From America’s Leading Gold-Stock Analyst Sean Brodrick:

Wild Gold Profits in a World Gone Mad

With the Fed printing TRILLIONS of dollars … coronavirus

sinking the economy … and debt exploding, billions of dollars

in flight capital is driving gold to new highs…

Here’s how to turn this historic gold rally

into massive gold-stock gains …

To join now before this offer expires, click here.

Or, for the full transcript, read on …

Announcer: He’s the most successful gold stock analyst in America today, a man who’s been called the” Indiana Jones of Investing.”

He travels far and wide, hunting down investments with enormous potential …

From gold mines deep in Argentina … to diamond fields north of the Arctic Circle … to an ancient Mexican city of silver and mummies.

His boots-on-the ground approach allows him to uncover hidden investment opportunities that less adventurous analysts routinely miss.

He speaks on stages all around the world.

He has the CEO’s of almost every major gold company on speed dial.

He’s called on by Fox Business, CNN, CNBC, Bloomberg, the Glenn Beck program and countless other shows for his unique market calls and predictions …

Predictions that have helped his followers live out the retirement of their dreams thanks to returns of 157%, 216%, 237%, 305%, 363%, 468% and many times more.

Folks, host, Sean Brodrick …

Sean Brodrick: Hello and welcome!

I’m reaching out to you at a moment of both extreme danger and extreme opportunity for investors.

A new, terrifying trend is in the making.

And unfortunately, the overwhelming majority of people do not see it coming. They will watch passively as it unfolds. And their wealth will evaporate, sometimes gradually, usually very rapidly.

But those who take some simple actions will not only avoid this disaster, they could also grow much richer along the way.

Right now, as we speak, we are witnessing a massive surge of government spending. We are witnessing a great explosion of Fed money printing.

And if that weren’t enough … we now have the unprecedented CERTAINTY that much MORE spending and much MORE money printing is still to come.

In response to all this, one unique asset is ALREADY surging: Gold.

And today I’m going to show you how to go for wild gold profits in this world gone mad.

Because while gold bullion has been rising, gold mining shares have been rapidly exploding.

Senior gold mining stocks are up by an AVERAGE of nearly 90% since March. That’s 6.7 times MORE than gold bullion.

Junior mining stocks are up EIGHT POINT FOUR times more than bullion!

And the surge in my favorite gold investments have DWARFED even those stellar gains.

But as you’ll see in just a moment, this recent surge in gold investments is just a taste of what’s to come. Because right now, we’re on the cusp of what could very well be…

The Greatest Gold Bull Market in 100 Years.

If you think that’s an overstatement, then just look at what’s happening all around you:

We have the greatest global economic crisis in 100 years … the largest surge in deficit spending in 100 years … and the biggest jump in central bank money printing in 100 years.

So, tell me, why would it be an overstatement to expect the greatest gold rush in 100 years?

Even former gold sceptics are finally recognizing the sheer INEVITABILITY of this gold boom.

Top economists at Bank of America, for example, have just issued a landmark report titled “The Fed Can’t Print Gold,” and their target for gold happens to be the exact SAME target I announced last year — $3,000.

But that’s just my immediate target.

Today, I’m going to show you why gold is going a LOT higher. And, I’ll show you how to go for windfall profits as gold smashes through that $3,000 target on its way to $5,000 per ounce, and beyond!

I will reveal my #1 gold investing strategy, a time-tested strategy that could hand you fast gains of at least 300%. And, if that sounds like a lot, it’s actually rather conservative.

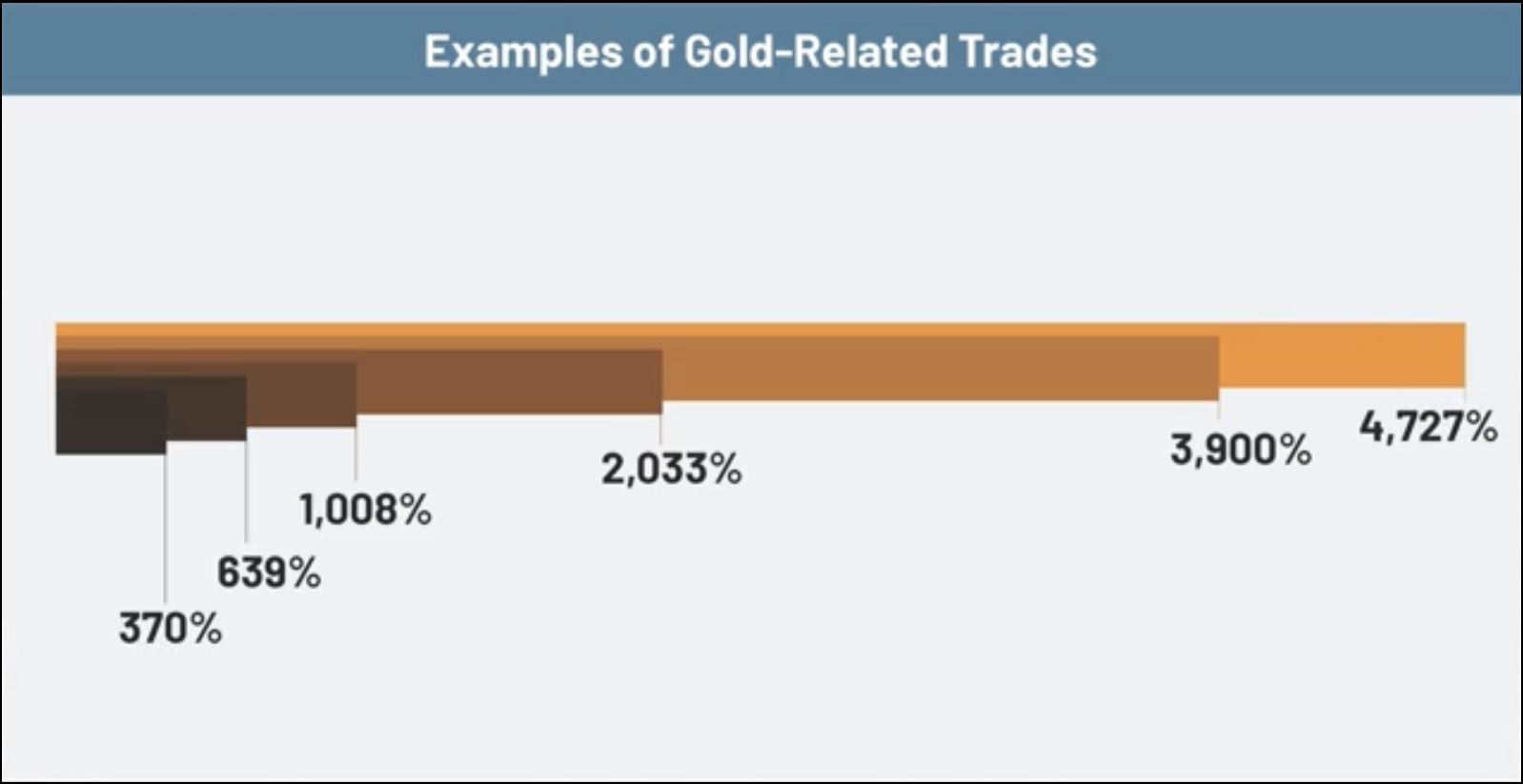

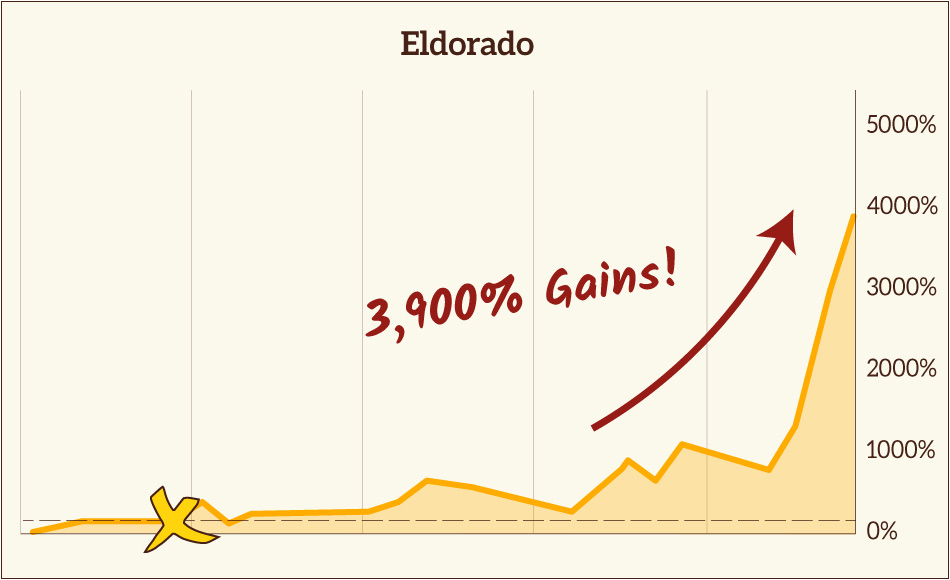

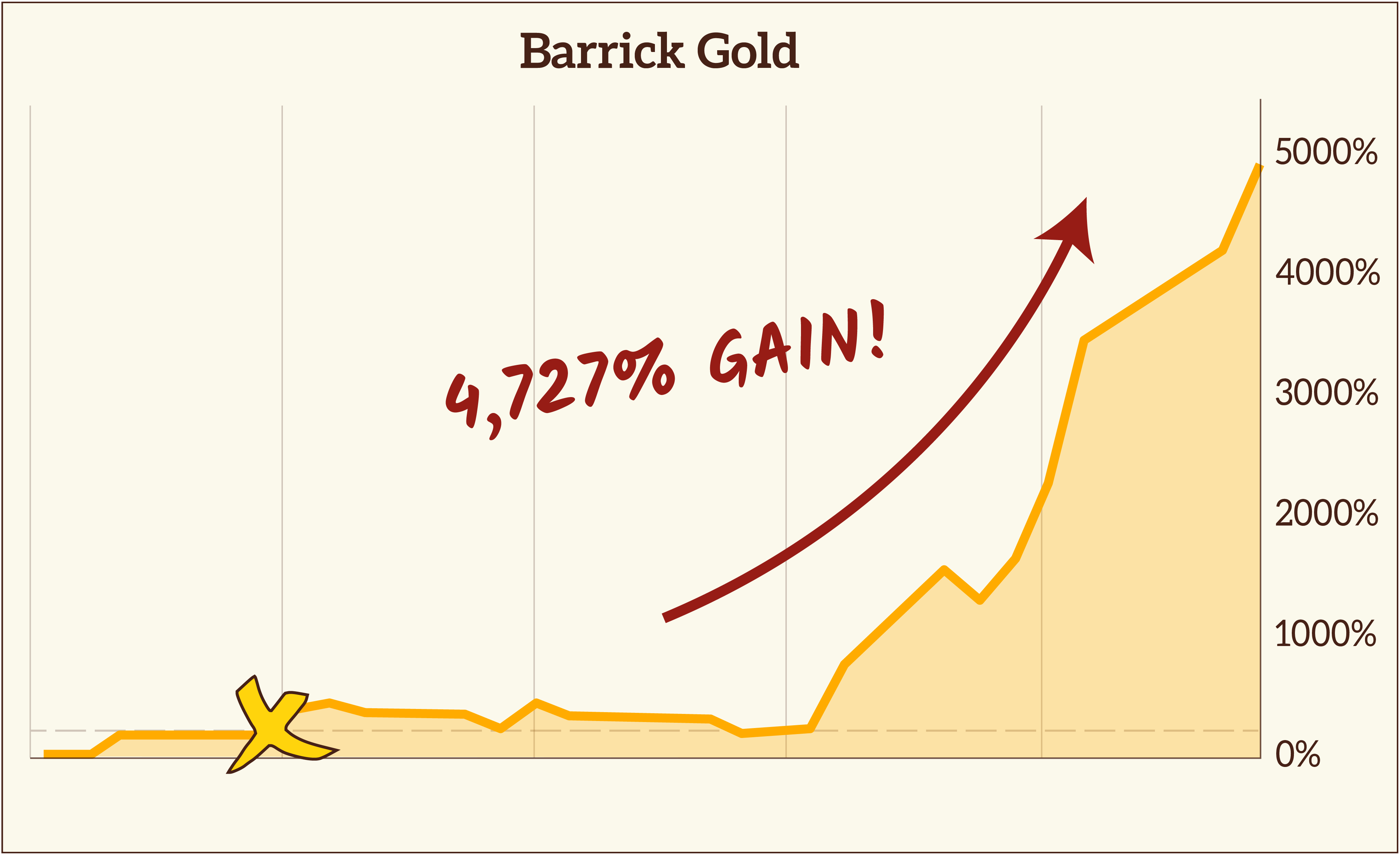

Because even during gold booms that PALED in comparison to what’s coming, my strategy could have produced fast returns of 370% … 639% … 1,008% … 2,033% … 3,900% … and a MINDBGOGGLING 4,727%.

To put the 2,033% gain in perspective, it was NOT the best return, and yet it means that a $10,000 investment generates a gain of $203,300.

In other words, even with our country still struggling to recover from its worst economic decline since the Great Depression, you have the chance to potentially pocket massive, life-changing returns …

IF you use this simple strategy that I reveal today …

And IF you take action in a timely manner.

But first, let me show you how recent market events have conspired to create the ultimate bull market for gold.

As you know, gold has long been the safe-haven asset that smart investors flock to in times of uncertainty.

But now the situation is far more extreme. Because …

Now the Federal Reserve and Its Cohorts

Teleported Us from a World of Uncertainty

to a World of INSANITY

Just consider this:

You’ve watched this happen. But are you aware of how dramatic the impact will be on your money? As the coronavirus spread around the globe, millions of businesses shut down, many forever. Streets were deserted. And unemployment surged to Depression-era levels, a greater danger to the financial system than at any time in history.

For ten years, more and more Americans went to work each day, as the unemployment rate declined steadily from its peak in the Great Recession to the lowest in 50 years.

Then, in the blink of an eye, it all came crashing down.

The coronavirus ripped through the world with alarming speed.

Millions of people were infected, hundreds of thousands died, and leaders were forced to shut down almost all trade.

As a result, we watched our great economy crash and burn faster than anyone could have imagined. Millions of small businesses shut their doors, many forever.

Cities lay deserted as people were forced to shelter-in-place.

Unemployment surged to the highest level since the Great Depression, and by some estimates, even HIGHER. Rich, poor, and middle class found themselves without income.

Food banks were stretched to their limits, overwhelmed by the demand.

Over 40 million Americans were thrown out of work.

And the unemployment rate surged far past its peak of the Great Recession, far more swiftly than in the Great Depression and with far greater danger to the financial system than at any time in modern HISTORY.

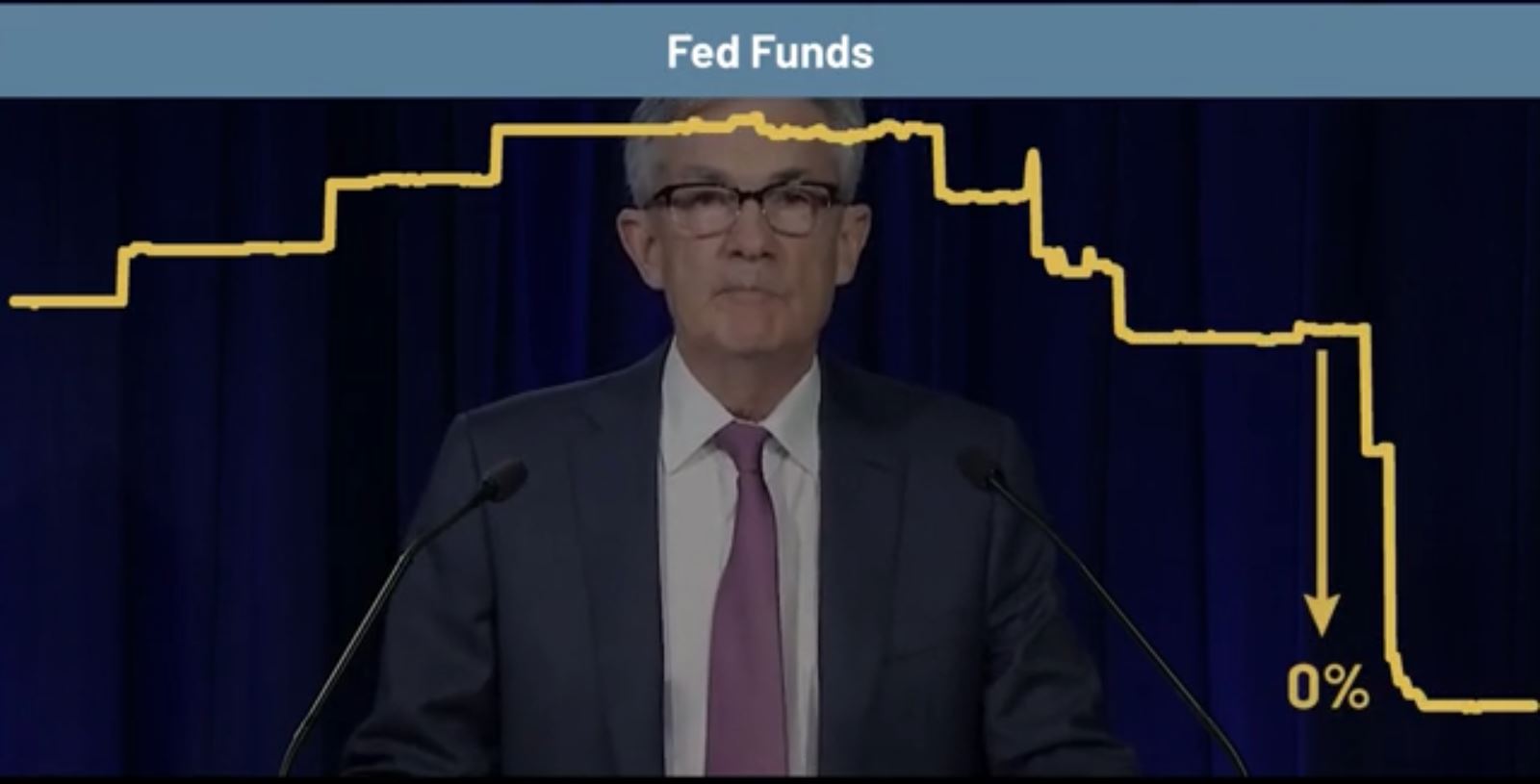

The Fed immediately shoved interest rates down to zero. But it was still not nearly enough.

So, with the US in the throes of a full-scale collapse, Fed Chairman Powell decided he had no choice. He abandoned any and all prior efforts to get interest rates back to normal and immediately shoved them down to ZERO, absolute zero.

But if you think that’s shocking, wait till you see what else he did …

You see, from 2015 to 2017, the Fed kept its balance sheet assets stable. In other words, it mostly refrained from additional money printing.

And, in 2018 and 2019, it even began to gradually reduce its balance sheet, finally starting the long-overdue process of exiting from its money-printing binges of years past.

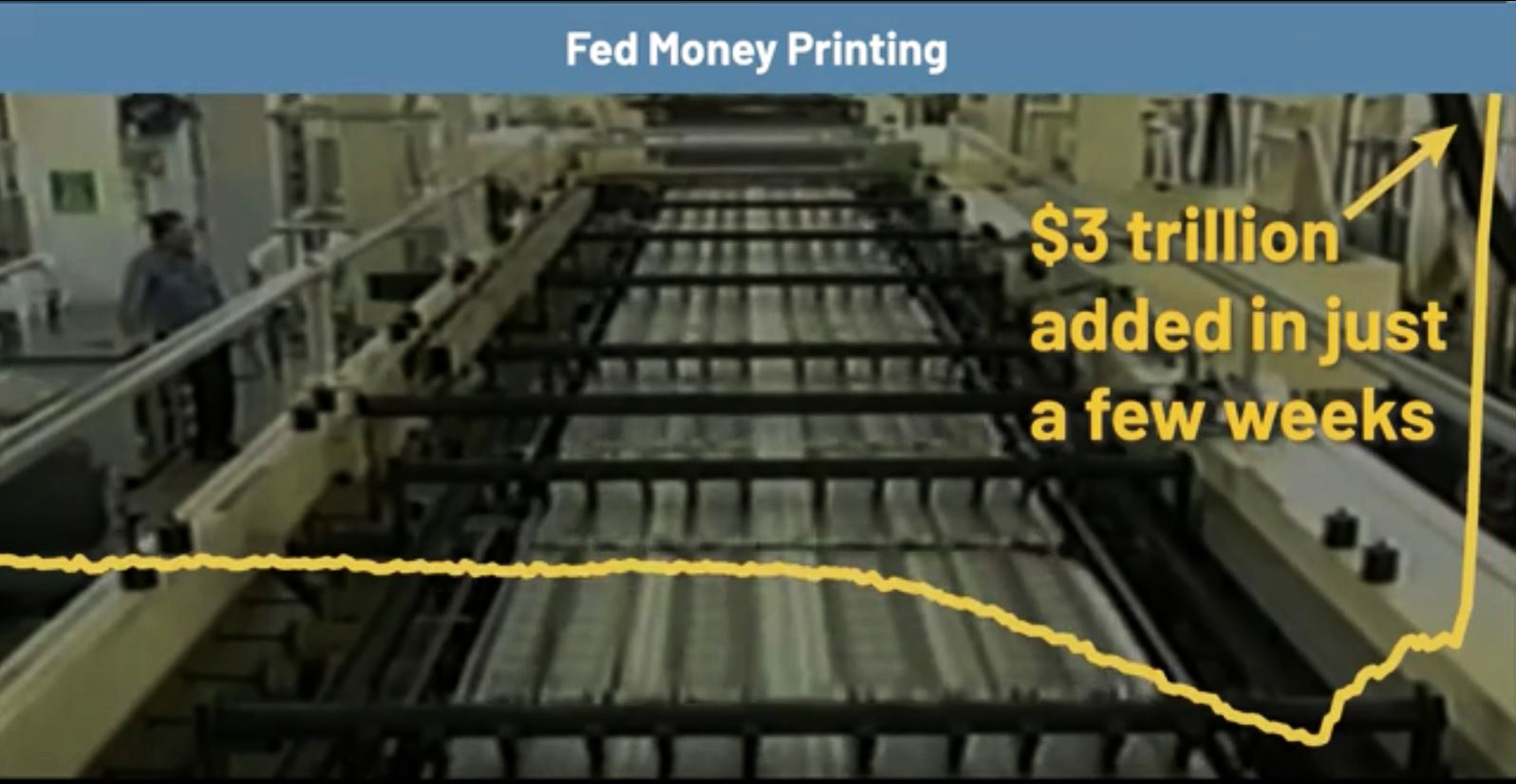

The Fed shocked the world by printing $3 trillion in just a few weeks. The consequences for gold are virtually unlimited.

However, in late 2019, in response to pressure from Washington, Fed Chairman Powell quietly reversed course. He began printing money again, and many analysts thought THAT was outrageous.

Imagine their shock when they saw THIS →

Its money printing has gone absolutely WILD!

In just a few weeks’ time the Fed has suddenly created $3 trillion in new paper money. What’s worse, based on everything Fed Chairman Powell has written and said, he’s just warming up.

Now you may think all this money printing is a necessary evil, or, you may think it’s like making a deal with the devil.

But regardless of what you or I may THINK, the cold, hard reality is that this absolutely shocking series of events HAS happened, the madness is CONTINUING to happen, and worst of all, there’s nothing we can do to STOP it from happening.

IT, IS, BEYOND, OUR, POWER!

But here’s what’s NOT beyond our power:

The Ability to Protect Our Wealth and MAKE

Wild Gold Profits in a World Gone Mad

You see, when the government goes berserk and destroys everything that sustains the future value of our money, the consequences are clear.

But, fortunately, the pathway to riches is also clear.

That’s because it has happened time and time again throughout history.

And every time, the relative value of gold skyrocketed.

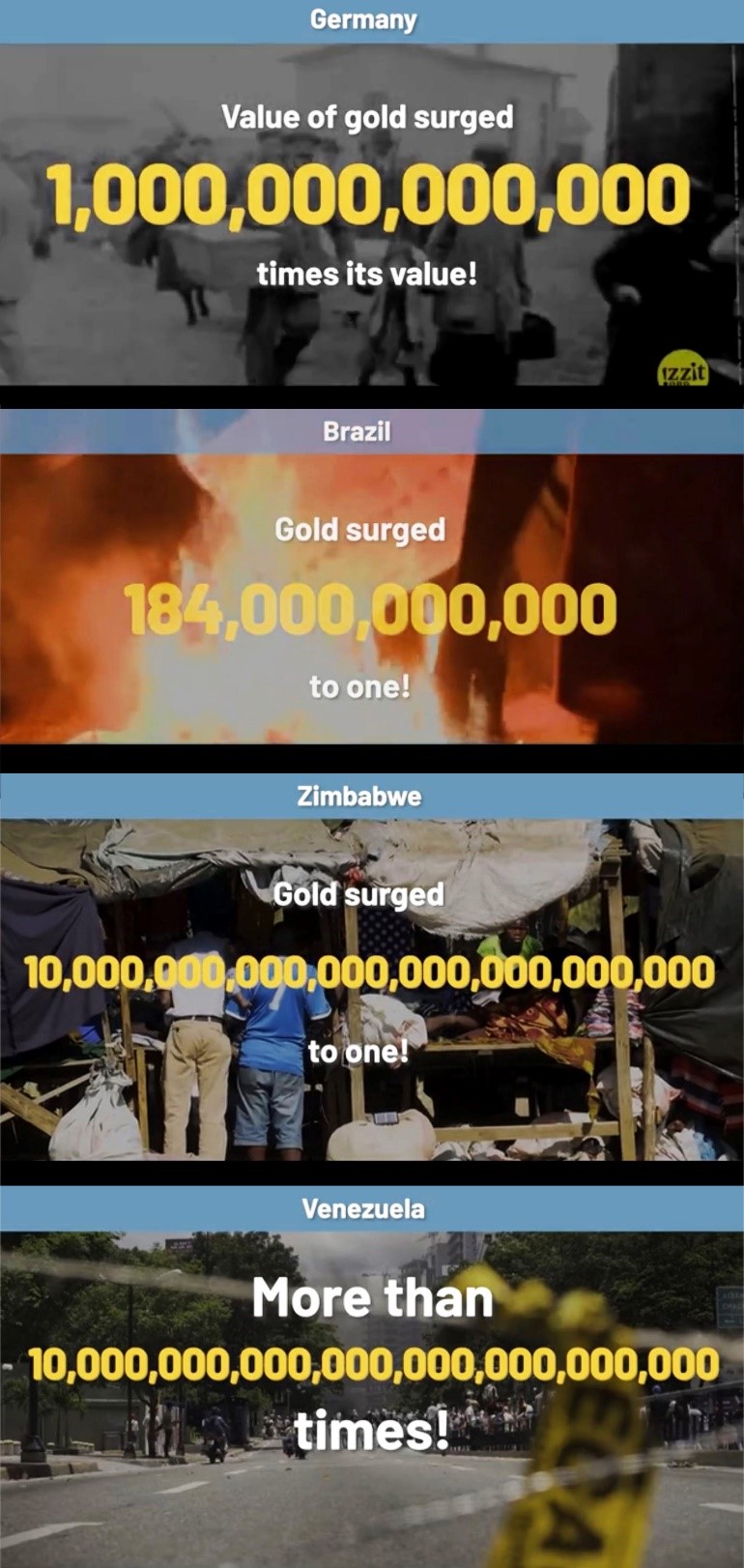

In each of these countries, the value of gold, as measured in their currencies, surged billions, trillions, even septillion times. And in the United States, it has happened twice, although to a lesser degree, creating two massive gold bull markets.

Look what happened in the German Weimer Republic after World War I. The value of gold, as measured in German marks surged tenfold, one thousand-fold, one million-fold and ultimately one TRILLION times its value of just a couple of years earlier.

But, if you think rampant inflation can’t happen again in our lifetime, think again. Because it HAS happened in our lifetime!

In Brazil in the mid-1980s, after the fall of the military government, Brazil’s first elected president in 20 years became gravely ill on the eve of his inauguration and died before he could take office.

In the political and financial confusion that followed, inflation took off like a rocket and continued for a full ten years. Just with that inflation alone, the value of gold, as measured in the Brazilian currency, surged by a factor of 184 BILLION to one.

In Zimbabwe, as Robert Mugabe ruled with an iron fist, the value of their dollar fell so far and so fast that a single dollar bill, was replaced with a billion-dollar bill, then a 100-trillion-dollar bill, which STILL did not buy a loaf of bread.

Just with that inflation alone, the value of gold, as measured in their currency rose by a factor of 10 septillion to one. That’s 10 followed by 24 zeros.

In Venezuela, as Nicolás Maduro destroyed the country’s capitalist economy step by step, the destruction of the currency has been even MORE severe than it was in Germany, China, Brazil or Zimbabwe.

According to the estimates of the Central Bank of Venezuela, the inflation rate increased by nearly 54 million percent. I say estimates because the government has stopped releasing official data.

But based on the International Monetary Fund’s estimates, the value of gold, as measured in Venezuelan bolivars, has surged even MORE than 10 septillion times.

As you can see, history is littered with stories of rampant inflation.

Despite this, most people believe that kind of thing could never happen in America, and frankly they’re probably right.

But even if we witness just a small FRACTION of the monetary destruction we saw in these examples, it will still be enough to drive the price of gold to $3,000, $5,000, and ultimately, $10,000 per ounce.

Some people ask, “if gold hasn’t surged to $10,000 by now, why will it do so in the future?” But they’re ignoring FOUR frightening facts that could doom ALL forms of paper money in the years to come and drive gold even higher than $10,000 per ounce.

Frightening fact #1. In the past, the money printing and resulting hyperinflation was predominantly contained to one isolated episode in one country at one time:

Germany in the early 1920s. China after World War II. Brazil in the late 1980s and early 1990s. Zimbabwe in the late 2000s. Venezuela since 2016.

But today, the fires of inflation are being ignited GLOBALLY.

The largest central banks in the world have mounted a coordinated, simultaneous attack on all currencies.

Every major central bank on the planet has artificially pushed its official interest rates to near zero or even below zero:

The Bank of China. The Bank of Japan.

The Reserve Bank of Australia.

The European Central Bank.

The Bank of England.

And, of course, the U.S. Federal Reserve.

So now, it’s not just ONE individual attack on one separate currency spread out over a century. Instead, what we’re seeing right now is a coordinated, simultaneous attack on ALL currencies.

Frightening fact #2. We’re not just dealing with insane money printing and dangerously low interest rates.

To fund its bailouts, stimulus checks, and various Government programs, Congress has instantly quadrupled the federal deficit to $4 trillion and is on track to double it AGAIN to $8 trillion.

This insane spending is expected to an EXTRA $16 trillion to our federal debt by 2025.

Frightening fact #3. All this is happening with alarming SPEED.

To accumulate the first $16 trillion in government debts, it took 226 years and EVERY president of the United States from George Washington to Barack Obama.

Now, to accumulate and commit to the same amount, it has taken our government just two MONTHS.

Frightening fact #4. Massive global trade, the powerful force that kept commodity prices low for all these years is now COLLAPSING. In its place, we now see the worst trade wars in our lifetime, and they’re just beginning!

That’s the bad news.

The good news is that this insanity has opened up a massive opportunity for you. The opportunity to go for wild gold profits in a world gone mad, starting right now.

That’s because the gold markets reaction to this monetary madness has been very predictable. And, it’s the same reaction that’s powered almost every major gold bull market of our lifetime.

When will the value of paper money begin to plunge? Well, it turns out that in most countries, it is ALREADY plunging, especially in emerging markets.

Since these are measured against the U.S. dollar, it may LOOK like the dollar is going up. But that’s very deceptive. What makes a lot more sense is to look how GOLD is going up in those countries.

When measured against other major currencies, it has ALREADY surged to all-time highs — and far beyond.

So, now you have a choice.

You can hold paper money, hoping and praying that its value will not be trashed. Or, you can move to assets that naturally surge when governments declare war on paper money.

That’s why …

The World’s Savviest Investors Are Moving to Gold. And, They’re Moving at a Rapid Pace

According to the World Gold Council, gold investment demand has climbed by EIGHTY PERCENT in the first quarter of 2020.

Money is flooding into gold ETFs. And the U.S. Mint reports that gold coins are being snapped up at the fastest pace in years. Just in American Eagle coins alone, investors have just bought 142,000 ounces, the most years.

And guess who else is jumping into the gold market hand over fist: central banks THEMSELVES! This is a dramatic turn of events. Until recently central banks had no use for gold. They even called it a “barbarous relic.” But now, as you can see, they’ve changed their tune.

Years ago, central banks were net SELLERS of gold.

But, in 2018, central banks bought the most gold since the end of the gold standard in 1971. And that was just the beginning. In 2019, central banks ramped up their purchases even more.

According to the World Gold Council, a dozen central banks increased gold holdings by AT LEAST one ton through the first eight months of 2019, including the largest first-half increase in global gold reserves that the World Gold Council has seen in its history existence!

All of this tells us one thing:

Even without the coronavirus pandemic, gold was preparing to surge. Now, adding the rocket fuel of insane money printing, gold is going to soar higher than ever.

Which begs the questions, what’s the best way to profit from this gold superboom?

I Have Four Distinct Gold Recommendations

To Share With You …

First, is to invest a modest portion of your money in gold bullion and coins. This is the safest way to protect yourself from the monetary madness unfolding.

The second play you should consider is investing in an ETF that holds physical gold.

The third way to ride this gold boom is to invest in ETFs that hold baskets of gold miners. This gives you much greater upside potential without needing to pick the best miners.

So, let me tell you about two ETFs I like right now:

The first is the VanEck Vectors gold miners ETF GDX. It’s already up 90% since March and it’s outperforming gold by more than 6.7 to one. So, for every dollar you could have made in gold, this ETF delivered $6.70 cents.

The second is the VanEck Vectors junior gold miners ETF (GDXJ), which is up a massive 113% since March and outperforming gold by 8.4 to one. So, for each $1 gold investors have made, this ETF delivered gains of $8.40 cents.

Now, these three ways of profiting from the gold boom are all great. Each has the potential to deliver sizable returns over the coming months, but there is a much, much better strategy.

It’s …

My #1 Gold Investing Strategy,

THE Strategy That Lets You Go For Wild

Gold Profits In A World Gone Mad

It allows you to exploit the best built-in “leverage,” a special kind of leverage that requires NO debt, NO margin, NO open-ended risk. It allows you to make huge profits on even MINOR, seemingly insignificant increases in gold.

For example, not long ago …

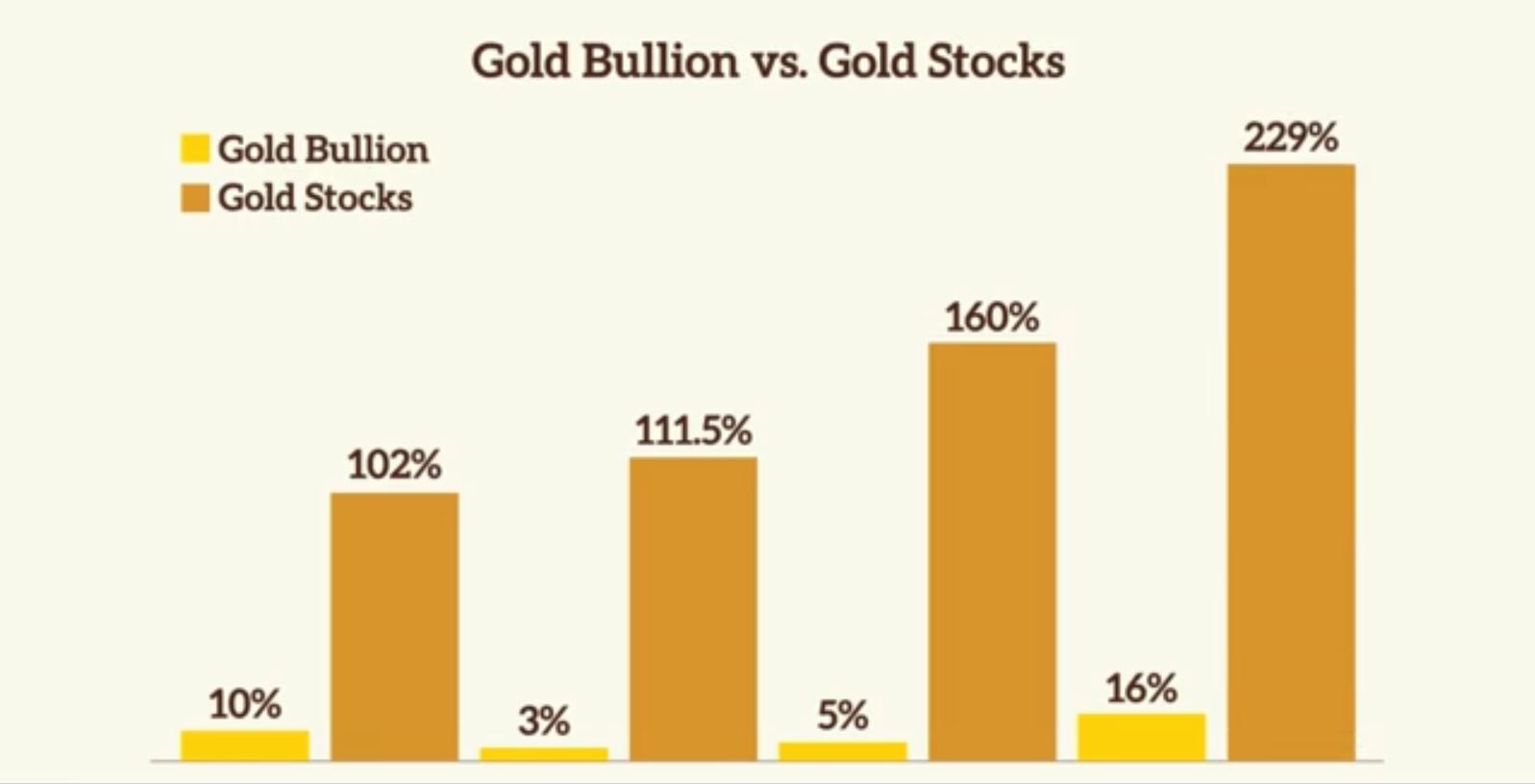

- When the price of gold bullion rose 10%, YOU could’ve banked a 102% gain,

- When gold rose 2.8%, YOU could’ve made a gain of 111.5%,

- When gold rose 5%, my strategy would’ve paid YOU 160%, and …

- When gold rose 16%, you could’ve earned 229% ...

Here’s how it works:

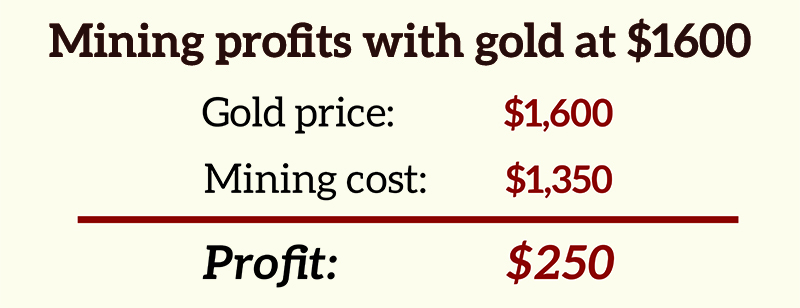

Let’s say an ounce of gold is $1,400 and it jumps to $1,600, just like it did recently.

That’s a 14% gain. Nothing to write home about.

Now, however, let’s say you own a gold mining company. And let’s say this company’s total cost to mine gold is an average of $1,350 per ounce. So, with gold selling at $1,400, their profit is $1,400 minus $1,350, or a meager $50 per ounce.

Then gold rises to $1,600. But despite the rising price of gold, it still costs this company the exact same $1,350 to mine each ounce.

Now, their profit is $1,600 minus $1,350, or $250 dollars per ounce of gold. You see? Suddenly, their profits have surged from $50 to $250.

In other words, with a meager 14% rise in the price of gold, they just multiplied their profit margins FIVE TIMES OVER!

To put this in perspective, imagine if Apple announced they’d magically QUINTUPLED their profits overnight. The stock would go through the roof!

And this built in “leverage” is WHY all it takes is a very MINOR gold-price increase to give you potential gold-stock gains of hundreds — even thousands — of percent in just weeks or months.

And, as gold prepares to surge to new, all-time highs on the back of the monetary madness that’s unfolding, you could be looking at similar, or even greater, profits from gold mining stocks.

However, you need to know WHICH gold stocks to invest in and WHEN to buy and sell them. Fortunately, this is a question I’ve devoted most of my life to. And, after countless years of research, after visiting dozens of gold mines, interviewing their CEOs, and supervising a dream team of data scientists, I cracked the code.

I developed a unique indicator that I apply to gold-stock charts. When it appears, it signals the stock is about to EXPLODE higher. And, if you learn to spot this secret pattern, you could get wildly rich from 2020’s gold boom.

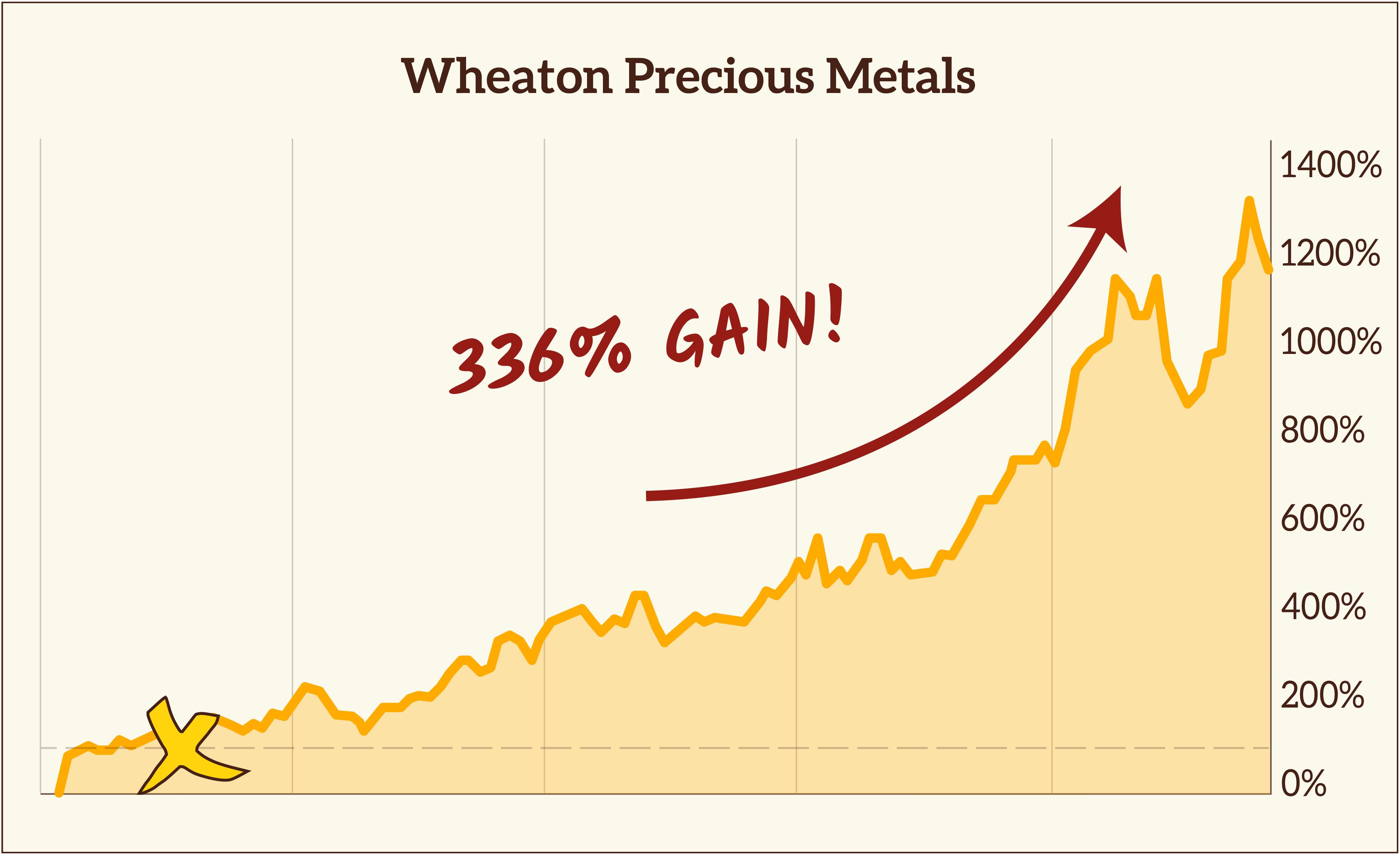

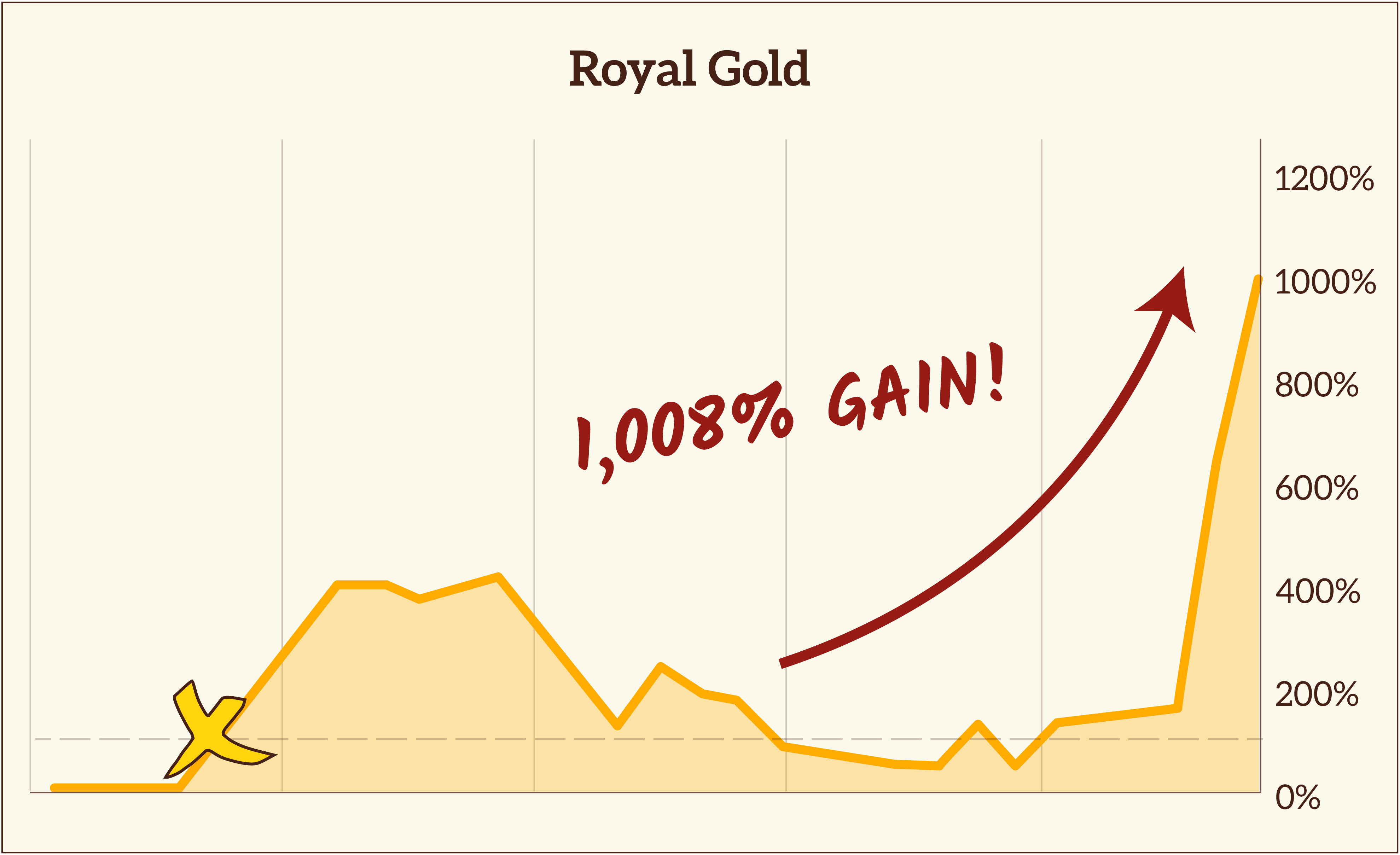

That’s because my indicator tells you EXACTLY when to buy an undervalued gold stock just BEFORE it soars. I call this pattern, the Gold X Indicator. And it is so powerful that it has predicted virtually EVERY gold-stock runup of 250% or more.

Case in point, here’s just a small selection of the Gold X trades my system recently identified:

- 336% on Wheaton Precious Metals.

- 370% on IAmGold.

- 639% on Barrick Gold.

- 1,008% on Royal Gold.

- 2,033%, ALSO on Royal Gold.

- 3,900% on Eldorado.

- Plus, another 4,727% on Barrick Gold.

Catching just one of these trades would be enough for many investors, but my Gold X Indicator identified dozens of profitable trades like these, and with today’s red-hot gold market, it’s set to find new trade after new trade.

In fact, I’d say this new gold boom is the best buying opportunity I’ve EVER seen.

Which is why I use my proprietary Gold-X Indicator. I leverage my years of experience in the gold markets. I go back to my rolodex of industry insiders. I find you the best, highest-profit gold stock opportunities. And I deliver trades with the potential for at least 300% profits.

And in the booming gold market that’s raging right now, I’ve already got several red-hot trades queued up and waiting for you.

I have so much more to tell you. And so many more urgent recommendations to give you.

So I have a very simple suggestion.

Click here, and I will take you to my web page.

I will show you my new reports that I’ve just written for you. I will give you the opportunity to download them right away when you join my service for just a few cents per day.

And I will give you a 100% money-back guarantee. So no matter what the future may bring and no matter what you ultimately decide, you can keep all my reports for free.

Thank you so much for watching.

Best wishes,

Sean