“Thank you, Mr. President!”

Trump Opens Door to Payments of Up To

$2.6 Trillion in “Victory Checks”

for Ordinary Americans.

Deadline Approaching: Why you must

“enroll” before November 15.

Dear Investor,

Thanks to President Trump, the Internal Revenue Code has greenlit Section 965 for only the second time this century.

This is an exceptionally rare — and potentially profitable — event.

As a result of this event, companies have begun cranking out up to $2.6 trillion in payments and transactions, which we call “victory checks” … opening the door for millions of everyday Americans to collect a surprise windfall.

If this situation plays out like I expect …

Total payments could amount to an average of $20,644 per American household.

Tear open YOUR envelope and find a “Victory Check” worth up to $20,000!

(Or even better, you can have the money deposited straight to your account.)

That’s what I expect for you, at a bare minimum.

But by following my precise instructions today, you could rake in FAR more.

You see, these “victory checks” won’t be sent out willy-nilly to every Tom, Dick and Harry.

- First, you have to know this opportunity exists (So you are already far ahead of most people just by reading this special bulletin today.) …

- Next, you have to get your name on the “distribution list.” (I’ll show you how in just a moment.)

- The last part is easy. You simply sit back and keep an eye out for the payment to hit your account!

Today I am going to show you how to do it.

I must admit. I was skeptical when I first heard about this unusual opportunity.

But after researching this exciting opportunity in detail, I’ve discovered it is the real deal.

Now I’m letting you in on the secret in time to get your name on the list before the next “victory checks” start mailing.

The best kept secret in Washington D.C.

An arcane, easily overlooked section of the new Tax Reform Package — signed into law by President Trump on December 22, 2017 …

Can lead directly to you finding the equivalent of a non-transferrable check in your mailbox. Or even better, it can be deposited straight into your account.

The amount could start at $20,664 and could range all the way up to $200,000 or more. All to spend as you please.

Whether you like it or not, the GOP Tax Plan will affect Americans across the board.

While mainstream media chooses to focus on the obvious changes, like dropping from seven tax brackets down to four … a downsizing of many deductions … and the establishment of a new family credit …

Only a few people have seen the privileged information hidden inside IRS Section 965.

It’s been years since the government last triggered it …

So naturally, plans for this giant payout program have gone relatively unnoticed. But here’s the thing …

Thank you, Mr. President

Almost no one is talking about the single biggest provision in this blockbuster bill.

It is a brand new “tax holiday” event for everyday Americans!

I’m not talking about a sales tax holiday here …

A property tax holiday …

Or even a personal income tax holiday …

Instead, a very unusual “tax break” is being rolled out. It totals $2.6 trillion. And a portion of this massive tax break could be yours.

You earned it by working hard your whole life.

Now you just have to reach out and grab it.

Sure, I know the government puts through sweetheart deals all the time …

Most benefit only the rich and powerful.

But I refuse to let them sneak this one through without giving you a chance to cash in.

In order to fast-track your participation, I have just published a special report on this urgent matter. It gives you step-by-step instructions on how you can participate in this massive $2.6 trillion payout.

The WORST thing you can do is let a check for $20,644 slip through your fingers.

It also shines a light on the ten biggest tax holiday opportunities out there.

You can access this special report — for free — by acting today.

But first …

Introducing the nation’s only “Equal Opportunity” Millionaire program

You’ll be shocked at how easy it is to collect a “victory check” in 2019.

But I need to warn you … there is no time to be complacent.

The next major round of “victory checks” will go out on November 15. So you’ll definitely want to add your name before that date.

Because if you enroll even one day later, you could miss out completely.

So who is eligible to receive a “victory check”?

Like I said, almost everyone.

Unlike so-called “cash-back programs” offered by the government, this one has:

- No age limits (you could be 18 or 97 years old to collect) …

- No income cutoffs (unemployed workers and multi-millionaires are eligible) …

- No political affiliation (Even though the 45th president is a Republican, he’s just as happy to pay out to diehard Democrats.)

Sounds intriguing, right?

You might be wondering why Congress is triggering this special IRS Section 965 provision — and why now?

Let’s take a peek at the underlying cause for this radical new tax holiday.

Here’s one world record the U.S.A. wishes it didn’t own

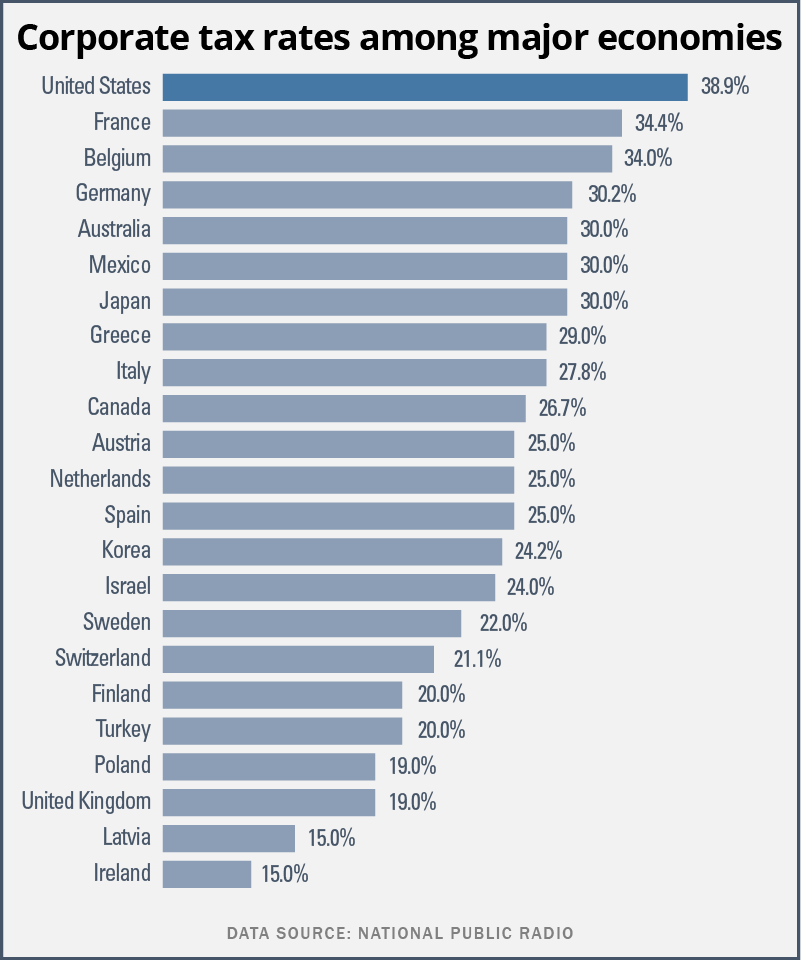

Until recently, the United States had the highest corporate tax rate in the developed world.

At 38.9%, it wasn’t even close.

America — the country that prides itself on having the hardest working, most innovative citizens in the world — was severely handicapping the very companies that make us the envy of the world.

Our corporate tax rate was so punitive, that businesses looked for every loophole they can find to reduce their overall burden.

Every day, for example, thousands of hired guns along K Street in Washington D.C. exert influence over policymakers to enrich their Fortune 500 clients.

But one loophole has been a constant source of underground profits … providing a greater benefit than all the others — until now.

It’s this loophole that President Trump officially closed the moment he signed IRS Section 965 into law.

You see, companies that do business and earn money overseas don’t have to pay U.S. taxes on it until they bring it back home.

And big multinational companies earn a ton of money overseas.

We’re talking billions and billions of dollars.

As of the latest estimates, the top five companies have stashed an estimated $500 billion overseas. Yes, half a trillion in cash that they refuse to bring home.

Can you blame them?

From their point of view, slapping a 38.9% tax penalty on this bundle of cash is like kissing $194 billion goodbye. Like so many of our tax dollars, it will get sucked into the black hole of Washington.

Why on earth would they do that — especially if someone is offering them a “Get Out of Jail Free” card?

That’s essentially what President Trump and the GOP are doing by enacting Internal Revenue Code Section 965.

President Trump knows the only way that money is ever coming back to America is if we stop punishing companies that sell American goods around the globe … and make it easy for them to bring this money home.

And that’s effectively what Trump has just done …

A rare trifecta —

Good for the government, for business, and for YOU

With his new tax plan, President Trump is giving America’s biggest, best and most profitable companies a “Use it or Lose it” incentive to act now …

A fixed time frame to bring this overseas cash back home.

The carrot?

A ridiculously low, one-time tax rate they’re unlikely to ever see again.

Instead of spanking them with a punitive 39% tax on all that cash … the new tax rules lower the rate to between 8% and 15.5%.

A tax rate that low acts like a magnet …

Watch for as much as $2.6 trillion to come home, leading to a terrific three-way win …

- Win #1: So far, Uncle Sam has deposited a cool $465 billion into its coffers from this program — providing needed infrastructure capital and a rare political win for both Trump and Congressional Republicans to brag about.

- Win #2: Multinational companies SAVE almost $3 for every $1 they would have paid in taxes (by paying only 8% to 15% instead of 38.9%) …

- Win #3: And you, along with fellow investors, get a realistic shot at divvying up more than $2,000,000,000,000 in newly available cash.

It’s this last point I want to drill down on now.

Get ready for …

A gift like investors have never seen before

Trump’s plan to bring back overseas profits is a major bonanza for shareholders.

Imagine YOUR surprise when your “Victory Check” lands in your account!

So, what will companies on the receiving end of this tax break do with the hundreds of billions of dollars they repatriate back to the United States?

A big chunk of this one-time tax holiday on overseas profits will almost certainly flow straight to shareholders — and to the bottom line of investors’ portfolios.

How do I know?

Well, a few of them have admitted as much.

Asked what he would do with repatriated cash should the Trump administration slash taxes on foreign profits, Cisco Systems Inc. CEO, Chuck Robbins, said:

“We have various scenarios in terms of what we’d do, but you can assume we’ll focus on the obvious ones — buybacks, dividends and M&A activities.”

Gary Dickerson, CEO of Applied Materials Inc., gave pretty much the same response.

And one Goldman Sachs analyst is on record as saying:

“We expect firms would allocate repatriated cash evenly between returning cash to shareholders (buybacks and dividends) and investing for growth (capex, R&D, and cash M&A).”

No surprise, really.

The stated mission of all Fortune 500 companies is to look after their shareholders.

That means keeping their share prices as high as possible.

When they see billions and billions of stranded cash suddenly appear on their balance sheet …

It’s pretty hard to pass up giving shareholders an unexpected holiday treat.

There’s an excellent chance your “victory check” will come in the form of a dividend payment or a sweet offer to buy back your shares …

In fact, it’s underway already.

U.S. dividends hit a new record high in the first quarter of 2018, according to the S&P Dow Jones Index. More than 940 companies raised their yield for shareholders, up 7.6 percent year over year.

They’re raising the dollar amount of dividends, too. CNBC reports that dividend payouts rose on average by 13.85 percent between January 1 — June 5, 2018. For example,

Juniper Networks upped their dividend rate by 80% …

Newmont Mining boosted their dividend by 87% …

Pioneer Natural Resources raised their yield by 300% …

And Anadarko Petroleum raised their dividend from $0.20 to $1.00 per share — a whopping 400% increase!

Here’s more good news for shareholders. Stock buybacks are also on the rise.

(As you may know, buybacks tend to raise a company’s stock price by reducing the number of shares on the market.)

In 2018, S&P 500 companies unveiled plans to buy back almost $1 trillion in stock in 2018.

That’s a record amount — nearly twice the figure from the year before.

During the first quarter alone, the largest 15 firms with overseas holdings gave about $55 billion of that money to their shareholders by purchasing company shares off the open market. I believe this buying frenzy is just getting started. Investors LOVE dividends and buybacks …

They can make you far richer no matter what happens to the stock price!

The great thing is sometimes this money is credited straight to your account … other times a check is mailed to your house.

But the chance to receive a one-time “special cash dividend” makes this an even more exciting opportunity.

You’ll potentially enjoy a “Special Cash Dividend” in 2019 … up to 10x BIGGER than regular dividends

If you follow my recommendation today …

And “enroll” by the November 15 deadline …

You will be eligible for a one-time cash payout — payable to all shareholders on record.

These “Special Cash Dividends,” as I like to call them, can amount to a yield of 10% … 20% … all the way up to 90% or more of the value of your shares, depending on the company.

This can add up to a significant amount of cash.

For example, I took a look at publicly traded stocks that have paid noteworthy dividends over the last ten years. The results range from total special cash dividends of $2.11 per share … all the way up to $105.85 PER SHARE.

In fact, one aerospace company I examined paid a special cash dividend in five out of six years since 2012. If you owned 1,000 shares of their stock, you’d have an extra $105,850 thanks to special dividends.

The first six weeks of 2019 has seen an explosion of special dividends. For example,

- Southern Copper (SCCO) authorized a $0.44 per share payment

- Great Southern Bancorp (GSBC) authorized a $0.75 per share payment

- CNA Financial (CNA) announced a $2.00 per share payment

- Park Electrochemical (PKE) announced a $4.25 per share payment

With such lucrative payouts on offer, you might be wondering …

“How can I accurately predict which companies will issue a “Special Cash Dividend” now?

And when will it be paid?”

Now, no one can predict the future with 100% certainty. But I have just compiled an in-depth summary of which ten companies are most likely to pay the biggest “Special Cash Dividends” now that President Trump has approved IRS Section 965.

This special report is called, “The Top 10 ‘Victory Check’ Opportunities Of 2019.”

And I’m ready to share it with you.

Inside, you’ll learn EVERYTHING you need to know to take advantage of this amazing opportunity, including:

- Which ten companies are MOST likely to issue big “Special Cash Dividends” to shareholders …

- When they are likely to issue them …

- And exactly how big these checks could be.

Having access to this special report allows you to act as soon as the companies begin issuing “victory checks.” That could be just days from now.

Let me tell you about one company you’ll find on page two of your free special report …

According to my estimates, it could pay out a staggering 96% on its current share price in a single day.

Think of it this way …

If you were to buy $5,000 of this stock just as it acts on IRS Section 965 …

You could receive a $4,800 “Special Cash Dividend” — as soon as the very next day.

Where else can you get nearly a 100% return on your money, practically overnight?

That’s extra money for you to enjoy. Free and clear, to spend as you like.

Some will say it’s impossible. But as I’ll explain in a moment, we have history on our side.

Mind you, this is just one example of the monumental “victory check” opportunities I’ve identified.

Today, I want you to have all TEN.

So … can I rush this valuable special report to your address now …

For free?

The single biggest profit opportunity

I’ve seen in my 25-year career

To get an idea of the money on the table over the next 90-180 days …

All you have to do is look back at what happened the last time a major “tax holiday” was authorized.

Back in 2004, a “tax holiday” was approved by the U.S. Congress.

Back then, times were tough. The economy was running on fumes. Folks were under pressure to put food on the table.

So George W. Bush’s administration implemented IRS Section 965 in a drastic attempt to spur American companies to create thousands of new American jobs, boost R&D, and upgrade their factory infrastructure.

He approved a “holiday” for profits held overseas with an extra-low tax rate of 5.25% … and 800 big companies took advantage of the sweetheart deal.

The holiday lured more than $300 billion back to the United States …

Lawmakers hoped the additional spending would create 500,000 jobs. Only the money didn’t go where initially planned.

According to Forbes …

“Almost all of it — about $299 billion — was used to increase shareholder dividends or buy back stock.”

Imagine, a near 1:1 ratio between tax holiday dollars … and likely shareholder benefits.

Only it wasn’t jobseekers who benefited. It was everyday investors!

A 2010 study by academics at Harvard University, the University of Chicago and the Massachusetts Institute of Technology came to a similar conclusion. They estimated that for every $1 that came back, there was an increase in shareholder payouts of between 60 and 92 cents.

Dell is a great example. They lobbied hard for the tax holiday.

They promised to use some of the money to build a new plant in Winston-Salem, N.C., and eventually brought back $4 billion from overseas. They spent $100 million (or about 2.5% of the funds) on a plant they admitted would have been built anyway.

You know what they did about 60 days later?

They used $2 billion for a massive share buyback!

A couple of billion dollars can do a lot for a stock trading at about $35 a share, right?

It can potentially put a ton of extra cash into your pocket. Practically overnight.

Fact is, either a dividend or stock buyback can do wonders for a stock’s price.

The secret is being able to identify WHO will pay out next … and timing it right.

Well, get ready for it to happen again.

And it’s way BIGGER this time.

This time, there is the potential for almost ten times more cash to come back compared to 2004.

Remember, companies have been hoarding cash overseas for many years since the last tax holiday.

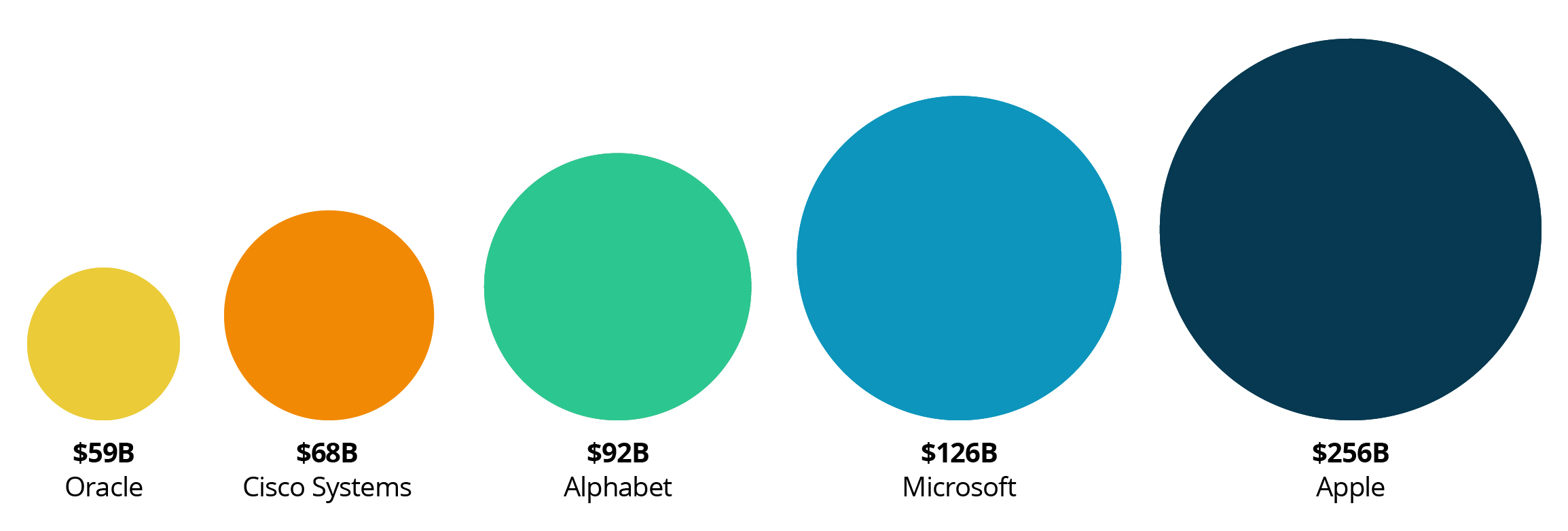

Apple alone holds $257 billion overseas, or 93 percent of its entire cash hoard, as of the end of 2016. Other tech giants with lots of money stashed overseas include:

- Microsoft with $126 billion

- Alphabet with $92 billion

- Cisco with $68 billion

- Oracle with $59 billion.

Add up all the untaxed profits and you get a staggering sum … $2.6 trillion.

If my instincts are right, nearly every single tax holiday dollar will end up in the pockets of lucky investors.

Either as a regular dividend … a stock buyback … or in the form of a “Special Cash Dividend”.

The Economist had this to say:

“The government may as well write shareholders a check.”

I agree. A well-deserved “Victory Check” for ordinary Americans!

$2,600,000,000,000 is a gargantuan sum of money …

A whole lot of people are going to benefit …

In my 23 years as a “boots-on-the-ground” analyst, explorer and editor, I’ve never come across a jackpot this big.

So please …

If you’re interested in getting a slice of this gigantic payout, you’ll need to move fast.

You have until November 15th to “enroll.” No later.

Your chance to make a bundle from

the biggest tax holiday of all time

Kudos to President Trump and the GOP for triggering IRS Section 965 for only the second time this century.

This is your opportunity to make a bundle from the biggest tax holiday of all time.

For once, everyday folks get an opportunity to share in a massive $2.6 trillion prize.

But you must get your name on the “distribution list” by November 15th — before companies announce their new dividends and stock buybacks.

If you miss it, it could be too late.

I suggest you reach out and position yourself to grab a “victory check” (potentially worth $20,644 or more) that is rightfully yours.

Don’t be one of the unlucky ones who looks back six months from now and says, “Why didn’t I try to claim my fair share while I had the chance?”

So now it’s up to you …

Will you enroll for the biggest tax holiday event in your lifetime …

Will your name be on one of the “victory checks” …

And how much will yours be written for?

Doing nothing is the worst thing you can do right now because …

This may be your last big opportunity

before the next crash

Soon, very soon, you could be nursing a financial hangover of epic proportions.

The recent market correction was a sign of things to come.

My research shows that a market top is in sight.

Let me remind you what happened just over ten years ago on October 12, 2007.

On that precise day, the S&P 500 hit a high-water mark of 1,562 … and started dropping.

Finally, on March 6, 2009, we hit a rock-bottom low of 683. We witnessed a menacing 56.3% drop in stock market valuations in less than 18 months. And even then it took 3 long years for the S&P to get back to 1,500.

It could happen again.

You’ve heard about a few of the trouble signs …

Gargantuan federal debt … political and economic meltdown in Europe and Japan … the dollar and other major currencies about to fall off a cliff.

There are too many fault lines appearing to mention here, but my indicators show the turmoil could be even WORSE than what happened in 2008. We got a small taste of it with October’s quick 1,400 point market pullback.

Luckily, there’s still time to build up your nest egg …

Despite the trouble I see down the road, stocks will continue to rally in the short term.

But once they stop, it will be all downhill — and LIGHTING FAST.

I want to be sure you’re prepared for the inevitable market downturn. So I’d like you to see what I’m doing to grow my own portfolio and protect my family from what’s ahead.

I’ve written down everything I think you should do now in a brand new research report called “Beware the Ghost of 2008.”

Inside, you’ll find five easy steps you can take NOW to potentially make 300% … 400% … even 500% on your investments while the market is still going up … and pivot to take decisive action once the crest appears.

I’d like to send it to you for free when you click the button below.

The information inside is extremely time-sensitive.

You can’t buy this report on Amazon … Barnes and Noble … or anywhere else. But it’s yours free with this invitation today.

You’ll find it’s the perfect companion guide to your “Top Ten ‘Victory Check’ Opportunities Of 2019” special report.

So, you’ll be covered for the upside — and the inevitable downside.

Grab them both now. There’s no guarantee either will be around forever.

You get them both — for FREE — when you accept a risk-free subscription to my monthly bulletin on how to profit from the financial markets, Wealth Supercycle.

Finally, some straight talk on building

your permanent financial empire.

I’ve never been known for beating around the bush. And I’m not going to start now.

Here’s the deal …

Things move fast in the digital age, so I want to be in constant touch with you to make sure you take full advantage as these shifts take place in the markets. With my recommendations:

- I’ll get you in at the right target prices …

- I’ll tell you when to buy or sell for maximum profits …

- And I’ll provide trailing stops for your protection …

The only way I can do all this is through my monthly advisory, Wealth Supercycle.

Each issue of Wealth Supercycle contains a “model portfolio” that shows you exactly what to buy, what to hold, what to sell … and when.

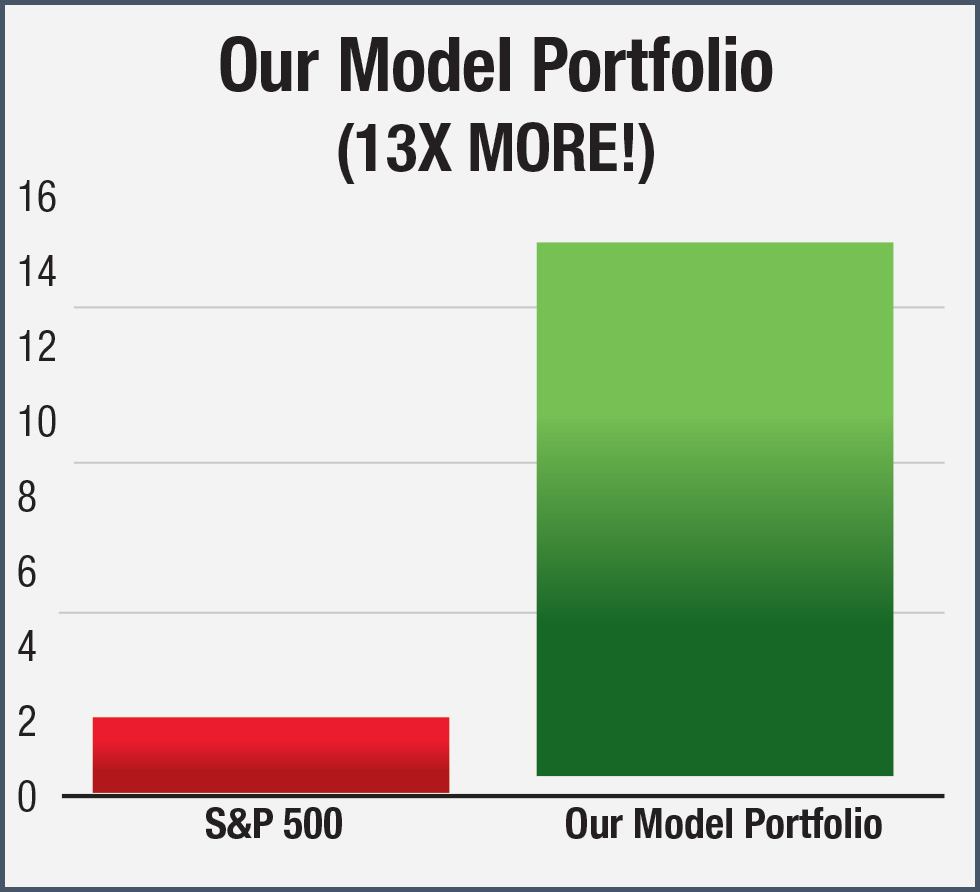

How are we doing? Glad you asked …

As you can see, our Model Portfolio is practically off the charts!

You’ll also get “Flash Alerts” whenever my sources say you need to take action quickly. These bulletins will arrive in your inbox whenever there’s a change in the market that calls for immediate action on your part.

That’s not all.

You also get access to our regular e-mail updates. This exclusive service is yours FREE — as an extra perk. It contains unbiased daily market commentary you won’t get from Wall Street. Inside, my team and I will provide our latest insights on the stock market, gold, energy, real estate and more.

One more thing …

You might be asking, “Does it really work that well?”

Well, consider this …

I get letters like this one in my inbox almost every day:

“This has been the best performance newsletter ever for me.” — Michael S., Houston, TX

“This has been the best performance newsletter ever for me.” — Michael S., Houston, TX

“I've read a lot of newsletters over the years, and never thought I would say this, but I'm up $24,000 in 4 months. Wow!” — Steven T. Riverside, IL

“I've read a lot of newsletters over the years, and never thought I would say this, but I'm up $24,000 in 4 months. Wow!” — Steven T. Riverside, IL

“ Informative and decisive.” — Tim U., Bay Village, OH

“ Informative and decisive.” — Tim U., Bay Village, OH

“This is an important part of my retirement "nest egg" and so far it is performing as you promised it would. Keep up the good work!” Norm G., British Columbia

“This is an important part of my retirement "nest egg" and so far it is performing as you promised it would. Keep up the good work!” Norm G., British Columbia

Our members would gladly pay the full $228 cost a year for this service.

In fact, some of them have told us they would pay ten times as much to remain a member in good standing.

That should boost your confidence.

But by acting today, you won’t pay even half as much. Not even one quarter of it!

If you click this link in the next ten minutes, I’ll not only give you a free copy of “The Top Ten ‘Victory Check’ Opportunities Of 2019”…

And a free copy of “Beware the Ghost Of 2008” …

I’ll also give you a one-year, risk-free trial subscription to Wealth Supercycle for just $39.

Yes, $39 … a discount of more than 82% off the regular price. That’s about 11 cents per day. Tiny, right? You might come across that much in your jacket pocket.

Why so low?

For two big reasons:

-

I’m on a mission to help people make as much money as possible now that Congress has signed IRS Section 965 into law. This is your chance to potentially earn a quick $20,644 (at the very least) … all the way up to $200,000 … to spend as you please.

(You’ll need your free special report to capitalize. It’s called, “The Top Ten ‘Victory Check’ Opportunities Of 2019”.)

-

Once you’re flush with cash, I’ll do everything in my power to protect you from the looming market top — and precipitous fall that will follow — that I see coming.

(That’s where your second free special report comes in, “Beware the Ghost Of 2008”.)

In both cases, we need to keep an open line of communication to ensure you have the ability to achieve maximum gains.

Latch onto the PROFIT ROCKETS …

and escape the COSTLY DUDS

That’s my goal with Wealth Supercycle.

It essentially lets you ride the crest to a level of wealth you never dreamed possible.

Starting with a potential welcome victory check of as much as $20,644 … and perhaps many multiples of that amount. Once you’re positioned there …

We’ll put specific actions in place to try to rescue you from the market carnage that lies ahead.

You essentially get the best of both worlds. And I promise it’s never been easier to start your profitable journey with us today.

Try it for 12 months without risking a penny!

(And get two more special reports FREE!)

You’ve made it this far, so I know you’re interested.

So, for today only, I’m willing to do two more things for you to get you over the line …

First, I’ll offer you a 100% money-back guarantee for 12 full months. You must be absolutely thrilled with the financial advice you receive over the next year, or you don’t pay a red cent.

You’ll get ALL of your money back, even if you ask for a full refund on the last day of your subscription. No questions asked.

How’s that for confidence!

Second, I’d like to send you TWO MORE SPECIAL REPORTS to help you take advantage of a couple of potentially lucrative profit-making opportunities.

FIRST, here’s your primer on how to tap HUGE profits in the natural resources sector, while reducing your risk at the same time.

I expect by following my advice today, you could be the recipient of one … two … perhaps even seven “victory checks” during 2019.

That’s great — but it’s not the only way to make big money.

I also want to share my other top investments for 2019 with you, starting with natural resources.

Right now, natural resources present some of the biggest profit opportunities out there!

When you measure natural resources in the real world — with inflation-adjusted dollars, you’ll see there’s massive upside opportunity for a quick reward.

In fact, just to reach the highs they made last time, when the U.S. dollar’s value was eroding rapidly …

- Gold will have to rise to at least $2,300.

- Aluminum will have to more than TRIPLE to $7,559 per ton.

- Tin will have to DOUBLE — to $39,595 per ton.

- Wheat will have to triple … corn will have to jump four-fold … and sugar will have to shoot up by TEN TIMES.

In your free special report called, the “The Windfall Of A Lifetime,” my team lays out the compelling market forces that nearly GUARANTEE a new natural resources boom. And exactly how you can get in and make a killing.

SECOND, put on your contrarian hat and get ready to make a boatload of money as the S&P 500 heads south.

The big dip isn’t here yet … but it’s coming.

The #1 thing you should do once the market makes a big move down is to clear your portfolio of the $1 trillion in stocks that sovereign wealth funds and central banks could unload during 2019. These have nowhere to go but down.

Next, I want you to load up on resilient bonds and a rock-solid bank account loaded with these safe funds.

If you want to go further … to turn this market and economic crisis into a massive wealth-building opportunity…

Here at Wealth Supercycle, we have a history of helping our subscribers do exactly that. In this free special report called, “Three Investments That Soar When Markets Crash” …

We’ll hand you a trio of investment ideas that tend to perform best in down markets. We give you the benefits and drawbacks of each … and explain how you can put these investments to work in your own portfolio.

A Phenomenal $544 value … Yours for just $39

Wealth Supercycle normally costs $228 for one full year.

But today I’m going to put $189 right back in your pocket … as my special gift to you.

Incredibly, you pay only $39 when you join today. That’s only 11 cents a day!

You’ll get immediate access to your “Top Ten ‘Victory Check’ Opportunities Of 2019” special report …

Plus, three more special reports that I’d like to send you as part of this package, at NO additional cost. (Each one carries a $79 value so you’re bagging a terrific bargain right off the bat.)

Remember, you’ll get access to all of these reports the minute you join.

And of course, you’ll also get a full year of Wealth Supercycle — delivered to your doorstep every month — showing how to cash in on the best financial opportunities of 2019.

Plus, your subscription to Wealth Supercycle

is fully guaranteed.

You don't even have to make your final decision now. Just join us and get your four free special reports right away. Then, take all the time you like — up to a full year — to make your final decision.

Even if you decide to cancel on the very last day before your membership expires, we will rush you a full refund; the entire $39. We'll even insist that you keep every issue of Wealth Supercycle, your copy of “The Top Ten ‘Victory Check’ Opportunities Of 2019” and everything else we've sent you in the meantime with our thanks for giving us a fair trial.

Don’t delay! Time is running out!

But, time is running out on your chance to cash in on the massive $2.6 trillion tax holiday.

President Trump kicked it all off by signing IRS Section 965 into law in late 2017 … and I expect the next round of Special Cash Dividend victory checks will mail by November 15, 2019.

Do you want to miss out on this extraordinary (and time-sensitive) opportunity?

I didn’t think so.

Please click here right now.

You’ll be sent to an order page where you can take as long as you need to decide if Wealth Supercycle is for you.

If so, you’ll get 12 issues of Wealth Supercycle …

Including my “Flash Alerts,” model portfolio, and regular e-mail updates.

Plus, your FREE COPY of “The Top Ten ‘Victory Check’ Opportunities Of 2019” … and three more special reports.

That’s a total of $544 worth of newsletters and special reports for just $39.

You’ll save $505!

Your satisfaction is guaranteed until the clock strikes midnight on the last day of your subscription.

You’ll have the opportunity to keep everything I’ve sent you and get ALL YOUR MONEY BACK with no questions asked should you choose that option.

But if you’re like thousands of our readers, I suspect you’ll prefer to stay for the long term.

Get up to 7 FREE Reports when You

Try Wealth Supercycle Risk-Free!

YES, ENROLL ME TODAY FOR A TRUMP “VICTORY CHECK” — PLUS EVERYTHING SHOWN ABOVE! ALL FOR ONLY $39 …

First things first … make sure you enroll for your share of the massive $2.6 trillion tax holiday

Like I said, this is the biggest opportunity I’ve witnessed in my 23-year career … you won’t want to miss it.

Whatever you do today, do yourself and your loved ones a big favor by claiming the “The Top Ten ‘Victory Check’ Opportunities Of 2019” special report I have reserved for you.

Inside you’ll find EVERYTHING you need to know about cashing in on IRS Section 965 now that President Trump has signed it into law.

Including:

- Exactly which companies I expect will pay out the biggest Special Cash Dividends in “victory checks.”

- When these payments should happen.

… And how BIG your check could be. (Of course, nowadays, the money is deposited straight to your account, which is even better.)

I truly believe this is the most lucrative action you can take today … all year … or even this DECADE.

That’s why I urge you to click the button below and join me as we aim to cash in on the biggest Tax Holiday event of our lifetime!

Sincerely,

Sean Brodrick

Editor

Wealth Supercycle