Overlooked Investment Finally Getting its Turn to Shine

In a gloomy market that can’t seem to catch a break, there is one patch that shines brightly: gold. As I told you Saturday, gold recently marked its highest close since July. But you know what? There’s one investment that is outshining gold. One you should consider buying right now.

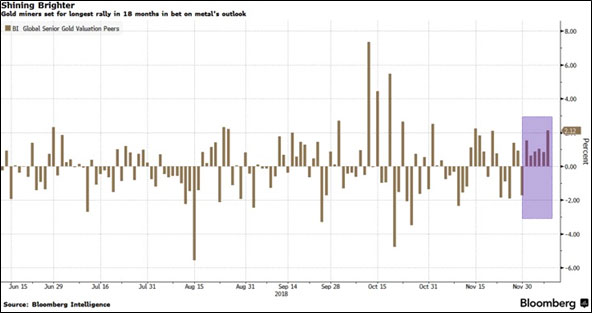

I’m talking about gold miners. Gold miners as a group recently headed for their longest rally in 18 months, as you can see from the Bloomberg chart below …

Why is gold shining so brightly? Take your pick — stock markets on the Slip ‘N Slide of doom … worsening trade tensions between the U.S. and China … a U.S. dollar buckling under the pressures of soaring debt … a messy Brexit that threatens to tear Europe apart … and more.

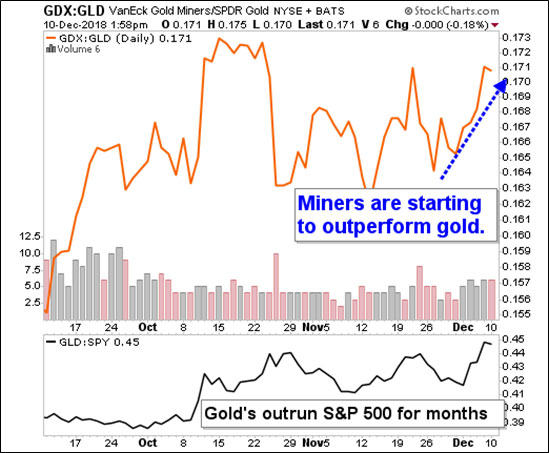

Gold is often considered the best of the “safe havens.” That’s why it has outperformed the S&P 500 for months. And now … now we are seeing gold miners outperform the metal itself.

When the miners outperform the metal, that means investors are turning more bullish on both. This is because miners are leveraged to the underlying metal. As investors become more bullish, they buy the more speculative, leveraged instruments.

Sure, the stock market as a whole seems to be sliding into a bear market. But there is always a bull market somewhere. And that bull market now is in precious metals miners.

You can play this with the VanEck Vectors Gold Miners ETF (NYSE: GDX). It’s a basket of leading miners. But for real outperformance, you’ll have to roll up your sleeves, do the research and buy individual miners.

I’ve recently given my Supercycle Investor subscribers a pair of gold miner picks — picks that will ride this next rocket of a rally. If you’re doing this on your own, be careful. But don’t sit this one out.

All the best,

Sean