WARNING: The Coming

“Stock Market Tsunami”

Changes Everything!

IN THIS FREE REPORT:

- Should you get out now ... or go “all in”?

- Why the Dow Jones will hit 45,000 in a matter of months

- The Russian economist who predicted what’s happening in today’s stock market ... and was executed for being right!

- How you can “surf” the coming market tsunami to the top ...

- And get out before the “mother of all crashes” to follow

Dear Investor,

Wherever I go these days, people keep asking me the same question:

“Should I go ‘all in’ ... or get out now while the getting is good?”

It seems like nobody knows whether to make hay while the sun shines in this soaring stock market ...

Or take their money out now and stuff it under the mattress before the next crash comes.

And who can blame them?

This stock market is on a bull run unlike anything we’ve seen in history.

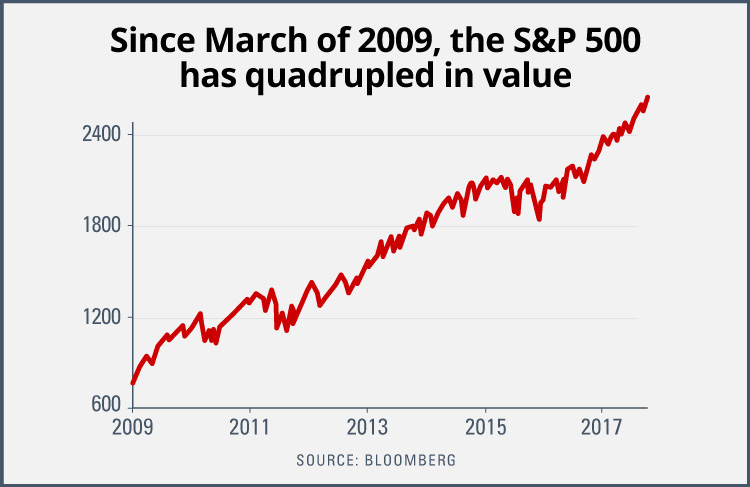

Since March of 2009, the S&P 500 has quadrupled in value.

In just twelve months, the Dow Jones set over 40—count ‘em, forty! — record-breaking closing highs.

At one point we saw twelve straight months with a positive return in the S&P — the first time that’s happened since 1935.

So how come nobody is popping champagne corks ... eating caviar ... and buying yachts?

Look around you these days and all you see is anxiety, fear, and worry.

Every investor I meet nowadays is as nervous as a long-tailed cat in a roomful of rocking chairs!

Why?

“What goes up must come down,” they say.

“Nothing this good can last forever.”

“Valuations are too high. Volatility is too low. Interest rates have nowhere go but up so the market has nowhere to go but down.”

Et cetera. Et cetera. Et cetera.

Sound familiar?

Take it from me, none of that stuff matters.

There are forces beneath the surface of this market that are far more powerful than anything you can see from watching the usual indicators.

That’s why I KNOW the answer to the question of whether you should go all in or get out now.

The answer is you’ve got to do BOTH.

You’ve got to go “all in” right now.

And get ready to get out fast later.

Because the rise in the stock market we’re seeing now is the first sign of a tidal wave that’s headed our way.

Over the next few months, this “stock market tsunami” is going to lift the Dow to 45,000.

Yes, you read that right. You will see the Dow reach 45,000 in a matter of months.

That’s the good news.

The bad news is that when this tsunami hits the shore, you’re going to see the mother of all crashes.

If you want to survive, you’ve got to make as much money as you can right now.

Then get out when the wave begins to crest over the top.

In the next few minutes, I’m going to show you exactly how to do that.

But first, let me introduce myself.

The man who changed my life forever

Hello, my name is Sean Brodrick.

Fifteen years ago, I met a man who changed my life forever.

His name was Larry Edelson.

Although Larry and I were both experienced market analysts and traders, Larry had an ability to see the future unlike anyone I’ve ever met before, or since.

In 1987, for example, he predicted the worst collapse in U.S. stock market history.

Everyone thought he was crazy because America was enjoying one of its longest economic booms of all time.

Folks on Wall Street laughed and called him “Chicken Little Larry.”

The Day Wall Street Stopped Laughing at Larry

But they stopped laughing on October 19, 1987, when the Dow lost 23% of its value in a single day.

Twenty years later, Larry was one of the few analysts who warned we were in a housing bubble.

He said the housing crisis would take the stock market and the entire U.S. economy down with it.

Of course, he turned out to be exactly right.

Then in March of 2009, he said the worst was over and it was time to buy stocks again.

Over the next seven years, the S&P rose by 252%.

Just like he said it would.

If the name Larry Edelson sounds familiar to you, it’s probably because you’ve seen him interviewed in the financial press many times.

The media always asked Larry how he could see what others couldn’t.

Journalists from the New York Times, CNBC, Forbes, and many others grilled him about what would happen next in the stock market.

I’ll never forget his sly smile when he made bold predictions that often flew in the face of what every other market analyst was saying.

Like the time he said the Dow Jones would soon cross 20,000 on its way to 45,000 by 2020.

I thought the reporter would spit out his coffee when he heard Larry say that!

But guess what? That’s exactly what’s happening right now.

One day I asked Larry

how he did it

One day, I asked Larry:

“How do you do it? How can you see around the corner? How do you know what’s going to happen next in the stock market before anyone else?”

Over the course of the next few minutes, I’m going to tell you exactly what Larry said to me.

But first I have to give you some sad news:

Larry Edelson passed away recently.

His death came as a shock to his friends, family, the global financial community, and Larry’s thousands of avid fans across the world. I lost a friend, and a great, personal mentor.

But typical of Larry, he knew what was coming ahead of time and he planned ahead for it.

As my professional mentor and personal friend of 15 years, Larry passed the torch to me to preserve his legacy.

He founded The Edelson Institute, where I am now the senior editor.

He also gave me the keys, if you will, to the amazing artificial intelligence software he called “The E-Wave Model.”

And yes, he gave me the answer to that question I asked him many years ago:

“How do you know what the stock market is going to do before anyone else?”

Here’s Larry’s Secret for Seeing What’s

Coming Next

Ever since Larry was a student at Columbia University, he’d been fascinated by the cycles and patterns that occur over and over again in human economies.

Investors tend to make the same mistakes over and over again.

Over the years, Larry realized that whether you’re selling an uninhabited island for $24 worth of “wampum” …

Or whether you’re standing on the same island and trading billions of dollars worth of “CDO’s” …

Human beings tend to make the same mistakes, misjudgments, and misunderstandings again and again.

And they do so in predictable patterns that often resemble “waves.”

That’s an important insight. A dangerous insight.

So dangerous, in fact, that the man who first made this discovery was executed by his own government.

The Most Dangerous Man in the Soviet Union

His name was Nikolai Kondratieff. And he wrote a book called “The Long Waves in Economic Life.”

Stalin thought Nikolai Kondratieff was the most dangerous man in the Soviet Union. Why? Because he alone understood how economies really work.

The book — really just a pamphlet — was only 23 pages long. You could read it in less than an hour.

But it contained an idea so revolutionary. So incendiary. So threatening to the Soviet Union that he was sentenced to ten years of hard labor.

But the Soviet bosses didn’t want to take any chances. On September 17, 1938, Nikolai Kondratieff was shot by a firing squad.

Why?

Because he predicted communism would fail and be replaced by capitalism.

It wasn’t an opinion, said Kondratieff, it was a certainty.

Because human economies move in waves.

When you stop and think about it, that should come as no surprise.

Science has taught us, after all, that everything in the universe moves in waves. Sound moves in waves. Light moves in waves. Electromagnetic waves are what let us listen to music on the radio and watch shows on television.

Is it any wonder human economies move in the same way?

Economic “Waves” Predict What the

Stock Market Will Do Next

Kondratieff proved that economies act just like waves in the physical world. Like radio waves, they have phases, amplitudes, and frequencies.

What’s more, economic waves come in cycles that make changes in the economy easy to predict.

As easy as the phases of the moon. The rise and fall of the tides. The changing of the seasons.

What Kondratieff called “The Long Wave” — which was later named “The K‑Wave” in his honor — shows the changing cycles of private and public influence in the economy.

The Roaring Twenties

During the private cycle, free enterprise leads to increasing growth and prosperity.

Think of the “Roaring Twenties,” for example.

Eventually, the wave reaches a crest and begins to collapse in on itself.

This collapse is triggered by a stock market crash, a housing bust, or a run on the banks.

Think of the 1930s.

The K‑Wave crashed with the Great Depression.

At this point, the economic wave enters a phase of public influence.

The government intervenes in the economy by printing more money. Manipulating interest rates. Increasing government jobs, welfare, and handouts.

For a while, everything seems to work fine. But this phase, too, leads to a crash. Because even governments must obey the laws of economics.

And the most basic law is this:

You Can’t Keep Spending Money You Don’t Have!

This is how Kondratieff knew that communism in the Soviet Union would be replaced by capitalism.

He predicted it in 1926. Sixty-one years before it happened.

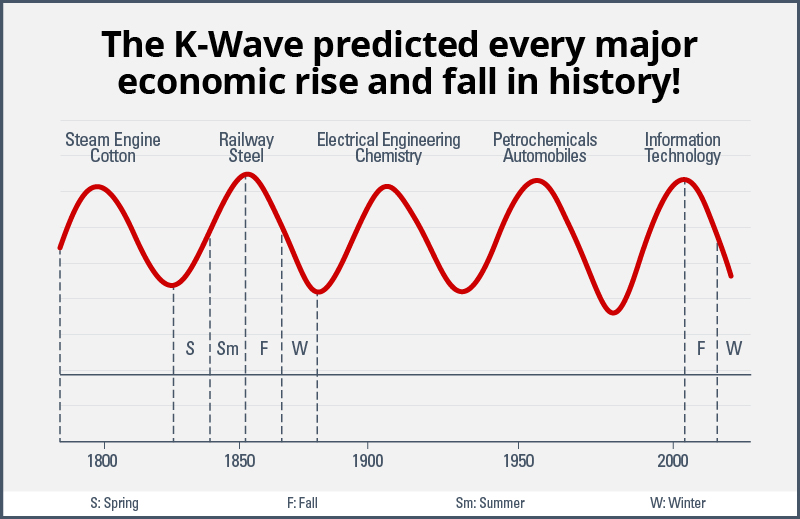

According to Kondratieff, the K‑Wave has a frequency of 47 to 64 years. And if you look back through history, you’ll see how accurate the K‑Wave is:

The K‑Wave predicted every major economic rise and fall in history.

From crest to crest, you can see the dawn of the industrial revolution. The golden age of railroads and steel. The onset of electrical and chemical engineering. The age of the automobile and oil. And, most recently, the information age which peaked with the rise of Internet stocks in 2000.

But you can also see the troughs of those waves:

The panic of 1819. The “Long Depression” of 1873. The “Great Depression” that began in 1929. The stock market crash of 1973, when the market lost 46% of its value, ushering in a long period of “stagflation.”

Where Are We Now?

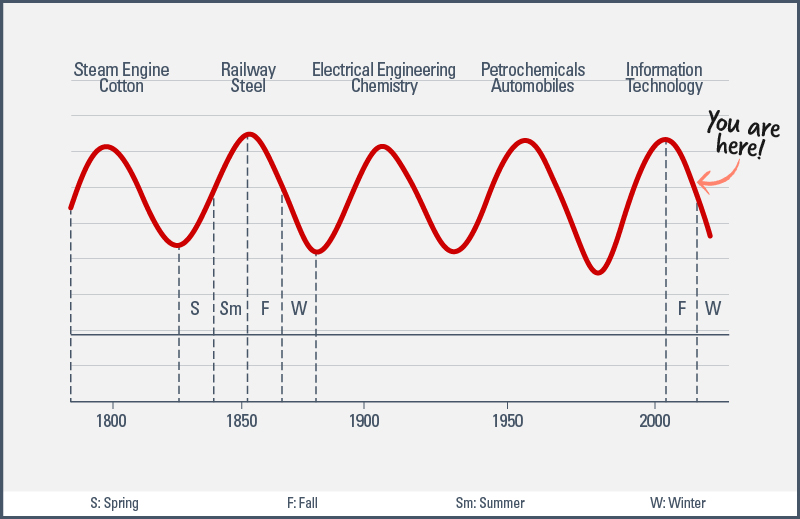

You are here.

If the K‑Wave is correct, most economies of the world will soon enter a period of deep recession, even depression.

Which could last as long as 23 years and include seismic shifts in the fabric of society.

Of course, you could write this off as the hare-brained theory of one mad Russian scientist.

But Nikolai Kondratieff was not alone.

Over the years, other economists have confirmed his theories.

They’ve come up with even more accurate ways to predict major shifts in the economy.

Kondratieff Was Not Alone

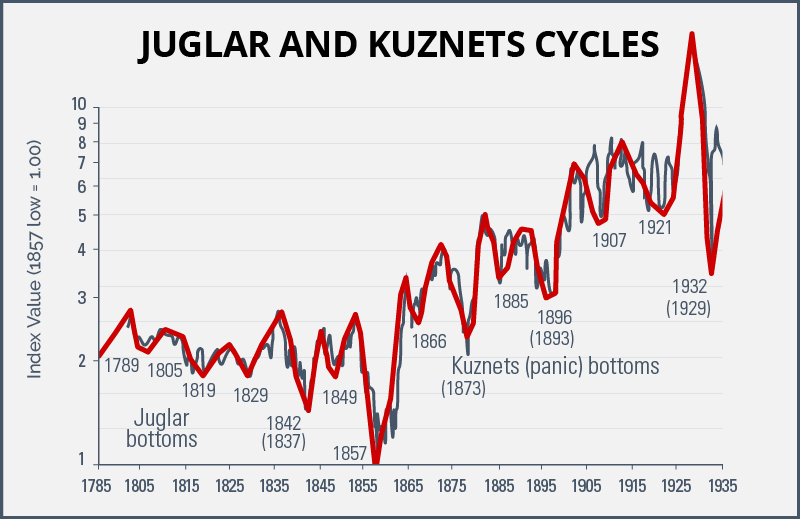

The 18-year investment cycle described by Simon Kuznets:

Predicts "panic bottoms" in the market.

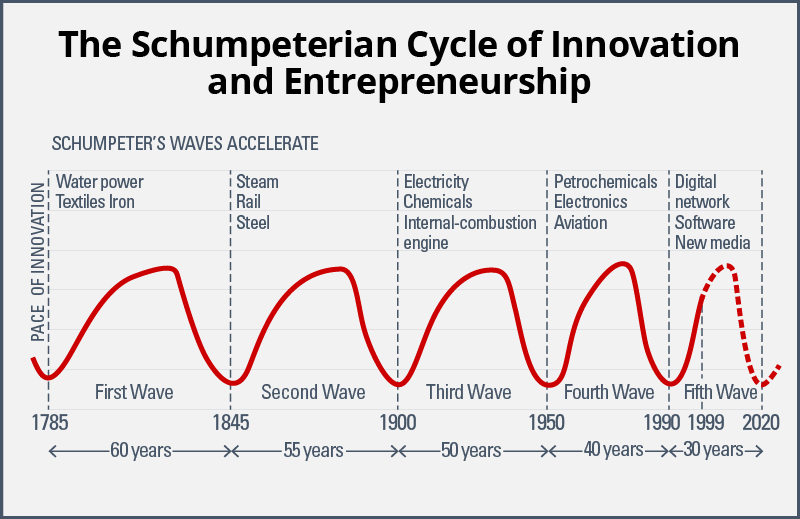

The 50-year “Cycle of Innovation” developed by Joseph Schumpeter:

Predicts periods of economic and political upheaval.

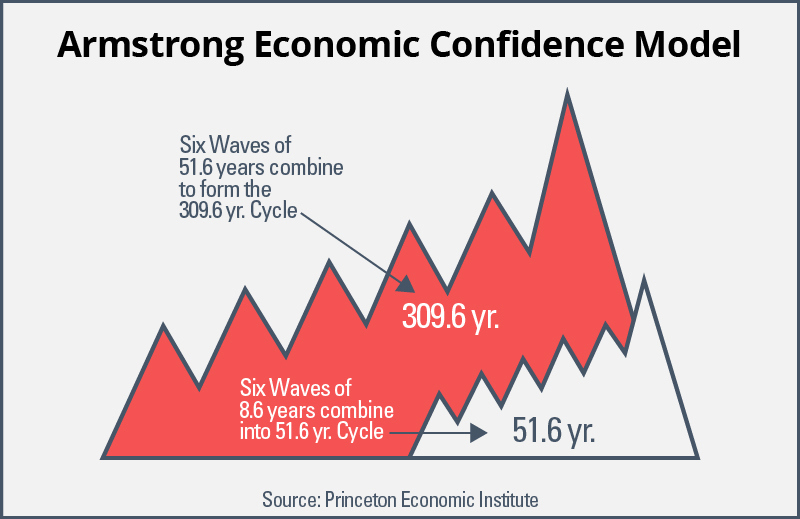

The 8.6-year “Economic Confidence Model” of Martin Armstrong:

He was recently profiled in The New Yorker magazine. The Model predicts panics every 8.6 years, or 3,141 days.

Armstrong’s cycle predicts that a major financial panic takes place every 8.6 years, or 3,141 days.

If the number 3,141 looks familiar to you, by the way, put a decimal point where the comma is and you’ll recognize it as “pi.”

Which you may recall from your high-school geometry is the number that determines the diameter of a circle.

If history repeats itself in cycles, you may wonder what was happening 3,141 days ago.

Answer?

We were in the middle of the debt crisis and Great Recession of 2008-2009.

But that’s not the scary part.

What’s really scary is that ALL of these cycles are now pointing in the same direction.

“The Size of the Coming K‑Wave Could Be Enormous”

One of Kondratieff’s disciples, Joseph Schumpeter, wrote:

If the shorter cycles come into phase with each other — and if they, in turn, join with the K‑Wave — the “amplitude” of the resulting wave would be enormous.

It would result in an economic catastrophe of epic proportions. In other words, it would be a TIDAL WAVE of economic change.

The last time all these cycles converged was during the Great Depression.

And now it’s happening again.

Economic Tidal Waves Act Just like Tsunamis

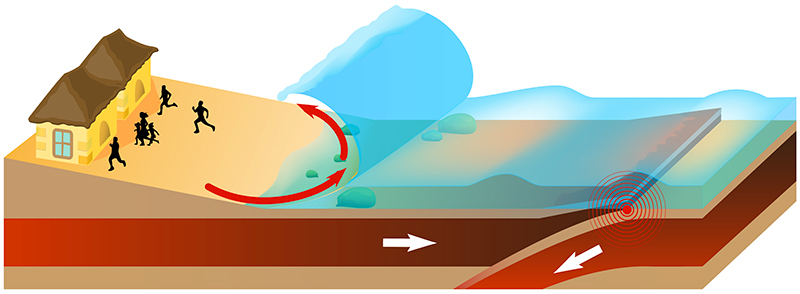

According to M.I.T. research, tidal waves in the economy work a lot like those in nature.

Deep beneath the ocean floor, two tectonic plates rub against each other to create a fissure or fault line.

As the pressure builds up over the centuries, a rupture occurs.

When two tectonic plates rupture underwater, a tsunami occurs.

It’s an earthquake. But it’s happening underwater. So nobody can see it or hear it. Until it’s too late.

The earthquake displaces massive amounts of water, which move outward in waves at speeds of up to 500 miles an hour.

When the first wave hits the shore, it causes utter devastation.

According to National Geographic, “The enormous energy of a tsunami can lift giant boulders, flip vehicles and demolish houses.”

But from a financial standpoint, the K‑Wave will be even worse:

- Millions could lose their homes.

- Millions more could see their lifesavings wiped out in an instant.

- Businesses, large and small, could close their doors.

- Even the bare necessities of life — food, water, clothing — might become scarce.

This financial devastation will radiate outward from its source at an alarming speed until every civilized human being on the planet is affected.

Where Is the “Fault Line” in the Global Economy?

So where is the fault line in the global economy?

Where is the fissure that threatens to rupture and trigger this economic tsunami?

The answer should come as no surprise to you.

You see it in the headlines when you open the newspaper every morning.

You hear it on TV every night when you turn on the news.

It is, after all, where most of the world’s worst human disasters have taken place over the last 2,000 years.

Of course, I’m talking about Europe.

Ever since the European Union was formed in 1979, the entire continent has been drowning in a sea of debt.

Europeans Are Running up a Tab That Soon Will Come Due!

For more than 40 years, Europeans have been living like kings and working like couch potatoes.

Many Europeans have been living like kings and working like couch potatoes.

As they sip wine and nibble on cheese in their cafés …

Enjoying their 35-hour work week mandatory month-long vacations, and free health care …

They’ve been running up a tab that boggles the mind.

Of the 28 countries in the European Union, 19 are deep in debt …

Despite repeated efforts to bail them out.

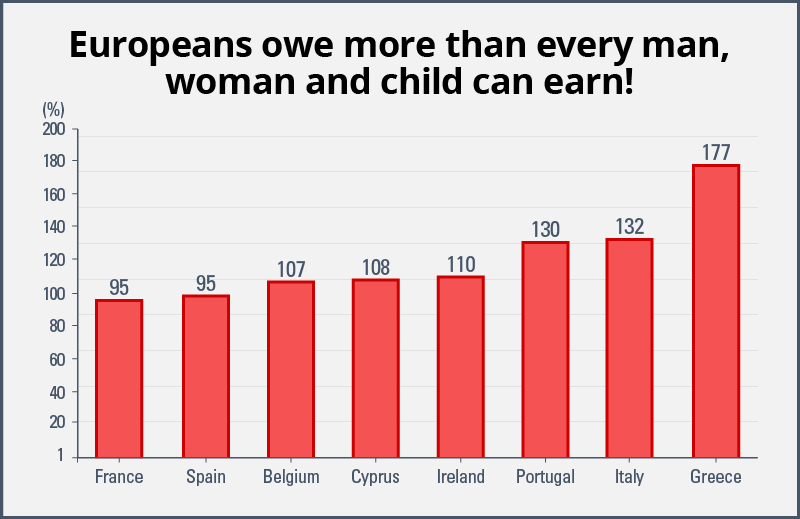

Europeans owe more than every man, woman and child can earn!

The people of Spain, for example, would have to fork over ALL of their annual income in taxes just for the government to break even.

But many countries actually owe MORE than their people and businesses can produce each year (GDP).

Cyprus owes 8% more than its GDP … Portugal owes 30% more … Italy 32% more.

Greece still takes the cake with 79% more money in debt than every man, woman and child in Greece can earn.

The Judgment Day Is Coming

Some “economists” don’t read history.

Of course, some economists say it doesn’t matter. They say you can just keep printing more money forever.

But history has shown this isn’t true.

Ever since Roman emperors began debasing their coins, we’ve known there’s always a price to pay.

There’s always a judgment day.

For Europe, the judgment day is here.

Europe Is Starting to “Crack”

The tectonic plates which have held the EU together for 40 years are starting to show cracks and fissures.

Hordes of refugees have amassed in camps at Europe’s border, threatening to climb over the fences.

They want their share of the free stuff, too

Tens of thousands of young male refugees have broken through to Northern Europe.

Unable to speak the language or find jobs, they hang out on street corners, some harassing European women and throwing rocks and bottles at men.

The refugee crisis in Europe is a fuse that could cause the entire continent to explode.

And terrorism is also on the rise.

In Paris, terrorists killed 130 innocent people and injured 368 more in November of 2015.

In March of 2016, terrorists killed another 31 people in Brussels, the capital of the European Union.

Then, the attacks became more frequent: Berlin, December 2016. Westminster, March 2017. Stockholm, April 2017. Manchester, May 2017. London, June 2017. Barcelona, August 2017.

Brexit Is Straw the Breaks the Camel’s Back

The majority of British citizens are sick of the EU. Many of their leaders now realize it was a big mistake from the get-go. So they voted to get the heck out.

Other nations, such as Hungary and Poland, wish they’d never joined the EU in the first place.

According to the New York Times, “the EU could dissipate faster than even its detractors could’ve dreamed.”

Are Hitler and Mussolini Ready for Their Big Comeback?

Meanwhile countries like France and Germany have watched the rise of politicians who promise to preserve the purity of their populations.

Sound familiar?

Watching the news out of Europe nowadays is like watching a black-and-white newsreel from the 1930s.

Beware the return of nationalist parties in Europe. No mustaches this time!

Like Germany in the 1930s, the highlight of that newsreel could be the collapse of the European currency.

Back then, German marks were more useful in the fireplace as kindling than at the grocery store to buy food.

Could it happen again? In fact, it’s already happening.

And according to the K‑Wave, it’s happening right on schedule.

European Banks Steal Money from

Their Own Customers!

In some European countries, interest rates have now turned negative. Which means you now have to PAY the bank to hold your money.

At least the money is safe, you might think. But it’s not.

Because governments in Europe are so broke they can’t keep their greedy hands off it.

In Cyprus, for example, the government reached into the bank accounts of anyone who had more than 100,000 euros on deposit …

And took 40% of it!

They didn’t even have the courtesy to leave a thank-you note.

It’s called a “bail-in.” Because European governments no longer have enough money to bail banks out.

Watch Out for the Collapse of the Euro!

Meanwhile, the euro continues to drop in value.

At its peak in 2007, one euro was worth $1.59. As of October of 2017, it was worth just $1.17. That’s a drop of 26%.

When it becomes worth less than a dollar, the euro could go into free fall.

My prediction?

The EU will break apart.

And when it does, the euro will collapse.

This is the “economic earthquake” that will send shockwaves throughout the global economy.

And the first place the tsunami will hit is Japan.

Here’s Why Japan Will Be the Next to Fall

Why Japan?

Because after the United States and China, Europe is Japan’s biggest trading partner.

When Japan sends cars, cameras, and computers to Europe, they expect to get paid for them.

If they don’t get paid — or if they get paid in devalued euros — the fault lines in Japan’s own economy will crack wide open.

Because even though Japan seems like a rich country, it’s economy is actually a house of cards waiting to fall down.

For two reasons:

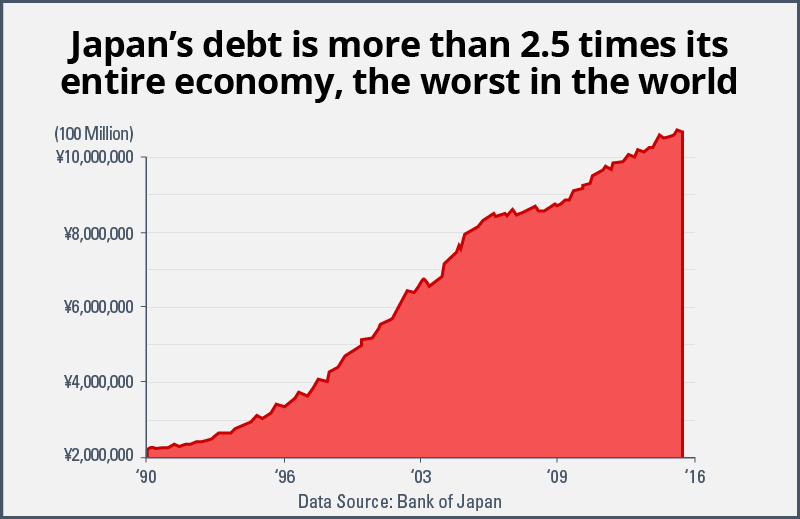

First, because the national debt in Japan is even WORSE than any country in Europe, including Greece.

Japan has the biggest government debt pile-up in the world — more than one quadrillion yen.

Japan’s debt is more than 2.5 times its entire economy, the worst in the world.

That’s more than two and a half times the entire Japanese economy.

Which makes the Greeks look downright frugal by comparison.

What’s more, the Japanese keep adding to their debt at a rate of 97 trillion yen per year.

How the Japanese Keep Their “Ponzi Scheme” Going

So why haven’t you seen riots in the streets of Tokyo like you did in Athens?

Because the Japanese still have a strong manufacturing base and a healthy trade balance.

As long as Europe keeps buying Hondas and Sony’s, the Japanese can keep their Ponzi scheme going.

When the euro falls, however, it will take the yen with it.

And the Japanese economy — the third largest in the world — will come tumbling down.

Japan’s Worst Problem — Deflation!

But the deficit isn’t the worst of Japan’s problems.

The bigger problem is that the Japanese people aren’t stupid.

They know their debt is not sustainable. They know their pension plans and social security checks are at risk.

So they’ve been hording money at an alarming rate and refusing to spend it.

As a result, many consumer prices dropped like a rock.

When the Japanese consumer knows the price of a car will be LOWER next year than it is today, what does he do?

He saves his money and waits until next year, of course.

Nowadays there’s only ONE product in Japan that’s selling like hotcakes …

The typical Japanese consumer would rather save his money than spend it. And who can blame him?

Home safes!

This kind of deflationary cycle is what can turn a recession into a depression.

The Japanese have suffered four recessions in a row since 2008. For all intents and purposes, Japan has been in a depression for many years.

Which makes it even LESS likely they’ll ever be able to get out of debt.

The bottom line?

Just like the walls of traditional homes, the Japanese economy is made out of paper.

When the K‑Wave hits Tokyo, the result will be devastation.

Welcome to the Only Country in Worse Shape Than Japan!

But there’s one country in the world that’s in even worse shape than Japan. Even worse than the European Union. Even worse than Greece.

Can you guess where it is?

Home sweet home!

The United States will be the last place the tsunami hits. But because it’s the world’s biggest economy, it will suffer the most.

America also has the world’s worst debt, although politicians don’t like to talk about it. They’ll tell you it’s “only” 20 trillion dollars.

But when you add all of the money our government owes to veterans …

Baby Boomer retirees …

Medicare and Medicaid recipients …

All the things Washington calls “unfunded liabilities” …

Suddenly our debt looks more like 127 trillion dollars.

Which would make it worse than Greece. Worse than Japan. Worse than any other country in the world.

Every Baby Born Owes Uncle Sam $1,100,000!

Soon, every baby born in the United States will get a slap on the butt from the doctor …

And a bill from Uncle Sam for 1.1 million dollars.

Again, some economists say this is nothing to worry about.

We’ve been running a deficit ever since the Revolutionary War, they say, and we’re still here. It’s no different than carrying a long mortgage.

Here’s what happens when you can’t pay your debts.

But when you can’t afford to make payments on your mortgage, that’s when they kick you out on the street.

Which is exactly what will happen to the United States in a few short years.

Before long, payments on the national debt will become the third largest item in the federal budget.

What can the Fed do to get us out of this mess?

There Are Only Three Things the Fed Can Do About It:

They’ve only got three big guns in their arsenal, and they’ve already fired all three of them with no impact.

They tried lowering interest rates.

Since 2007, the Fed Funds rate has dropped from 5.5% to just 0.26%. That’s a 95% reduction, but it didn’t help.

Big gun number one? Dud!

They tried pumping cash into the banking system in exchange for bonds and securities.

But in 2007, the Fed’s balance sheet was just $890 billion.

Now it’s $4.5 trillion and they’ve got nothing to show for it but a pile of their own lousy bonds.

Big gun number two? Misfire!

Finally, they tried to stimulate inflation.

But recently, the CPI grew by only 0.7% and producer prices actually fell by one percent — ushering in a new era of deflation.

That’s something we haven’t seen in the United States since … you guessed it, the 1930s.

Speaking of deflation, I was on an airplane not long ago and I sat next to a dairy farmer.

“Keep your hands to yourself, farmer!”

He said milk prices have fallen so low he’s now milking his cows three times a day just to break even.

I said, “I didn’t know you could milk a cow three times a day.”

“You can milk them four times a day,” he said. “But when am I supposed to sleep? And if I produce that much milk, the prices will go down even more.”

It’s a classic deflationary spiral — the first sign of a coming depression.

Big gun number three? BACKFIRE!

Frankly, there’s only one kind of ammunition the government has left to fight this sovereign debt crisis:

Bullets!

And don’t think for a moment they won’t use them.

Here’s How the Economic Crisis Will Unravel

The crisis will start in the global bond markets as investors start dumping U.S. Treasury bonds at any price.

Washington will respond by raising interest rates.

But no matter how high the rates go, investors will avoid U.S. bonds like a five-day-old fish.

As interest rates rise, America’s retirees will watch the bond prices in their portfolios take a nosedive.

The value of investments that millions of retirees depend on for income — including private pensions and “guaranteed” annuities — will vanish.

With no reserves on hand and nobody left to lend it money, the government will have no choice but to start laying off its 2.7 million federal employees.

- Next they’ll delay sending out Social Security checks.

- No more money for Medicare and Medicaid.

- No more food stamps. Welfare checks. Or disability payments for veterans.

- Banks and businesses will shut their doors.

- There will be no cash left in the ATM machines …

- No gas at the service stations …

- No food on the grocery shelves.

That’s when the American people will take to the streets. Some in peaceful protest, yes. But millions more will take to the streets in hunger, anger and fear.

When You Dial 911, You’ll Get a Busy Signal

When this happens, don’t count on the government to help you! You can dial 911 if you want, but you’ll just get a busy signal.

Because the police, the National Guard and the army will be patrolling the streets in tanks warning people to stay inside or risk getting shot.

The government will not be your friend at this point.

The government will NOT be your friend at this point. It will be your mortal enemy. Because there’s nothing more dangerous than a government fighting for its own survival.

Like a wounded animal, it will do whatever it can to stay in power. Even if it means taking away your freedom and stealing your money.

So how can you protect yourself?

Time to Pack Your “Bug-Out Bag” and Run?

Or Would You Rather Get Rich?

Well, some people have built a little cabin in the woods. They’ve stocked it with food, guns, and ammunition. They call it a “bolt hole.”

You know what? It’s not such a bad idea! But it’s not for everyone.

I’ve got a better way to protect myself. And you do, too.

The answer is to get rich. Rich enough to weather the storm and keep your assets out of danger.

The best defense, in other words, is a good offense. And guess what?

The K‑Wave itself will give you the perfect way to do that.

How?

Here’s How to Surf the “K‑Wave” Safely to Shore!

By “surfing” the K‑Wave safely into shore.

Because after Europe and Japan collapse, the K‑Wave will reach a “crest” before it hits the United States.

Like any wave, the K‑Wave will reach a crest before it crashes.

That crest is called “flight capital.”

What is flight capital?

Let me explain.

You see, investment capital always flows in one direction: It flows AWAY from danger and TOWARDS safety and growth.

As Europe and Japan collapse, rich people in those countries will look for somewhere to put their money where it will be safe and have a chance to grow.

What Would You Do if You Were in “Pierre’s” Shoes?

Suppose, for example, your name is Pierre Dubois and you live in Paris.

For 30 years you’ve owned a restaurant on the Left Bank and now you have 500,000 euros socked away for your retirement.

But the French government has been talking about negative interest rates to stimulate their failing economy.

Which means that for every year you keep your money “safely” in the bank at negative 0.05%, you’ll lose 2,500 euros!

You’ve thought about smuggling the cash out of the country.

But the French police now have “cash-sniffing” dogs at the borders to stop you from doing that.

These dogs don’t sniff out drugs, they sniff out cash!

What you really need is someplace to invest your money. Someplace safe and secure. Someplace where it will grow enough to offset your high French taxes.

But where?

To answer that question, let me take you back in history …

Here’s What Happened the Last Time the K‑Wave Hit:

Let’s go back to the last time the K‑Wave hit the global economy with the kind of force that’s now on its way.

I’m talking about 1932 — the depth of the Great Depression.

This is the great untold story of the Depression in America, the part that’s never taught in schools.

Everybody knows about the crash of 1929 and the Great Depression. Investors jumping out of the windows on Wall Street. The soup lines. The Dust Bowl.

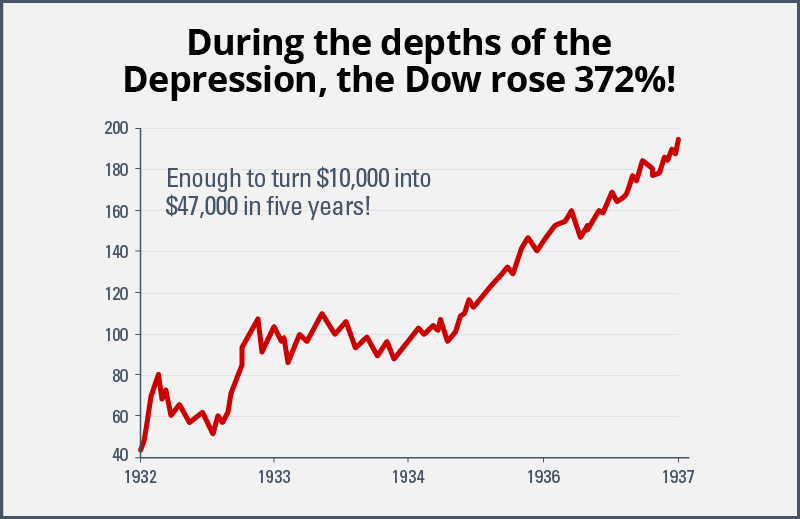

But nobody remembers the period between 1932 and 1937 was one of the greatest bull markets in history.

During this time the Dow Jones Industrial Average rose by 372%!

During the depths of the Depression, the Dow rose 372%! Enough to turn $10,000 into $47,200 in five years!

That’s enough to turn $10,000 into $47,200 in just five years.

That’s the same as $780,543 today.

What caused this incredible run-up on Wall Street?

Why were some people getting rich inside the New York Stock Exchange when so many people outside were standing in line for soup?

The answer?

Flight capital from Europe.

Rich Europeans Needed Someplace

Safe to Stash Their Cash

Because in 1932, Europe was in even worse shape than the United States. Germany was bankrupt. France, Italy, and even England were facing dire financial problems of their own.

Yet there were still lots of rich people in Europe. Many of them sitting on family fortunes dating back hundreds of years.

They needed to find a place to stash their money where it would be safe, secure, and have a chance to grow.

They found it in the American stock market.

Because America was still a lender nation back then, not a borrower. The U.S. Dollar was still backed by gold. Our great blue-chip companies like General Motors and General Electric were strong.

The American stock market, in other words, was the safest place in the world to sock away some money.

To Europeans who were scared of Hitler and Mussolini. Worried about their failing economies. Frightened by the looming threat of war …

Wall Street looked like the land of milk and honey.

So the Dow Jones soared. And some people got crazy rich as a result.

Here’s How J. Paul Getty Got Rich in the Depression

Take J. Paul Getty, for example. He became a billionaire at the height of the Great Depression. How?

To put it simply, Getty understood the secret of flight capital. He realized that when you have a struggling global economy, plus shaky governments throughout the world …

It triggers a TIDAL WAVE OF CAPITAL flowing out of government bonds and into stocks.

Which is exactly what happened.

The Dow Jones rallied from a low of 40.52 in July of 1932 to a high of 195.2 in March of 1937. That’s a gain of 372% during the worst depression in history!

By the time J. Paul Getty died, he was worth $19.6 billion in today’s dollars.

Now It’s Happening Again!

Flash forward 85 years — or two K‑Wave cycles — and you’re watching the same thing happen again.

The K‑Wave tsunami will wipe out the European Union.

Then the tidal wave will crash into Japan within a year.

At that point, millions of wealthy Europeans and Japanese will be searching the globe for someplace safe to stash their money.

Where will it go?

There’s Only One Place the Money Can Go:

The so-called BRIC countries — Brazil, Russia, India and China — offer a chance of growth … but no safety or security.

Would you trust your lifesavings to Vladimir Putin or the dictators in Beijing?

In Brazil, the president was recently impeached as millions took to the streets, and the new president is even more corrupt. In India, over 190 million people are still starving.

No, there’s only one place it can go. The last harbor of safety, growth, and rule of law in the world:

The United States of America.

But where exactly?

Which Investments Will Attract the Most “Flight Capital?”

It certainly won’t go into U.S. Treasury bonds because there’s no return there.

And with $127 trillion dollars in debt, there isn’t much safety either.

Some of it will go into gold, of course. But there isn’t enough gold in the world to accept this massive influx of money.

High-rise condos like these in New York are the “bolt-holes” of rich Europeans and Asians.

Some of it will go into high-end American real estate. In fact, you’ve already seen that happen. You’ve probably read about the skyscrapers in New York filled with $100 million condos.

These apartments are the “bolt holes” of frightened Europeans, Japanese, and other Asian billionaires.

But the problem with owning a luxury condo is that it isn’t liquid.

If you need to get your $100 million out of your condo fast, how quickly can you sell it?

No, there’s only one place in the world that has the liquidity, the stability, and the return that Japanese and European investors want:

Wall Street.

Catch the Crest and Escape the Crash!

That’s why the K‑Wave will reach a “crest” in the stock market before it hits the American economy.

As the K‑Wave crests, I predict the Dow Jones will reach at least 45,000 by 2020.

How did I come up with such a shocking figure?

Our artificial intelligence software—the “E-Wave Model”—did the calculations.

But they’re not hard to understand.

The model took a key point of the Dow and multiplied it by the same amount the Dow rose during the Depression.

But I said “at least” 45,000 because I believe that’s a conservative estimate.

According to our model, the Dow could go much, much higher.

Why?

Multinational Corporations Have Cash to Protect, Too!

Because we’re not just talking about individual European and Japanese investors here. We’re also talking about multinational corporations, both foreign and domestic.

Apple alone has more than $260 billion on its books right now, most of it parked in low-yielding investments overseas. That’s more cash than most major governments keep on hand!

As those investments get more and more risky — and yield less and less income — the bean counters at Apple will be looking for somewhere else to put it.

And the first place they’ll look will be Wall Street.

Nor is Apple alone …

- Microsoft is sitting on $132 billion in cash and cash equivalents...

- Google has $96 billion burning a hole in its pocket …

- Johnson & Johnson … General Electric … Pfizer … and dozens of others are in the same cash-rich quandary.

These companies are facing the same problem as the restaurant owner from Paris, “Pierre Dubois”:

Where can you put your savings that is safe, liquid, and has some chance of growth?

There’s only one answer:

The U.S. stock market.

You Are in for the Greatest Bull Market Ride in History!

Which is why you and I are in for the greatest bull market ride in history.

If you’re over the age of 50, this is likely to be the last great bull market of your lifetime. Even if you’re the under the age of 50, it could be the fastest run-up in stocks you’ll see as long as you live.

But here’s the best part:

Because you’ve read this letter, you will be one of the few people who understands what’s going on!

While others sit on the sidelines, shake their heads, and mutter, “Why is the stock market going up when the global economy is tanking?”

YOU will know exactly what’s happening and why.

The only question is:

Will you take advantage of it?

When the Dow hits 45,000 by the year 2020, will you kick yourself and say, “Gee, I guess Sean was right. I sure wish I’d listened to him.”

Or will you be popping the cork on a bottle of champagne and telling the skipper of your yacht to set sail for your private island in the Caribbean?

The choice is yours.

But you’ve got to make that choice today.

Because the window of opportunity is small and it will slam shut before you know it.

Where Will YOU Be When the K‑Wave Crashes?

When the K‑Wave crashes into the American economy …

You’ll either be one of the lucky few who are rich and secure …

Or one of the millions who are hungry, desperate, and afraid.

Now you might be tempted to say, “Dow 45,000 sounds pretty good to me, I’ll just hold onto my U.S. stocks and watch them double in value.”

In other words, you might be tempted to sit tight and do nothing.

But sitting tight is the worst thing you could do.

For three reasons:

Three Reasons Why “Sitting Tight” Is the

WORST Thing You Could Do

First, because you can't expect EVERY part of your portfolio to rise in lockstep with the Dow.

If you have a diversified portfolio — as most investors do — the K-Wave will cause many of your stocks and bonds to crash even while the Dow is going up.

If you’re holding Treasury bonds, municipal bonds, high-yield corporate paper, or international equities, for example, you’re going to take such a beating that it won’t matter if the Dow goes to 45,000 …

You’ll still go broke!

Second, you can do more than just double your portfolio in order to protect yourself.

That’s why I’m going to tell you in the next few minutes how you could make 300% … 400% … even 500% on your investments in a short amount of time.

Because you’re going need that kind of growth to stay safe after the crash.

The Tide Will Go OUT Before It Comes Back In!

The third reason you can’t sit tight is because the K‑Wave will act just like a real tsunami.

In other words, the tide will go out just before the wave comes in — like a powerful undertow.

Our “E-Wave Model” says the Dow could suffer a severe correction before it starts to rise again.

But in the next few minutes, I’ll tell you how to protect yourself from this undertow and position your portfolio for the crest that’s right behind it.

That’s why sitting tight is the worst thing you can do.

So what should you do?

Here’s What I’m Going to Do with My Own Investments

Let me tell you what I’m doing to grow my own portfolio and protect my family from what’s ahead.

I’ve written it all down in a research report called “THE STOCK MARKET TSUNAMI: Catch the Crest and Escape the Crash.”

I’d like to send it to you for free when you click the button below.