The Doom Loop Comes ’Round Again! Here’s How to Steer Clear

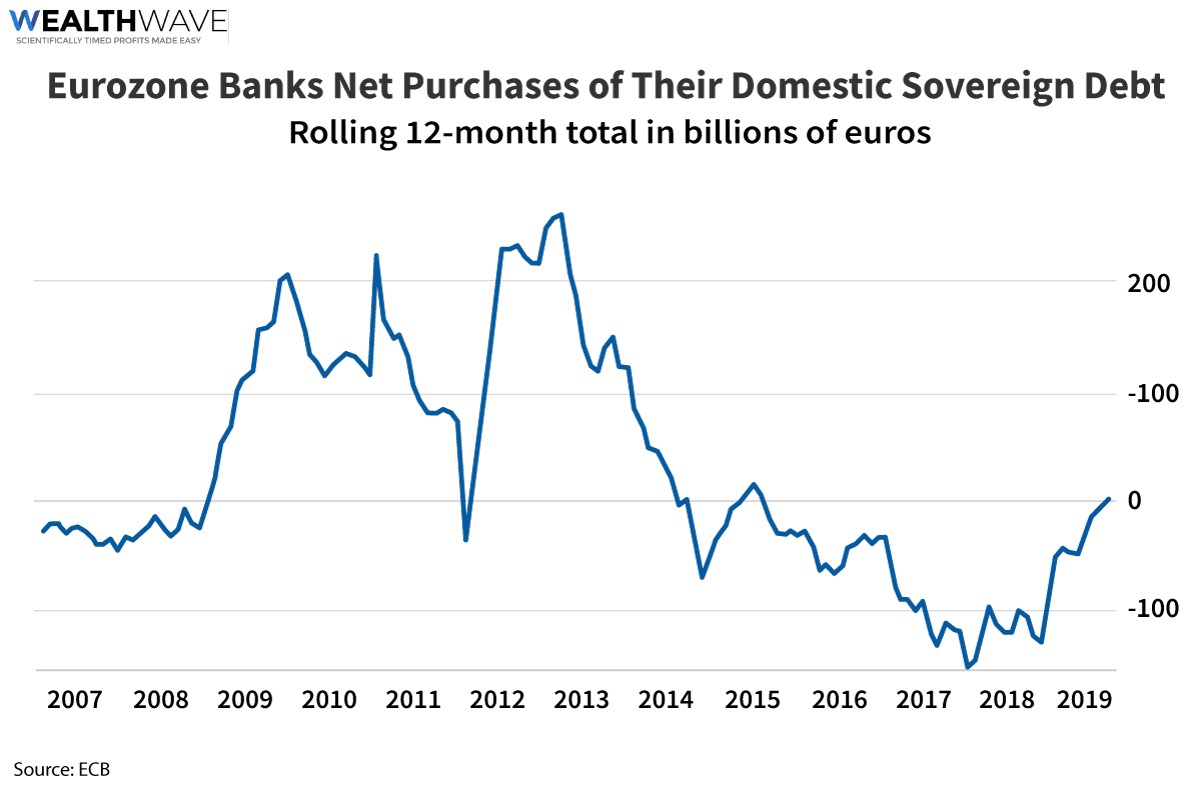

Banks across the eurozone are stocking up on their own governments’ bonds.

Why should you care? In the current economic climate — when the pandemic is kicking one economy after another down the stairs — it raises the odds that we could see a “doom loop.”

A doom loop occurs when banks buy more and more sovereign (government) bonds only for that same government to keep bailing out banks.

This cycle erodes the value of the same government debt that the banks hold. In turn, that means the banks need ANOTHER government bailout.

We saw this during the last financial crisis, as wobbly European states like Greece and Italy teetered on the brink of bankruptcy. Who was going to buy their bonds? Their own banks were already stuffed to the gills.

Italy and other European countries almost crashed and burned in doom loops three years ago. Now, it looks like we’re getting a sequel. And you know what they say about sequels: They’re usually worse than the original.

But wait. It gets worse.

When banks take risks, those risks can get a form of default insurance called credit swaps. Credit swaps allow derivatives traders to hedge or speculate on creditworthiness.

Credit rating agency Fitch downgraded four Italian banks this week. The reason was those banks hold way too much Italian government debt, which they’ve piled up thanks to the financials and economic crises triggered by the pandemic.

Italian banks are vulnerable because Italy is one of the most indebted countries in the world. Italy’s ratio of government debt to GDP is 135%. And it’s getting worse because spending is soaring to fight the pandemic recession just as tax revenues are drying up.

As Italian and other European banks pile up on government debt, the cost of the credit default swaps — the insurance to protect those bets — is rising.

Here’s a snapshot of credit default swaps at big banks across the eurozone.

That trend is up. And that trend is not good in a financial crisis (like we have now).

Things are so bad in Italy, some politicians are talking about issuing mini-BOTs (literally mini “bills of treasury”). These would allow the Italian government to pay off some of the mountain of debt it owes to commercial businesses and suppliers.

That sure sounds like an alternative currency. What would that do to the value of the regular currency? No one knows for sure, but it’s probably not good.

But surely, you might think, the European Union wouldn’t allow the Italians to do that to their common currency. Probably not. So, that would open the door to Italy leaving the European Union.

Do you see how all these threads could unravel?

America Has Its Own Problems

Before we get too smug on our side of the Atlantic, remember, we’ve been long forecasting that troubles around the world would wash up on our shores.

Heck, in Saturday’s column, I showed you how the U.S. government is stacking up deficits from here to the moon.

And it’s likely to get worse before it gets better. If it gets better.

On Wednesday, Federal Reserve Chair Jerome Powell said the Fed and other policymakers may have to use additional weapons to pull the country out of the deepest recession since World War II.

Importantly, Powell said that now is not the time to worry about the deficit.

“Now, when we are facing the biggest shock that the economy has had in modern times, is, for me, not the time to prioritize considerations like that,” he said in a speech for the Peterson Institute.

Powell downplayed the prospects for a quick, “V”-shaped economic recovery and said that the severe effects of the lockdown that has brought the economy to an “abrupt halt.”

Powell’s speech was seen as very “dovish.” In other words, the Fed is likely to damn the debt torpedoes and spend at full speed ahead.

That means the Fed will have to sell a lot more debt. The Chinese aren’t buying anymore; the Russians, neither. That means the big Wall Street banks will have to shoulder the load.

Hm, that could be an awfully familiar situation.

NOW do you see why we should keep a nervous, watchful eye on Europe’s potential doom loop?

How to Invest for This

One investment that went bouncing around on a roller coaster ride after Powell’s speech was gold. While Powell flatly rejected the idea of negative interest rates, his “pull out all the stops” approach to stimulus sounds bullish for gold.

And as I told you Saturday, traders are betting that the Fed will come around to negative interest rates eventually. That would be another boost for gold.

That’s because a long-time knock on investing in gold has been that it offers investors no dividend. Interest rates at or below zero would work to eliminate the “opportunity cost” associated with owning precious metals.

Bottom line: Forget piling up debt to the moon. The U.S., and other governments around the world, are going to pile up debt to Mars.

They’ll electronically print money to do it. And when they print fiat currency, gold shines by comparison. Simply because you can’t print it.

So, yes, gold does have appeal during these troubled times.

Keep your eyes on Europe. Keep your eyes on the doom loop — it’s coming ’round again. Definitely keep your eyes on the Fed.

And keep buying gold.

All the best,

Sean