Do This Before You Invest Another Dollar in Oil …

Man, sentiment in the crude oil market turned from bullish to bearish in record time. While we may see a pullback, that will likely be a setup for the next big rally. Let me show you some charts explaining why … and how you can profit.

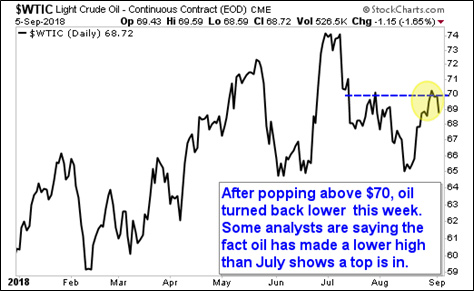

First, yeah, we did see oil put in a short-term peak this week.

Wednesday saw crude tumble the most in three weeks. Fears of trade wars are casting gloom over the oil market. Meanwhile, in July, U.S. crude oil production hit 11 million barrels per day. This was the first time that ever happened!

And then, when oil inventories in Cushing, Okla., rose by an estimated 600,000 barrels last week — well, oil went for a slide.

The bears are figuring that trade tiffs will get worse before they get better. They also figure that a build in supplies is going to continue.

Let me change your mind about that with the next couple of charts …

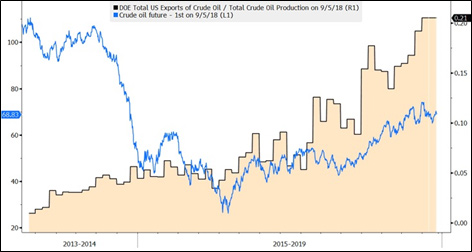

First, U.S. crude oil exports hit an all-time high of 2.2 million barrels per day in the latest count from the Energy Information Administration. Check out this EIA chart …

Holy oil gusher, Batman. Look at that rocket launch!

And slowly, those exports are taking up a bigger and bigger share of total U.S. crude oil production. Here’s a chart I made on my Bloomberg terminal …

The blue line is the price of oil. The tan section is the percentage of U.S. oil production that is exported.

The fact is, 21% of all crude oil produced in the U.S. is now exported. That’s way, way up from 5% a few years ago.

So, America is producing more oil. But we’re exporting more of it, faster!

Meanwhile, the leading provider of oilfield services has an opinion about production in the Permian Basin. You know — the area where most of America’s oil shale growth is coming from. In fact, 60% of the growth in oil production comes from the Permian.

Schlumberger’s CEO Paal Kibsgaard published a transcript of his prepared remarks on the company website ahead of a presentation in New York. In it, he said,

“The well-established market consensus that the Permian can continue to provide 1.5 million barrels per day of annual production growth for the foreseeable future is now starting to be called into question.

“In fact, so far in the third quarter, the hydraulic fracturing market has already softened significantly more than we expected in spite of the overall rig count holding up relatively well.

“We continue to believe that our industry is set for a multi-year global growth cycle.”

So, just to sum up:

• America is producing more and more oil. But a lot of that growth is from the Permian.

• The growth rate in the Permian can’t continue at this rate. Production there may even fall sooner than many think.

• America is exporting more and more oil, finding new markets in an oil-thirsty world.

This tells me that, while oil prices have peaked, it’s just a short-term peak. What smart investors should do is make a shopping list, then buy with a vengeance at the next bottom.

And that bottom could come sooner than later.

What would qualify a stock for that shopping list?

• For producers and explorers, I want stocks that are growing their reserves and production, while keeping a lid on costs.

• For oil services stocks, I want those companies with expanding operating margins.

It’s that simple. You’ll find some great candidates in leading holdings of the SPDR S&P Oil & Gas Equipment and Services ETF (NYSE: XES) and the Invesco S&P SmallCap Energy ETF (Nasdaq: PSCE).

Make no mistake — I think many of these stocks have lower to go. And that’s great. We’ll be able to buy them cheaper.

Because when that bottom comes, these stocks could boomerang higher.

Sentiment in oil stocks is bearish now. It will turn bullish again soon enough. Keep your shopping list handy, and be ready to wave buy-buy-buy at the bears in the rearview mirror when the bottom comes.

Al the best,

Sean