In 1824, Danish physicist and chemist Hans Christian Ørsted heated and mixed two compounds together, producing a lump of metal that looked a lot like tin. It wasn’t until 1845 that German chemist Friedrich Wöhler — after much failure — was finally able to repeat Ørsted’s feat.

For years afterward, this shiny metal was so rare in its purified form … it was even used in the high-end jewelry of the upper class.

What was this metal? Try not to laugh …

It was ALUMINUM.

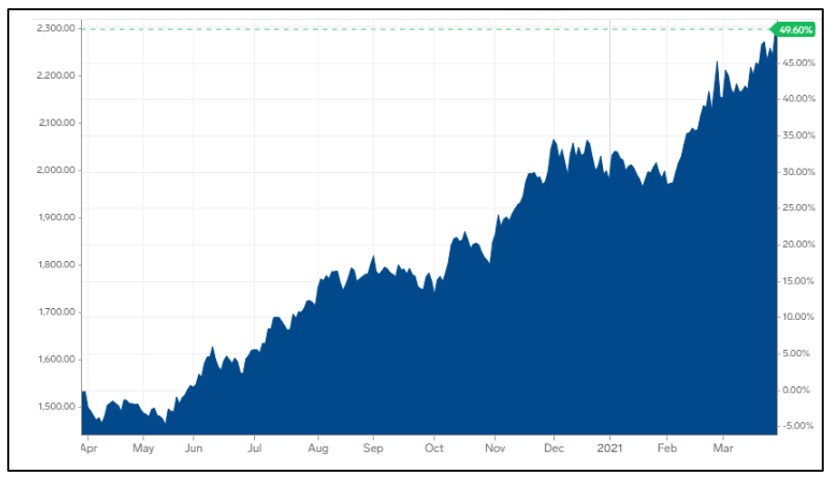

And have you seen what’s been happening to the price of aluminum lately? Here’s a chart from Business Insider:

Aluminum is up about 53% in the past year. It anticipated the global economic recovery before most of the market. And stimulus plans around the globe keep stoking the fires under this metal.

But back to our history lesson: Aluminum was rare when it was first discovered, and for a while, it was very expensive — as expensive as platinum and harder to work with. It was considered a rare and wondrous metal, which is why the Washington Monument was capped with a pyramid of aluminum in 1884.

It wasn’t until large-scale production of aluminum became possible in 1888 that its price began to fall.

Aluminum’s ability to form hard, light alloys with other metals provided the light, yet strong, airframes used in both World Wars … in addition to widescale building and construction. In 1954, aluminum production eclipsed that of copper and became second only to iron as a main industrial metal.

Eventually, it became widely used in everyday items, from eyeglass frames to aluminum foil and beverage cans …

In fact, the Latin word alumen actually stems from the Proto-Indo-European root alu, meaning “bitter” or … “beer!”

And because of its corrosion resistance, light weight, conductivity and mechanical strength, aluminum is also used for electrical applications (as conductor alloys, motors, generators, transformers, capacitors, etc.) and in machinery and equipment (processing equipment, pipes, tools, etc.).

Aluminum production is an exceedingly laborious endeavor …

Bauxite ore is first converted to aluminum oxide and then to 99.99% pure aluminum by three separate processes.

All this requires a LOT of energy. How much energy, you ask? About 5% of all the electricity generated in the United States in a year. Yeah, that surprised me, too!

And that’s why producers tend to locate smelters in places where electric power is both plentiful and inexpensive. The largest facilities are located in China, India, Russia, Canada and the United Arab Emirates (UAE).

China alone produces over half of the world’s aluminum. In 2017, most bauxite was mined there, followed by Australia, Guinea and India.

Recycling is another key source. Especially since it requires only 5% of the energy used to produce the metal from raw ore.

The great majority (about 90%) of the aluminum oxide mined from bauxite ore is converted to metallic aluminum. What about the rest?

The oxide itself (also called “alumina”) has several functions. It is widely used as an abrasive in highly reactive environments such as high-pressure sodium lamps, as a catalyst for industrial processes, and as a drying agent.

Other aluminum salts are used for water treatment, paper manufacturing, dyeing, deodorizing, leather tanning …

… as catalysts in chemical and petrochemical industries, as antiperspirants and astringents, as antacids …

… to solidify cement, and to make glass, ceramics, cosmetics, paints and varnishes.

Some aluminum salts even serve as an immune adjuvant (immune response booster) in vaccines.

Despite its widespread occurrence in the Earth’s crust, aluminum has no known function in biology. And it’s remarkably nontoxic. (Some have suspected aluminum as being a cause of Alzheimer’s disease. But 40 years of research hasn’t found clear evidence of this.)

Obviously, aluminum is a major player in the world economy. And the world economy is just now rising out of the coronavirus panic in a big way!

So how can you play this?

The Invesco DB Base Metals Fund (NYSE: DBB) holds a basket of future contracts on aluminum, copper and zinc. While it’s not a pure aluminum play, these three industrial metals should travel similar paths.

The fund has an expense ratio of 0.75% per year.

The First Trust Indxx Global Natural Resources Income ETF (NYSE: FTRI) holds a bunch of natural resource stocks. Its two biggest holdings, BHP Group (NYSE: BHP) and Rio Tinto Group (NYSE: RIO), both produce aluminum. FTRI also sports a nice dividend yield of 3.27% and has an expense ratio of 0.43%. Be aware, though, that this fund’s trading volume can be thin at times.

Alcoa Corp. (NYSE: AA) is probably the best pure play on aluminum you can find. With its subsidiaries, the company not only mines bauxite ore but also produces alumina and pure aluminum for customers in the U.S. and internationally. It even owns hydroelectric plants that sell electricity to traders, large industrial consumers, distribution companies and other generation companies. The firm was founded in 1888 and is headquartered in Pittsburgh.

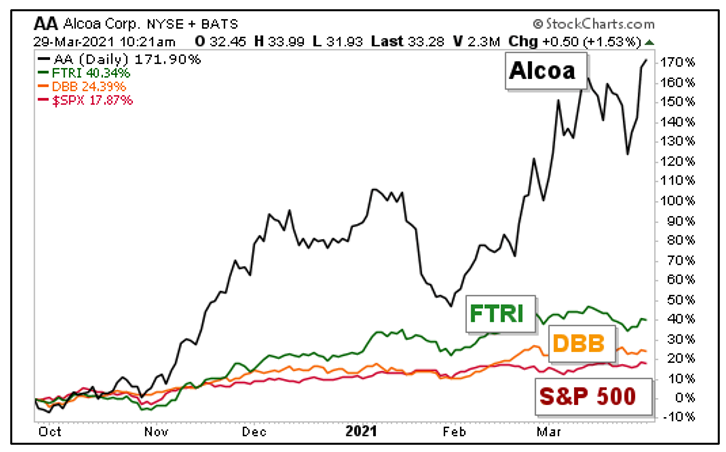

Let’s look at a performance chart of all three over the past six months.

All three have outperformed the S&P 500. But Alcoa has led the pack with a 171.9% gain in the past six months.

Which will outperform going forward? My crystal ball is cloudy on that one. Do your own due diligence; you’re in charge of your investment destiny.

Yes, aluminum may seem BORRRRINGGG …

But it’s anything BUT that for investors going forward!

All the best,

Sean