deeper and deeper into debt.

Great Britain shocked the world by voting to leave the European Union, while powerful new separatist movements in Greece, Spain, Germany and France are pushing the E.U. even closer to the brink of oblivion.

But despite the spreading of turmoil overseas, we continued to consistently predict a massive rise in U.S. stocks.

Why? Because, as we wrote repeatedly, flight capital from Europe and Japan that would drive U.S. stocks to unimagined new levels.

As a result, we predicted that the Dow Jones Industrial Average would surge well past the 20,000 mark. Since then, trillions of dollars flowed into the United States and the Dow surged virtually nonstop, exceeding 28,000 in November of 2019.

But now, our cycles research is sending a very different message — a message that no wage-earner, retiree or investor can afford to ignore.

The most powerful financial cycles ever

discovered are aligning even

as you read this ...

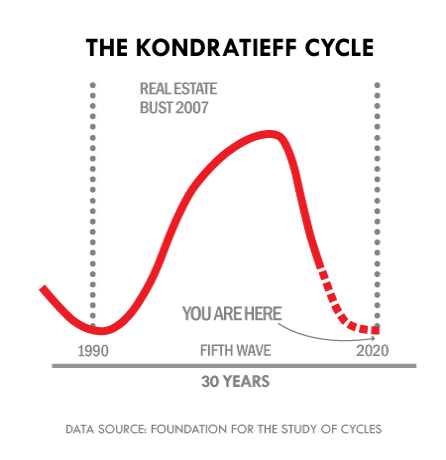

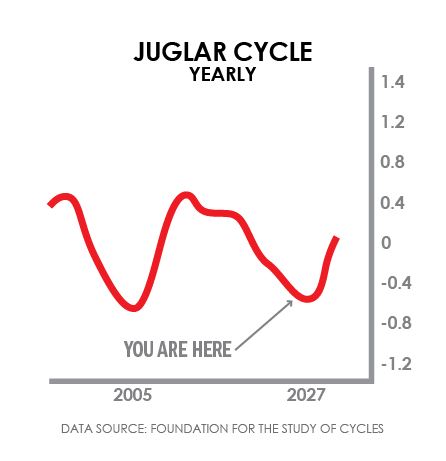

Four of the most powerful economic forces known to man have converged for the first time in more than 80 years:

The time-honored Kondratieff Wave, which is signaling an ever-weaker economy ... soaring unemployment ... skyrocketing interest rates ... massive defaults on public and private debt ... and more ...

The powerful debt cycle: Governments, which continually robbed Peter to pay Paul, have reached a point of no return, forcing them to take extreme measures. Most have embarked on wild money-printing binges to force interest rates down to zero. Some — such as the governments of France, Germany, Italy, and Japan — have even force investors to buy their bonds with negative interest rates. Others have assumed dictatorial powers.

The recession cycle, faithfully predicted by the inverted yield curve: This happened in 1973, 1980, 1981, 1990, 2000, 2009, and it’s happening again right now

The 7-to-11-year Juglar Cycle, which is signaling massive hoarding of cash by businesses ... plunging re-investment of earnings ... massive job destruction ... and a comatose economy ...

The rising cycle of war: This includes not only a massive global arms build-up, but also cyberwars, trade wars, and currency devaluations

Every day, the news coming out of Europe CONFIRMS what the cycles are telling us: This great crisis has already begun!

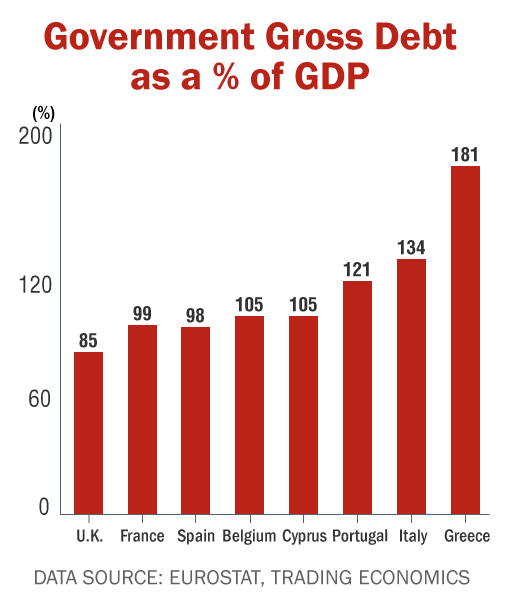

Moreover, the debt crisis you saw a few years ago in Greece and other PIIGS countries was only the tip of the iceberg.

Europe is deeper in debt than ever:

- Despite repeated bailouts, 20 of the 28 EU member states — including the largest states; Spain, France, Italy and the UK — are deeper in debt now than ever before.

- In Spain and France, it would take nearly all the money generated by their economies in an entire year to equal their national debts.

- Portugal owes 21.5% more than its economy produces. Italy owes 34% more.

- The Greek government, still in the worst shape even after six huge bailouts, owes 81% more than its economy produces.

Brexit is only the beginning and European governments are desperate:

In Spain, the government has begun taxing bank deposits. You pay an income tax on your paycheck, then pay another tax when you deposit it in the bank.

In France, police routinely search travelers, looking for large amounts of cash that’s being smuggled out of the country to avoid taxation.

In Cyprus the government literally robbed its own banks. Depositors with more than 100,000 euros watched helplessly as the government seized up to 40% of their money.

Meanwhile, France's economy remains stagnant, and President Macron's attempts to revive it are already running into stiff political resistance.

The clincher is that the euro has resumed its long-term plunge against the dollar – a sign that investors see the handwriting on the wall and they're jumping ship.

MY FORECAST:

The European Union is headed for a crisis. It could even disintegrate.

Cycles research has made it possible for us to accurately predict ...

Every major twist and turn in the stock market since 1986 ...

Every major trend in the gold market since 1999 ...

Major movements in the U.S. dollar, the euro and yen, oil and many other commodities ...

Predictions that could have helped you multiply your money many times over!

Get my “Buy” and “Sell” signals for today’s best Supercycle investments:

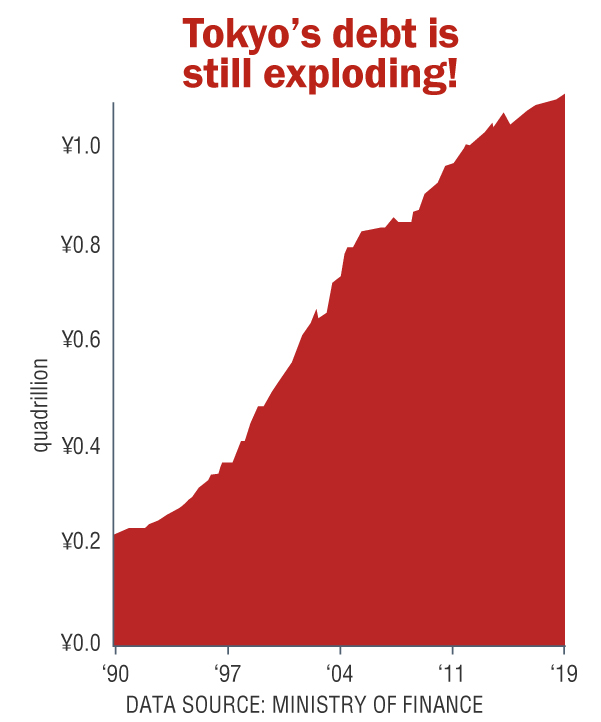

The facts on the ground in Japan are even more disturbing.

The Japanese government is struggling with not just one but two deadly crises:

Japan’s first crisis is debt:

Japan is saddled with the largest government debt in the world: More than 1 QUADRILLION YEN. That’s a “one” followed by FIFTEEN zeros:

Tokyo is 1,000,000,000,000,000 yen in debt. And it means that even if Japan had a yearly budget surplus of one trillion yen, it would still take 1,000 years for the country to pay off its debt.

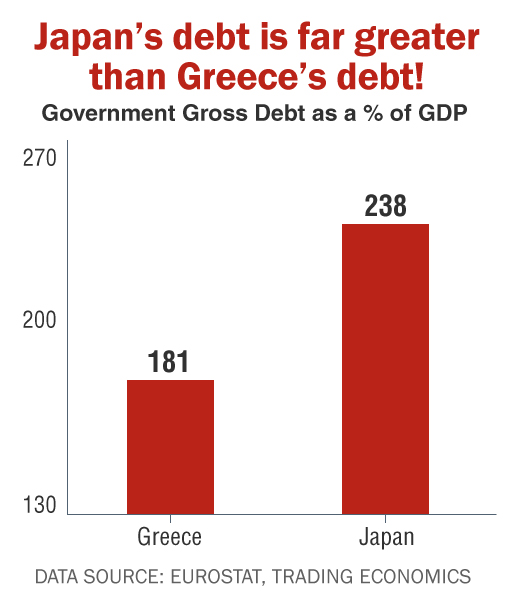

Tokyo’s debt is nearly two and one-half times the size of the entire Japanese economy and more than DOUBLE the debt load that pushed Greece, Ireland and Portugal to the brink of collapse.

Japan’s debt is still skyrocketing. Social welfare spending in Japan, already one third of the 101-trillion-yen budget, is rising automatically by about one trillion yen every year.

Japan’s second crisis is that its people are saving; NOT spending — and for good reasons:

Japanese citizens are also hoarding cash because they fear Tokyo will have to cut their retirement checks and other government benefits. They’re saving as much as they possibly can for the rainy days they believe are coming.

This is an extremely dangerous situation.

It is threatening to slash government revenues, even as the nation’s debt and the cost of servicing that debt continues to skyrocket.

MY FORECAST:

As Europe goes, so goes Japan

If Europe — Japan’s #2 trading partner — collapses, it will be the straw that breaks Japan’s back. Japan’s economy will finally come apart at the seams.

Exports — the lifeblood of the Japanese economy — will plunge. The economy will crater. Tax revenues will evaporate.

Tokyo will have no choice but to default on its massive 1 quadrillion yen debt.

Get Sean Brodrick’s weekly updates to protect your wealth as Europe and Japan implode ...

PLUS urgent investment recommendations whenever Sean releases them (DAILY when warranted) and much more:

For Europe and Japan, there is no way out.

Readers often ask me why it’s inevitable that these governments will default.

QUESTION #1 IS ...

“Couldn’t Europe and Japan simply

borrow more money?”

No! They are already borrowing every euro and yen that investors will loan them!

And now, those investors will close the spigot. European and Japanese government bonds will decline; their interest rates will rise.

Their debts are so massive, so utterly unpayable that the investors who have been buying their bonds will revolt.

In recent years for instance, even as U.S. stocks surged, their treasuries and corporate bonds often cratered.

This is the very essence of a sovereign debt crisis:

Investors wake up.

They realize that not only will the debt never be repaid; these governments may fail to pay the interest due on the debt they already have.

As they slow or stop government bond purchases, bond prices drop. Interest rates rise, making it even harder for governments to pay interest on the money they owe.

And that’s what could cause the greatest government debt disaster of all – default. It’s a deadly spiral; one in which the only survivors are the very first investors to reach the exit doors.

But then the stampede begins.

I’m also asked a second question:

“Why can’t these governments simply PRINT enough money to get them out of trouble?”

But creating money out of thin air is no solution.

Europe is printing money like there’s no tomorrow, but debt is piling up faster than ever and the economy is coming unglued.

The Bank of Japan has printed tens of trillions of yen in recent years, but it suffered through more than two decades of stagnation and recession.

But despite everything, Japan’s economy remains mired in muck, growing barely more than 1% per year on average since 2011.

The U.S. is the world’s safest safe haven ... for now.

Believe it or not, there is some good news in all of this — especially for investors in the United States.

The first bit of good news is that there’s still time — not much time, mind you, but some time — to prepare.

The second piece of good news is that the troubles in Europe and in Japan already have wealthy investors and institutions there seeking safe havens.

And for now, at least, the world’s safest safe haven is the United States of America.

Where will YOU be when Washington runs

out of money?

How will you get by when this great Supercycle strikes America?

The best defense is a powerful offense — with Sean Brodrick's Wealth Megatrends!

That’s why savvy European and Japanese investors are already dumping trillions of euros and yen, driving those currencies lower ...

And why they are buying trillions of U.S. dollars, driving the greenback ever-higher.

What’s more, they’re using those dollars to buy assets here: Stocks. Real estate. Bonds. Even collectibles.

But if history — if our cycles research — proves anything, it’s that this trickle of flight capital coming out of Europe and Japan is about to become a massive flood.

It’s crucial that everyone who owns stocks ... everyone with a retirement account ... understands this.

Because at a time like this — with most of the world burning down around you — growing rich is your ONLY real defense.

And here’s more good news. Our research shows ...

This crisis will unfold in four, distinct phases, giving you the opportunity to amass not just one, but FOUR impressive fortunes:

FORTUNE #1

RIGHT NOW - as Europe continues to implode before our very eyes, crushing the euro currency and European stocks and driving massive waves of capital into U.S. stocks and other assets ...

FORTUNE #2

As one crisis after another hammers Europe, and as Japan’s massive debts begin to crumble — as their currencies and stocks crater and as even more money flows into U.S. investments ...

FORTUNE #3

Throughout this crisis flight capital from panicking investors in Europe, Japan and the U.S. drive tangible assets — particularly gold, silver and energy investments — through the roof.

FORTUNE #4

When this great crisis finally impacts Washington D.C., leaving our economy and stock market a smoking ruin ...

Because with each passing day, America’s final reckoning is drawing nearer.

The same fate suffered by Europe and Japan ultimately awaits us as well.

Donald Trump is doing everything he can to boost the U.S. economy right now. And the flow of capital from overseas is also helping. But no one can make America's huge debt problem disappear.

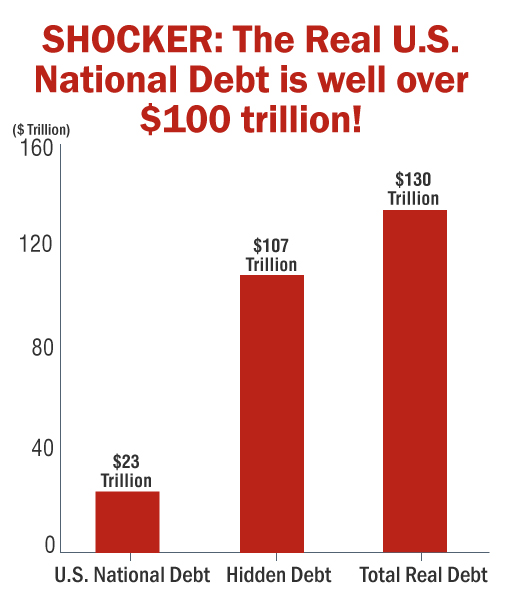

And the plain truth is that Washington D.C.’s debts are far larger than most people realize.

Everyone worries about our $23 trillion national debt; that it equals more than the value of all the goods and services the U.S. produces.

Let me tell you: That’s a drop in the ocean.

In addition to that debt, according to the latest statistics from the U.S. Department of the Treasury, our government owes another $107 trillion that it never wants to talk about.

These are what it politely calls “unfunded liabilities” — the money it owes primarily to veterans and to seniors in pensions, Social Security and Medicare payments.

Altogether, Washington is on the hook for more than $130 trillion.

That’s more than 6 times the size of the entire U.S. economy.

A line of 130 trillion dollar bills would reach around the Earth at the equator more than 506,000 times. It would reach all the way to the sun and back more than 67 times.

And what’s worse, some economists say the real number is much higher — well over $200 trillion. Plus, nearly $1 trillion more dollars in additional debt and obligations are piling up with every passing year.

Sorry — but I have to ask,

“Who are we really kidding here?”

Everyone knows Washington will never make a dent in paying down that debt.

What most economists also know, but won’t say, is that Washington won’t be able to even service that much debt for much longer.

What’s worse, any significant surge in defense spending or decline in the economy could ultimately push Washington into a default of some kind.

It could be a default on the sly (via inflation), a default via a de-facto dollar devaluation or perhaps even an outright default forced by a government shutdown.

And long before that happens, the U.S. government’s bonds will have collapsed in value.

The bottom line is that our government, our economy and our society are living on borrowed time. Ultimately, it will all come crashing down.

After more than 60 years of

out-of-control spending,

Washington, D.C. will simply

run out of money ...

Government payments to individuals — and to the companies it does business with — will be slashed.

Over 2 million civilian government workers would no longer be able to reliably expect their paychecks.

Millions who thought they could count on Washington to care for them will suddenly find themselves destitute ... hungry ... abandoned ... and helpless.

All hell will break loose.

Outraged at this callous breach of faith, armies of angry citizens will take to the streets in violent protests, just as they already have across Europe.

Millions more will spend their days desperately hunting for food and safe shelter.

In many areas, civil society will implode. Law and order will break down. Anarchy will rule.

Americans who have known only safety and comfort in their lives will find themselves having to fight every day just to survive.

And the government — equally desperate to survive — will declare a kind of war on its own citizens. Privacy will be a thing of the past. Washington’s spies will be everywhere.

Normal restraints on government authorities to seize citizens’ savings, homes and other private property will be torn down. In major hot spots, we may even see battle tanks, armored personnel carriers and heavily armed soldiers patrolling the streets.

The great debt collapse this Supercycle brings with it is as certain as death and taxes:

We’ve always known there was no way Washington could tax, print and spend forever. That kind of insanity is simply unsustainable.

We’ve always known that the day would come when it would all come crashing down. The only question has been “When?”

Now, we have an answer.

Our study of cycles — the most powerful forces in the economic universe — has provided it.

The great global government debt collapse that has already begun in Europe ... that will quickly spread to Japan ... will inevitably strike America as well.

When that happens, only those who are prepared will have a prayer of protecting their loved ones; let alone preserving their wealth or their quality of life.

And those who do prepare will also have the opportunity to make a lot of money — with the handful of crisis investments that explode in value at times like this.

I’ve already begun preparations to protect my own wealth and to profit.

Follow my recommendations and this crisis could make you very, very rich:

There are two pieces of

positive news in all of this.

The first is that you still have some time to prepare.

The second is that getting through this in safety — with your wealth secure and growing — will not be difficult IF you make the right moves now.

I am taking several important steps to get my family through this — and I strongly recommend that you do the same:

The first step is EDUCATION. Study this crisis so you’ll know exactly what to expect.

There are hidden, telltale signs that you need to be aware of, and knowing them can make a critical difference for you and your loved ones.

I’m lucky in this regard. I’ve been able to spend most of my career — more than 30 years — studying economic cycles and the events they have driven throughout history.

And today, I spend most of my time focusing on the developments in Europe, Japan and the United States that are causing this crisis to intensify.

Please accept this free report to preserve your wealth and keep it growing ...

In my brand-new free report — The Final Reckoning — I give you the details on the four powerful financial cycles that are now pointing to a massive global debt collapse.

I give you the actual timeline for all four phases of this crisis — when you can expect Japan’s collapse to hit full force and when I expect the crisis to hit home in the United States.

You will, in fact, have the opportunity to create not just one, but FOUR great fortunes as this crisis unfolds.

I show you what you must do to preserve your wealth and go for windfall profits every step of the way:

When you need to go all out with stocks and other investments designed to soar in each phase of this crisis ...

The types of investments you need to be looking at ...

And the one time you should go to cash, take all your money off the table and stand pat.

CHAPTER I:

Best investments to

own RIGHT NOW ...

In Chapter One I cover the first phase in detail: The investments that are destined to lead the pack beginning immediately.

We first began alerting investors to the massive influx of "Fear Money" from Europe and Asia in 2015. And since that time, flight capital has already driven many U.S. stocks through the roof.

And sent the Dow soaring 10,000 points, past the once unthinkable 28,000.

If you had owned the right stocks since we issued that warning, you could have seen spectacular, life-changing gains from that capital flight.

Starting now, that trickle will become a flood, and the gains we’ve already seen will pale in comparison. If you own the stocks foreign investors want, you can rake in a fortune.

We will identify the stocks foreign investors will be chasing BEFORE they do.

These are the investments I’m using to make the most of the tremendous opportunities I see right now for U.S. investors.

They include ...

-

A unique investment to capitalize on the strength in the U.S. dollar versus other currencies as more and more “flight capital” prepares to leave Europe.

-

Select blue-chip-like (but beaten down) U.S. stocks that will also soon start soaring, again, on the backbone of flight capital rushing in from overseas.

-

And who can ignore gold in a major crisis? I’ll show you the best way to stake out a leveraged position in gold — a position that could multiply your profits many times over as tens of thousands of savvy investors begin to realize the final reckoning for Europe, Japan and Washington looms large.

Click here to discover the investments that are already soaring due to this crisis.

CHAPTER II:

Windfall profits as

spirals into crisis.

In Chapter II I cover the second phase of this great crisis and give you three types of investments that are designed to generate windfall profits as Europe is rocked to its foundations.

I show you how you can ...

-

Go for massive profits as the euro currency crashes

and burns ... -

Grab still more profit potential as European bonds crater ...

-

And earn a third fortune as European stock markets

implode ... -

All without actually going short or buying a single

foreign investment!

And there’s more:

-

I give you a simple strategy that could multiply your money up to six times over as European flight capital drives the Dow to 31,000 and beyond ...

-

Three ways to leverage your gold and silver profit potential as they inevitably bottom and then begin to soar as sovereign defaults loom large.

When the crisis strikes, investors around the world will pour massive amounts of money into precious metals stocks that are now trading for a fraction of what they will likely be worth.

Yet the last time gold and silver prices surged, some of these select stocks generated returns up to 2,957% — enough to turn every $10,000 you invest into more than $300,000!

And then there’s the defense sector. Sadly, sovereign debt defaults bring out the worst in government leaders. They point fingers at each other and blame other leaders, causing civil and even international unrest to rise exponentially.

You’ll want to own shares in top defense companies and also companies engaged in protecting the digital privacy of investors and citizens worried their country is going down the tubes.

But you have to be selective. Some companies and industries will reap great rewards. But there’s no defense for owning the rest.

That’s why I also give you the U.S. investments that will get hit hardest:

-

The ten biggest famous-name American stocks that will get crushed as Europe collapses.

-

U.S. real estate investment trusts that will get hit hard as European real estate crashes and burns.

-

The European oil and gas companies that nobody should own now, but millions of Americans DO own: Avoid them at all costs!

CHAPTER III:

Investments to give you THREE MORE massive paydays as Japan collapses ...

As the Japanese yen disintegrates ...

As the Japanese bond market comes unglued ...

And as Japanese stocks implode.

And you can do it all without ever going short or buying a single foreign investment!

CHAPTER IV:

Investments you need to buy

IMMEDIATELY to protect yourself as this

crisis comes to the U.S.A.

Finally, in Chapter Four, I give you my comprehensive strategy for protecting your assets and preserving the profits you made in the first three phases of this crisis as this great global debt collapse comes to America ...

I give you my top three U.S. traded natural resource stocks that will explode in price as the U.S. economy hits the skids — including ...

-

The international mining company that has it all: Not just gold and silver, but aluminum, coal, copper, iron ore, lead, zinc, tin, uranium, titanium, diamonds and much more. My #1 must-own tangible asset company!

-

I’ll also introduce you to one of the world’s largest copper and gold miners with reserves including 102 billion pounds of copper, 40 million ounces of gold and 266.6 million ounces of silver.

PLUS, I’ll introduce you to my top three U.S. defense stocks — companies set to profit from a world gone mad:

-

It’s a Fortune 500 company with the distinction of being the ONLY firm that designs, builds and maintains nuclear aircraft carriers for the U.S. Navy. Plus, it’s also the source for both nuclear and non-nuclear ships — and maintenance for those ships — for the U.S. Navy and Coast Guard. It could be a triple, in my opinion — powerful enough to turn every $10,000 you invest into at least $30,000 and probably much more!

And I also name the ONE kind of “supposedly safe” investment that’s destined to destroy vast amounts of wealth as this great debt crisis comes to America. Please make sure you do NOT own this one!

How to get your FREE copy of

The Final Reckoning:

I will deliver The Final Reckoning without cost to anyone who applies for a risk-free subscription to my newsletter, Wealth Megatrends.

This way, you’ll get off to a fast start with your preparations. Plus, I’ll keep you 100% up to date on this rapidly developing crisis in each issue of Wealth Megatrends.

I’ll show you what I’m doing myself and what I would urge you to do as well.

And when fast-breaking events warrant I’ll also rush you urgent Flash Alerts via email.

Plus, you receive our regular, e-mail updates.

To help as many people as possible, I have even reduced the subscription price of Wealth Megatrends BY MORE THAN HALF:

Normally $228 per year, new subscribers can join now for just $29 ... save $199 ... and get The Final Reckoning — a $79 value, free.

Even my publisher wants to know why I’m willing to offer Wealth Megatrends at more than 85% off the normal price. Actually, I have two reasons:

First, this is the single most dangerous political, economic and social crisis any of us has ever faced. And I have made a serious, personal commitment to help as many people get through it as possible.

Second, the folks who subscribe to Wealth Megatrends tend to stay with it for a long time. I sincerely believe that once you’ve seen my work, once you’ve experienced how powerful and profitable this letter really is, you and I will be together for life.

Plus, your subscription to

Wealth Megatrends is fully guaranteed.

You don't even have to make your final decision now. Just join us and get your free reports. Then, take all the time you like - up to a full year - to make your decision.

Even if you decide to cancel on the very last day before your membership expires, we owe you a full refund. Just let us know and we’ll promptly refund every penny you paid. We'll even insist that you keep every issue of Wealth Megatrends and everything else we've sent you in the meantime with our thanks for giving us a fair trial.

I also want you to have these four

additional free eBooks help make sure you survive and thrive:

STEP #2 in surviving this crisis is to make the best of the time we have left to build the portfolio designed to explode in value as Europe and Japan collapse. In 7 Growth Stocks to Buy NOW, I name the stocks I’m counting on to post the greatest profits.

STEP #3 is to begin building your defensive positions now. I’m talking about gold and silver. As this hits Europe, then Japan and finally the United States, investors all over the world are going to stampede into precious metals as a way to protect their wealth and buying power.

In Your Best Defense, I give you my formula for profitable gold and silver investment including how to get them at a discount ... the costliest mistakes precious metals investors make ... the gold and silver investments you should avoid at all costs ... and the names and telephone numbers of the only bullion dealers I personally trust with my own investments.

STEP #4 should be a no-brainer: Put some of your money where Washington can’t find it. The most dangerous entity on Earth is a government that’s fighting for its life. Remember: Cyprus stole up to 40% of bank depositors’ money. Don’t think for a minute it couldn’t happen here!

So, in The World’s Best Privacy Havens, I name three places where you can legally hide some of your money from prying eyes.

The key word is “LEGALLY.” No recriminations possible.

STEP #5 is one of the most important of all — and I tell you all about it in The Windfall of a Lifetime.

Massive global events like this one just naturally create massive movements in the investment markets. That’s a fact.

And frankly, most people will be perfectly happy to double or triple their original investment.

But when I see a situation like this one ... one that I believe with all my heart will cause the biggest profit opportunities any of us has ever seen ... a crisis that I am convinced is carved in stone ... I want to put the pedal to the metal ...

And I do it with a special class of high-powered investments that are designed to deliver profits of up to $100 or more for every $1 other investors make.

So in The Windfall of a Lifetime, I show you how you can use this crisis to build true, generational wealth in any market — stocks, bonds, currencies, gold, silver, commodities ...

All without ever buying a single one of them. I know it’s hard to believe; but it’s 100% true.

And not only that, your risk is strictly limited while your profit potential is not!

A special bonus gift

to help you through this crisis:

It’s a free three-month subscription to our flagship service, Weiss Stock Ratings Heat Maps.

This groundbreaking stock rating system was ranked #1 in the nation by the Wall Street Journal. Every day, Heat Maps’ high-powered computer program sifts through more than 12,000 stocks to find the strongest, top money-makers. With Heat Maps, you can zero in on today’s best stocks, while keeping landmines out of your portfolio.

It’s the perfect complement to your Wealth Megatrends service, especially as this crisis unfolds. And when your free Heat Maps subscription is up for renewal, we will notify you in advance and tell you about the lowest renewal rates then in effect.

Your income, savings, investments and retirement — even your family's safety — all hang in the balance:

I sincerely fear that those who fail to heed this warning could lose everything.

This should not be a difficult decision for you to make ...

You now have irrefutable proof that a major global disaster is brewing:

-

You've seen how the most powerful forces in the economic universe are now aligning to create the most severe crisis of our lifetime.

-

You've seen that the facts on the ground — in Europe ... Japan ... and here in the U.S. are in total agreement with the warning now being sounded by our cycles research.

-

And you've seen that the first phase of this crisis — the collapse of the EU — has already begun to unfold.

The conclusion is clear: Our governments have amassed debts — so massive, they can never be repaid. And since that debt cannot be repaid, it will not be repaid.

Over 943 million people in Europe, Japan and the United States — are about to be hit with the cold reality that the promises made to them by politicians are, in the end, utterly worthless.

The handwriting is on the wall: There will be hell to pay.

This great debt collapse isn't

going to wait for you, me or

anybody else.

It's coming whether we like it or not ... and whether we prepare or not.

My prime objective is to make sure you have every chance to save yourself, your family and your money. That's why I wrote this report ... why I'm going out on a limb with these very public warnings ... and why I want to get a free copy of The Final Reckoning into your hands; the sooner, the better.

Click here to receive $594 in free gifts and discounts: Join me for 12 months of updates in Wealth Megatrends for just $29. You save $199 off the regular rate.

The choice is entirely yours, of course. I sincerely hope you will decide to join me in preparing.

I look forward to welcoming you aboard!

Sincerely,

Sean Brodrick,

Editor, Wealth Megatrends

Or call customer service at 1-877-934-7778 TOLL FREE

(Overseas, call 1-561-627-3300)