Hoo-boy! Have you seen the panic attack Wall Street is experiencing over inflation? Higher inflation numbers sent stocks skidding lower. As the prices of everything from homes to steaks to cars start lifting off, investors don’t know what to buy!

Good news: I know what to buy.

You may recall a few weeks ago when I wrote about inflation and the erosion of our purchasing power. I mentioned the March Consumer Price Index (CPI) rise of 0.6%, thanks to a cocktail of supply challenges and pent-up buyer demand.

April’s inflation data was worse. Consumer prices increased 0.8% in April, good for a 4.2% change over the prior 12 months.

The economy has not fully reopened yet, but we’re already seeing prices rise in response to a release of pent-up demand from lockdowns. Add in higher wages and disrupted supply chains … and we have a recipe for inflation hotter than my aunt’s five-alarm chili.

Federal Reserve Chair Jerome Powell says that inflation is “transitory.”

Ha!

If the initial spending from consumers is affecting prices this heavily before a complete full-scale economic reopening, imagine the impact once the economy really opens up.

The Tables Are Turned!

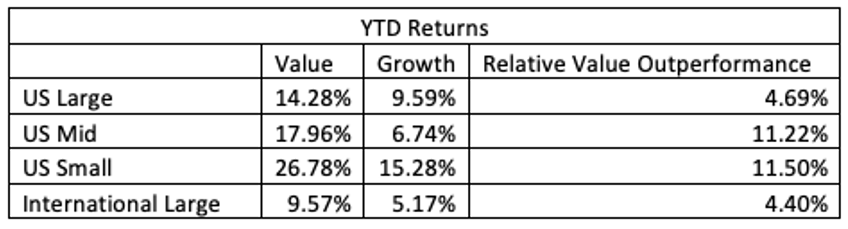

Growth stocks have outperformed value investments over the past decade-plus, but we saw a significant reversal at the beginning of this year due to inflationary concerns.

As shown in the chart below, value stocks of all market cap sizes have outperformed their growth counterparts this year so far through the end of April, and this is likely here to stay for the duration of the inflationary period. With the way governments are printing and spending … it will last a while.

Why Is This Happening?

Inflation. It effectively devalues future cash flow. The further into the future you’ll get that money, the less it is worth now. With value stocks, investors recoup their money sooner than later. On the other hand, growth stocks are long-duration assets — they “grow” into their high price-to-earnings (P/E) multiples. Eventually. Hopefully. The higher inflation goes, the more overpriced growth stocks look.

And that’s why value, which sees investors recoup their money sooner rather than later, shines as inflation heats up.

On April 29, I gave you three ways to protect yourself from inflation: Treasury inflation-protected securities (TIPS), commodity exposure and gold. Then, on May 13, I gave you another idea: dividend growers.

I hope you bought some of those. They’re doing great.

Do you want one more idea? An investment that could race higher and leave inflation in the dust?

Bank on It!

Financials and bank stocks usually have low P/E ratios and price-to-book values, and they can often trade below their intrinsic value. As valuations crunch with higher inflation, these stocks historically perform better.

Bank stocks thrive in an inflationary environment because their net interest margin widens since their cost of borrowing is less variable than the rates they offer as lenders.

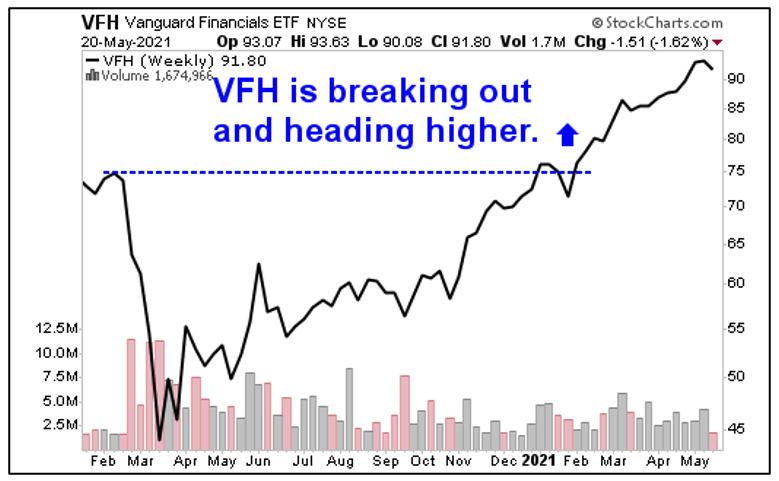

One way to play the banking sector is with the Vanguard Financial Index Fund ETF Shares (NYSEARCA: VFH).

VFH has roughly $10.7 billion in assets under management, and its top holdings include JPMorgan Chase & Co. (NYSE: JPM), Berkshire Hathaway, Inc. Class B (NYSE: BRK.B) and Bank of America Corp. (NYSE: BAC). This exchange-traded fund (ETF) pays a 1.8% dividend yield, and it has a very low expense ratio of 0.10%.

Let’s look at the big trend in VFH by looking at its weekly chart.

Man, what a great uptrend. And you can see that VFH broke out to the upside earlier this year. And it looks poised to potentially go much higher.

Whatever you do, don’t let pesky inflation erode your hard-earned assets. Instead, use it to build greater wealth.

All the best,

Sean