A Pair of Tiny Gold Explorers with Huge Potential

Gold seems to be finding firmer footing, and gold miners are already surging higher. And this week, I talked to the CEOs of two excellent gold explorers.

I’ve already shared them with my Gold & Silver Trader subscribers. In fact, they own one of these stocks already.

American Pacific

On Monday, I talked to American Pacific Mining Corp. (OTCQB: USGDF, Rated D). It’s a tiny company with a market cap of just $10.3 million. American Pacific’s CEO Warwick Smith and President Eric Saderholm gave me the scoop on the latest drill results from Rio Tinto Group (NYSE: RIO, Unrated). Rio is drilling American Pacific’s Madison Copper-Gold Project in Montana as part of a joint venture.

Rio Tinto must spend $30 million to earn up to 70% of the project. They are drilling a dozen holes right now, and the results on the first hole came in. It’s a good one!

Rio reported 23.61 meters grading 2.9% copper and 1.7 meters grading 69.4 grams per metric ton of gold. So, there’s 2.2 gold ounces in every ton of rock. That is RICH rock. The hole also extends mineralization in the structure down about 30 meters.

Warwick told me that another eight holes are waiting to be assayed, and the results should be out in 10 to 14 days.

And the company has more news. Its Tuscarora Gold Project in Nevada also has a partner, Elko Sun. Elko Sun can earn a 51% interest in the Tuscarora Gold Project by spending a little more than $3 million. Elko is a private company, but it’s going public through a vehicle called Soldera Mining Corp. (CSE: SOLD, Unrated), which is listed on the Canadian Securities Exchange.

American Pacific is going to get a bunch of Elko/Soldera shares as part of the deal. So, that’s like putting more money in the company coffers. Elko is going to drill 3,000 meters at Tuscarora over the next year.

This is all excellent news. Now, let’s look at the weekly chart …

You can see the stock was in a big downtrend. It broke that downtrend in March. It has spent the past four months digesting gains. Volume is improving.

A parade of news on the Madison Project — plus whatever else the company comes up with — could send this stock much higher. It looks like the market is in a “show me” mood on this stock. More drill results could change that, and for the better. You can see the full American Pacific Mining presentation HERE.

Eclipse Gold

On Tuesday, I sat in on a presentation for Eclipse Gold Mining Corp. (TSX-V: EGLD; OTC Pink: EGLPF, Rated E). The company has a market cap of $28 million and the presentation was given by CEO Mike Allen. I own shares of this stock.

Mike had great success with another gold company, Northern Empire, that was sold to Coeur Mining, Inc. (NYSE: CDE, Rated D+) for $117 million. It made my subscribers a nice chunk of money. Now, he and the Eclipse team are working on advancing the Hercules project in Nevada.

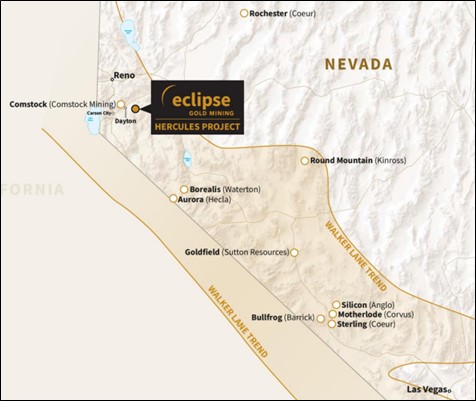

Hercules is on the prolific Walker Lane Trend. It’s “elephant country” is the kind of place where big, even really big, deposits are found.

Mike says the area around Hercules is so good — “Mineralized outcrop literally as far as I could see” — that the first time he saw it, he was moved to expand the land package from 10 square kilometers to 88 square kilometers.

Now, here are some of my notes from the call …

- Two drill rigs are going on the property. The samples from a dozen holes are already in the lab, and results should come out soon.

- Grade is strengthening as the exploration team moves south in the system.

- A property-wide airborne survey should be completed any day now. My experience is this could reveal even more targets.

- Hercules is on a hill, which should lower the strip ratio, or the amount of ore that must be moved to get to the ore, if this project is turned into a mine.

The upshot is Mike believes Hercules is a district scale, gold system with the potential for a low-strip open pit mine. Drilling will prove if he’s right. A big plus is that the project is in Nevada. It’s one of the best places in North America to develop a mine.

Still, the market hasn’t woken up to Eclipse’s potential yet. That’s okay.

Heck, if it continues to drift sideways while gold wakes up again, I may buy more.

You can see the full Eclipse Gold Mining presentation HERE.

Two Great Prospects

I like both companies, but it’s tough to buy anything in this roller coaster market. You can certainly buy pullbacks. However, if you’re in a more speculative frame of mind, buying good stocks that are already running is also a good move. Just don’t chase a stock by buying it all at once. Use the “salami” method, taking it a slice at a time. That way, you’re in it, and if it pulls back, you can pick up more at a better price.

I hope you found these interviews as illuminating as I did. M&A in the mining space seems to be heating up. Great projects will be scooped up by the big guys and we’ll try our darndest to get there in front of them.

All the best,

Sean