Research firm that predicted the Savings & Loan Crisis, the Dot-Com bust, and the 2008 Great Financial Crisis releases bombshell new exposé:

THE BIGGER LIE

They tell you it’s nothing to worry about, but here’s the truth:

Key economic indicators are flashing red … bankers and billionaires are running scared … and Washington is powerless to stop it …

To see all the benefits, jump here.

Or, read on for the full transcript …

MARTIN: I’m Martin Weiss, founder of Weiss Ratings.

I’ve been tracking the rise and fall of economies, markets and investments for over fifty years.

I’ve seen the best of times and the worst of times.

But I’ve never seen anything like this before.

Right now, Washington and Wall Street are running scared. They see a giant avalanche heading their way.

It started out as a little more than a dusting of snow on a partly cloudy winter day. They told us it was nothing. Just a temporary flurry.

But then it showed its true colors — a new kind of INFLATION that accelerates with alarming speed, that threatens to bury almost anyone or anything in its path.

Slowly at first, and with greater haste today, the biggest investors in the world have begun to quietly move their capital to safer havens.

What they don’t tell you is that it’s also the biggest threat to average Americans.

Driving the cost of food and gas to the highest levels of all time, making almost every home in America unaffordable, gutting the purchasing power of our dollar.

It’s already happening all across America but …

What You’ve Seen So Far Could Just Be The Beginning

And still, most investors don’t see the handwriting on the wall. They don’t seem to realize that, in times like these, the consequence of complacency is catastrophe.

They have not yet started to move their money to safer shores.

Because most Americans have never experienced anything like this in their lifetime.

They don’t remember the 1970s, when folks waited for hours in gas lines just to top off their tanks … when millions had to pay 18% or more for a home mortgage … and when mass protests erupted across the land.

They didn’t live through the inflation that gutted the economy of Argentina and Brazil in the 1980s, destroying the savings of millions of middle-class citizens … bankrupting their governments … prompting their leaders to confiscate their bank accounts … unleashing mass protests … and tearing apart the fabric of society.

Nor does anyone dare think about the hyperinflation that wreaked havoc on the entire world …

Starting in Germany after World War I …

Creating the greatest avalanche of worthless paper money ever seen …

Giving rise to the most murderous dictator in the history of Western civilization …

And plunging the entire planet into a great war that made all prior wars seem small by comparison.

Hundreds of millions of Americans going about their daily business in America today are oblivious to the torrid past of inflation. Fewer still believe anything vaguely similar might be possible today. They have not yet learned the lessons of history.

They’ve been told by Washington to look the other way, that it’s just “transitory” — merely a temporary blip.

But now the time has come. The time has come for someone who knows the truth, speaks the truth and acts on the truth about inflation.

Someone who has always fought for average investors, who has a long and deep history of helping them to escape inflation, to shield them from inflation and, to mount the best defense of all – an offensive strategy to ride the wave of inflation and get rich in the process.

Now is the time for an inflation fighter who’s had the courage to shout his warnings from the rooftops and fight inflation on behalf of average investors.

That man is Sean Brodrick, senior analyst at Weiss Ratings and one of the most experienced inflation fighters of our time.

You may have seen Sean delivering his inflation warnings to millions of viewers on media outlets like CNBC, ABC and Fox News.

Or perhaps you know him as the Indiana Jones of inflation fighters, exploring the resources and mining the opportunities all across the globe that investors can use to make the most money in times of inflation.

Gold and silver mines … energy and natural resources, here in the U.S. and in the far corners of the world — from the remote regions of South America to the far reaches of the Arctic.

All with decades of boots-on-the-ground experience that has helped investors score countless windfalls … even as others saw their buying power and their wealth decimated by inflation.

Sean’s also known for his brutal honesty.

And today, he’s issuing his starkest warning of all …

So, please join me in welcoming Sean Brodrick.

SEAN: Hi! I’m Sean Brodrick, and I’m here to tell you that despite the lies we’re being fed … despite the still-loud voices telling you that everything is fine … and despite the so-called good health of the economy … there is a huge new threat to your money.

Something that impacts everything we buy, everything we invest in and everything we already own: The value of the U.S. dollar.

I call this threat the Great Money Nightmare.

I believe that anyone who fails to understand the Great Money Nightmare — and anyone who chooses to ignore its consequences — is likely to repeat some of the gravest financial errors of the decades to come … and the century past.

While those who face it head-on have the opportunity to do precisely the opposite — to turn what might otherwise be a nightmare into a new kind of prosperity, not only for themselves personally, but also for the benefit of all concerned.

To all those in the first category of investors, my advice is very simple: Don’t bury your head in the sand. Don’t follow the mainstream media or even social media. Learn for yourself, independently, what the true facts are. Then, take your destiny into your hands and chart your own, safer, more prosperous financial future.

That’s what I’m here to help you get started with today. Then, the rest will be up to you.

You already probably know quite a bit about this phenomenon. You know that many people in high places are prone to lying and deception, especially when things are bad.

You should also know that the Fed has printed trillions of dollars and pumped the money into the banking system.

You should also know how this has created one of the greatest income drains in history for anyone with money in a bank, a money fund, an insurance policy or the stock market. It doesn’t matter if it’s locked in an IRA, a pension plan, a 401(k) or even investments that are supposedly “safe” like Treasury bills and bonds.

Inflation doesn’t care. It guts the very currency that your assets are denominated in, be it the U.S. dollar, euros, pound or yen.

That directly impacts the value of your assets no matter where you are and virtually no matter what you invest in.

First they took away any kind of decent yield that people might have hoped to make on their savings. And now, they’re gutting the value of your principal with inflation.

I think that’s tragic. Many people work hard all their life. They build up a nest egg; they expect the yield on their money to make a substantial contribution toward their living expenses and their retirement.

Instead, what kind of yield can people get on their money?

Unless they take wild, wild risks, they get practically ZERO. Nothing but a speck of dust.

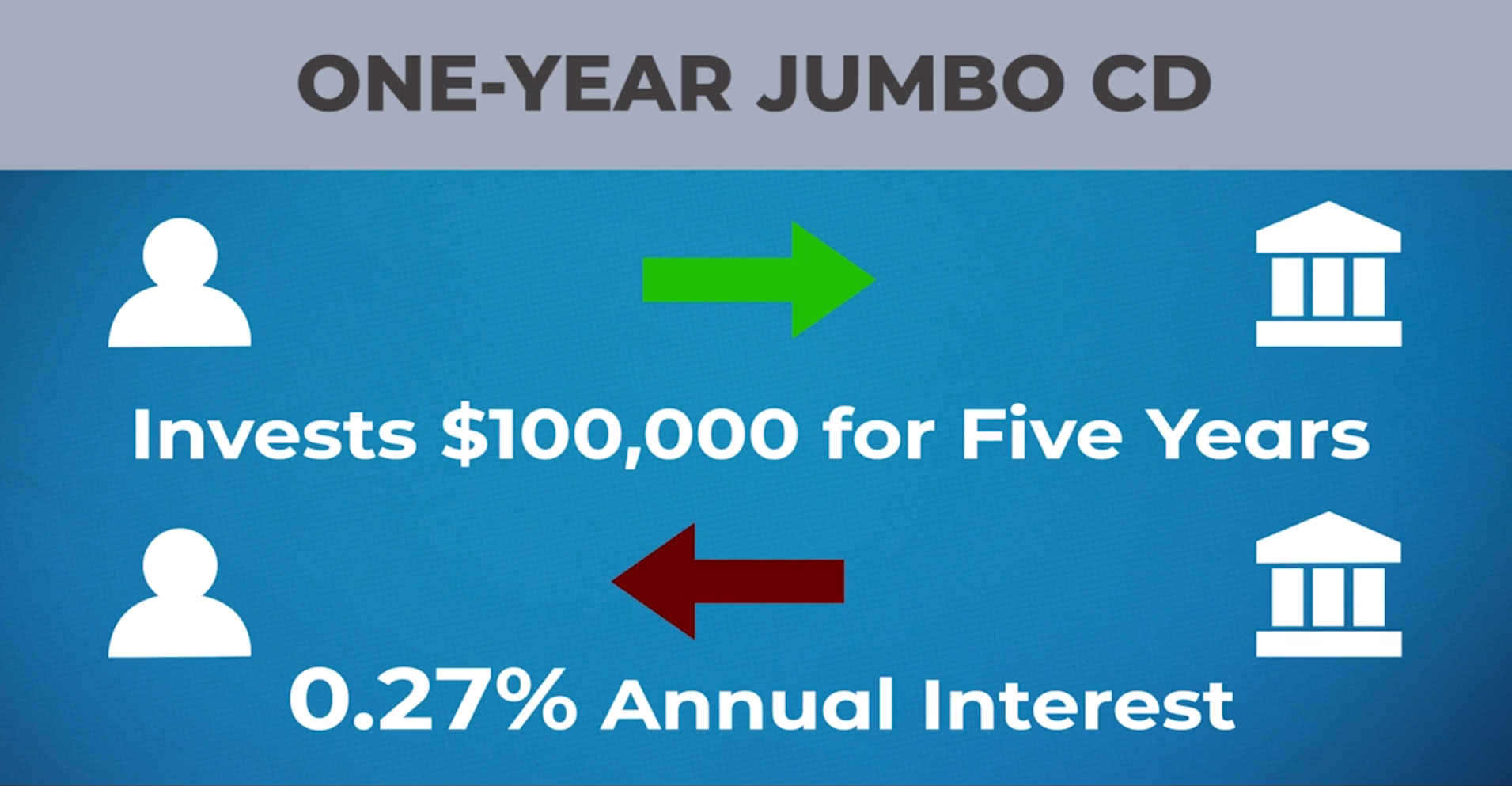

Look at the rip-off deals offered from banks, for example.

Even if someone puts up $100,000 … even if they lock up their money for five long years … all they get is a meager 0.69% in the annual interest.

That’s the average rate on a 5-year jumbo CD. And the 5-year jumbo CDs are the BEST deal you can get at a U.S. bank.

Imagine that. The best deal and only 0.69%!

If they lock up $100,000 for just one year, all they get is 0.55% interest.

If they invest a single dollar UNDER the $100,000 minimum, they get even less.

If they leave their money in a bank money market account, they get 0.1%. That’s a meager dime for every $100 on deposit.

And that’s even AFTER the Fed’s recent rate hikes!

Drip by drip, year after year, the Fed has squeezed nearly every penny out of any decent yield citizens may have hoped to make.

But if you think that this water torture is bad, now comes the death blow.

Surging inflation — the most insidious and most powerful threat to money known to man.

With surging inflation, not only have the high priests of finance stolen years and years of the interest income that all hard-working Americans deserved, they’ve also unleashed the most horrendous financial forces known to mankind: The destruction of the money itself.

Not only do we still get ridiculously low yields, but also one of the fastest surges in the inflation rate in history.

Not only have they stolen the interest, they’re now destroying the principal too.

They blame it on COVID lockdowns and the post-COVID resurgence. They blame it on war and supply-chain disruptions.

But the real cause is right there in front of them. To see it plain as day, all they have to do is look in the mirror.

The culprit is their own zeal to print money and make the rich richer.

The culprit is their own reckless attempts to defy Mother Nature and create wealth out of thin air.

They say inflation will soon come back down to normal. But even as they utter those words, they keep running the same money printing presses 24/7 and they keep feeding the same fires of inflation that they try to blame on everything except themselves.

The Fed talks about tapering — in other words, reducing the rate of money printing — but all they’re really doing is tinkering, making minor (and temporary) mid-course corrections in a never-ending flood of funny money.

The Fed raises interest rates, but the rate hikes are still far, far away from catching up with inflation. Even with recent rate hikes, the average saver is still losing more money to inflation than at any time in 50 years.

What’s worse, if all they’re doing is tinkering and toying around, can we have any semblance of confidence that inflation will really come back to normal?

Of course not.

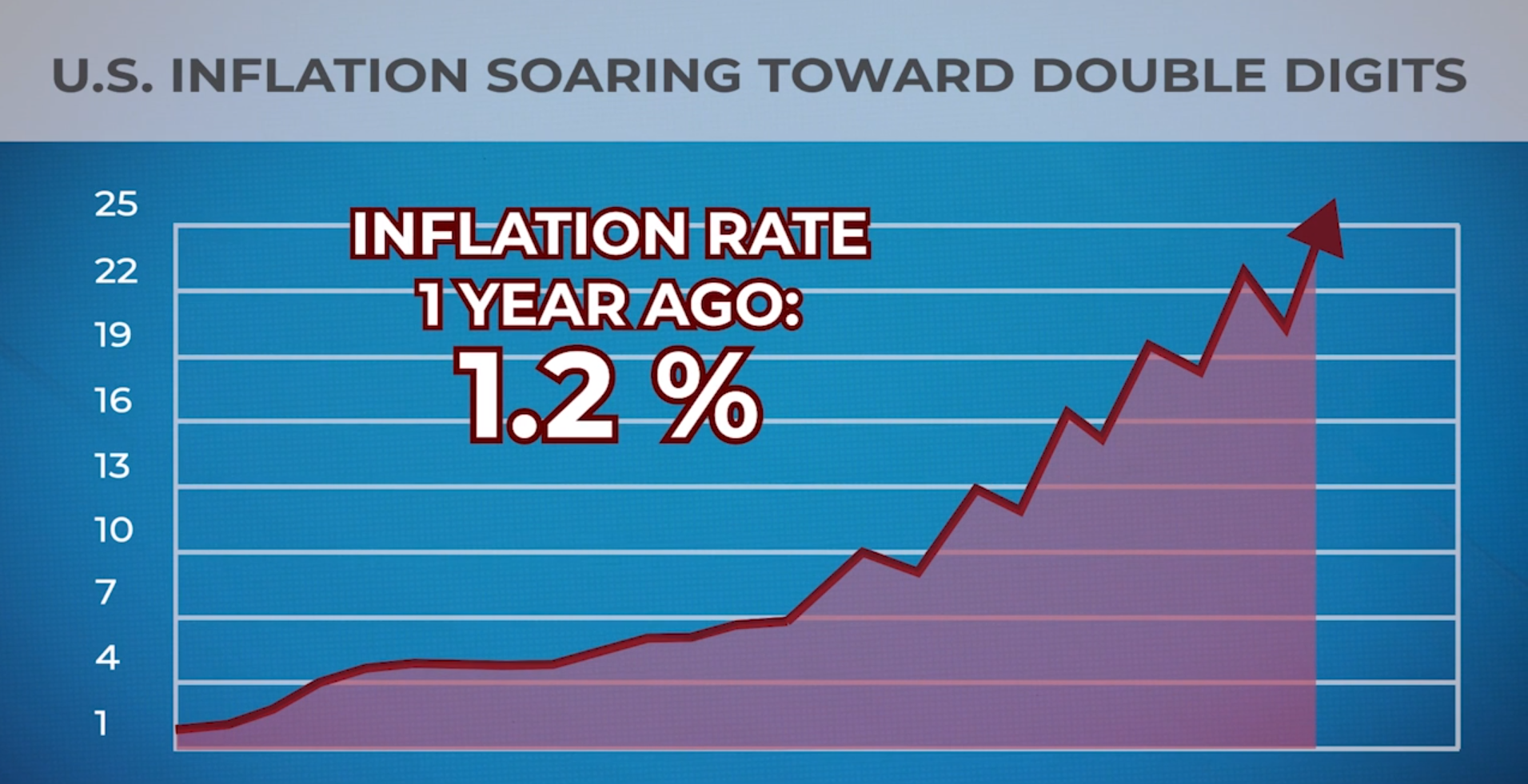

If anything, it’s bound to get worse, a lot worse. Already, it’s accelerating at nearly the fastest pace in history. In just two years, the rate of inflation in the United States has surged more than sevenfold.

It’s threatening to kill the retirement of hundreds of millions of citizens. And it’s quickly gutting their ability to build generational wealth.

It’s the last warning that the time is NOW to open our eyes, wrap our wealth with a protective shield and turn the tables on the high priests of finance.

Instead of being the victim of this great nightmare, it’s time to turn these powerful forces in our favor.

I’m going to show you how in a moment.

First, though, I don’t want you to take my word for any of this. I want to give you proof — hard, undeniable proof.

Start with this indicator.

Yes, the indicator is my grocery bill.

Now, let me preface this by saying I’m a simple guy with simple tastes.

My wife and I are both cooks, but we eat pretty simply — ground beef for meatloaf, pork chops, a dozen eggs, coffee, wine …

There’s nothing crazy or exotic on this list. No caviar, truffles or expensive champagne. It’s honestly just the regular stuff every American needs to feed their family for a week … and that they should be able to afford.

But let me tell you: I was shocked when the cashier told me the bill for this short list of groceries.

I’ve been buying family groceries for 25 years … and this is the most outrageous bill I’ve had to pay.

Adding insult to injury, I know it’s just going to get worse the next time I shop, and a LOT worse soon thereafter.

So, I decided to investigate. I wanted to figure out just how bad things actually are.

Want to know what I found?

First, I checked out housing market trends over the past 18 months.

Last year, we saw an 11% price surge. This year, it’s looking like another 12%.

It’s a frenzy.

A couple we know struggled to buy a condo. Thankfully, they didn’t need to renovate or build new. If they did, it would’ve cost even more as material prices have surged.

In April 2020, $5,000 bought enough lumber to build a nice-sized house.

Now you’d need $25,000 to buy enough to build a small single-family unit. And that’s if you can even get the supply you need — chances are, you may have to wait months. And it’s not just about wood.

New York’s famous dollar pizza now costs $1.50 — a whopping 50% increase!

The name of the company and the sign on the store is still “$1 Pizza.” But the signs on the sidewalk are “$1.50 Pizza.”

Seems like they also believe the Great Money Nightmare is just temporary, a passing fad.

Wheat prices are up 19%.

Sugar’s up 29%.

Corn … a stunning 20% higher.

Can you imagine that? Plain, ordinary corn. An ingredient that’s in so many products we buy each week I’ve lost count — cereals, snack foods, salad dressings, taco shells, flour products, you name it. And it’s up 20%!

Hah! Now try and compare THAT to the 0.69% yield people are making on their 5-year jumbo CDs! It’s 29 times higher.

And look at THIS! Ordinary Colombian coffee, up 60%.

That’s not just 29 times higher than the best interest rate you can get on bank deposits. It’s 87 times higher.

Heck! With inflation at that level, all the interest people make in an entire year is wiped out in just four days!

What did the Fed do about this? Hah! It’s a joke, and it’s not funny. According to the Fed’s so-called inflation targets, these kinds of prices were not supposed to go up this high for nine years.

But it happened in less than ONE year, something no one at the Fed — let alone at the White House — likes to talk about.

That helps explain why they neglected it for so long and why my grocery shopping list now comes with such a huge price tag.

But it doesn’t stop there. Prices are soaring across the board — some as much as 180% in the past year.

And they want us to look the other way?!

The problem is you cannot afford to look the other way because the situation you’re facing today is the worst in my lifetime and even in my father’s lifetime. In fact, it’s the worst in the last 100 years.

This chart shows the yield you can earn on your liquid savings AFTER you take away the money you’re losing to inflation.

Until now, the worst it’s ever been in the last century was in February 1975. That’s when the country was plunged into a deep recession, New York City was going broke and the Fed cut interest rates to the bone. For a short while, if you had your cash sitting in a bank, instead of making money, you were losing it — 4.97% per year.

The second worst situation was five years later. This time, the big problem wasn’t crazy low interest rates. It was crazy high inflation. So, after inflation, you lost 4.8% per year.

But now, thanks to the Fed, we have both plagues — BOTH still-low interest rates AND crazy high inflation — AT THE SAME TIME.

To our knowledge, this has never happened before in the history of the United States of America.

In other words, what happens to the money you have sitting in cash is worse than anything we’ve EVER seen before. You’re LOSING 7%, 8% or even more per year.

And it’s probably going to get worse. The Fed isn’t going to continue slamming the brakes on its money printing. That would almost definitely sink the economy into the deepest depression of all time, and they know it.

Even if the Fed finally gets serious about ending money printing, it will almost certainly be too late. In fact, all our research tells us it already IS too late.

Inflation is already feeding on inflation. Wages are already beginning to skyrocket. And since time immemorial, skyrocketing wages have ALWAYS driven up the prices on virtually everything people buy.

Everybody knows that. It's a proven fact.

In fact, everything I’ve just told you is based on official government data, which is another problem.

Because the government is notorious for fudging the inflation numbers to hide the truth about how bad things really are.

Independent calculations show the situation is actually a lot worse.

“This will all go away,” they say. “Give it time,” they insist.

Well, I don’t buy it.

I think they’re lying, plain and simple.

Inflation is transitory? They’ve already backpedaled on that lie.

They have the tools to control inflation? Another lie.

The way they calculate inflation? Probably one of the most insidious lies of all.

They know if they told the truth, it would trigger a massive financial crisis.

So, they keep stringing us along, delaying the inevitable and putting people’s futures at risk.

Unfortunately, millions of Americans believed them!

They believed everything was going back to normal … they believed the out-of-control price hikes were temporary.

And, as a result, they’ve put their financial future in grave danger.

Their savings, their wealth, their retirement, their way of life … could all be significantly devalued by these lies.

I’ve uncovered mountains of alarming evidence that proves this financial disaster is not just likely to happen … it’s already happening!

This is not a prediction because we are already seeing the effects.

The evidence is incontrovertible.

JPMorgan, Deutsche Bank, Paul Tudor Jones, Warren Buffett, Stanley Druckenmiller and many other Wall Street juggernauts have seen the writing on the wall … yet the average investor is still complacent.

That’s sad … and ironic in a way.

But here’s the greatest irony of all …

While the Great Money Nightmare could gut the value of money, my research tells me that’s also what could create the best investment opportunity I’ve seen in my 30-year career.

And most people will miss it. That’s the irony!

Instead of building wealth thanks to the tidal wave of inflation, their wealth will be swept away by the tidal wave of inflation.

If things play out as I expect they will, those who take action immediately will not only avoid the Great Money Nightmare, they will also have the opportunity to build generational wealth.

Not because of what the government does for you … but because of what the government does TO all of us.

Not by following the so-called experts on Wall Street, but by following your own common sense and the basic steps I will outline for you in a moment.

Now, I want to be clear: I’m not speaking out against the government for the sake of it. I love our country, warts and all. But someone needs to tell you the truth before it’s too late.

At Weiss Ratings, we’ve been telling investors the hard truths for the last 50 years.

Our research and ratings are so accurate, they have been praised by Members of Congress, the U.S. Government Accountability Office (the GAO), Forbes magazine, Barron’s, The New York Times and countless others.

That’s because we have the most accurate — and the most powerful — ratings system in the world.

In The Wall Street Journal, the Weiss stock ratings were ranked #1 — ahead of all major rating agencies and research companies covered, including Goldman Sachs, Morgan Stanley, Merrill Lynch and Standard & Poor’s …

We’ve spent millions of dollars building our ratings system and almost fifty years perfecting it …

We rate 9,997 stocks … 2,169 ETFs … 25,610 mutual funds … and over 1,000 cryptocurrencies …

Not to mention practically every bank, credit union and insurance company in the country.

All that data — and our unique methodology for analyzing it — gives us an invaluable edge that alerts us to the soft spots in the entire financial system long before anyone else. In fact, our analysts have predicted nearly every major boom, bubble and bust since 1971.

In the late ‘90s, we were practically the only ones sounding the alarm on the dot-com crisis. We called the top of the market and told our readers to get out.

We did the same in 2008. We were the only ones who specifically NAMED and gave advance warnings about the failure or government bailouts of Bear Stearns, Lehman Brothers, General Motors, Fannie Mae, Wachovia, Citigroup, Bank of America and many others.

These kinds of on-target warnings prompted Worth magazine to say “Weiss’ record is so good compared with that of their competitors … consumers need look no further.”

And The New York Times to say, “Weiss was the first to see the dangers and say so unambiguously.”

Barron’s wrote “[Weiss] is the leader in identifying vulnerable companies.”

Or consider Chris Ruddy. He's the founder of Newsmax and a friend of Donald Trump. He wrote “Weiss’ prediction of the current economic crisis is uncanny.”

More importantly, our forecasts allowed investors to avoid big losses and even make money as the crisis unfolded. And those who listened could have avoided losses as large as 93% …

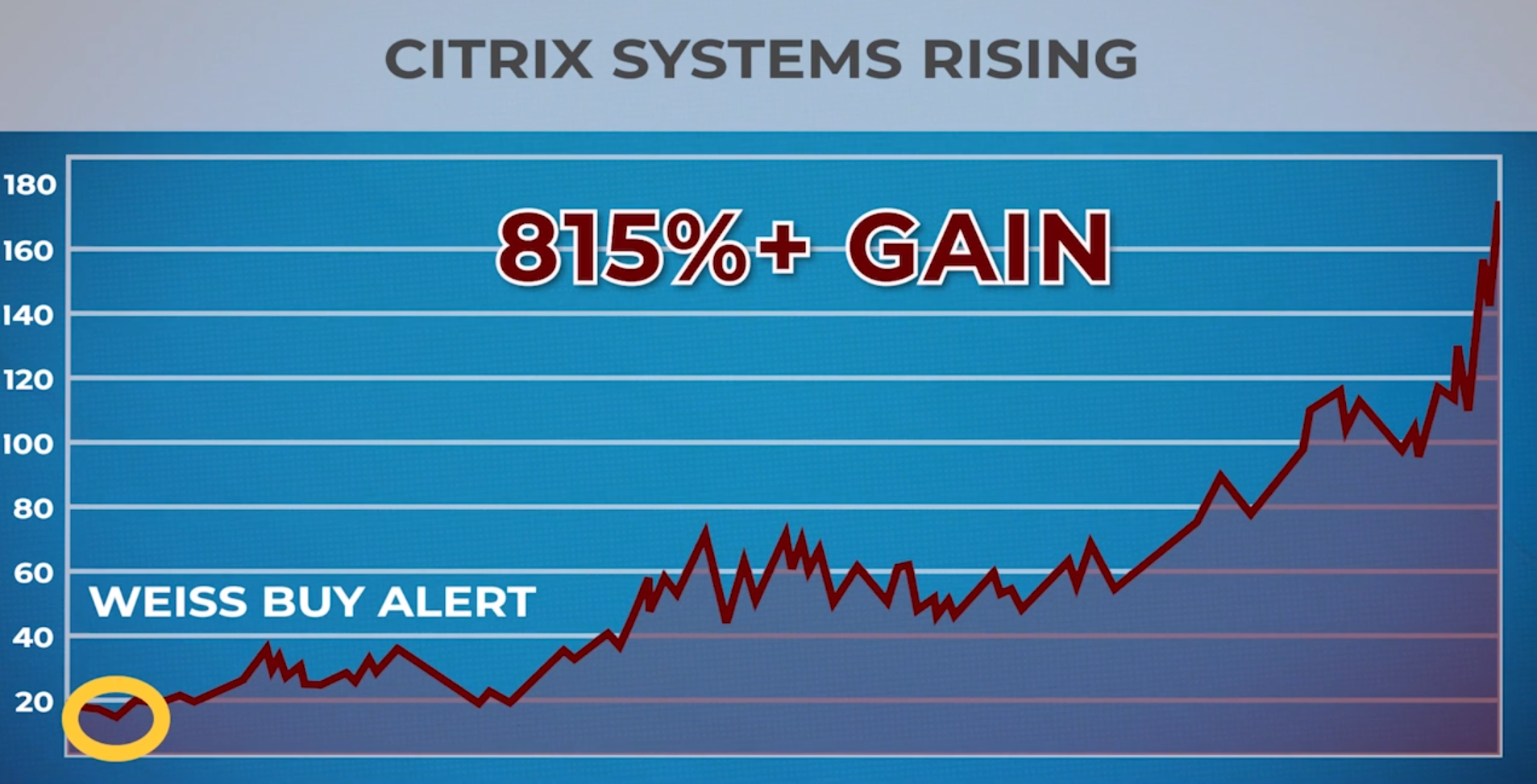

… and had the chance to go for returns of 815% or more when we called the bottom and said it was time to buy.

Then, in late 2019, we said that a global disaster would strike the markets in 2020.

We didn’t predict the COVID pandemic, of course. No one saw THAT coming.

But we did predict the consequences: Turmoil in the stock market and the economy, more massive money printing and soaring inflation.

That brings us to today …

Our indicators for the Great Money Nightmare — driven by catastrophic inflation — are now flashing red …

Now is the time to stand up and really take notice. The situation has become even more urgent, because we’re not just seeing it in the economic data, we’re seeing it in every aspect of our nation, right before our eyes.

Americans living in fear of new unknowns … Washington in turmoil … politics in disarray … Wall Street on the brink …

And that’s BEFORE inflation really hits millions more Americans in the pocketbook.

In 2016, the LIMRA Secure Retirement Institute demonstrated that every 1% increase in the inflation rate would steal $34,406 from the average retiree’s purchasing power. This is calculated assuming that the stated inflation rate would rise over a 20-year period.

Shadow Government Statistics, a non-governmental research organization, calculates that the true inflation rate could be as high as 17.5%. That would mean $602,105 siphoned off from the average person’s retirement.

More than half a million dollars in spending power potentially running away!

All because the Fed has let inflation surge out of control.

Now I don’t know about you, but I’m not going to sit idly by while hundreds of thousands of dollars of my purchasing power disappear.

Fortunately, I don’t have to, and neither do you.

With some smart money moves, you could sidestep the Great Money Nightmare hurtling towards us and I’ll show you how to do that in just a moment.

The U.S. Government has printed and spent so much money; they’ve caused demand to skyrocket. And they’ve created a catastrophic shortage of workers, making it impossible for businesses to provide enough goods and services to meet demand.

Here’s the way I see all this playing out.

Rampant, galloping inflation — a frightening scenario in America unlike anything we’ve seen before …

Interest rates soaring into double digits, but inflation wiping it all out and more …

Bond yields going through the roof, but their market values wiped out — down to $0.50, $0.25, even $0.10 for every dollar of face value …

Stock investors losing money even when the market rallies because the value of thier money falls a lot faster …

The average American is losing buying power — no matter how high his salary SEEMS to be going up …

Massive labor strikes and collective walkouts, even nationwide shutdowns … followed by huge wage increases … and then walkouts that are even bigger.

I want to be crystal clear: The government is not coming to save you.

From everything I know and see, there’s nothing they can do to stop inflation and save your retirement.

I hate to be the bearer of bad news, but in good conscience, I can’t simply watch the savings of hard-working people get swept away by this tidal wave.

After all, if you knew disaster was heading my way, you’d want to tell me, right?

You’d want to arm me with knowledge so I could prepare, protect myself and even profit from the situation if possible.

That’s what I’m doing for you today.

You can’t stop inflation, but …

You CAN stop it from killing your retirement.

You CAN stop it from wiping out your savings.

And you can even use this inflationary environment to your advantage.

How? Now we get to the meat of this conversation.

I’ve uncovered a short list of investments that I feel are ideal for this situation.

I call them the Inflation Winners.

With the official inflation rate already near double digits and the true inflation rate far higher, I predict that my favorite investments will continue to surge in value.

I believe investors will be shocked at how much asset protection my Inflation Winners will provide.

For one thing, these are investments that performed exceptionally well during the last major bout of inflation back in the late ‘70s and early ‘80s.

BIG INFLATION WINNERS

- Inflation Winner #1 went up 70%.

- Inflation Winner #2 went up 100%.

- Inflation Winner #3 went up 102%.

- Inflation Winner #4 went up 199%.

- Inflation Winner #5 went up 271%.

- Inflation Winner #6 went up 296%.

And they weren’t the biggest winners of all …

That’s looking in the rear-view mirror, of course. But even if conditions today are very different, I think that history is good evidence of the potential for the Inflation Winners I’ve identified this time around.

This time, I’ve picked out SEVEN Inflation Winners.

As prices continue to rise … supplies continue to dry up … as the government continues to spend money like there’s no tomorrow … as more workers demand higher wages … and as people wake up to just how dire the inflation actually is …

I predict my Inflation Winners will go up as much, or possibly even more, than most of the Inflation Winners of the 1970s.

I explain all the details inside my new bonus report: The Inflation Survival Guide.

In this special report, I name each of the Inflation Winners for you, detail their potential, explain why I selected them and show folks how to invest.

I feel even just one or two of these investments could help make the difference between a retirement in jeopardy and a retirement that comfortably carries investors through this crisis and beyond.

I show you one of the few bonds that could actually PROTECT your money in an inflationary environment.

I tell you about five Inflation Winner investment funds. I think they’re ideal for times like this.

Plus, name my #1 Inflation Winner. I predict this company will be among the best preformers in an industry that’s already among the leaders — energy. The same sector that massively outperformed the market during the last inflationary crisis.

However, this isn’t just any energy stock.

It’s set to yield roughly $3 billion in free cash flow this year …

And if energy prices continue to climb — as I predict they will — this company could be gushing profits.

You’ll get the names of these high-powered investments inside my Inflation Survival Guide.

And that’s just the icing on the cake.

You see, protecting and growing your wealth isn’t just about what you buy. It’s also about ensuring you’re not stuck holding the assets that could crash as inflation spirals out of control.

That’s why I’m also naming the investments I think you should SELL immediately.

These are widely popular companies that may look great on the surface, but which our ratings have flagged as highly vulnerable to today’s chaotic market.

Millions of investors own them — either directly or indirectly, via a mutual fund, pension plan or even their insurance policy.

As the reality of just how bad inflation is finally hits the mainstream … our ratings and research tell us these investments could fall to the floor!

And when inflation surges, guess which investments always crash first?

Corporate and Treasury bonds!

The last time we saw double-digit inflation in the United States, the price of an average investment-grade corporate bond fell by 48.5%.

Investors lost almost as much in bonds as they lost in stocks during the Great Financial Crisis.

Think you can protect yourself from the ravages of inflation by running to the so-called security of U.S. Treasurys? Last time around, anyone who invested in a 20-year U.S. Treasury bond when inflation began to surge, witnessed a whopping 52% decline in its value. Even worse than the decline in investment-grade corporate bonds.

This means many investors could see their wealth gutted in two ways:

First by inflation eroding their spending power, then by supposedly safe investments crashing in value.

However, with your copy of my Inflation Survival Guide, I give you my best, step-by-step guidance on how to protect your investments, your home and your earning power.

In a moment, I’ll show you how to download your copy of my urgent new report, The Inflation Survival Guide.

First, I want to tell you about three more special reports I’d like to give you …

Bonus report #2 is, 12 Inflation-Beating Stocks for the Next 12 Months …

Earlier, I explained that our firm, Weiss Ratings, has one of the most accurate stock rating systems in the world.

By using our ratings, we’ve been able to uncover undervalued stocks with huge profit potential. Just look at some of the first tech stocks that got our buy ratings after in 2004.

- Fair Isaac Corporation (FICO) — 1,544% return.

- Manhattan Associates (MANH) — 1,818% return.

- Amphenol Corporation (APH) — 2,037% return.

- Intuit (INTU) was a 2,686% return.

- Lam Research (LRCX) — 2,857% return.

- Ansys, Inc. (ANSS) — 3,111% return.

- Tyler Technologies (TYL) — 4,687% return.

- And Apple (AAPL)? A staggering 29,287% return.

To put that in context, on average, 469 stocks that received their first “Buy” rating by Weiss in 2004 and 2005, produced an average total return of 1,052%, while the return on the S&P 500 as a whole was 471% during the same period.

And now, our ratings have identified what we believe could be the biggest winners in the years ahead.

In “12 Best Stocks for the Next 12 Months,” I’ll name each one. That’s the second free report I want to send you right now.

My third urgent report is Bloodbath in Bonds!

Remember, even though you may have never bought a bond in your life, you may still have a big chunk of your nest egg in bonds indirectly — via a mutual fund, life insurance policy or annuity.

You see, right now, if things play out like I expect … other than the one type of bond I’m recommending, bonds are one of the riskiest places to put your money.

As inflation gathers pace, new bonds will naturally have to yield more and investors will dump their old, low-yielding bonds.

And it means the price of nearly all bonds you own today will go down … down … down.

I have little doubt: In the turbulent months ahead, there will be safer places to put your money … and offer more reliable income. I tell you all about them in my bonus report, “Bloodbath in Bonds!”

Speaking of safer places to put your money, the first things that comes to mind are gold and silver, right?

That’s what most people use to hedge against inflation. But did you know there are other metals, minerals, and elements that are even more precious?

I'm talking about what's called “rare earth metals.”

Unless you're a geologist, you may not recognize them by name:

Holmium … scandium … promethium … to name a few.

What makes these substances so valuable is they are used in virtually every important electronic technology sweeping through the world today.

Rare earth metals are vital to the manufacturing of batteries for electric vehicles … “cloud” computers … solar panels … high-speed transit … smartphones … almost everything that’s needed in our new high-tech economy.

The smartphone you have in your pocket, for example, contains no fewer than eight rare earth metals.

That takes me to the fourth bonus report I have for you, The New Precious Metals. “The New Precious Metals.” I'll name my number one pick you can buy in this explosive sector. It’s an ETF. It’s very easy to buy, uses no leverage, options or fancy maneuvers. And based on my estimates, it gives you huge upside potential.

So, I’m sure you’re wondering by now, how you can get your hands on all four of my special bonus reports?

All you’ve got to do is agree to a low-cost trial of my research service Wealth Megatrends.

Wealth Megatrends is focused on identifying the major economic trends unfolding in the markets. Trends that can either make you staggeringly wealthy or destroy your financial future.

Starting immediately, I will give you the private links to download my four bonus reports …

- Bonus Report 1. The Inflation Survival Guide

- Bonus Report 2. 12 Inflation-Beating Stocks for the Next 12 Months

- Bonus Report 3. Bloodbath in Bonds

- Bonus Report 4. The New Precious Metals

Each of these will be priced for $79 each, or $316 for the set.

Plus, you can get started right away with a risk-free membership in my Wealth Megatrends.

Our standard price of one year of Wealth Megatrends is $129, and many thousands of investors are on board with me at that rate.

But given the urgency of the Great Money Nightmare, the grave financial damage it could cause and the potential profits it could generate, we have slashed the introductory price to only $49 per year.

That’s less than 14 cents a day for access to an entire year’s worth of research and recommendations … plus my four bonus reports that you can download immediately just minutes from now.

Between the value of those reports and the deep discount on my monthly Wealth Megatrends, you save a total of $396.

But that’s not all.

Markets are increasingly volatile. The entire world has crossed an invisible threshold from unusual stability to unprecedented instability.

Waiting one month to hear from me — or anyone else for that matter — just doesn’t cut it anymore, especially in this crazy era we live in today.

So, in addition to my in-depth monthly research, I will also give you free membership in my e-letter, Wealth Wave.

My Wealth Wave updates, sent to your inbox three times weekly, are the ideal companion to the in-depth research I provide monthly via Wealth Megatrends.

I alert you to critical changes that are hitting right now … and to those I feel are likely to strike tomorrow.

I tell you when I think it’s time to be more cautious … and when it’s time to invest more.

And I give you a heads-up on entirely new opportunities coming rapidly down the pike.

For all this (and much more) for an entire year, I think $49 is just a small fraction of the value you get.

I think you’ll agree. But, if, at any time in your first year with me, you disagree.

You’re Protected By Our 100% Money Back Guarantee

If, at any time, you’re NOT satisfied with the value you’re getting, just let us know.

And we will give you a full, 100% refund on every penny you’ve spent.

Take the next full year to decide if Wealth Megatrends is right for you.

Check out my recommendations, read my special reports, take advantage of my three updates per week. Then decide. At any time for any reason, if you feel Wealth Megatrends isn’t right for you … just call our customer service team with our toll free 1-800 number and we’ll promptly refund your money.

Even if it’s day on 365 of your membership, we’ll give you all your money back, no questions asked.

And you can keep everything you’ve received from me — including all four of my bonus reports and all 12 of my monthly issues.

It’s my way of saying “thank you” for your giving my investment research and guidance a try.

Just click the button below and check out all the details. Then, I’ll give you full access within seconds.

But hurry, there’s no time to waste.

Inflation is already surging. The Great Money Nightmare is just beginning. It’s not waiting for anyone.

So, click below to test drive my Wealth Megatrends now, and if you’re ready, start taking protective action while you still can.

Thank you very much for your time and your interest.