The price of crude just hit a 4-year high, and oil traders are starting to talk about $100 oil. Normally, this is where I would start selling. But one chart keeps me in the bull camp.

I mean, OPEC is the world’s “supermarket of crude oil,” right?

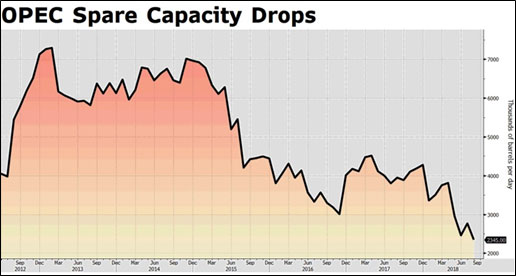

Well, the supermarket’s shelves are shockingly empty. Here’s a chart I snagged off my Bloomberg terminal …

According to a spokesman for the Organization of Petroleum Exporting Countries, via Bloomberg, OPEC’s spare capacity has dropped to 2,345,000 barrels per day. That’s not that much. It’s roughly equal to the daily exports of Iran, Kuwait or Nigeria.

And that’s OPEC’s official number. It’s not like they let you check. Others put total spare capacity lower. Some as low as 900,000 barrels per day.

Let’s say something goes wrong. Say, civil war in Nigeria impacts exports, or any of another crises that could be hidden in the dark depths of the oil fields. Well, with OPEC’s spare capacity so tight, that’s when prices could go KA-BOOM!

In other words, the next supply disruption could be rocket fuel for oil prices.

The supply demand squeeze is getting serious as President Trump’s new sanctions on Iran kick in. Iranian exports will fall by about 1.5 million barrels per day; only China and India will keep buying in defiance of U.S. sanctions. That means other buyers must find other sources.

That’s the headline reason anyway. The underlying reason is good ol’ tightening global supply and demand. On the supply side, output in Venezuela is slumping due to that country’s spiral into socialist oblivion. Libya’s output is struggling, too. On the demand side, more and more people around the world want to drive like those car-crazy Americans.

Commerzbank analysts recently said, “OPEC currently has just enough oil to meet global demands without Iran’s supply.” However, the international oil body’s spare supplies are limited and “will not be enough if supply is additionally reduced by outages elsewhere.”

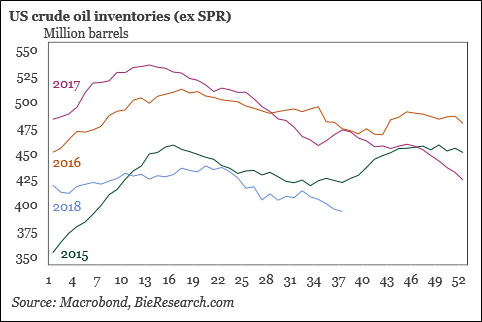

Meanwhile, U.S. oil inventories are well below recent years. Here’s a bonus chart showing U.S. inventories this year compared to previous years.

The 2018 line is the blue one that ends halfway across the chart. As you can see, it’s low. And getting lower. Commercial crude oil inventories fell by 2.1 million barrels in the most recent week.

So, could prices hit $100 per barrel? Definitely. Heck, they could even spike higher.

The Big But!

But — and this is important — even if oil prices did spike to $100, I don’t think they’d stay that high. For one thing, President Trump would probably tap into America’s Strategic Petroleum Reserve sooner rather than later.

For another, as prices go higher, peoples’ driving habits will change, and that will weigh on demand. That, in turn, will bring demand more in line with supply.

There are plenty of ways to play this. The iShares US Oil & Gas Exploration and Production ETF (NYSE: IEO) is one example …

After tracking sideways since May, IEO is breaking out the upside again. This kind of breakout gives us a price target of $89.

It’s not a long-term play. As I said, oil prices will top out. But it could add some rocket fuel to your portfolio in the short term. If you’re in the bull camp on oil, you might want to start loading that rocket.

All the best,

Sean