5 Good Reasons to Buy Cannabis Stocks This Fall

Cannabis stocks have had a tough year. America’s leading marijuana benchmark, the ETFMG Alternative Harvest ETF (NYSE: MJ), dropped as much as 37% since peaking on March 19. That’s the kind of pain normally reserved for motorcycle crashes and divorce courts.

But don’t let all the green leaves scattered up and down Wall Street obscure the real opportunity for you here. I’m going to show you not only why you should buy, but if you buy going into the fall months, why you’ll be buying near the bottom.

Reason No. 1: Seasonal Rally

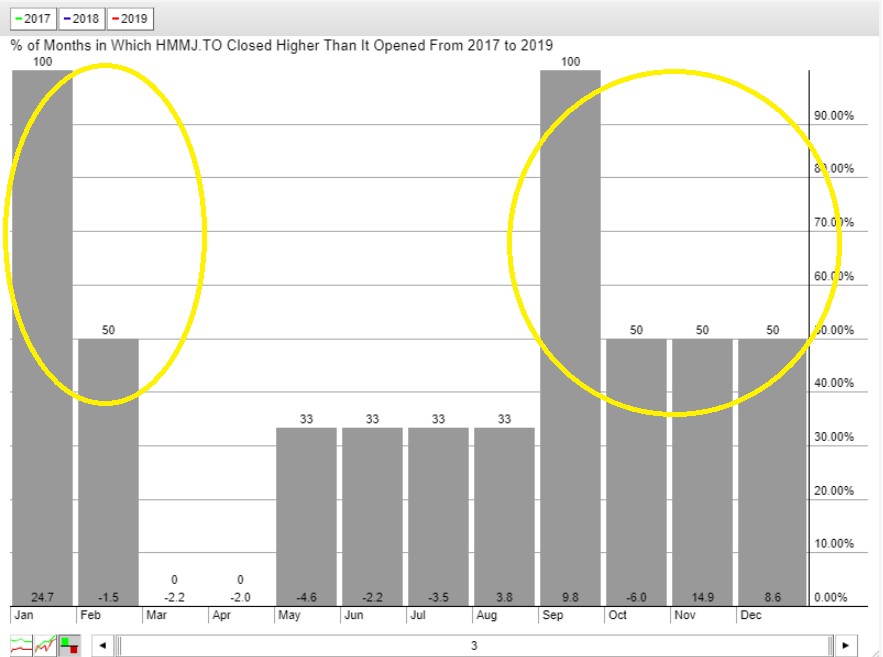

In my column on Aug. 3 — slightly over a month ago — I explained how cannabis stocks usually have a great second half of the year. Here’s a chart of Canada’s Horizon’s Marijuana Life Sciences Index ETF (TSX: HMMJ). It doesn’t have a decent U.S. listing, so I don’t talk about this one a lot. But it has something the MJ ETF doesn’t: Three years of history. That’s because HMMJ has been around longer.

So, if you were looking for historical record of a seasonal rally, you’d want to look at Canada’s pot ETF. And sure enough, it shows up bigtime.

This is a seasonality chart of HMMJ. You can see that the fund ends September higher than it started it. Every. Single. Time.

October, November and December are also pretty good months for HMMJ. January has turned out be a winner in each of the past three years. And February is pretty good too. Canadian pot stocks hit a seasonal slump in March, and stay there until August.

Hey, wait a minute! Doesn’t that line up with what we’ve seen in marijuana stocks recently? It sure does.

To be sure, past isn’t necessarily prologue. But if history is a guide, cannabis stocks like the cold. They rally when the autumn wind blows.

And speaking of that …

Reason No. 2: The Big Rally in Marijuana Stocks is Already Starting

Holy pumpkin spice Batman! Look what happened to MJ when September rolled around. It rallied off its lows in a hurry.

You can see that the MJ ETF rallied on Friday over its 20-day moving average. The 20-day moving average is usually seen as the dividing line for short-term bullishness and bearishness.

We’ve been faked out before — earlier in August was a prime example. But there’s a difference this time. Volume. Bullish volume is running at 2.5x normal. High volume is a sign of investor conviction.

Now, what might have sparked such a move? For one thing, the broad market is rallying. But there’s also something specific to cannabis.

Reason No. 3: Revenue Estimates are Soaring

Market research and data analytics firm Prohibition Partners just released a new North American Cannabis Report.

The firm analyzed the cannabis industry in Canada and the United States. And the analysts say that by 2024, North America’s cannabis market will be worth $47.3 billion.

Daragh Anglim, the firm’s managing director, told the Benzinga news website that the report offers good reason to believe that both medical and recreational cannabis will be completely legal in the entire region by 2024 and “integrated across a number of industry verticals from pharma to food.”

Importantly, this is higher than previous estimates by other serious analysts. Sure, it’s a guessing game. But the consensus, as tracked by Statista, was that the North American cannabis market would be $29 million by 2024.

So, this new estimate is 63% higher! Wow!

If that’s anywhere close to true, no wonder beaten-down cannabis stocks are picking their heads up out of the ditch they’ve fallen into.

Anglim added that his company’s estimate is probably low. Double Wow!

Reason No. 4: You’ve Been Trumped!

Those are three solid economic reasons for cannabis stocks to move higher, potentially much higher. Now, I’ll give you a political reason. In response to a reporter question, President Trump said that his administration will let states set their own marijuana policies.

“A lot of states are making that decision, but we’re allowing states to make that decision,” the President said.

So, if the Trump administration is taking a hands-off approach to cannabis — if it will keep its big government paws out of the way while states proceed legalizing — that lifts a lot of fear off the market.

Reason No. 5: Taxaholic State Governments Love Pot

Because there’s a very good reason for states to legalize: M-O-N-E-Y. Nevada just reported it has raked in more than $100 million from cannabis taxes and fees in the last fiscal year.

That revenue was $99.18 million in tax contributions and another $10 million in fees. Nevada’s weed revenues jumped 33% year over year in 2018.

This year looks EVEN BETTER! Monthly revenues are running up about 28% year over year. And as Curly from City Slickers might say …

Other states, including Colorado and California, are rolling in the green thanks to cannabis taxes. I think more and more states will follow suit. After all, as the saying goes, tax revenue is the most addictive drug in America.

So, those are five good reasons for pot stocks to take off. And they’ve been beaten down so far, the prices, while not bargains, are much better than they’ve been in months. It becomes a bargain if you pick the right stocks and they blast off.

You can always buy MJ. Or roll up your sleeves and do the hard work of picking individual stocks.

Whatever you do, don’t sit on your hands. I just gave subscribers to my Marijuana Millionaire Portfolio a new pick. I highly urge you to check it out. I go in depth with my recommendations and offer specific “buy” and “sell” prices.

Marijuana Millionaire Portfolio enrollment is currently closed to new members, but you can call our customer care department at 877-934-7778 to let us know that you’re interested in an open spot, when one becomes available.

After all, there is money to be made in these fields of green.

All the best,

Sean