BOOM. BUBBLE. BUST!

When the "K-Wave" comes to Wall Street, will you catch the crest? Or get crushed in the crash?

To join now, click here.

Or for

the transcript, read on...

They call it the fisherman's prayer:

"Dear Lord, be good to me. Thy sea is so great, and my boat is so small."

But they might as well call it the investor's prayer, too.

Because it doesn't matter whether your nest egg is a modest $100,000 or more than a million...

In the global economy, it's just a tiny boat on a storm-tossed sea.

Imagine, if you will, that you're sitting in your boat just a hundred yards from shore, when you spot a gigantic wave headed your way.

Towering 50, 75, 100 feet in the air, it's bearing down on you with frightening speed.

Should you confront it or outrun it?

What do you do?

Do you turn your boat toward the shore and row like mad, hoping you'll reach land before the wave?

Or do you turn into the wave and row toward it, hoping it will lift your boat and pass underneath you before crashing on shore?

Whether you realize it or not, my friend, this is the situation you're in today.

There is a wave headed your way.

It's called the "K-Wave."

And you are now at that critical moment when you must decide whether to confront it or outrun it.

The decision you make today can spell the difference between losing nearly everything you've struggled, sacrificed, and saved to achieve...

Or reaching a level of wealth and prosperity you never dreamed possible.

If expert forecasts are correct, you could multiply your investment by up to 20 times over the next 10 years.

Make the wrong decision and you could be one of millions of Americans who will watch their nest egg vanish faster than you could imagine.

In a moment, I'm going to tell you exactly what the K-Wave is... why I believe it's headed your way... and what you need to do about it now.

But before I do, let me introduce myself.

We've predicted nearly every boom,

bubble, and bust since 1987

My name is Sean Brodrick, and I'm the Senior Editor of the monthly letter, Wealth Megatrends.

Working with my late colleague and mentor Larry Edelson, we have predicted nearly every major boom, bubble, and bust in stocks since the 1980s.

In 1987, for example, we forecast the sharpest collapse in the history of the stock market.

The "experts" on Wall Street laughed at us because the American economy was booming at the time.

But they stopped laughing on October 19, 1987 when the Dow lost 22.6% of its value in a single day.

Twenty years later, we were among the few who warned of a housing bubble and its effect on mortgage-backed securities.

Of course, we turned out to be right.

But in March of 2009 — when nearly everyone was trying get out of stocks as quickly as possible — we said it was time to buy.

Since then, the Dow has risen by more than 300%.

In late 2019, we said that a global disaster would strike in 2020.

And it did.

Along the way, we've not only helped our readers protect their assets...

We've also told them how to multiply their wealth by recommending stocks that have grown by as much as 374%... 588%... even 823% since I became editor in 2016.

Of course, you can’t always make that much money, and losses are always possible, too.

But overall, when you understand the cycle of wealth, that alone can go a long way toward building wealth.

The Secret of Our Uncanny Predictions

What's our secret?

It's the tidal waves of history — of booms, bubbles, and busts.

And the fact that, if you know what to look for, they can be as predictable as the cycles of nature.

Why are we doomed to repeat the endless cycle of boom, bubble, and bust that has made some investors very rich over the centuries...

And caused many others to die in poverty and despair?

The answer to the last question is simple:

If you stop and think about it, everything in the universe moves in cycles.

The tides of the ocean repeat their endless cycle every day.

Winter, spring, summer, and fall arrive on the exact same days of the calendar every year.

Even the stars in the sky go through a cycle of birth, life, and death over the course of eons.

The economist who got a bullet

in his head for his beliefs

One of the first people to apply this insight to economics was an obscure Soviet economist by the name of Nikolai Kondratieff.

In a 28-page paper called "The Long Waves in Economic Life," Kondratieff said that economic cycles come in regular waves that make changes easy to predict.

What Kondratieff called "The Long Wave" — later named the K-Wave in his honor — reflects the changing cycle of public and private influence in the global economy.

During the private cycle, free enterprise leads to increasing growth and prosperity.

This is the BOOM phase, in other words.

Eventually the wave reaches a crest as greed, speculation, and "irrational exuberance" take over, and stock markets become frothy.

This is the BUBBLE.

Then the economy starts to collapse into itself. A housing crisis, a run on the banks, or some other unusual event triggers a crash in the stock market... with a ripple effect throughout the wider economy.

This is the BUST.

That's when the government steps in

to make matters worse

That's when the government begins to intervene.

The treasury prints more money.

The central bank manipulates interest rates.

The legislature passes stimulus bills to increase government jobs... public works projects... welfare... and handouts.

For a while everything seems to work fine.

But this phase of the cycle leads to an even greater crash.

Because governments must obey the natural laws of economics.

And the most basic law of economics is this:

You can't spend money you don't have!

Did Josef Stalin give Kondratieff a medal for this important discovery?

No, he gave him a cigarette, a blindfold, and a bullet in the head.

Because one of the predictions Kondratieff made in "The Long Waves in Economic Life" was that communism would eventually fall and be replaced by capitalism.

Based on the length of the K-Wave, Nikolai Kondratieff predicted the Soviet Union would collapse in the late 1980s.

Which is exactly what happened.

History's endless cycle of

boom, bubble, and bust

In fact, you can look back through history and see an endless cycle of booms, bubbles, and busts that go back as far as we have written records.

Fifty years ago was the crushing "stagflation" of the 1970s.

Forty years before that was the onset of the Great Depression.

Fifty years before that was the First Great Depression of 1873.

Forty years before that was the Panic of 1837.

And so on.

In between these "troughs" in the K-Wave there were peaks of great economic activity and growth.

The industrial revolution.

The emergence of steam engines and railroads.

The "Gilded Age."

The Roaring Twenties.

The prosperous 1950s.

The Internet boom at the turn of the millennium.

As Nikolai Kondratieff discovered, these economic waves have a cycle of roughly 40 to 60 years.

With a "boom" period as the wave begins to rise. (Think of the Gilded Age).

Followed by a "bubble" as the wave crests. (The Roaring Twenties)

And then by a "bust" as the wave crashes into shore, causing widespread unemployment, poverty, and civil unrest. (The Great Depression)

Which may make you wonder:

Where are we now?

You are here!

If you look at this chart, you can see we're in a downslope that began in early 2000s.

"But wait," you say, "the stock market is much higher now than it was back then."

True.

But most of that gain is an illusion, and I'll explain why in just a moment.

Since the new millennium began, the entire global financial system and economy have slammed by a series of life-threatening crises.

From 2000 to 2003, technology companies lost 75% of their value and took more than a decade to recover.

Between 2006 and 2010, housing prices collapsed, some of the world's largest banks went broke, the global economy suffered its worst decline since the Great Depression, and the entire global financial system came closer to a fatal meltdown than at any time in modern history.

For many years thereafter 2010, Europe plunged into a debt crisis that ravaged the continent.

And in the wake of the coronavirus pandemic, the global economy suffered its worst decline in history.

But here's the key: Each time, the U.S. Government, the Federal Reserve and central banks all over the world pumped ever-larger floods of paper money into the economy and artificially drove stock prices higher.

For all these years, the economy has been on life support, and the stock market has been pumped up like a balloon.

If you measure the Dow against an objective standard — the price of gold, for example — you'll see that stocks have actually been falling since the year 1999.

This chart shows you the Dow measured in the price of gold...

As you can see, it hit its peak in August of 1999 when the Dow Jones Industrial Average was worth 45 ounces of gold. Now it's worth only 19 ounces of gold.

Measured in gold, the stock market has fallen 58% since 1999.

So, what really is this phantom growth in the stock market? It's asset price inflation caused by...

Guess what!

The U.S. Treasury and the Fed!

Or consider the Dow compared to Bitcoin, and you'll see that the asset price inflation in the last few years has been even worse.

On January 1, 2017, the Dow Jones Industrial Average traded for 20 Bitcoin.

Today, it's worth only about HALF of a Bitcoin.

Measured in Bitcoin, the stock market has fallen 97% — just since 2017.

It's much worse than they re telling you

I won't bore you with a long rant about how much money the Fed has printed and how much the federal government has been spending during the pandemic.

But I will say this:

It's much worse than anyone is telling you!

You already know about the $6 trillion President Trump spent on the coronavirus crisis and economic stimulus.

You also know about the nearly $2 trillion more that Joe Biden added in his first two months in office.

Joe Biden's $11 trillion "shopping list"

Not to mention the trillions more that Biden plans to spend in the next couple of years on such things as...

- Student loan forgiveness.

- Climate change.

- Green energy.

- Infrastructure.

- Expanded Obamacare.

- Medicare for 60-year-olds.

- Free college education.

- And universal pre-school.

What's the total bill for all these programs?

At least another $11 trillion.

That's on top of the trillions the government is already obligated to spend over the next few years:

- On Medicare.

- Social Security.

- Government pensions.

- Interest payments on government bonds.

- Veteran's benefits.

- And more.

Experts estimate these so-called "unfunded liabilities" will exceed $157 trillion by the year 2023.

That's $157,000,000,000,000.

"The ticking time bomb of national doom"

These unfunded liabilities have been called "the ticking time bomb of national doom."

Medicare, for example, is expected to run out of money by 2026.

Social Security won't have enough money to pay people their full benefits by 2034.

It says so right on your Social Security statement!

But it also says you shouldn't worry because the government will come up with some solution by then.

Can you guess what the government's solution might be?

Print more money!

And that's the real problem.

The real problem is that all this government spending is not backed by anything other than a digital printing press.

In other words, the government is writing checks without any money in the bank.

It reminds me of the story about the boy who went off to college and his parents decided to give him his first checking account.

Before long, the young man bought so much beer and pizza that his checks started to bounce.

His father called him and said, "You're out of money, son."

"How can I be out of money?" he replied. "I've still got lots more checks!"

You might not be too surprised by that kind of stupidity from a freshman in college.

But it's downright scary when you see the same behavior from the Chairman of the Federal Reserve Board!

The United States Treasury doesn t have a loving parent to turn to when it runs out of money.

A debt that's too big to be paid off

The sad fact is that the national debt is now too big to be paid off by the usual means of raising taxes and cutting spending.

Raising taxes?

Why, you'd have to collect nearly $474,000 in extra taxes from every man, woman, and child in the United States to pay off the national debt.

Cutting spending?

Yeah, sure. Maybe you could balance the budget if you got rid of the Army, Navy, Marine Corps, Air Force, Medicare, Medicaid, and Social Security.

That might make a dent in the deficit.

But I think the American people would miss some of those things, don't you?

No, the only solution is the same one the young college freshman came up with:

Keep writing more checks!

Or, in the case of the Fed, keep printing more and more dollars.

Unfortunately, once a society depends on printing press money — money that's not backed by taxes or supported by spending cuts — that society is essentially doomed.

You know it.

And I know it.

But the most powerful people in Washington are in a complete state of denial.

What happens when a "quack" theory

becomes conventional wisdom?

In fact, this denial has a name:

It's called "Modern Monetary Theory."

It sounds impressive, doesn't it?

It sounds like something cooked up in the ivory towers of academia by economists with PhDs who've written important scholarly papers...

But who never learned how to tie their shoes.

What exactly does Modern Monetary Theory say?

It says government spending doesn't have to be backed by anything at all.

Not by gold. Not by taxes. Not even by borrowing money with government bonds.

Governments can just keep spending... and spending... and spending. And nothing bad will ever happen!

Modern Monetary Theory has

escaped from the lab!

Unfortunately, as I'll explain in a moment, Modern Monetary Theory is worse than a wild experiment by a mad scientist.

It has escaped from the lab of academia. And it has begun to spread around the world like a virus.

At first, most people thought it was a joke.

Anybody with an ounce of common sense knew that Modern Monetary Theory was absurd.

Unfortunately, common sense is a rare commodity among politicians and bureaucrats.

Before long, Modern Monetary Theory began to gain traction in the international economic community.

At the European Central Bank. The International Monetary Fund. Even in the halls of Congress.

Representatives like Alexandria Ocasio-Cortez...

David Stockman, Budget Director under Ronald Reagan, explains it this way:

"We don't often hear monetary authorities talking up the theory in public, but it is clearly the de-facto policy most central banks are putting into practice."

Indeed, Modern Monetary Theory has changed the ballgame when it comes to government spending.

During the financial crisis of 2008, for example, the Fed was uneasy about how much money they were printing to save the nation's banks from failure and rescue the economy.

They said it was an emergency measure. One time only. Never again.

But under the cover of Modern Monetary Theory, the government no longer needs to make excuses for their reckless extravagance.

They just keep printing more money with no end in sight.

Deficits don't matter!

Because according to Modern Monetary Theory, deficits don't matter!

But history has taught us over and over again that deficits do matter.

For nearly 5,000 years of recorded history, we've seen evidence of societies getting into serious financial trouble (if not total collapse) because of too much debt.

Take ancient Rome, for example.

Many people think the Roman Empire fell because it was sacked by barbarians.

But the main reason the barbarians were able to succeed is because the Romans had already destroyed their own society from within.

Mostly thanks to Roman emperors spending money they didn't have.

Which, in turn, caused a rampant inflation and devaluation of Roman money.

How inflation destroyed the Roman Empire

Under the early Roman emperor Caesar Augustus, a "denarius" coin was made of 99.5% real silver.

But 300 years later, during the reign of Claudius the Second, the amount of real silver in a denarius was down to just 0.02%.

By the end of the Roman Empire, many former Roman senators and other wealthy Roman citizens were reduced to moving to the countryside where they could eke out a living as subsistence farmers.

This is what ended the powerful Roman Empire and ushered in the nasty, poor, and brutish era we call "The Dark Ages."

A new Dark Ages?

Are we on the verge of a new Dark Ages now?

Of course, the governments and central banks of both Europe and United States will do everything they can to stay in power and prop up their economies.

But most of the usual steps have already been taken — and failed to work.

They tried spending like drunken sailors. But it wasn't enough.

Then they tried lowering interest rates to zero... and even below zero. That wasn't enough either.

Central banks have also tried monetizing the debt by purchasing their own government bonds.

But this policy — with the fancy name of "quantitative easing" — also failed to achieve the desired results.

What's next?

The next step is to deliberately create inflation.

Why?

Because inflation is a sneaky way to reduce the deficit.

"Inflate or die!"

When you inflate the dollar you wind up paying off your debt with money that's worth less than when you incurred the debt.

Suppose you bought a car for $20,000 today, for example, and promised to pay for it next year.

If you could deliberately trigger 50% inflation, you'll wind up paying $15,000 for a $20,000 dollar car.

Clever, isn't it?

That's why Jerome Powell, the Chairman of the Federal Reserve Board, is following a policy that could be summed up like this:

"INFLATE OR DIE!"

To trigger inflation, Powell has promised not to raise interest rates for at least two years.

His goal used to be 2% inflation.

But now he's willing to allow even higher rates of inflation before he taps the brakes by raising interest rates.

Opening the "Pandora's Box" of inflation

But triggering inflation is like opening Pandora's Box.

Once you crack the lid open a little bit, you could suddenly get much more than you wanted.

A campfire of inflation quickly becomes a forest fire of economic destruction.

That's the real reason Powell doesn t want to raise interest rates.

He's afraid.

And he should be!

Because even a slight increase in interest rates could send the economy into a tailspin.

It's one thing to keep running up deficits, after all.

But it's quite another thing if you can no longer afford to pay the interest on your debt.

When inflation gets out of hand, the government will do everything they can to stop it.

Everything wrong.

Next step? The "globalization" of money!

After inflation goes wild, I predict the next step will be to "globalize" the world's currencies.

Towards the end of World War II, the economic leaders of

45 nations met in a little town in New Hampshire, Bretton Woods.

The purpose of the Bretton Woods conference was to set the monetary policy for the postwar world.

Whether you agree with them or not, the policies adopted at Bretton Woods have shaped the global economy for the past 75 years.

Now, some powerful people around the world — including Kristalina Georgieva, the chairman of the International Monetary Fund — are calling for another Bretton Woods.

You might call it Bretton Woods 2.0.

"Our founders did it," says Ms. Georgieva. "It is now our turn. This is our moment!"

"This is our moment!"

Our moment for what?

Well, nobody knows what kind of crackpot ideas they would cook up in a Bretton Woods 2.0.

But one thing is for sure:

It won't be good for the U.S. dollar.

It won't be good for the United States of America.

And it won't be good for you and me.

Introducing the "OPEC" of currency

Most likely, the outcome of the next Bretton Woods would be the creation of a kind of "currency cartel" to control the supply of money around the world.

Just like a handful of Arab countries formed OPEC to control the supply and price of oil around the world...

This new "currency cartel" will control the supply and value of money.

It will decide who gets how much money depending on how much they think you "need" and how much they think is "fair."

If a nation violates its quota by printing more money than it's allowed, it will be punished with penalties, taxes, and tariffs.

If a nation keeps violating the rules, it will be shunned as an international pariah that nobody wants to do business with — almost like North Korea is today.

The member nations might be allowed to keep their own currencies.

But the important fiscal and monetary decisions will be made by the cartel. And who knows?

The economic geniuses at Bretton Woods 2.0 could even decide to create a brand new currency for the world to use.

Turn in your dollars for a "Bancor"

Don't laugh. It almost happened at the first Bretton Woods in 1944.

John Maynard Keynes proposed the creation of a new currency called "The Bancor" that the whole world could use.

Fortunately, wiser heads prevailed.

But it has been a long time since we've seen "wiser heads" of any kind in the international economic community.

"America will never go along with these ideas!" you might say.

Don't be too sure.

My guess is nearly all of President Biden's advisers will think it's the smart move.

But it's not.

It's the worst thing we could do.

Because in my opinion after inflation and globalization, the next domino to fall will be devaluation.

How much would your dollar be worth?

How much would your dollar be worth at this point?

It would be worth as much as Kristalina Georgieva says it's worth!

If she wants it to be worth 97¢, it ll be worth 97¢. If she wants it to be worth 2¢, it'll be worth 2¢.

It's not up to you how much your dollar is worth, in other words. Nor is it up to the currency markets. Certainly not the "invisible hand" of capitalism.

It would be up to Kristalina Georgieva and the financial geniuses at the IMF.

They would decide how much your dollar needs to be worth to achieve their goals.

Devaluation of the currency, after all, is how nations throughout history have managed to wriggle out of debts they couldn't pay.

Watering down the currency is a time-honored way of paying off your debts with money that's worth less now than it was when you ran up the bill.

We've already talked about how the Roman denarius was devalued from 99.5% silver all the way down to just 0.02%.

But that was just one of dozens of times this has been done throughout history.

The day the U.S. Dollar was devalued

It has even happened here in America.

In 1932, Franklin Roosevelt required all Americans to turn in their gold.

If you refused to do it, you'd be put in jail for 10 years and fined nearly $200,000 in today's money.

Roosevelt compensated people who turned in their gold at $20 an ounce.

But then he set the price of gold at $35 an ounce.

Since the value of the dollar was still linked to the price of gold at that time, he essentially devalued the U.S. Dollar by 42%.

The early stages of a global devaluation

To put it bluntly, based on what I'm seeing we are in the early stages of a carefully planned global currency devaluation.

From that point forward, bad things will start to happen very quickly.

So, please pay close attention to what I'm going to say in the next three minutes.

Because even though the scenario I'm about to describe is a living nightmare that can leave millions of Americans desperate, poor, and hungry...

There will also be opportunities for people (like you) who understand what's happening to make money every step of the way.

Here's how the American

economy could unravel

From where I sit, here's one scenario how the American economy will begin to unravel:

The problems will start in the bond market.

With out-of-control spending, massive deficits, and growing inflation... investors around the world will avoid buying U.S. Treasury bonds like 5-day-old fish.

On the day when there's "no bid" for bonds, the Fed is forced to raise interest rates just so someone, anyone, will buy their paper again.

But rising interest rates will cause the price of existing bonds to fall off a cliff.

And since government bonds are the bedrock of America's pension plans... annuities... and 401(k)'s...

The investment values that millions of retired people depend upon for income begin to vanish.

Money markets might "break the buck"

As this scenario unfolds, money-market funds might even "break the buck" as they did in 2008.

In other words, every dollar you have in a money-market fund at your bank or brokerage firm could suddenly become worth less than a dollar.

This would cause a panic as investors and savers alike — businesses, too — run to pull their savings out of money-market funds.

To prevent a collapse of the economy, the government could institute a "Universal Basic Income" to keep money flowing into people's dwindling bank accounts.

At this point, the U.S. dollar will be little more than pixels on a computer screen.

NOT backed by gold.

NOT backed by bonds.

NOT even backed by the "full faith and credit" of the United States.

What does "full faith and

credit" really mean?

What do the words "full faith and credit" mean, after all, if the government has no credit and the people have no faith in the currency?

Worst of all, when people realize their money is rapidly losing value, they expect even more inflation.

So they start to spend more money because they know it will be worth less tomorrow than it is today.

Ten dollars may be an outrageous price to pay for a head of cabbage.

But you have to pay it because the price will rise to $20 the next day... or even by the end of the same day.

Don't laugh!

This is what has happened over and over again throughout history.

It has happened in Third World countries like Zimbabwe.

It has happened in First World countries like Germany.

It has happened in ancient times as it did during the fall of the Roman Empire.

And it's happening now in Venezuela, which — don't forget — used to be the richest nation in South America.

When people lose faith in their money, they also lose faith in their government.

Here's what happens when government

loses its grip on power

And when a government begins to lose its grip on power, it starts to take drastic measures to hang onto it.

Consider this next phase of the scenario...

Taxes go up. Not just on the rich, but on everyone.

And not just on your income, but on your assets, too.

Have you got a big house? A fat 401(k)? A nice car?

Get ready to pay extra taxes on all those things.

After all, it's only "fair," they'll say!

Why should you have a Cadillac when other people have to take the bus?

Suddenly, the government has to make an about-face.

Spending is cut to the bone.

Social Security checks are delayed — or suspended.

Medicare and Medicaid are slashed.

Food stamps. Welfare checks. Disability payments. Unemployment. It all comes under the ax.

State and local governments are forced to cut back, too.

In fact, they're hit even harder because, unlike the federal government, they can't print money.

So, they make drastic cuts in fire departments.

Police departments.

Trash pickup.

If you dare to walk the streets at night...

If you dare to walk the streets at night, you might see buildings burned down... or windows broken by looters... or uncollected garbage everywhere.

When you go to your bank to withdraw cash — or even get your valuables out of your safe deposit box — the doors are locked.

Even when you go to the ATM machine, sign say "Out of cash. Come back later."

Service stations run out gasoline.

Grocery stores run out of food. Or whatever little food remains on the shelves is too expensive for most people to buy.

That's when people take to the streets.

Many in peaceful protest.

But also many in hunger, anger, and fear.

Or consider this even more extreme scenario...

The government realizes a rebellion is under way.

That's when it starts to behave like a cornered animal.

Armored vehicles roam the streets with megaphones warning residents to stay indoors — or else.

National Guard soldiers are posted nearly everywhere you go.

Strict curfews are enforced.

You need a reason to go outside of your house, just as you did during the early weeks of Covid.

They might let you go to the grocery store...

If you have $10... no, $15... no, $20 for a head of cabbage.

Because for every minute a soldier detains you to check your papers, the price of food keep going up!

Can this extreme scenario be avoided? Sure. Nothing about the future is absolutely written in stone. But the sheer fact that the probability of this scenario has increased is horrifying in itself.

And believe it or not, I have some good news!

And it's simply this:

Europe has already tipped

over the first domino

I pray everything I've just described to you never happens. And maybe it won't. But the fact is, Europe is already much further along towards disaster.

That’s not good news. But it gives you come advance warning.

Why?

Because it means you not only have time to prepare...

You actually have time to profit.

Let me explain.

Like I said, the European Union is much farther down this road to ruin than the United States.

And remember, Kristalina Georgieva of the IMF has already said "this is our moment" to fully centralize, control, and regulate the world's money supply.

I believe rampant inflation and devaluation of the euro is just around the corner.

Which means that wealthy Europeans are likely already looking for a place to put their money where it will be safe and has a chance to grow.

As the legendary banker Walter Wriston of Citicorp once said:

"Capital always goes where it's welcome and stays where it's well treated."

Which is why wealthy Europeans are more than likely going to go on a feeding frenzy in the U.S stock market.

Because, after all, there's nowhere else to go!

We know this can happen because we ve seen it happen before.

The 400% bull market nobody remembers

Look back at the last time the K-Wave hit the global economy with the kind of force that's on its way today.

I'm talking about 1932 — the depth of the Great Depression.

Everybody knows about what happened during that period...

Investors jumping out of windows on Wall Street. The soup lines. The Dust Bowl.

But nobody remembers that the 4-year period between 1932 and 1936 was one of the greatest bull markets in history!

During this time, the Dow Jones Industrial Average rose by nearly 400%!

What caused this incredible run-up?

Why were some people getting rich inside the New York Stock Exchange when so many people outside were standing in line for soup?

The main answer?

Flight capital from Europe.

The incredible effect of "flight capital"

Because in 1932, just like today, Europe was in even worse shape than the United States.

Germany was bankrupt. France, Italy, and even England were facing dire financial problems of their own.

Yet there were still plenty of rich people in Europe — many of them sitting on family fortunes dating back hundreds of years.

They needed a place to stash their money where it would be safe, secure, and have a chance to grow.

They found it in the American stock market.

So the Dow Jones soared.

And some people got rich.

How rich?

How rich would you be if it happened again?

Well, just think about what would happen if the K-Wave has the same effect today as it did in 1932.

If you have $500,000 invested in the stock market, for example...

And the Dow has the same kind of run-up that it did in 1932...

You could be sitting on a nest egg worth $2,500,000 in four years!

But it's likely to be even more than that.

Why?

Because nowadays, we also have giant multinational corporations who are sitting on large stockpiles of cash and wondering where to invest it.

Apple, for example, has more than $195 billion in cash on its books right now.

Microsoft is sitting on nearly $137 billion in cash and cash equivalents.

So is Alphabet. It also has $137 billion burning a hole in its pocket.

Amazon, Facebook, and many others are facing the same cash-rich quandary.

And don't forget about all the government stimulus checks!

Some people need the stimulus to pay their rent and buy food.

But many others simply put it in the stock market!

The K-Wave is starting to crest

If you look closely, in fact, you can see signs that bubbles are beginning to form in the stock market.

Which tells me the K-Wave is already starting to crest.

The so-called "meme stocks" like GameStop — which were driven up to ridiculous prices by social media — may look like outliers at first.

But did you know that nearly one out of ten American investors bought stock in GameStop during its recent run-up?

If you include other viral stocks like AMC, Nokia, and Blackberry, nearly one out of three Americans have taken part in this feeding frenzy.

By contrast, the Dutch tulip craze seems downright sensible!

"Even Shaq has a SPAC.

What could go wrong?"

Meanwhile, the hottest investment on Wall Street nowadays is something called a "SPAC."

Which stands for Special Purpose Acquisition Company.

A SPAC is a company that does nothing. Makes nothing. And sells nothing.

So why do people invest in SPACs?

Because they think the managers might have an idea someday... and the idea might turn into a product... and the product might sell for a profit.

Maybe!

SPACs attract a lot of money and publicity from celebrities, who invest millions of dollars in these speculative ventures.

As the Chief Economist at the consulting firm RSM said:

"Even Shaquille O'Neal has a SPAC. What could go wrong?"

With all this money flooding into the stock market, I believe we could see the Dow reach 100,000 over the next few years.

Why the Dow could reach 100,000

sooner than you think

Yes, you heard me right!

The Dow Jones could hit 100,000 relatively soon.

But let me give you an important warning:

You can't simply sit around and wait for it to happen.

You can't hang onto your 401(k) and expect it to triple in value.

Because as I said before, the K-Wave will behave just like a wave in the ocean:

Right now, everything tells me we're near the end of a BOOM when the K-Wave lifted nearly all boats...

We're already in transition to a BUBBLE, as the wave crests with wild speculation...

And there will be a BUST when the K-Wave crashes onto the shore with one of the worst economic catastrophes the world has ever seen.

Where will your little boat be when that happens?

Will it be torn to pieces by the tons of water falling on your head in a global financial collapse?

Or will you be one of the fortunate few who ride the crest of the wave to the top... and get out in time before the crash?

I know which outcome I want for my family and me.

That's why I want to tell exactly what I m going to do with my own money in the days, weeks, and months ahead.

Let me start by sending you a free special report called "BOOM, BUBBLE, BUST!"

In it, I'll show you the 7 simple steps you should take right now to ride the K-Wave to the top...

Get out in time to protect your assets from the coming currency crash...

Then put your money in a place where it can grow rapidly — in what is certain to be a long and painful aftermath:

STEP #1: DON'T COUNT ON CASH TO PROTECT YOU.

If you're one of those investors whose first instinct is to run to cash when you see the market getting too high...

Or if you're the type who likes to keep a ton of greenbacks stashed under your mattress or squirreled away in a home safe...

Don't count on cash to save you this time!

Liquidating your assets now, in fact, may put your wealth at even greater risk.

Because this time, the currency itself will be at the center of the storm.

If the dollar collapses, what good will it do to have most of your wealth in dollars?

STEP #2: BUY STOCKS WHEN THEY GO ON SALE!

As the K-Wave approaches the United States...

And flight capital from Europe and around the world begins to flood into the U.S stock market...

You're going to see a bull market run on Wall Street unlike anything we've witnessed before in our lifetime.

Which is why you actually want to buy more stocks whenever the time (and price) is right.

In your free report, I'll reveal the names and ticker symbols of some of the stocks I believe are likely to rise the most when the K-Wave begins to crest.

I'm especially bullish on stocks in the areas of electric vehicles... telecommunications... infrastructure... cybersecurity... marijuana... and even oil.

Yes, you heard me right!

In the summer of 2020, you actually had to pay someone to take a barrel of oil off your hands.

Now, oil stocks are in the first phase of a major comeback...

And I'll explain why in your free report.

But watch out!

Not every stock in the market is going to participate in this bull market.

Some stocks are going to go under water when the K-Wave hits — including some that you think of as "safe."

Never forget: ALL investing involves some level risk, sometimes more, sometimes less.

This is why I say the prudent approach is to invest only funds you can afford to risk.

And why I work so hard to steer you away from the riskiest investments — and the riskiest times.

STEP #3: NOW IS THE TIME TO DIP YOUR TOE INTO BITCOIN.

If you've hesitated to buy Bitcoin until now, I can't blame you.

Until recently, most people thought it should have zero value. Warren Buffett even said, "Bitcoin is rat poison squared."

But as Bob Dylan said, "The times they are a-changin'."

Bitcoin is going mainstream.

And it's not too late to get in.

You may have noticed that CNBC now flashes the value of Bitcoin on the screen every few minutes along with the Dow, NASDAQ, and the S&P 500.

Is Bitcoin going to be the world's new digital currency that replaces the dollar, the euro and the yen?

That was the original plan, to be sure. But it didn't work out that way because practically no one spends Bitcoin.

It makes no sense to spend it because it goes up so much in value. Instead, once people own some Bitcoin, they just want to hold it... and hoard it.

Like gold.

Some experts are now calling Bitcoin "digital gold," and they're right.

That's also why Bitcoin surged when the pandemic struck and the Fed printed money like crazy. Investors all over the world saw Bitcoin as a kind of gold and rushed to buy it.

After the pandemic began and the Fed dropped interest rates to nearly zero, gold rose about 25%. Not bad.

But even after a sharp (but normal) correction in May, Bitcoin was up about 700%.

Which means that if you'd invested a modest $50,000 in Bitcoin in March of 2020, you’d be sitting on roughly $350,000 about one year later.

Unlike Gamestop, this amazing run-up is not being caused by small-time investors who don't know what they re doing.

According to Business Insider...

It's being driven by corporations, hedge funds, financial advisors, and even institutional investors moving Bitcoin into their balance sheets for the first time.

The "smart money," in other words is now buying Bitcoin, and they're just getting started.

Tesla, for example, put $1.5 billion dollars into Bitcoin.

"Square" invested $170 million in Bitcoin, which is 5% of its balance sheet.

No wonder Cathie Wood, founder of the ARK Innovation ETF, has said that Bitcoin could go up by another $400,000.

The CEO of Kraken, Jesse Powell, is even more bullish on Bitcoin:

"I think $1 million as a price target within the next 10 years is very reasonable," he told Business Insider.

If he's right, buying Bitcoin could turn every $10,000 you invest into $200,000 over the next decade — no matter what happens in the stock market.

Am I saying you should run out today and gobble up all the Bitcoin you can?

No. But whenever its price takes a big dip, it will be a good time to take a bite.

Plus, there's a better way to profit from the cryptocurrency revolution than just buying Bitcoin, which I'll tell you about in a moment.

STEP #4: GET AHEAD OF THE COMING INFLATION.

The pandemic kept a lid on consumer and business spending in 2020. It created huge pent-up demand for services, travel, even just a night out at the restaurant.

As a result, the American economy is "spring-loaded" and likely to lurch into a faster gear as most adults are vaccinated and life returns to normal.

When lots of people start spending at once, it will have an inflationary effect as saved-up money chases fewer and fewer goods.

Not to mention the torrent of money the U.S. government is pouring in at the same time.

No, this is not yet the "hyperinflation" that could be coming after the K-Wave crashes into American shores.

The inflation on its way now is just a preview of coming “attractions.”

As such, it's a good opportunity for you to accumulate wealth now that will help protect you later.

There are two kinds of assets that do well in times of inflation:

Financials.

And commodities.

In your free report, BOOM, BUBBLE, BUST! I'll tell you exactly which banking and commodity stocks to buy now...

(And, of course, which to avoid.)

STEP #5: BUY LAND, NOT LANDMINES!

"You should always buy land," said Mark Twain, "they're not making any more of it."

It was true when Twain was alive, and it's still true today.

But when you buy land, watch out for landmines!

The coronavirus pandemic has left commercial real estate in dire straits.

You don't want to own anything right now that depends on unemployed people to pay their rent on time...

Or businesses to renew their office leases after they've found out how efficient it can be for most employees to work from home.

But there are certain kinds of real estate that are bound to do very well in the next few years.

Including farmland.

Computer warehousing.

And the land needed for cellular antennas.

There are just three companies that have a virtual monopoly on cellphone antennas, for example.

And all three appear poised to skyrocket as 5G takes hold around the country.

I'll give you the names and ticker symbols in your free report: BOOM, BUBBLE, BUST!

STEP #6: WHEN INVESTORS GET A "CRUSH"

ON STOCKS, BUY GOLD!

As the stock market goes higher and higher, the average investor will ignore gold.

But that's why now is a good time to stock up on the yellow metal.

Because gold is cheap and gold miners are even cheaper.

When you look at this chart of the 15 biggest gold miners divided by the S&P 500, you can see they're as cheap as they were in 2002 — right before the big rally.

Even if gold does nothing more than match that 2002 run-up, you could turn every $10,000 you invest into as much as $61,656. Using Jan 1st 2002 price of $276.5 of gold as start point

Mark my words when the K-Wave begins to crash on Wall Street, investors will stampede into gold like Oklahoma Sooners.

No wonder a handful of savvy Wall Street insiders have been quietly buying gold on the side.

The investment bank Goldman Sachs recently created its first Exchange Traded Fund for gold for their exclusive clientele.

Other ETF's have been stocking up on gold in a way they've seldom done before.

Last year they added a whopping 624,327 troy ounces of gold to their holdings.

Even Warren Buffett — who used to hate gold — bought 21 million shares of Barrick Gold for $563 million in 2020.

I'll let you know exactly which mining stocks you need to buy now in your free copy of BOOM, BUBBLE, BUST!

But don't forget about silver!

Even though I expect gold to skyrocket when the K-Wave comes to Wall Street, I believe silver will do even better.

The great thing about silver is that will give you growth during the crest... and protection after the crash.

Because silver is not only a precious metal that holds its value in hard times... But it's also an industrial metal that's in more demand now than ever before.

Silver plays a key role in at least three key megatrends that will help drive the market higher over the next few years:

- Solar power.

- Electric vehicles.

- And 5G cellular.

When you buy silver, in other words, you're buying a trifecta ticket on three of the biggest growth industries in the U.S. economy.

No wonder investment in physical silver hit a 5-year high in 2020 with 236.8 million ounces, as the demand in America climbed by 62%.

Meanwhile, the supply of silver has been falling.

So now is the time to get into silver in a big way.

But don't just hold your silver in physical coins... ordinary ETF's... or your grandmother's knives and forks.

Send for your free copy of BOOM, BUBBLE, BUST! for the specific silver mining stocks I recommend.

And take full advantage of a silver rush the likes of which we haven't seen since the Comstock Lode.

STEP #7: KNOW WHEN TO FOLD 'EM!

The K-Wave is a moving target.

Stocks will start to rise as European flight capital floods into the U.S. stock exchange.

The market will get bubbly as a rising stock prices triggers greed from investors looking to make a quick buck on short-term speculation.

Then the global economy will crash when the inflation... devaluation... and globalization of U.S. Dollar sparks a collapse in the world's currencies.

In short:

Boom... Bubble... Bust!

That's why the worst thing you could do right now would be to sit tight and do nothing.

Because even though I'm predicting the K-Wave will lift the Dow to 100,000 in the next few years...

There are 3 reasons why you can't afford to simply sit back and watch it happen.

FIRST, because you re probably not 100% invested in the Dow. You probably have a diversified portfolio of many other kinds of assets.

Until now, that kind of diversification was the smart way to invest.

But as the K-Wave hits American shores, the stock market will go topsy-turvy.

The old "rules" will no longer apply.

Some of those investments are going to shoot to the moon while others are going to sink like a stone.

So even if the Dow reaches 100,000, you may not be better off than you are today.

SECOND, you actually need to do better than the Dow to protect yourself from the serious trouble that may lie ahead.

That's why I'm going to tell you in the next few minutes about how you could outperform the Dow with a handful of stocks (and other assets) that could multiply your money many times more than the Dow in the months ahead.

The THIRD reason you can't just sit back and do nothing is because there's a strong possibility of a major pullback in the stock market before the K-Wave starts to climb.

CAUTION: Beware the undertow!

It's just like what happens in the ocean.

When a big wave starts to form offshore, it's preceded by a powerful "undertow" flowing in the opposite direction out to sea.

People who have witnessed tidal waves (and lived to talk about it) often say the tide receded by hundreds of feet just minutes before the tsunami struck.

Which is why I'm getting ready for the possibility of a 20, 25 or even 30 percent correction in the market very soon.

It's also why I need to be in constant contact with you to help make sure you're buying the right investments at the right time...

And selling them before you get caught holding the bag.

So with your permission, I'd also like to send you a trial subscription to my monthly letter, Wealth Megatrends.

Try it risk-free... and get a free gift, too!

When you give Wealth Megatrends a try, I'll send you a copy of "BOOM, BUBBLE, BUST!" absolutely free with your subscription.

With it you'll understand the fundamental forces at work as the K-Wave floods the European Union and starts to flow towards the United States.

While other investors are scratching their heads and wondering why the stock market keeps going up as the broader global economy continues to stumble...

You'll not only recognize what's going on...

But you'll also know exactly what to do about it.

You'll take full advantage of the rising prices in the market as flight capital from around the world flows into U.S. stocks.

You'll avoid getting caught up in the bubble as greedy speculators, day traders, and unsuspecting investors are drawn into a frothy market.

Most importantly, you'll be protected when the inevitable crash occurs.

That's where Wealth Megatrends comes in.

Follow our model portfolio for

Both profit potential and protection

Because in each issue you'll find a model portfolio that can put you in a position to profit from the K-Wave's rise...

And it's also designed to protect you from the global economic catastrophe that lies ahead.

I'll let you know exactly which stocks you should buy...

How much you should pay for them...

And when to sell them for the maximum profit.

Since the K-Wave will cause many sudden changes in the market, I'll reach out to you more than once a month with timely guidance and specific instructions.

Three times each week, you'll receive a copy of my e-letter, The Wealth Wave, where my team of analysts and I will give you our latest insights on precious metals, energy, real estate, and more.

Whenever you need to make a move now, I'll send a "Flash Alert" to your inbox so you can jump on opportunities and sidestep dangers quickly.

You might expect results like that from an expensive "trading service" that costs upwards of $2,000 per year.

But a year's subscription to Wealth Megatrends only costs $149 retail.

And, you won't even pay that much.

Or even half that much.

Because the stakes are so high and the time to take action is so short...

I've asked my publisher to slash the regular retail price by more than 80%.

4 FREE Special Bonus Reports

When you subscribe I'd also like to send you 4 more special bonus reports as a kind of "welcome aboard" "gift".

I believe the K-Wave and its rippling aftereffects will dominate the global economy over the next three years, just as I've told you today.

But it will also create swirls, eddies, and whirlpools in the investment markets that present dangers — and offer opportunities — you need to know about before it's too late.

I call these global currents "Megatrends."

This is your shot to make money on these "megatrends" while you still can

Do you have any bonds in your portfolio, for example?

If so, you're going to need my free special report, "BLOODBATH IN BONDS!" as soon as possible.

Most people look at the bond portion of their portfolios as a safe harbor.

We take risks with stocks in the hope of future growth.

But we count on our bonds as the anchor to provide complete safety and a reliable source of income — especially in retirement.

That's why it pains me to tell you that bonds are probably the most risky place to put your money today.

Why?

Because as the K-Wave approaches American shores, both consumer prices and asset prices will rise.

Even if we avoid the "hyperinflation" of Germany, Zimbabwe, and Venezuela...

The way I see is the kind of rampant, widespread, and persistent inflation we saw in the 1970's is a virtual certainty.

And if that happens with the price of everything going up, investors will dump bonds. The Treasury will be forced to pay much higher interest rates on all new bonds.

Which means the price of the old, low-interest bonds you own today will go down... down... down.

And municipal bonds?

I don't even want to think about it!

The pandemic and lockdown has already left many American cities, counties, and states in dire financial straits.

When the K-Wave strikes, it's not unreasonable to expect that some municipal and state bonds will simply default.

Not all bonds will default, of course.

But in the turbulent months ahead, there will be safer places to put your money... and even places that offer more reliable income.

I'll tell you about them in your free special report, "BLOODBATH IN BONDS!"

Introducing the new precious metals

Speaking of safer places to put your money, there are precious metals, of course.

But did you know there are other metals, minerals, and elements out there that are even more precious than gold nowadays?

I'm talking about what's called "rare earth metals."

Unless you're a geologist, you may not recognize them by name:

Holmium... Scandium... Promethium... to name a few.

What makes these strange substances so valuable is they are used in virtually every important electronic technology sweeping through the world today.

Rare earth metals are vital to the manufacturing of...

Batteries for electric vehicles...

"Cloud" computers...

Solar panels...

High-speed transit...

Smartphone batteries....

And many others.

The smartphone you have in your pocket, for example, contains no fewer than eight rare earth metals.

Ironically, most rare earth metals are not actually so rare.

In fact, they're available in some places around the globe.

But they don't tend to accumulate in one place like the famous Comstock Lode of silver or the Homestake Lode of gold.

Which makes them difficult and expensive to extract in large quantities.

So you've got increasing demand...

And limited supply...

Which is the classic formula for making money!

How much money?

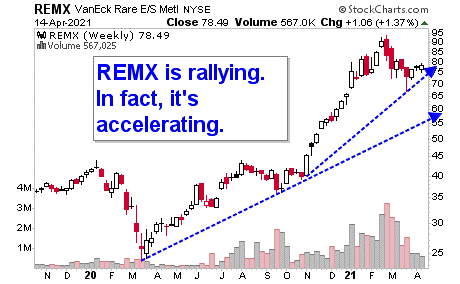

Just look at this chart of one of my best picks for a rare earth metal ETF I recently recommended to my readers:

In your free report "THE NEW PRECIOUS METALS," I'll not only reveal the name of that ETF...

I'll also spell out many other ways you can take advantage of this investment opportunity of a lifetime.

More "marijuana millionaires" than ever before!

Talk about opportunities of a lifetime, let's not forget about marijuana.

If you think you missed the boat on cannabis...

If you didn't jump on the early "penny pot stocks" five or ten years ago when they were the darlings of the investment world...

If you didn't enjoy the 100%... 500%... even 1,000% growth in value that some (but not all!) of those stocks returned...

You may be kicking yourself today.

But I'm here to tell you the biggest opportunities in cannabis are still ahead of us.

Why?

Because pot has always been illegal at the federal level in the United States.

Which has held back the entire marijuana industry from the very beginning.

Until now, investing in marijuana has been like driving your car with the parking brake on.

But all of that is about to change.

Why?

Because with Joe Biden in the White House and the Democrats in control of both houses of Congress at least until the end of 2024...

It seems to me that it's a virtual certainty the federal government will legalize marijuana.

They'll do it for many reasons.

Not the least of which is that they'll want to put a federal tax on it!

That's why Mexico just legalized recreational marijuana and is poised to become the biggest marijuana market in the world, adding still more pressure on its big neighbor to the north to do the same.

And it's why the opportunity for investors in marijuana is actually greater now than it was five years ago.

By 2024, I predict the retail sales of cannabis in the United States will get close to $40 billion a year.

So here's some good news if you missed the boat five years ago:

The boat is not only coming back for you...

It's a much bigger and faster boat than it was before!

But not all cannabis stocks will go higher.

Some will go down.

Some will implode.

Some may seem to have all the right ingredients, and they still turn out to be a steaming bowl of nothing.

That's why I separate the wheat from the chaff in your third free report:

"WELCOME TO CANNABIS COUNTRY!"

Better than Bitcoin!

Earlier, I promised you a better way of investing in the cryptocurrency revolution than buying strictly Bitcoin.

Bitcoin is like gold on steroids. Whenever central banks around the world print money like madmen, investors rush to buy Bitcoin as the ultimate escape haven.

And for good reason: It is now a proven store of value. And unlike paper money, its supply can never be expanded beyond a finite limit.

But there's another cryptocurrency that has far more practical uses than Bitcoin.

In 2020, it chalked up more than $1 trillion in transactions, much more than Bitcoin.

In rising markets, it has a history of rising about three times more than Bitcoin, giving investors triple the profit potential.

And it does so for a reason: This cryptocurrency provides the backbone of what could be one of the greatest money revolutions of all time:

A new kind of financial system, which will compete with, and even begin to replace, the financial system we know today.

That includes the $400-trillion banking system. The $200-trillion global market for stocks and bonds. And someday, even central banks themselves.

Hard to believe? Well, in my new special report "Better Than Bitcoin," I will PROVE to you how this revolution has already begun.

I will show you...

- Why this new financial system could grow 68x its current size, or another 6,700% growth from this point forward by competing with (or replacing) less than 1% of the traditional financial system.

- Why it could easily grow 100-fold (10,000%) in years to come.

- How the cryptocurrency providing the backbone of this new system has surged by more than 1,500% just in the last year, and...

- The undeniable reason why it’s likely to surge three times more than Bitcoin in 2021.

Plus, I will show you the best way to buy cryptocurrencies without opening any special accounts and with no fear of hacks, lost passwords or other of the hassles that often plague first-time Bitcoin investors.

It's all in your fifth free bonus report: BETTER THAN BITCOIN

To sum it up, when you click the button below today, you ll get:

- 12 monthly issues of Wealth Megatrendswith our concise analysis, model portfolio, and timely buy-and-sell recommendations. That alone is worth $149.

- The Wealth Wave e-letter three times per week, plus Flash Alerts whenever you need to make a move quickly.

- SPECIAL BONUS REPORT #1: "BOOM, BUBBLE, BUST!" ($79 Value)

- SPECIAL BONUS REPORT #2: "BLOODBATH IN BONDS!" ($79 Value)

- SPECIAL BONUS REPORT #3: "THE NEW PRECIOUS METALS!" ($79 Value)

- SPECIAL BONUS REPORT #4: "WELCOME TO CANNABIS COUNTRY!" ($79 Value)

- SPECIAL BONUS REPORT #5: "BETTER THAN BITCOIN!" ($79 Value)

Add it all up and it comes to $544 in newsletters, e-zines, flash alerts, and special bonus reports which you'll get for...

NOT the $2,000 that many "trading research services" charge...

NOT the $149 list price of a subscription to Wealth Megatrends...

BUT if you click the button below right now...

Just $29!

That comes to less than 8¢ a day.

Or a nickel and three pennies...

For information that could not only help make you tens of thousands in the boom...

Even more money in the bubble.

But also save you hundreds of thousands in the ensuing bust.

A guarantee backed by 50 years in business

I've also asked my publisher to give you the most generous guarantee in our 50-year history.

You can cancel at any time...

Whether it's on the first day of your subscription or the last...

You can keep all the issues, bonuses, and privileges you've received...

And you'll get ALL your money back on the purchase of your subscription.

No catch. No pushback. No questions asked.

One last hopeful word

Let me close on a hopeful note.

I sincerely believe that the United States of America will survive the coming K-Wave.

After all, we've survived it many times before.

We survived the stagflation of the 1970s. The Great Depression of the 1930s. The Panic of 1907. And many other cyclical crashes through our history.

Yes, America will survive.

But whether individual investors like you and me survive is another story.

Let me be brutally frank with you:

Things are going to get worse before they get better.

We're going to see more civil unrest. More riots in the streets. More division in our politics. More chaos in our stock, bond, and currency markets.

We could see a very serious attempt to replace our free-market democratic system with a much more intrusive and authoritarian government.

I believe that attempt will fail.

But not until the American people get poor enough... hungry enough... and angry enough to demand their financial freedom back.

If you have a $500,000 retirement portfolio, you could very well see it drop to $50,000 or less if you do nothing today.

Even a million dollars may not be enough to keep you safe and sound anymore.

That's why I urge you to click the button below right now.

Subscribe to Wealth Megatrends today.

Together you and I will catch the crest of the K-Wave...

And escape the crash!

Sincerely,

Sean Brodrick

P.S. Please don't feel rushed. Once you click the button below, your discounted price and benefits are locked in. Then you can take all the time you need to review your order and make your final decision.