NIMBY Accelerates the Coming Lithium Supply/Demand Squeeze

I’ve been moving my paying subscribers into lithium-leveraged plays because:

A) Those stocks are doing well.

B) There’s some very favorable math falling into place for this industry.

The fact is, demand for lithium and other battery metals is projected to accelerate over the next decade as demand from electric vehicles (EVs) and battery storage hits overdrive.

Wall Street analysts are now predicting that 75% of all mined lithium could go to electric vehicles by 2025. EV manufacturers can see a supply squeeze looming. So, they are buying up existing stockpiles and signing contracts to lock in future supply.

Morgan Stanley (NYSE: MS) expects lithium supply to remain tight for at least the next two years. There are as many different forecasts as there are analysts, but this projection from UBS Group AG (NYSE: UBS) is in the middle of the pack …

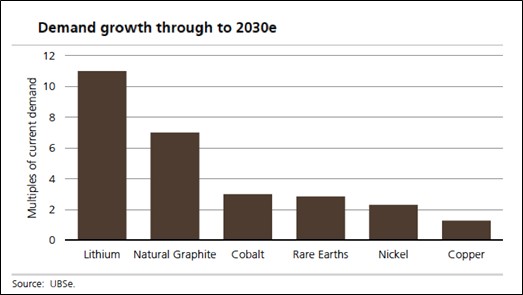

UBS expects overall lithium demand to increase elevenfold through 2030. That’s fueled by an EV adoption rate that UBS projects will increase to 20% by 2025 and 50% by 2030. These are all higher numbers than UBS projected just a year ago.

At the same time, graphite demand should increase sevenfold, and demand for other battery metals will also accelerate.

Which brings me to my big question: Where is it all going to come from? Because if recent news is any clue, a lithium mine is a tough sell in some districts.

America NEEDS more lithium production … but no one seems to want a lithium mine in their backyard.

Here’re three examples …

1. Piedmont Slow-Walks Its Permits

Piedmont Lithium Inc. (Nasdaq: PLL) wants to build the largest lithium mine in the U.S. as part of its deal to supply Tesla, Inc. (Nasdaq: TSLA) with lithium sourced from Piedmont’s deposits in North Carolina. It seems the company’s community relations are falling a bit short.

By that, I mean, according to a recent Bloomberg report, Piedmont “has not applied for a state mining permit or a necessary zoning variance in Gaston County, just west of Charlotte, despite telling investors since 2018 that it was on the verge of doing so.”

Considering that Piedmont wants to build an open-air pit more than 500 feet deep and chemical facilities, it’s unlikely its plans will be rubber-stamped. The community is going to want input.

“This has been the worst rollout of a project from a company I’ve ever seen,” Chad Brown, a commissioner who opposes the mine, told Bloomberg.

Piedmont says it wanted to make sure it had the Tesla deal in its pocket before proceeding with permitting plans. And these obstacles aren’t insurmountable. But there could very well be delays.

2. Quebec Lithium Projects Hits Rocks of Local Opposition

Sayona Québec, a unit of Sayona Mining Ltd. (OTC Pink: DMNXF), wants its Quebec project to be the next lithium producer in Canada. And it spent $94 million purchasing assets, including a chemical plant, that belonged to belly-up North American Lithium. Sayona aims to start producing lithium by early 2023.

However, Long Point First Nation has called for an immediate halt to Sayona’s exploration of its Tamsim Lithium project. The reason, according to the tribe, is that the local area, Anishnabeg, is “unceded ancestral territory.”

Basically, the tribe says they hunt and fish in the area, and they have real concerns about the effect a mine development near a local lake will have on local fish and game.

By the way, Sayona is partially owned by Piedmont, which must be busy hiring lawyers and community relations types. Also, Quebec is where Nemaska Lithium went belly-up after delays forced insurmountable cost overruns.

3. Grousing About Mine Development

Lithium Americas Corp. (NYSE: LAC) is chomping at the bit to build its Thacker Pass project in Nevada. Like Piedmont’s project in North Carolina, Thacker Pass could become one of America’s biggest lithium mines … but there’s a problem.

Environmentalists sued to block the proposed lithium mine, arguing that it could threaten the habitat of the sage grouse.

We’ll know how this is going by July 29. That’s when a federal judge, Miranda Du, says she will determine whether excavation work at the mine site should first be blocked while she considers the broader question of whether approval should have been issued in the first place.

Also, Thacker Pass has ancestral claims from at least five local tribes, some of whom oppose the project for one reason or another.

Bottom line: It takes years to build a mine. Even if all the projects I listed above are successful, it’s likely that local opposition — the NIMBY (not in my backyard) effect — will likely cause delays. And for small companies, expensive delays could be fatal.

And these three examples are just a sampling of lithium mines facing opposition, higher taxes or other potential setbacks.

That makes me think that lithium prices will squeeze higher, faster than Wall Street expects. And those companies that ARE able to produce lithium could see their share prices on the launch pad.

An easy way to play this is with the Global X Lithium & Battery Tech ETF (NYSE: LIT). It holds a basket of the best lithium names, and it’s already shifting into higher gear …

If you’re doing this on your own, do your research before buying anything. But the trend in lithium is strong, and share prices most likely will be, too.

All the best,

Sean