There was talk of a “blue wave” and a “red wave” in the recent election. However, the real news is the “green wave” that advanced cannabis legalization across America. And that’s just one of the forces powering up pot stocks right now.

Let’s talk about the election results first. Voters in New Jersey, Arizona, Montana and South Dakota all legalized recreational cannabis. South Dakota also approved a medicinal marijuana program on top of recreational. Meanwhile, Mississippi voters approved a purely medicinal marketplace.

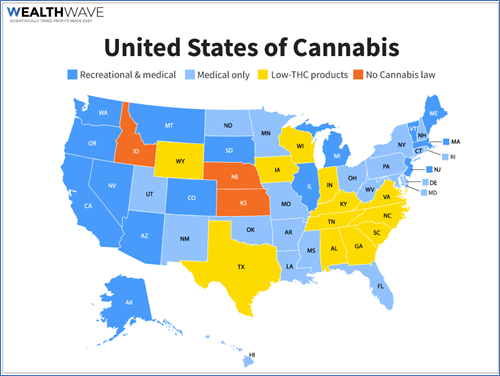

That, combined with previous legalization efforts, gives us a U.S. map that looks like this …

A total of 15 states have now legalized adult-use, recreational marijuana. Add in those states that allow medical marijuana use, and that’s a total of 36 states with some form of legal marijuana. Those states contain 70% of the U.S. population.

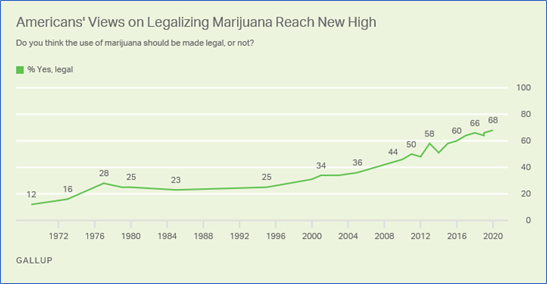

No wonder! Marijuana is more popular than ever according to the latest Gallup Poll. Here’s a chart from Gallup’s website …

That’s from a poll conducted before the election, between Sept. 30 to Oct. 15 poll. And it’s across the age spectrum. A whopping 55% of people 65 and older support legalizing marijuana.

And that’s for recreational marijuana. When asked about medical marijuana in another poll by the Pew Research Center, a whopping 91% of Americans approve legalization.

One of the most important states to legalize is New Jersey. As I explained in an Oct. 24 issue, that’s because New Jersey is next door to New York. And New York is not going to sit on its hands and watch New Jersey rake in all that sweet green tax money. Sure enough, New York is now moving ahead with plans to legalize in April.

As I said, that’s only one of the drivers for cannabis profits

What Will President-elect Biden Do?

Joe Biden won the Presidential election. Both he and Vice President-elect Kamala Harris have both publicly voiced support for marijuana decriminalization.

That’s nice, but that’s not what America’s cannabis multi-state operators (MSOs) need. What might help is rescheduling.

Thanks to the “reefer madness” hysteria of the last century, cannabis is a Schedule 1 drug, along with heroin. That means no medical value, a high potential for abuse and illegal in all circumstances. That’s insane.

Since the Drug Enforcement Administration is part of the U.S. Department of Justice — and part of the executive branch — the president can instruct the attorney general to reclassify cannabis into a different category of controlled substances.

Now, there might be pushback on such a move — from cannabis companies. That’s because there’s a bunch of companies that are doing very well with state-by-state legalization. Rescheduling weed would blow up the marijuana industry’s existing model. That probably means winners and losers.

Another thing Biden could do is slash the complex regulatory hurdles for cannabis companies. That would cut costs, so you don’t need pockets a mile deep to get into the business. Again, expect cannabis companies — who are good at jumping through hoops of red-tape — to push back on this.

I think rescheduling and deregulation would help most of America’s cannabis companies, and they’d fight it every step of the way. Like most Americans, they hate change.

There’s a third factor that could power marijuana stocks: profits.

The Rush to Profitability

After years of investment, more and more U.S. cannabis MSOs are edging toward profitability. The better ones are already there.

For example …

Grow Generation Corp. (Nasdaq: GRWG, Rated C) is a specialty garden center — catering to the pot-growing crowd — with 31 locations across 11 U.S. states. The company recently released their third-quarter earnings. Revenues rose 153% to $55 million. Earnings are projected to rise 229% this year and another 149% next year.

Green Thumb Industries Inc. (OTCQX: GTBIF, Rated D) is headquartered in Chicago and operates in 12 states. It just reported a tremendous quarter with revenue increasing 131% to $157.1 million. Green Thumb should swing to a profit this year and profits are projected to catapult 805% in 2021.

TerrAscend Corp. (OTCQX: TRSSF, Rated D) has vertically integrated operations in Canada, as well as Pennsylvania, California and New Jersey. It is forecast to lose money this year, then make a huge swing to profitability next year. Then again, earnings estimates for the current quarter have ratcheted up a whopping 89% in the past four weeks, so maybe it will get to profitability sooner than later.

You know what all three of these stocks have in common? They were all picked for greatness by our Weiss Cannabis Stock Rankings in the past few months. My Marijuana Millionaire Portfolio subscribers recently had open gains of 50% on Grow Generation, 63% on TerrAscend and 95% on Green Thumb.

And you know what? I think these stocks are going a LOT higher from here. They’re riding the great green wave. Grab a board and go along for the ride.

All the best,

Sean

P.S. —Don’t miss the URGENT CANNABIS INVESTOR BRIEFING I’m hosting with Dr. Martin Weiss this coming Monday, Nov. 16 at 2 p.m. Eastern (11 a.m. Pacific). For your free registration, click here now.