Grab the Cloud Because It’s the Future of Big Tech

Big tech companies are taking advantage of one of the hottest emerging industries.

Now, you can too.

I’m talking about cloud service technologies.

Cloud service technologies are essential for economies becoming more digitized, as many companies accommodate shifts to online platforms and remote working.

The cloud computing market is massive and growing rapidly. Grandview Research sees it expanding from a $369 billion market this year to over $1.2 trillion by 2028, which translates to compounded annual growth of over 19%.

There are many different cloud services, as businesses have differing needs, But the most prevalent uses include secure data storage, platform hosting, business analytics and more.

Big tech is seizing a rare opportunity to capitalize on an industry that is both highly profitable and wildly expanding.

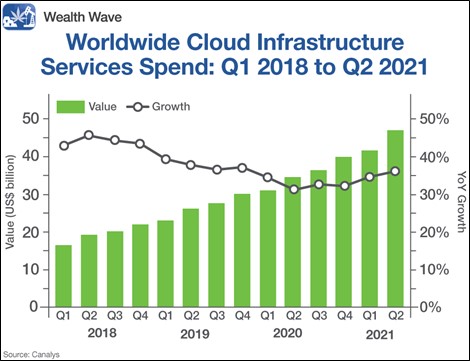

Check out this chart that shows the staggering yearly growth of just the cloud infrastructure segment:

Last quarter, global cloud infrastructure revenues increased 36% year over year to $47 billion! And that’s just one part of the industry!

Cloud services are significant growth drivers for tech giants, and it’s no wonder why analysts have been gauging cloud performance as one of, if the most important, factors when evaluating these companies’ performance during earnings season.

Amazon showed it prioritized the segment over all others when it tapped Andy Jassy to lead the company as CEO after Jeff Bezos stepped down from the role.

In the second quarter this year, Amazon.com’s (Nasdaq: AMZN) cloud revenues jumped 37% year over year to $14.8 billion, which topped the 32% year over year growth that it saw in the first quarter.

Amazon Web Services (AWS) is the company’s most profitable segment, accounting for 54% of its operating income, despite only making up 13% of its total revenues.

And its cloud rival Microsoft (Nasdasq: MSFT) achieved similar excellent results last quarter, with Azure cloud revenues increasing 50%. Its Intelligent Cloud segment as a whole generated $14.6 billion in revenues.

Big tech companies currently dominate the marketplace, but there are many opportunities to find significant growth with smaller cloud providers.

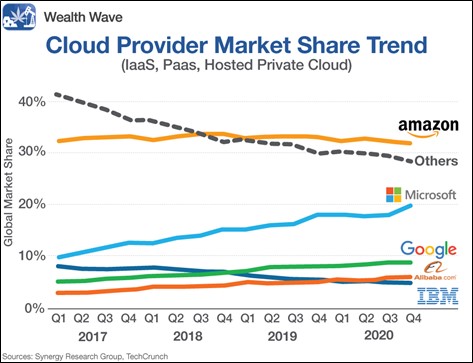

The chart below shows the market share trends for the biggest players worldwide. Note that big tech companies are gobbling up market share, while the total share for other companies has dropped since the beginning of 2017:

The market capitalizations of Amazon, Microsoft and Alphabet (Nasdaq: GOOGL) all exceed $1.7 trillion, and they recognize the importance of the industry for achieving their future growth objectives.

There are many ways to play this trend, but I have an exchange traded fund (ETF) suggestion for you to look into if you’re looking to get broad exposure.

Reach for the SKYY

First Trust Cloud Computing ETF (NYSEARCA: SKYY) is an ETF that tracks the ISE CTA Cloud Computing Index. SKYY has 66 holdings, so it offers broad exposure to the industry. All of its holdings have market caps over $500 million, and average daily trading volume in dollar terms must top $5 million.

SKYY’s top three positions by fund weighting are DigitalOcean Holdings (NYSE: DOCN), Arista Networks (NYSE: ANET) and Oracle (NYSE: ORCL), while tech giants Microsoft, Alibaba (NYSE: BABA), Google and Amazon are all among the top 11.

The fund manages over $6.6 billion in assets, and its average volume is over 235,000 shares. Its expense ratio is 0.60%.

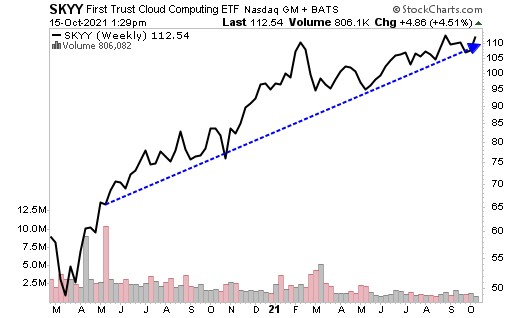

SKYY’s chart shows significant growth since the beginning of the pandemic, but it went through a lengthy period of sideways trading since February. Now that it has regained its momentum, it could blast past its highs.

Of course, always perform your own due diligence before entering a position.

There’s a dreamy future for cloud, and I strongly suggest you look into playing this trend.

All the best,

Sean