On Oct. 1, 1949, Mao Zedong proclaimed the founding of the People’s Republic of China.

This National Holiday starts every year with troops raising the flag in Tiananmen Square.

And with it, China’s Golden Week commences.

The government sponsors concerts, parades and fireworks shows. Government offices close. And citizens feast, relax and exchange gifts.

It’s like the U.S. Independence Day and Christmas rolled up into a seven-day public holiday.

Golden Week is also a time of travel. Tourist sites raise ticket prices, and the cost of flights and hotel rooms skyrocket.

• But one asset tends to fall before or during Golden Week … before rising. And that’s GOLD.

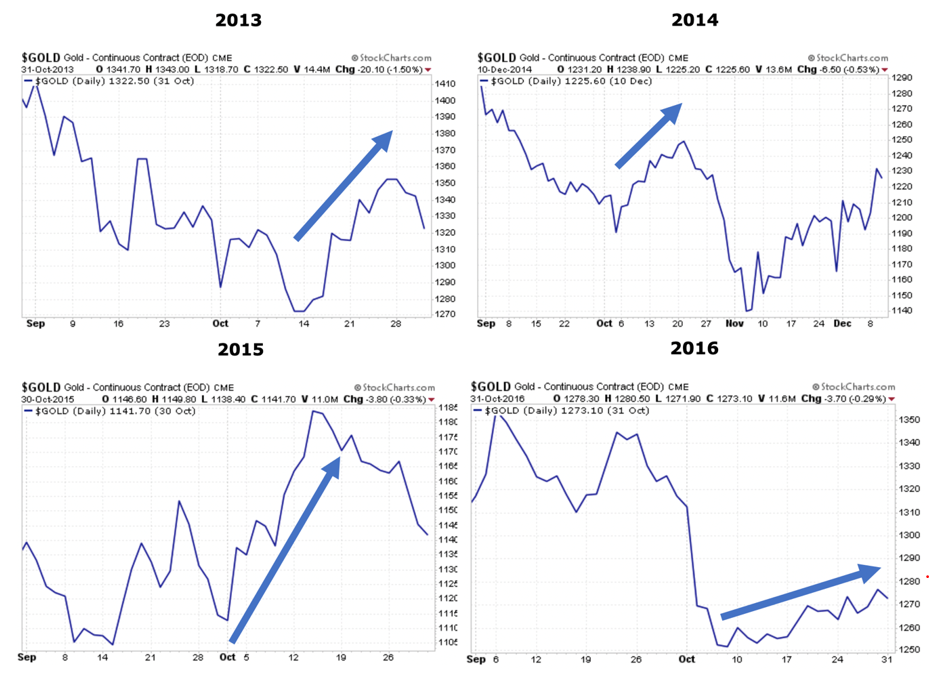

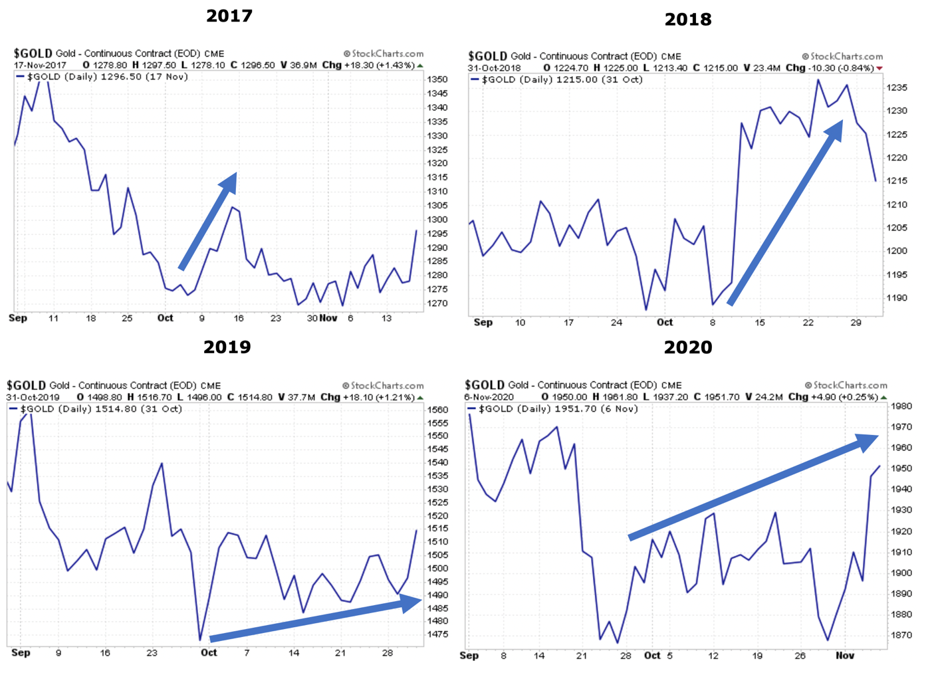

Look at these gold charts before and after China’s holiday, dating back to 2013:

Uncanny, right?

Could it be because one of the world’s biggest gold buyers — the Chinese government — goes on vacation?

Here’s where we are in 2021:

I can’t say for sure that gold will go straight up from here. It could drop a bit in the short term before turning back up … like it did in 2020 (or 2012).

• But if this year is like the past several … I’d say gold’s a pretty good bet right now.

So, you might want to think about buying some more bullion or investing in your favorite gold stocks.

Here are a few at the top of my list … and why they are there right now.

5 Ideas for a Post-Golden Week Bounce

Most people agree that you can’t go wrong with buying bullion at just about any price.

And everyone loves to buy “paper” — whether it’s gold, stocks or both — at a discount. And now is a good time to think about doing that.

For example, Barrick Gold (NYSE: GOLD) is coming off its one-year low. It’s trading near $18.64 at the time of this writing.

The same goes for Newmont (NYSE: NEM), which is trading near $54.83.

Exchange-traded funds (ETFs) are always a good way to have broader exposure with reduced risk. Both the SPDR Gold MiniShares Trust (NYSE: GLDM) and the SPDR Gold Trust (NYSE: GLD) are also coming off one-year lows.

Even if it seems like a golden opportunity right now, remember to do your own research before making any investment.

And if you’d prefer to get timely trading signals — buy and sell the moment that I recommend making a move — consider taking my Gold and Silver Trader service for a test-drive today.

All the best,

Sean