Copper has been beaten up lately, making it one of numerous grossly undervalued commodities right now.

And on Monday, Sept. 20, copper prices fell off the edge.

A large part of that had to do with the massive Chinese real estate developer, Evergrande … a company that few of us had ever heard of until a few weeks ago.

It’s the mega-corporation behind China’s housing construction boom. Evergrande’s played a significant role in all of those “ghost cities” … 1,300 real estate projects in over 280 locations throughout the country.

The company even has units dabbling in electric vehicles (EVs), health care, consumer products, video and television production … even a theme park.

The firm employs 200,000 people and indirectly creates over a whopping 3.8 million jobs each year.

So … why were markets rattled from New York to Nairobi?

• The company dropped a bombshell: It might default on its bonds.

After explosive expansion, Evergrande is buried under a crushing $300 billion in debt.

And the Chinese developer is SO HUGE that any failure could hurt not only the Chinese economy … but markets far beyond Shanghai and Shenzhen.

And not just in stocks, but also commodities. Like copper.

Why punish copper?

Short-term speculation around the future of construction in the world’s second largest economy — and the largest consumer of copper — is trumping other forces that support copper prices …

… like the International Copper Study Group (ICSG)’s latest bulletin, which showed a 90,000-ton deficit in June, compared with a 4,000-ton surplus in May.

• Plus, long-term demand keeps going up.

Especially for the market in “oxygen-free” copper due to soaring demand for consumer electronics and electrical and thermally conductive wiring.

The high conductivity to transfer low-frequency sounds makes oxygen-free copper beautifully suited for audio and video cables. And COVID-19 has boosted the manufacturing of electronics as government-enforced lockdowns supported in-home entertainment.

Oxygen-free copper wires also provide strength, durability and corrosion resistance, which means they’re good for vehicle radiators, gaskets, plumbing products and more.

Oxygen-free copper also enhances the overall performance of vehicles … of every sort. And the rising adoption of EVs should help, too.

• Is it time to buy the news?

I believe the Evergrande crisis is overblown. The wave of fear that washed over markets — including copper — could present a buying opportunity.

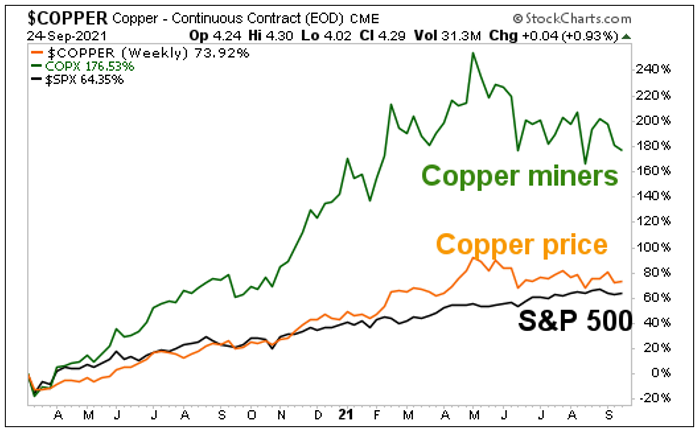

And copper already has outsized potential. Here’s a weekly chart showing the performance in copper, copper miners and the S&P 500 since around the start of the pandemic:

While the S&P 500 is up 64.3% since the start of the pandemic last year, which is not bad, copper is doing better, up 73.9%. Copper miners, as tracked by the Global X Copper Miners ETF (NYSE: COPX), rallied a whopping 176.5% over the same time frame. That’s because miners are leveraged to the underlying metal.

What’s more, copper miners are way off the highs they hit in April. That’s the thing about leverage: It works both ways. What this shows, though, is that copper miners have PLENTY of upside potential, especially if copper prices heat up again.

So this could be a good time to grab your own piece of this red-hot investment. Just do your own due diligence before buying.

If profiting from commodities sparks any interest, I highly recommend checking out my Gold & Silver Trader service.

In it, I help my subscribers profit from precious metals and mining shares. Right now, my subscribers are sitting on open gains of 44% and 24%, and we only got into these positions in the past couple of months.

For more information, click here.

All the best,

Sean