With the election in the rear-view mirror, gold is heating up, logging its biggest weekly gain since July. And gold mines are rising even faster.

That’s EXACTLY what’s supposed to happen in a gold bull market.

So, what should you buy?

I think we are quickly coming to a period of outperformance by explorers and developers. There’s a reason why: Mergers and acquisitions. That will be driven by big gold miners’ hunger for more deposits.

As I told you in my Oct. 10 issue, due to underinvestment in exploration across the industry — and no major new discoveries in the last three years — the average mine life across the gold mining sector has dropped from 20 years to closer to 10 years.

But even though gold prices are rising now, big miners aren’t spending more on exploration — they are spending less. That’s because the share prices of explorers, developers and small miners are so beaten down, it’s easier to buy those assets than it is to discover them.

We just saw this in the recent deal between Yamana Gold Inc. (NYSE: AUY, Rated C+) and Monarch Gold Corp. (OTCQX: MRQRF, Rated C). It’s a friendly merger that will allow Yamana to acquire Monarch’s Wasamac gold project and the Camflo property and mill for $116.7 million in cash and shares.

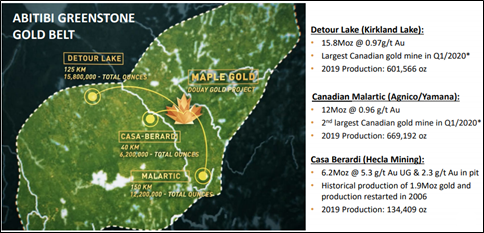

Yamana says the Wasamac gold project, which is in Quebec’s Abitibi region about 100 km from its 50%-owned Canadian Malartic mine, fits well into its exploration and development strategy.

Canadian Malarctic is that country’s largest gold mine. The other half is owned by Agnico-Eagle Gold Mines Ltd. (NYSE: AEM, Rated B-).

To which I say: “Very Interesting!”

Because also in that Oct. 10 issue, I profiled another explorer that is in Quebec’s Abitibi. And it just got a big investment from a big miner, too.

That small explorer is Maple Gold Mines Ltd. (TSX-V: MGM; OTCQB: MGMLF, Rated D). The big company is Agnico-Eagle Gold Mines. The two companies are entering a joint venture which will combine Maple Gold’s Douay project with Agnico Eagle’s neighboring Joutel project. Agnico Eagle has committed to spending a big chunk of money drilling the new combined project as well.

Indeed, if geologic trends were combustible, the Abitibi Greenstone Belt would be on fire, it is so rich with projects and so hot for deal-marking right now.

I found this so intriguing that I called Maple Gold’s CEO Matthew Horner on Monday.

Now, I own Maple Gold shares. And I’ve recommended this stock to my Gold & Silver Trader subscribers — twice. Since I mentioned it in the Oct. 10 issue, Maple Gold’s share price is up 106.9% in less than a month! So maybe I’m not impartial.

But I know a project with incredible upside potential when I see it.

On Monday, Matthew didn’t talk too much about what the company is doing. Most of that is confidential right now. Instead, we talked about the price of gold.

Matthew expects to see $2,500 gold in the near future. He sees this as a result of central banks around the world printing money like crazy. He said while you can shift the electronic printing presses into high gear, “you can’t switch on 900 gold mines to produce gold.”

That lines up with my view. So, naturally, I think he’s very smart.

Matthew also thinks the next leg higher in gold miners — not just the metal, but the miners — has already started. Producers are getting attention, as it should be, he said. But he expects money to move into explorers soon enough.

And he brought up the Yamana Gold/Monarch Gold deal. He says it shows that M&A activity is starting to heat up in the precious metals sector, and particularly in that part of Quebec.

Now, one thing Matthew and I have talked about is that though his company has made a joint venture deal with Agnico, more deals could be done. Specifically, a lot of the big miners might be kicking themselves right now for not doing a deal with Maple Gold Mines first. But their second-best choice would be to buy out Maple Gold and become Agnico’s partner in the joint venture.

Matthew says he’ll put up a fight if they try because he wants to unlock the true value in his company. In other words, get it to a much higher share price.

In our chat on Monday, Matthew added that he expects to see drill results from the Douay Project before the end of the year. That could get the stock rerated — higher — and bring in more interested buyers.

In my Nov. 5 issue, I told you about two more gold explorers — American Pacific Mining Corp. (OTCQB: USGDF, Rated D) and Eclipse Gold Mining Corp. (TSX-V: EGLD; OTC Pink: EGLPF, Rated E). Both of them have had a good week.

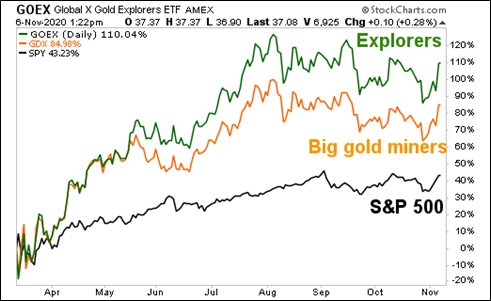

Indeed, since stocks and gold bottomed after the March liquidity crash, explorers have outpaced big gold miners — which in turn is leaving the S&P 500 in the dust.

Here’s a chart comparing Global X Gold Explorers ETF (NYSE: GOEX, Rated C), the VanEck Vectors Gold Miners ETF (NYSE: GDX, Rated C) and the S&P 500 (Rated C).

You can see the S&P 500 is up 43.2% since the March lows. Not bad. But the GDX is up 84.9%. And the GOEX, with its basket of explorers, is up 110.04%. Nice!

To me, it sure looks like all the pieces are coming together. We are entering the next phase of the gold rally. Miners are riding that rally. And explores are outperforming, as big miners scoop up the smaller companies for their assets.

You could consider one of the small explorers I mentioned here — I believe they still have enormous upside. Or perhaps you prefer less risk and lower returns of the GOEX.

Either way, you’ll likely still run rings around the broad market. The future looks golden!

All the best,

Sean