The One Chart That Shows Why Gold MUST Go Higher

The share price of Barrick Gold (NYSE: ABX) is up nearly 10% since it announced a takeover of Randgold (NYSE: GOLD) in a share-for-share deal valued at $6.5 billion. This means a lot more shares of Barrick will be issued.

On an ordinary day, that dilutive news might make Barrick’s share price go down. But it’s going up. Why? I have the answer to that billion-dollar question.

Answer: Because “mining” for more gold ounces through mergers is now a heck of a lot cheaper than actually prospecting for them.

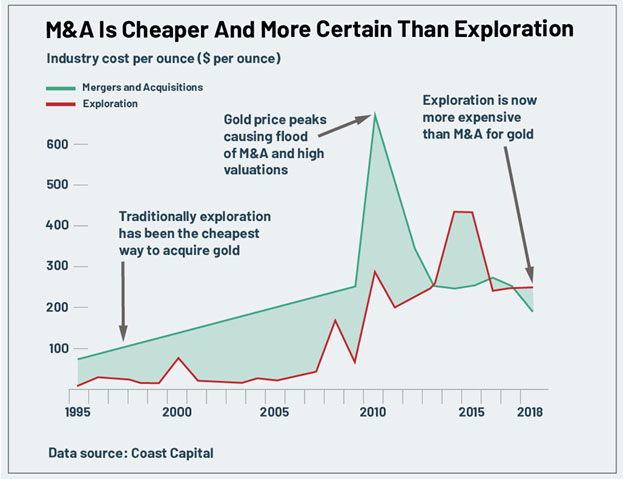

Indeed, the cost of finding an ounce of gold through exploration has risen eight-fold since 2007. And as this chart from Coast Capital shows, that puts it above the price of acquiring that same ounce through buying another company.

How is this possible? Because gold miners have been beaten down into the dirt. And gold is so cheap, nobody wants to spend a lot of time and money looking for it.

That means gold miners are using up the resources in the ground. I mean, gold isn’t a renewable resource. That’s why Barrick bought Randgold. Barrick’s gold reserves fell by 25% in the last year alone!

Barrick could go look for new gold deposits. Or it could just buy those gold ounces for less. Which is what it did. And that’s why investors are rewarding the company by sending its share price higher.

That’s all well and good. Now, let’s take the next step. I’ll show you why gold miners aren’t just cheap — they’re dirt-cheap! Let me give you a bonus chart that shows what I mean …

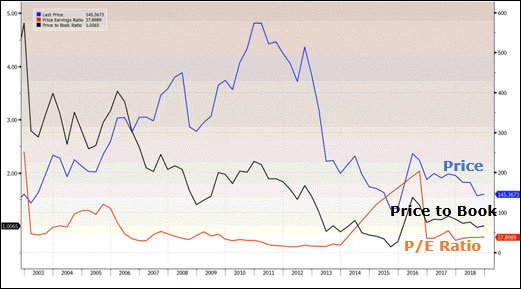

I made this chart of the Gold Bugs Index — a basket of leading miners — on my Bloomberg terminal.

Sure, the price of this gold-mining index is cheap. It’s down about 28% this year. And there’s only one time that miners have been this discounted, price-wise, since 2002. And that was in the depths of the bear market in late 2015.

But that’s just the beginning. I’ve added the price-to-book (or P/B) ratio and the price-to-earnings (P/E) ratio.

Price-to-book is what a company is worth compared to its assets. The companies in the Gold Bugs Index average a P/B ratio of 1.0065. Again, the only time gold miners were cheaper on this basis was in the depths of the bear market in 2015.

That’s getting to be a familiar refrain, eh?

Now, let’s look at price-to-earnings. On this basis, gold miners are as cheap as they’ve EVER been!

That’s because surviving gold miners are becoming lean, mean, digging machines. They’ve cut all the fat. The good ones are making money, even at today’s prices.

And when prices go higher, well — select miners will see their profit margins widen like the Grand Canyon.

And that brings me to my next point. So many people want to believe they are value investors. They “buy stocks when they’re cheap,” right?

But precious metals is one of the most hated industries around. It’s about as popular as a leper at a nudist colony.

And that is weird, since these charts show that gold prices can’t stay this low. They MUST go higher.

If that doesn’t happen soon, some gold miners will go out of business. Others will consolidate in a frenzy of M&A activity, because, again, it’s cheaper to acquire ounces through mergers than actually discover them.

If companies go out of business, and the only “new” gold ounces come through acquisitions, that means gold supply will go down. And as surely as dawn follows night, prices will go up.

It seems pretty win-win to me. That’s why I’ve given subscribers hot new picks in this industry. The disconnect in mining pricing can’t last. That dawn is coming. It’s time to rise and shine.

All the best,

Sean

P.S. Do you like the HOTTEST mining picks? Now, you can get the inside scoop. And you can do that by attending the New Orleans Investment Conference. This is an excellent conference. Doug Casey, Rick Rule, Brien Lundin and many other razor-sharp investors will share their insights with attendees. And I’ll be there — with my hottest picks. If you want to find more about it, CLICK HERE. And I hope to see you there.