5 Reasons to Be Bullish on Platinum & 3 Ways to Play It

Platinum has been on a slide since February.

• The COVID-19 Delta variant bears part of the blame.

It continues to fuel concerns about the global economic recovery.

China’s zero-COVID policy to contain the spread has severely constrained the country’s industrial growth. That came in at 6.4% in July … weaker than the 7.3% expected, and down from 8.3% in June.

In the U.S., the Institute for Supply Management’s Index of National Factory Activity fell to 59.5 from 60.6 in June — economists erroneously forecasted a rise to 60.9.

The subsequent fears about slow (and slowing) growth hurt industrial demand for platinum. The computer chip shortage that has limited auto production has also lowered the demand for platinum used in catalytic converters.

• You can also blame the strengthening dollar.

The U.S. Dollar Index, which measures the value of the U.S. dollar relative to a basket of other currencies, rallied from a late-May low of 89.50 to around 94 amid expectations the Federal Reserve is preparing to taper bond purchases later this year.

Plus, platinum supply is up a whopping 55% as South African mines and smelting now operate largely without the COVID-19 shutdowns of 2020.

More Reasons to Be Bullish Rather Than Bearish on Platinum

Several signs of a recovery exist …

• Those are mostly in the automotive sector due to rising production of heavy-duty vehicles, particularly in China.

In fact, automotive demand jumped 75%, or more than 285,000 ounces, year over year in the second quarter. This at the same time as global light vehicle production recovers from the pandemic.

• Plus, less costly platinum is being substituted for palladium more often.

In its Q2 report, the World Platinum Investment Council said automotive demand in 2021 should recover by 22% (+529,000 ounces) above 2020 levels and even 2% (+58,000 ounces) above 2019 levels. That’s despite ongoing concerns over microchip shortages.

• The council also says the platinum market will be more undersupplied this year than the 60,000 ounces it had previously estimated … forecasting a shortfall of 158,000 ounces.

And expectations of rising inflation in 2021 could support investment interest in platinum and other precious metals as a hedge.

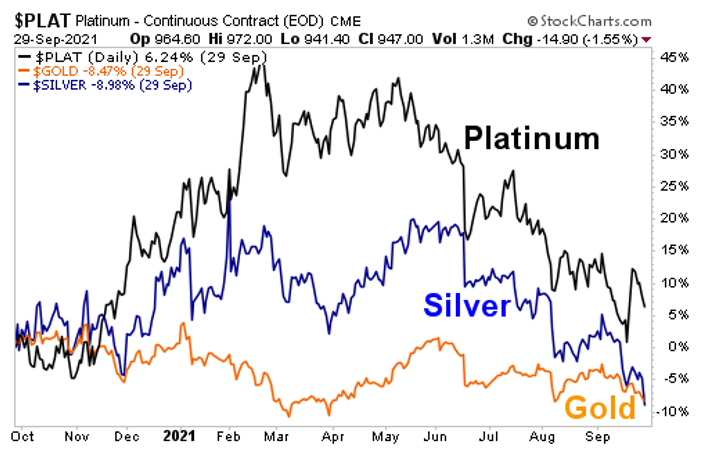

• In fact, platinum has outperformed gold and silver since this time last year.

While all three are going down recently, platinum outperformed on the upside.

• Among precious metals, many see platinum rising in value first in the nearer term.

And in the longer-term, dynamics point to strong demand growth and constrained supply along with greater investor interest, particularly due to platinum’s links to the nascent hydrogen economy …

WPIC’s research director, Trevor Raymond, says:

From a platinum investment point of view, it’s fairly long-term but it’s quite chunky. You’re looking at somewhere between 2 million and 3 million extra ounces on an 8-million-ounce market … the short term is that you’ve got green hydrogen manufactured by using platinum electrolyzers and you’ve certainly got heavy-duty fuel cells that seem to be coming in a lot quicker, particularly in China.

When the investors join the dots between decarbonization and platinum, they certainly will come and have a look at platinum, and that’s pushing up investment demand.

Given its green credentials and the ongoing supply deficit the price could head back toward 1,300 towards the middle of next year.

Coin Price Forecasts predicts platinum will hit $1,117 an ounce by the end of this year, and $3,128 by 2030. That’s a rise of 15.8% and 224% from recent levels.

• So, platinum’s slide might continue a bit longer. That makes this a good time to think about how you can fill your investment platter with platinum.

Platinum Should Shine Again … Here Are 3 Ways to Play It

One easy way to play is to buy the Aberdeen Physical Platinum Shares ETF (NYSE: PPLT), which holds the physical metal. Shares recently traded at $89.89.

The Hard Assets Alliance offers 1-ounce bars. You simply choose where you want them stored … in New York, Salt Lake City, London, Zurich, Singapore or Melbourne … and you can have them shipped to you at any time.

Platinum coins and bars are also available from online dealers like Kitco or Apmex. (Disclosure: I don’t personally benefit from any dealer suggestions.)

Another option is to buy “allocated” platinum. You save money on shipping and insurance costs by having it stored in a vault with your name attached. (I wrote about the benefits of buying allocated gold here.)

In a world where central banks are producing “funny money” practically out of thin air, it’s good to have some REAL money at your disposal. And platinum has plenty of reasons why it should appreciate … whether in physical or exchange-traded fund (ETF) form.

All the best,

Sean

P.S. I’ll have more insights on metals at the New Orleans Investment Conference, which runs Oct. 19 through 22. This is a fantastic conference in a wonderful city with plenty of great speakers, including Rick Rule, Ron Paul, James Grant, Grant Williams and many more. You can check out the details HERE.

What’s more, the conference organizers have pledged to donate $100 from each new primary registration to the New Orleans Second Harvest Food Bank. It’s a win-win. So, I hope to see you in New Orleans.