For months we heard tales of woe from the oil industry, as the COVID-19 pandemic crushed demand and cratered prices.

But a funny thing happened on the way to the graveyard … oil has bounced back to a one-year high and looks to go higher.

What investors should be asking themselves now is, “Is it too late to buy? And how can I profit from this?”

I have some ideas.

First, what’s driving the rally? A number of forces are converging. Here are the big three …

Force 1: China Leads Oil Demand Resurgence

What shellacked oil prices in 2020 was a drop in global demand, which fell 9%. Now, that’s changing. And China is leading the way.

China’s oil imports are estimated to have jumped by more than 32% in January. This was driven by China’s economic rebound; their economy expanded by 6.5% in the fourth quarter, beating forecasts.

China, which was hit first by the pandemic, has worked hard to get it under control. Its success gives oil traders hope that the rest of the world will follow suit sooner rather than later.

In fact, the Energy Information Administration said in its January Short-Term Energy Outlook that global liquid fuels consumption will grow by 5.6 million barrels per day (bpd) this year, or by 6% compared to 2020, and rise by another 3.3 million bpd in 2022.

Force 2: OPEC+ Production Discipline

OPEC+ is a broad 23-country coalition of the usual oil producing nations in OPEC and their allies in a group led by Russia. Led by Saudi Arabia, these nations have made cuts and are stingy about bringing production back online. OPEC+ is currently withholding just over 7 million barrels of daily output, or roughly 7% of global supplies.

What’s more, Saudi Arabia is tightening supplies further this month and next with a unilateral cut of 1 million barrels a day.

OPEC+ is keeping a sharp eye on the rollout of the COVID vaccine and how the world’s economy responds to an easing of the pandemic. As long as they maintain discipline, that should support prices.

Force 3: Falling Global Inventories

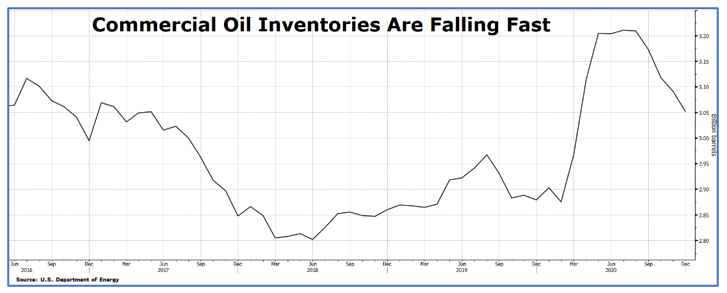

Rising demand and production discipline have led to the most important force in global oil prices — falling inventories in the developed countries of the world.

Those global inventories spiked to more than 3.2 billion barrels in May. But in August, inventories started to decline and are now back around 3 billion barrels and falling.

Here in the U.S., the American Petroleum Institute reported crude inventories fell by 4.3 million barrels last week. That’s the seventh decline in eight weeks.

So Where Will Prices Go?

The EIA expects oil prices to average $50 a barrel through 2022, and we’re already there. But one factor that many in Washington and on Wall Street may not be figuring in is that the pandemic price crunch in oil was devastating for shale oil producers. A lot of that production went away … and it may not come back for a long time.

New drilling won’t offset field decline rates of 6% to 40% per year. And U.S. crude production is down 2.3 million barrels of oil equivalent per day (BOEPD) from its all-time high set in March of 2020, at 13.1 mm BOEPD.

So, my estimate is that oil could comfortably rise into the mid-$60 range this year and may even peak over $70.

That means we have room to run. However, we just had a great long run. So, the next thing I expect is a pullback.

Since I expect oil prices to go higher, that pullback can be bought, leaving one last question: What should you buy?

You can stick with the major oil ETFS, including the SPDR S&P Oil & Gas Exploration & Production ETF (NYSE: XOP) and the Vanguard Energy Index Fund ETF Shares (NYSE: VDE).

But remember, one of the things we like about oil stocks is they can pay fat dividends. And the Alerian MLP ETF (NYSE: AMLP) — which, as its name suggests, holds a basket of master limited partnerships in the energy industry — recently yielded a stunning 11.94%. Not bad! In fact, very nice.

Full disclosure: I own the AMLP in my personal portfolio.

For more outperformance, you can drill down in these funds to find the best stocks. Again, I think a pullback comes next, so whatever you buy — stock or fund — you may want to wait for that if you’re more cautious.

But don’t wait too long.

All the best,

Sean