Is it time to set your sights on the sun? By that, I mean investing in the stocks of companies leveraged to solar power.

You’d be in good company if you did. Warren Buffett is building the largest solar plant in U.S. history.

NV Energy, one of Berkshire Hathaway’s (NYSE: BRKA, Rated “D+”) subsidiaries, is building a 690-megawatt solar power plant on federal land in Nevada. The current record for a solar plant is BHE Renewables’ 579-megawatt behemoth in Rosamond, California.

While the Trump administration favors coal over solar, a federal official praised the Berkshire project as an “America First Energy Plan,” echoing the president’s rhetoric.

The so-called Gemini Solar Project will be 25 miles from Las Vegas. Along with two other projects, it will generate 1.19 gigawatts of power for Nevada, enough to provide electricity for 230,000 homes. The projects also come with 590 megawatts of battery-storage capacity so electricity can be stored for when the sun isn’t shining.

The project will cost $38.44 per megawatt hour. For comparison’s sake, the average cost of a new natural-gas plant ranges between $44 and $68.

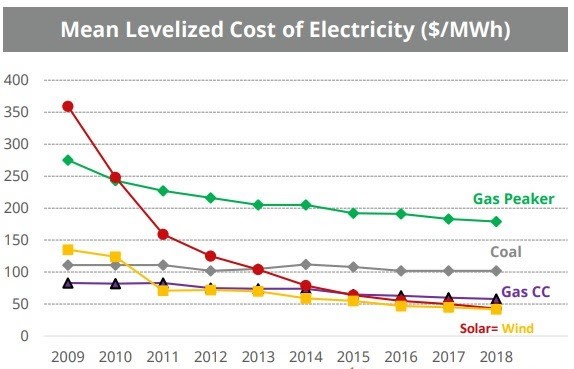

Utility-scale solar is on track for a record year due to states’ renewable energy targets and the ever-lowering cost of solar technology. The cost of solar-produced electricity has plunged a stunning 90% since 2009 … and it’s now cheaper than fossil fuels — even at today’s low prices. And costs are expected to drop even further — 34% — by 2022!

Not surprisingly, residential installations are expected to increase by a third this year, regardless of what happens with the COVID-19 pandemic. In fact, solar panel installation is set to be the fastest-growing job market in the United States for the next eight years according to the U.S. Bureau of Labor Statistics.

With renewable energy set to expand globally by 1,200 gigawatts (GW) from 2019 through 2024, with solar powering capturing 60% of that growth … it’s no wonder solar stocks have been powering skyward, outperforming fossil fuel stocks by a wide margin.

The Invesco Solar ETF (NYSE: TAN, Rated “C”) is up 14.4% so far this year against the S&P 500’s decline of 0.7% … while the Energy Select Sector SPDR Fund (NYSE: XLE, Rated “D+”) has had a staggering ONE-THIRD of its value lopped off.

And since the March bottom, solar has run rings around the S&P 500 …

You can see the S&P 500 was recently up 37% from the March bottom, while TAN soared more than 55%. While TAN is an easy way to get solid exposure, here are three individual stocks you should keep your eye on …

No. 1: Sunworks, Inc. (Nasdaq: SUNW, Rated “D”) provides photovoltaic systems for the agricultural, commercial, industrial, public works and residential markets in California, Massachusetts, Nevada, Oregon, New Jersey and Washington. The company also designs, finances, integrates, installs and manages systems ranging from two kilowatts for single residences … to multi-megawatt systems for larger projects. In addition, it offers a range of services, including design, engineering, procurement, permitting, construction, grid connection, warranties, monitoring and maintenance for its customers.

The company’s expected earnings growth rate for the next quarter is 76.9% and it trades at less than book value. That means you can buy it for less than the sum of its parts.

No. 2: First Solar (Nasdaq: FSLR, Rated “D”). What first sets First Solar apart is its proprietary “thin-film” module. In less-than-ideal conditions like low light and warm weather, these panels perform better than those made of silicon. They’re also larger, which helps reduce the cost per watt. Those factors make them ideal for utility-scale solar energy projects.

First Solar further sets itself apart by having one of the strongest balance sheets out there. It routinely has more cash than debt, giving it the financial flexibility to build thin-film solar modules for utility-scale customers. Simply put, First Solar is in an excellent position as the solar industry expands.

No. 3. SolarEdge Technologies (Nasdaq: SEDG, Rated “B”) manufactures the power optimizers and inverters used to convert the sun’s energy into usable electricity. These components improve the way solar panels convert DC power produced by the sun into AC electricity used by grid. A system that uses SolarEdge’s power optimizers will cost less than one that, for example, uses a microinverter built by a company like Enphase Energy (Nasdaq: ENPH, Rated “C”) … with minimal efficiency loss.

Over the past six years, the company has gone from the world’s 10th largest inverter supplier to the largest, with 52% of U.S. residential installations using the SolarEdge product.

Plus, SolarEdge Technologies’ success with inverters has allowed SolarEdge to venture into other parts of residential and commercial systems. The company is now offering energy storage and energy management services to grow its revenue per installation and it’s expanding these offerings to commercial and utility-scale customers.

And SolarEdge Technologies’ focus on manufacturing low-cost power optimizers has enabled it to win market share from its competitors.

The company has been generating free cash flow ever since it went public.

Despite astronomical growth, the solar industry is highly cyclical … going through rapid phases of over and undersupply. Having cash to ride the roller coaster — or the firepower to make an acquisition when valuations are low — gives SolarEdge a lot of options.

It’s taken us a while to get to where we are. And there’s still a lot of improvements that need to be made — in things like storage — so renewable energy works for everyone. But to me, solar feels like the ultimate form of energy we’ll be using for as long as we’re around.

All the best,

Sean