What if You Could Edit Out Nature’s Mistakes — And Profit From It?

Do you enjoy cheese with holes in it? How about tasty yogurt? There’s a new technology that is safeguarding your ability to enjoy both those things.

While that may sound very niche, this new tech is just starting. It could produce everything from allergy-free foods to greener fuels to making sure your pets don’t have birth defects.

I’m talking about genome editing. It’s used by yogurt and cheesemakers to make sure the bacteria that make those tasty foods aren’t wiped out by viruses. The food makers can literally edit the DNA of the bacteria to make them stronger and your cheese holier.

As I said, this is the tip of the iceberg. Genome editing has the potential to revolutionize modern medicine. Imagine being able to cure any genetic disease by simply rewriting DNA.

It could be like taking a magic eraser to any of the possible problems in a DNA sequence and correcting the problem.

Clustered regularly interspaced short palindromic repeats (CRISPR) is the basis of genome editing technology. CRISPR is the largest segment of the genome editing market and accounted for 40% of worldwide gene-editing revenue in 2017. The technology has allowed scientists to make incredible progress.

CRISPR gene editing involves a process where genetics can be altered using a “cut and paste” approach. It’s essentially a bacterial defense system that can be modified to accurately segment and isolate specific strands of DNA.

It has been used by scientists to make advancements in treating HIV, develop malaria resistance in mosquitos to reduce its spread and even eliminate cancer under certain circumstances.

The best part from an investment standpoint? It’s still in its early stages.

There is tremendous opportunity in the industry to improve the therapies for many of the world’s most terrible diseases, and the flow of capital into the space could bring us substantial profits.

Global genomics is a rapidly emerging market, and the genome editing segment is growing even faster.

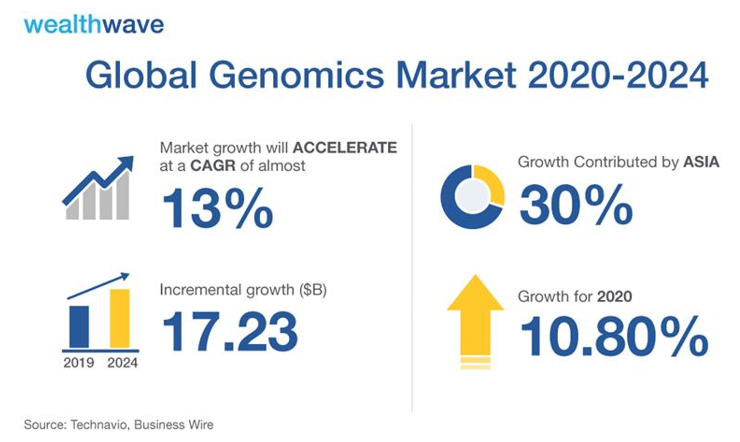

The total global genomics market is expected to increase an average of 13% annually between 2020 and 2024, with 30% of the growth coming from Asian markets. There aren’t that many industries with that kind of red-hot compound annual growth rate (CAGR).

Meanwhile, the total genome editing market is projected to grow at a 23% CAGR from 2021 to 2029, nearly quadrupling to $19.4 billion from $5.1 billion!

North America accounted for the largest proportion of the genome editing industry’s revenue, with 38% last year.

2020 saw promising progress from CRISPR, with its technology used to enhance COVID-19 testing and new associated proteins discovered.

This year should bring even greater advancements as more results come in from clinical trials addressing treatments for blindness, cancers, blood ailments, prolonged infections and protein misfolding.

If any of these trials show positive results, the companies behind them could see enormous growth.

There are many different approaches to play this trend, but here are three of the easiest ways to gain exposure to the future of precision medical technologies.

How You Can Profit

I have a couple of ideas for you: a pair of exchange-traded funds (ETFs) that look to capitalize on advancing healthcare technologies and treatments, but they employ different strategies and coverage areas with minimal overlap in their top holdings.

Pick 1. ARK Genomic Revolution ETF (BATS: ARKG).

ARKG is an actively managed ETF that aims to invest at least 80% of its assets in sectors conducive to the “genomic revolution.” It’s the most mainstream of these funds since its portfolio manager is Cathie Wood, the well-known founder of ARK Invest, an investment management firm with over $50 billion in assets under management (AUM).

ARKG’s investments typically fall under the healthcare, information technology, biotechnology and materials sectors.

The ETF’s top three holdings are Teladoc Health, Inc. (NYSE: TDOC), Exact Sciences Corp. (Nasdaq: EXAS) and CareDx, Inc. (Nasdaq: CDNA).

The fund has an expense ratio of 0.75%, and it currently has over $9 billion under management. ARKG is highly liquid, with an average volume of over 3 million shares.

Pick 2. Global X Genomic & Biotechnology ETF (Nasdaq: GNOM).

GNOM is heavily focused on the gene editing segment of the biotech industry. The fund only includes companies that generate greater than 50% of their revenues from gene editing, gene sequencing, treatment development, diagnostics or biotech. It aims to track the Solactive Genomics Index.

GNOM’s expense ratio is 0.50%, and it has a total of $206 million AUM. Its top holdings include Sarepta Therapeutics, Inc. (Nasdaq: SRPT), Genscript Biotech Corp. (1548: Hong Kong) and Arrowhead Pharmaceuticals, Inc. (Nasdaq: ARWR). GNOM averages 110,000 shares per day.

Let’s look at a performance chart of the pair of these funds:

Wow, you can see these funds have been on a wild ride. They are way off highs hit earlier this year, but they’re starting to rally again. To me, that makes them very attractive at present prices, but be sure to do your own due diligence before buying anything.

Keep these investments on your radar if you’re looking to gain exposure to innovations in healthcare. There could be massive potential.

All the best,

Sean