Last week, I told you about what I consider “2 Bargain Car Stocks” in the race to make electric vehicles (EVs). Today, we’ll look at what metals could do well in the next leg of this fast and furious charge into EVs.

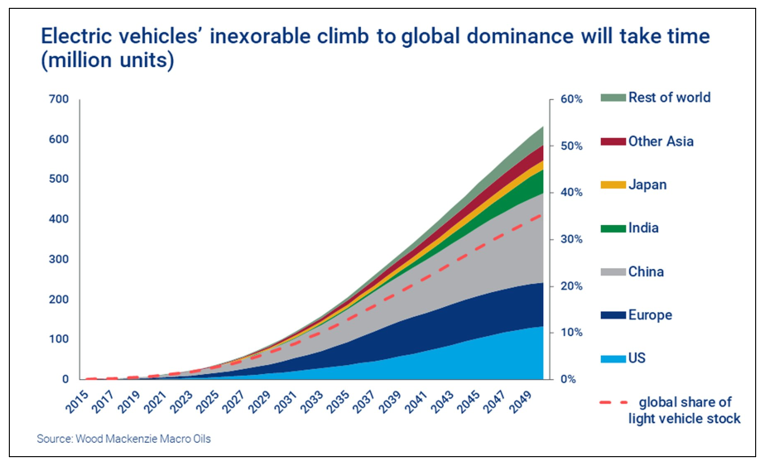

First, is there any doubt the EV market is ramping up fast and furious? Take a look at this chart from Wood Mackenzie …

The fact is, even though we think EV sales are booming … the real boom is yet to come. By 2040, experts predict that 57% of all passenger vehicle sales and over 30% of the global passenger vehicle fleet will be electric.

This is a megatrend that will play out over decades. For investors with an eye on the longer term, that’s a very good thing.

What’s driving this boom? Here are just some of the reasons …

• Global EV sales are projected to surge 60% this year, according to Bloomberg data, to about 4.4 million vehicles.

• China wants what it calls “new energy vehicles” to account for about 20% of total new car sales by 2025.

• Germany has extended subsidies on EVs for an extra four years.

• President Joe Biden announced plans to electrify the entire U.S. government vehicle fleet. The General Services Administration reports that there are approximately 645,000 vehicles in the fleet today.

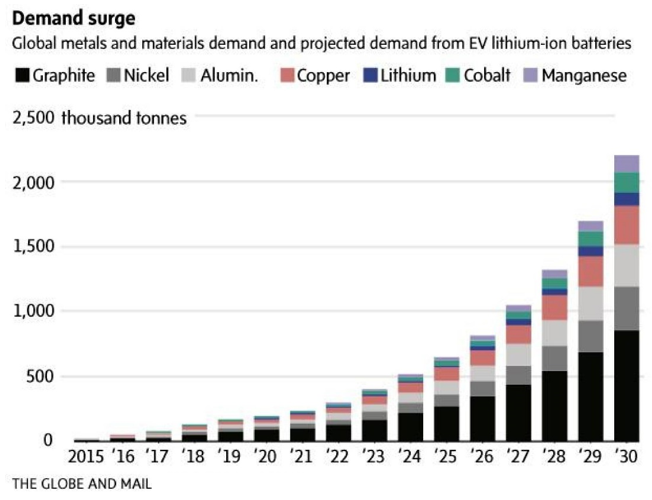

That kind of boom means auto manufacturers need to source all kinds of materials. Especially battery metals. Batteries account for about 40% of an EV’s cost.

Here’s a chart from The Globe and Mail of projected battery metals demand for EV lithium-ion batteries:

How can miners ramp up fast enough to meet that demand? They probably can’t. And that means the supply crunch will be resolved by prices going much higher.

Supply of some battery metals will start going into deficit by as early as 2026. In particular, cobalt, one of the most expensive parts of a battery, is on a collision course with a supply/demand squeeze.

Indeed, cobalt alone is up 20% since the start of the year. Nickel has surged more than 60% from a low in March of last year. And recent data from Benchmark Mineral Intelligence confirms recent strong price increases for these and other battery metals including lithium and graphite.

How Can You Profit from This?

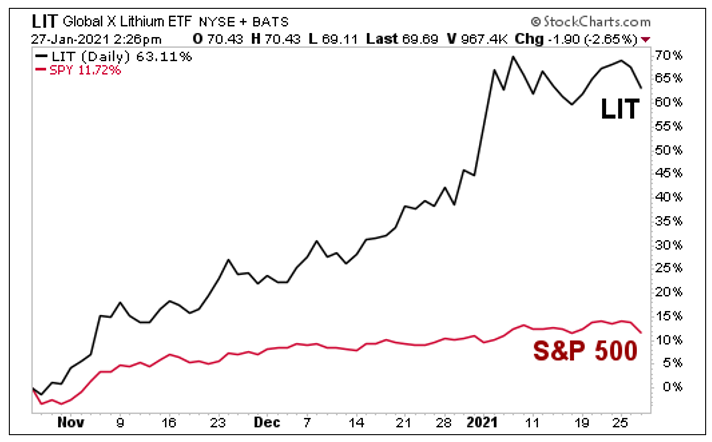

There’re individual stocks that will profit mightily from this. But you can also do it with ETFs. My Gold & Silver Trader subscribers are doing very well with the Global X Lithium & Battery Tech ETF (NYSE: LIT).

LIT invests in the whole lithium/battery/EV pipeline, from miners to refiners and battery and EV makers. And it’s leaving the S&P 500 in the dust. Just look at the last three months’ performance …

Will this outperformance continue?

Well, nothing goes in a straight line. But the megatrend is in place … and it’s pushing battery metal stocks relentlessly higher. Pullbacks can be bought. And smart investors will be the ones doing the buying.

All the best,

Sean