I just gave a presentation on marijuana stock investing for the MoneyShow yesterday. I hope you tuned in.

If you didn’t get the chance, then I have something you really should see.

Three charts that point to a bumper crop of profit potential.

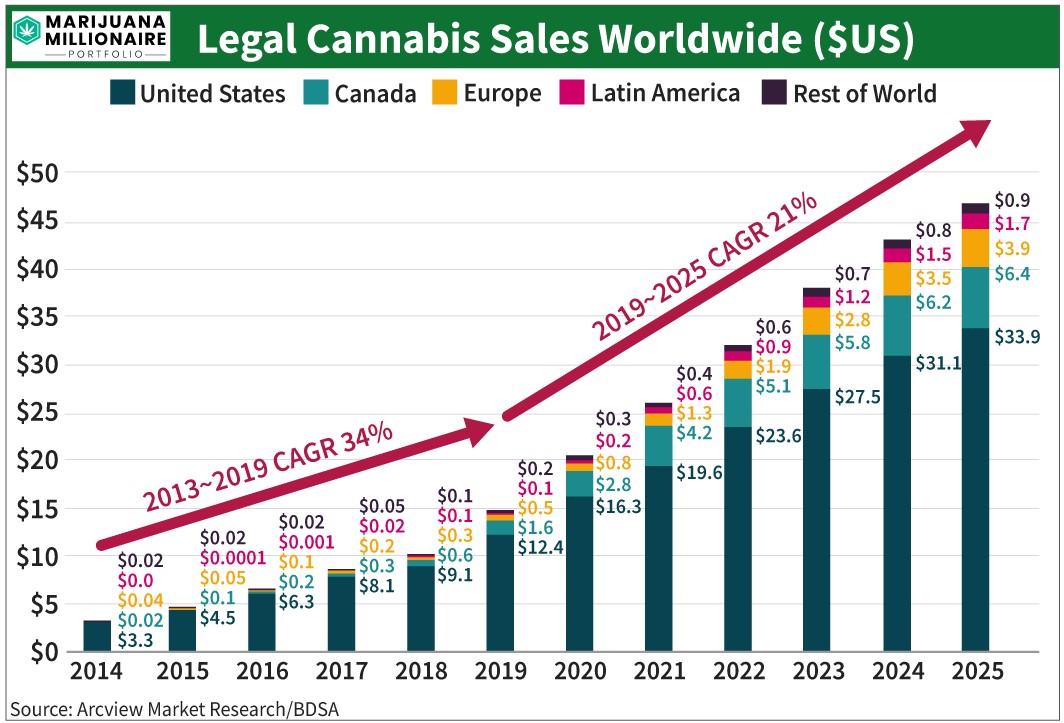

Chart No. 1: Booming Global Sales

This is a chart of the current and predicted sales of legal cannabis worldwide. Look at that liftoff!

Any business that is looking at a compound annual growth rate (CAGR) of 21% between now and 2025 is enormously attractive to investors.

Now, let’s add in the fact that central banks here in the U.S. and around the world are pumping trillions of dollars of stimulus into their economies. All that money is sloshing around, looking for somewhere to go.

A lot of that money is going to chase growth stocks … stocks with the kind of growth we’re seeing on this chart.

Chart No. 2. America Beats Canada

Here’s a chart of the two biggest cannabis stock ETFs traded in the U.S. — the AdvisorShares Pure Cannabis ETF (NYSE: YOLO, Rated “D”) and the AdvisorShares Pure Cannabis ETF (NYSE: MJ, Rated “D”).

MJ is much bigger than YOLO. But look at who’s outperforming …

You can see that, since the March bottom, YOLO has gained nearly twice as much as MJ. There’s a simple reason for that: MJ is more concentrated on Canadian stocks, and YOLO focuses more on U.S. cannabis companies.

And the companies south of the 49th parallel have a lot more going for them than the companies in Canada. There are some simple reasons why …

- Simple math: The U.S. has nine times the population of Canada.

- Canada makes its cannabis companies jump through a staggering amount of red tape.

- Cannabis is not federally legal in the U.S. … yet. But people know it’s coming, as I explained in my article on cannabis last week. And that potential is getting investors excited.

I’m not saying all Canadian cannabis companies are bad investments. I’m just saying that, on the whole, there are better bets south of the border.

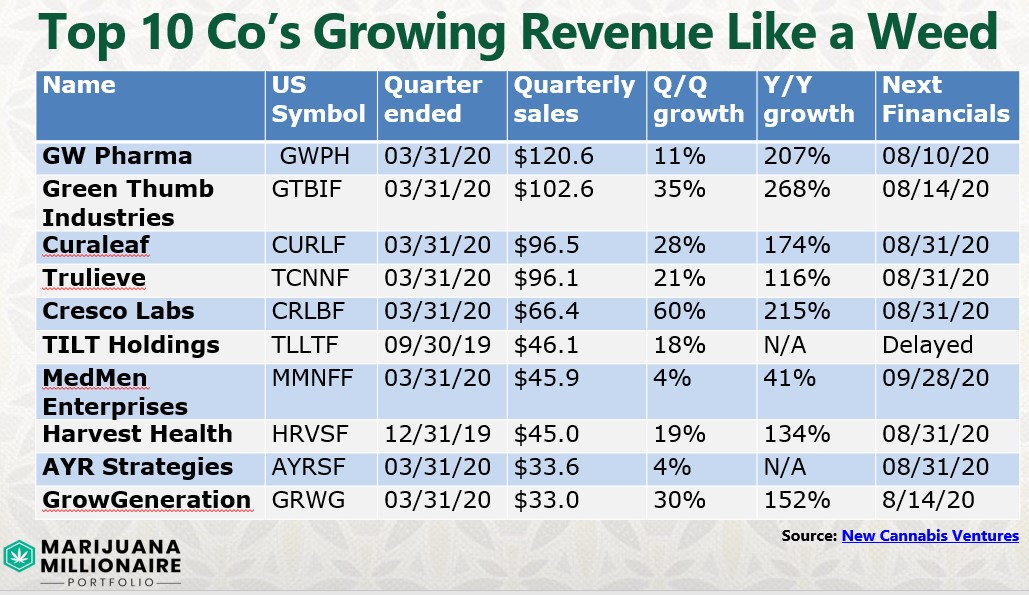

Chart No. 3: Rip-Roaring Revenues

I used data from New Cannabis Ventures to make this slide from my MoneyShow presentation. It shows U.S.-listed cannabis companies ranked by revenue. Importantly, it shows GROWTH in revenue.

You can see that the year-over-year growth in revenue of many of these names is something that Wall Street would kill for.

Now, not every company on this list is a “buy”. In fact, some are downright “sells” in my book. But many ARE good buys. And you can bet I’m getting my subscribers well-positioned in the ones I think are worth holding.

To be sure, I have an extra ace up my sleeve — the Weiss Cannabis Stock Rankings. This is a million-dollar system designed by some very smart people that take a lot of the guesswork out of picking which cannabis stocks are going to move higher. And I use that in my Marijuana Millionaire Portfolio.

This is an exciting time for cannabis investors. There’s a bumper crop of profits out there just waiting to be harvested. I hope you’re making the most of it.

All the best,

Sean