I’ve been pounding the table about copper, gold, steel, oil and other commodities. And this past week, gold soared to a seven-week high … steel futures jumped again, up 40% for the year … oil tested $60 as support and headed higher … and The Goldman Sachs Group (NYSE: GS) called copper “the new oil” and set a price target on the metal 23% higher by the end of the year.

So, the cyclical bull market in commodities that I’ve expected is breaking its harness and pawing the dirt, ready to run.

I hope you’re on board for that bull run. If you aren’t, there’s still time. What’s more, you might want to spare a glance for a bull market that’s right around the corner — in a commodity that Wall Street detests right now. It’s not looking bullish — so you can buy stocks levered to this commodity at dirt-cheap prices.

I’m talking about cannabis. While other commodities danced higher this past week, marijuana was still stuck in the convent, staring forlornly out the window. But not for much longer!

This is a good time to talk about marijuana because next week brings us April 20, or 4/20. As you probably know, 4/20 is an unofficial holiday for recreational cannabis smokers. If you don’t know why, you can read the history here.

With this “holiday” around the corner, why are cannabis stocks slumping? It’s just a normal correction after a big bull run that saw cannabis stocks take off like a kid after an ice cream truck. From the trough in March of last year to its recent peak in February, cannabis stocks as a group rallied 484%! Wow!

Nothing travels in a straight line, so we’ve seen some pullback recently. But that’s okay. One of my favorite cannabis funds, the AdvisorShares Pure Cannabis ETF (NYSE: YOLO), is looking like a potentially great opportunity due to its recent pullback.

On the chart, you can see how YOLO bottomed last March and peaked in February — that’s the 484% run I’m talking about. It has pulled back since then, and I’ve marked two areas of technical support. YOLO is testing the first level of support at $21.77 right now. It may pull back to that deeper support at $18.64.

Either support level is a good buying opportunity … because YOLO may not get to deeper support. Once it starts to run again, it could be off to the races.

Heck, in that rally that started last March, YOLO gained a stunning 395.57%! At the same time, the S&P 500 went up “only” 63.86%.

Let me tell you about three bullish things I’m seeing in cannabis right now:

1. Cannabis Sales To Jump Nearly 200% on April 20

Cannabis software firm Akerna Corp. (Nasdaq: KERN) just published a new analysis. The company expects national cannabis retail sales to reach $95 million on 4/20. That’s a big change from last year when sales came in at $32 million. That, in turn, was down from $40 million in 2019, thanks to the pandemic.

And $32 million to $95 million — that’s a jump of 196.9%! Wow!

2. Total Cannabis Sales Should DOUBLE in 4 Years

Cannabis sales are picking up steam. Every now and then, some smartie with a sharpie adds up how cannabis sales are doing and makes projections.

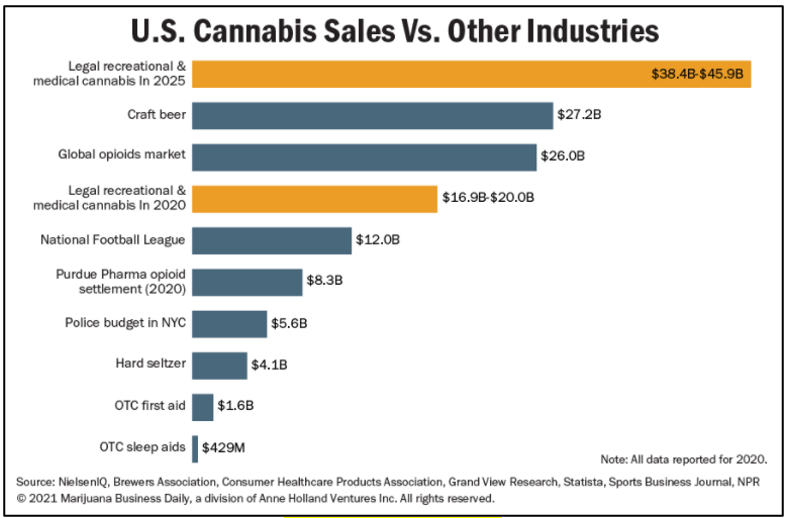

Here are the latest projections for cannabis sales in 2025 (yes … that’s only four years away) compared to other popular American pastimes and consumables:

The U.S. recreational and medical marijuana markets are on track to hit $45.9 billion in annual sales by 2025. That’s according to the newly released 2021 Marijuana Business Factbook. And it’s TWICE the level of sales projected for this year, which should come in between $22 billion and $26.4 billion.

3. States Rolling in the Green

You probably know that New York and Virginia recently legalized recreational cannabis. Now, there are two new bits of state news this week.

First, New Mexico just legalized recreational weed.

“Legalized adult-use cannabis is going to change the way we think about New Mexico for the better — our workforce, our economy, our future,” Governor Michelle Lujan Grisham tweeted after signing the bill on Monday.

In other news, Illinois is now making more money from taxes on pot than taxes on booze. Record-breaking sales in the first quarter brought the state $86,537,000 in legal weed tax revenue, topping the $72,281,000 collected from liquor sales in that same timeframe.

That MUST be making an impression on states that have yet to legalize.

Those are just my top three reasons. Let’s add in the fact that new polling data from Quinnipiac University shows seven in 10 Americans believe cannabis should be legal in the United States. As Quinnipiac says, this marks a record high of approval since the university started polling on cannabis in 2012.

Oh, one more thing. At a press conference on Sunday, Senate Majority Leader Chuck Schumer (D-NY) says a bill to federally legalize marijuana will be brought to the floor of the Senate “soon.”

At the presser, Schumer said the majority of Democrats supported the bill, and it’s getting support from “places you wouldn’t expect,” including the “Libertarian right.”

Actually, that doesn’t surprise me at all. Cannabis legalization is around the corner, and there will be a tidal wave of green profits. Smart people on both sides of the aisle will be ready for it.

YOLO looks like one fine way to play the possible rally in cannabis. Individual stocks could do even better.

All the best,

Sean