The rollercoaster ride from hell going on in the stock market is hiding a big move by uranium. Few investors know about it. And this rally isn’t just big, it’s probably going to get much bigger.

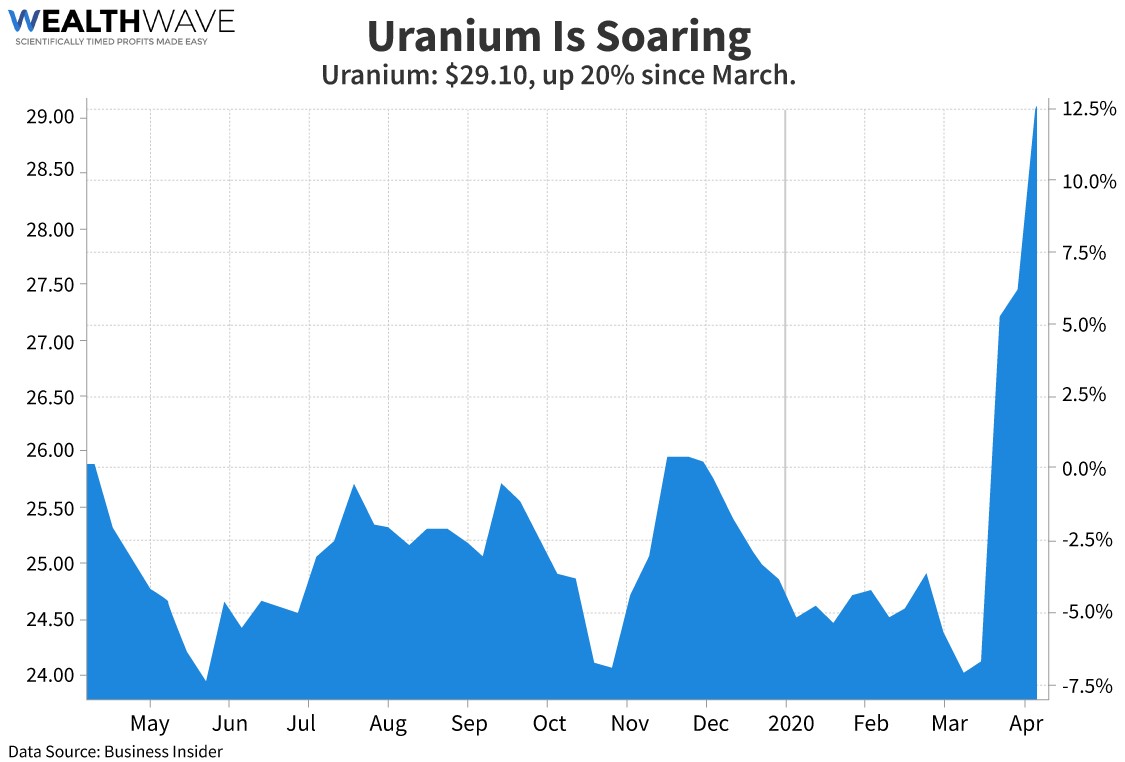

Here’s a chart of uranium over the last year.

Holy Geiger counter, Batman! What the heck is going on? Why is uranium up more than 20% from its March low?

I’ll tell you what’s going on. It’s another consequence of the COVID-19 pandemic, which is acting like igniter fluid for long-term bullish forces.

The outbreak is leading to a supply/demand squeeze that will keep this market hot for a while.

How? Let’s start with supply …

First, thanks to the spread of the virus, the African nation of Namibia halted all mining activity. Nambia is a key supplier to China’s huge and growing nuclear industry.

Then we saw Cameco (NYSE: CCJ) take the world’s biggest uranium mine, Cigar Lake, offline for a month.

Related post: 5 Reasons Uranium is 2020’s White Hot Opportunity

Finally, Kazatomprom, the state mining company in Kazakhstan, slashed its 2020 production forecast by up to 10.4 million pounds. That’s equivalent to 8% of global supply. Why? Because the government is taking steps to mitigate the spread of the coronavirus.

All in all, between 30% and 35% of global uranium production has now been affected by virus shutdowns. So, it’s a good ol’ fashioned supply squeeze. And tighter supply will squee-eeze prices higher, as we’re seeing now.

But that’s a short-term squeeze. What about longer-term? Well, more and more countries are building more and more nuclear power plants. There are 10 new atomic power plants coming online around the world this year alone, and three of them are in China.

Now, let’s move to demand.

Annual global demand for uranium is currently 150 million pounds. About 85% of that is met through long-term supply contracts.

But for years, utilities found they could just buy it cheaper in the spot market. As a result, they have left more and more of their required uranium demands uncovered.

This means 37% of U.S. power utilities’ uranium demand is uncovered for 2022. That represents about 9% of global demand.

That’s according to market analysts at Red Cloud data, who add: “We forecast a historical supply deficit opening up in the next decade, starting at 31 million pounds in 2022 and rising to more than 100 million pounds by 2034-35.”

So, COVID-19 may be the spark for higher uranium prices. But this long-term supply demand/ will be what keeps prices rising even after the health crisis passes.

The Global X Uranium ETF (NYSE: URA) is one way to play this move. It’s up 38% from its March lows. Individual stocks could offer more potential.

All the best,

Sean