Are you ready to get rich on the sun cycles?

I’m talking about making money on solar power. Last year around this time, I recommended my premium subscribers buy solar stocks.

They walked away with gains of 104%, 106% and 108%.

This year, we’re buying solar stocks again, and you should, too. That is, if you like money.

I’ll give you some reasons why …

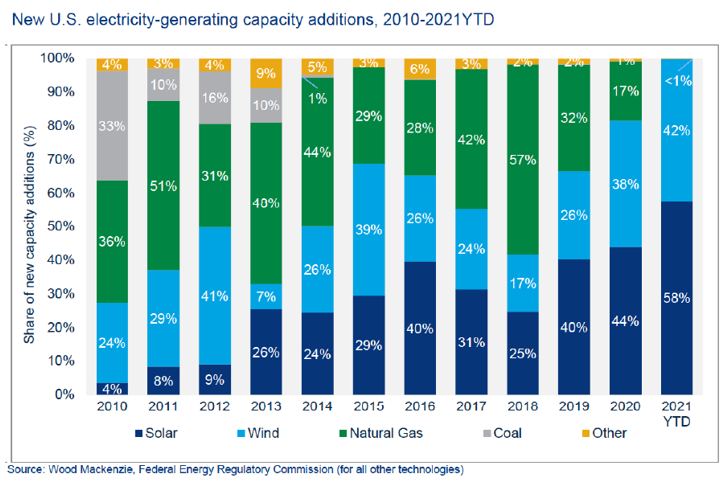

1. Solar power installation is soaring. In fact, solar accounted for 58% of all new electric generating capacity installed in the first quarter of this year.

And that’s just this year, and just in the United States. More than half of all new solar power is installed in China, and the rest of the world is racing to try and catch up.

2. The U.S. solar market is in a massive trend. In fact, the size of America’s solar market passed 100 gigawatts (GW) of installed electric generating capacity in Q1, doubling the size of the industry over the last 3.5 years.

Analysts at Wood Mackenzie forecast that the residential market alone will grow 19% year over year. They also say the solar industry will continue to break annual installation records in the U.S. for at least the next three years … talk about a megatrend.

3. The even bigger growth is in commercial installations. There, the growth rate is forecast to be 20% year over year. And this is contrary to forecasts from just a few months ago.

Why? Analysts were gloomy because the cost of the silicon used in solar power modules is rising, up 18% since January.

But that cloudy outlook passed, offset by lower balance-of-plant costs due to more efficient, bigger solar modules and larger power plant size. As a result, the cost per megawatt continues to fall around the world.

Pity Japan, which has stubbornly high solar power costs (though its costs are falling). The rest of the world has fallen to $51 per megawatt-hour (in Germany) or lower. In the case of the U.S., it’s now $35 per megawatt-hour, according to analysis from Bloomberg New Energy Finance.

4. Tax credits and more! Legislation introduced this week by Sen. Jon Ossoff of Georgia would offer tax credits for individual parts of the solar manufacturing sector. The bill would provide support for each stage of the supply chain, including polysilicon, wafers, cells and modules.

There’s also the potential for solar credits in the new infrastructure bill being debated in Congress.

Add it all up, and the International Energy Agency (IEA) estimates that U.S. photovoltaic (PV) system capacity will double to more than 180 GW by 2025. And the Solar Energy Industries Association raised its target to increase U.S. solar manufacturing capacity tenfold in the next decade, reaching 50 GW of annual production capacity by 2030.

Now, some solar power manufacturers will see margins squeezed by rising costs. Others won’t. Some will be hurt by a proposed U.S. ban on solar panel material linked to forced labor in China’s Xinjiang region.

The biggest gains will be in stocks that can navigate the minefield of potential trouble. Those are the kind I’m recommending to my subscribers.

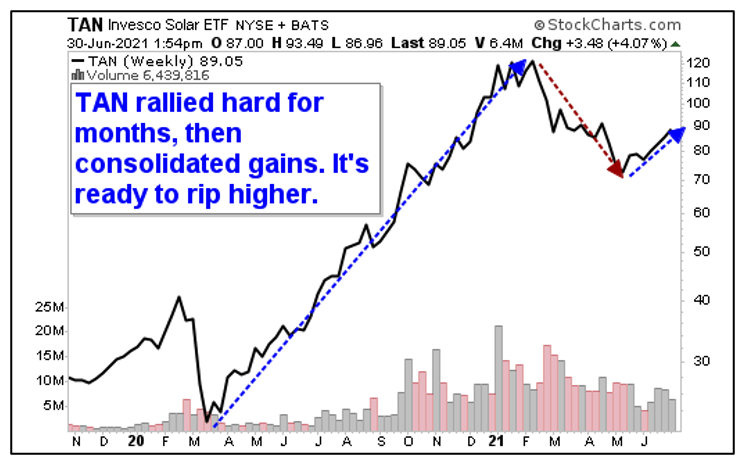

But, if you just want to go on for the ride in the cyclical upswing in solar, you can always buy the biggest solar-focused fund, the Invesco Solar ETF (NYSE: TAN).

TAN is stuffed with some of the best solar names, including Enphase Energy, Inc. (Nasdaq: ENPH), SolarEdge Technologies, Inc. (Nasdaq: SEDG) and First Solar, Inc. (Nasdaq: FSLR). It has an expense ratio of 0.69%.

This fund is primed to shine in the months ahead. Individual stocks could do even better. Whichever you choose, I strongly suggest you don’t miss this opportunity.

All the best,

Sean