– Warren Zevon.

The recent action in the markets reminds me of the lyrics to the song “Send Lawyers, Guns and Money” by Warren Zevon. Except I don’t think investors should be hiring lawyers. Instead, there are three other investments they should consider. And yes, one of them IS guns.

As I write this, the market seems to be freaking out over the uncertainty surrounding the election. This means traders are selling almost everything. This will probably continue into the election next week. And if we don’t have a clear winner on Nov. 3? Or Nov. 4? Well, this rising sense of panic could continue a while longer.

People who cast specific blame on Republicans or Democrats for worsening cycles of chaos ignore much bigger forces that are in play.

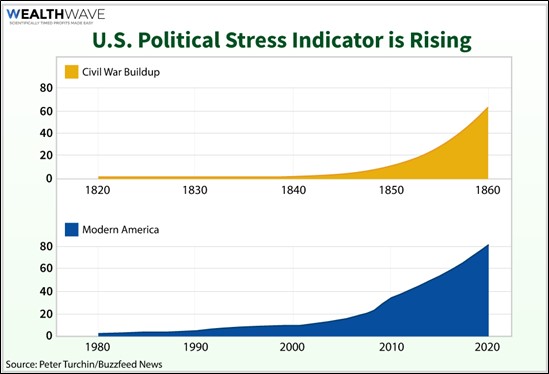

Sure, I talk about the war cycles, economic cycles and election cycles a lot. But it’s not just me. For example, Buzzfeed News just published an article chock-full of research data focusing on the “political stress indicator.” Let’s look at a couple charts from the article.

First, anthropologist Peter Turchin and sociologist Jack Goldstone have a model that measures political stress. And the scary thing is, the research shows that we’ve seen this in America before — in the run-up to the American Civil War.

The researchers have excellent credentials with the CIA and others in studying and identifying factors that predict when a nation is spiraling into chaos. Buzzfeed reports:

When Goldstone talks about America’s darkest days in the 1860s, he provocatively calls it the “First Civil War.” He fears that we may be on the way to a second one, with the 2020 election serving as a potential “fire-starter” event.

Let me add that this is only one possibility. Things could go wrong, but they could also go right.

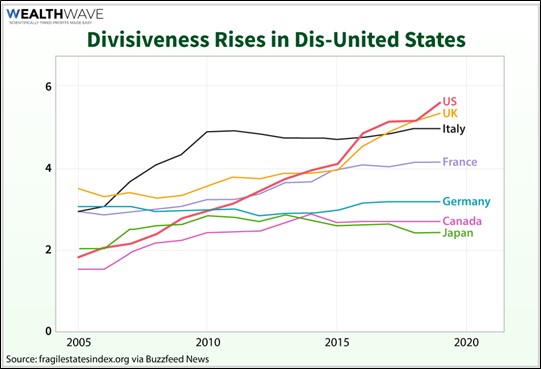

The second chart is from The Fund for Peace, a nonprofit that has developed a measure called the Fragile States Index (FSI) that seeks to identify nations that are at risk of violence and instability.

The line on the chart is a combined measure of security threats including terrorism, organized crime, factions in elites and widening separations between different groups in society. By these measures, the U.S. is in worse shape than other major powers. And we’re getting worse, faster.

What you as a citizen do about this is up to you. Today, I want to talk about what you as an investor can do.

There are three important things that need to be considered.

1. The Bull Market in Bitcoin

Bitcoin, the biggest and best-known cryptocurrency, is becoming the safe haven of choice in a time when central banks can print limitless paper currencies. Certainly, Bitcoin got a boost from the recent announcement by Paypal Holdings, Inc. (Nasdaq: PYPL, Rated B).

If you didn’t hear, payments platform PayPal says it will start accepting payments in digital currency. Since PayPal has over 26 million merchant accounts and 345 million users, that’s a HUGE door opening to acceptance of Bitcoin.

And it’s not just Bitcoin. PayPal’s announcement also stated that Ethereum, Litecoin and Bitcoin Cash would also be supported with the full rollout coming in 2021.

Another bullish factor is that major central bankers are talking about rolling out central bank digital currencies, or CBDCs.

Now, central banks aren’t doing this out of the goodness of their stony black hearts. If central banks shift to crypto, they will have even more power to control the supply of money.

In any case, support from a major payments platform like PayPal AND central banks is suddenly making crypto currencies a lot more respectable.

If the election triggers chaos in our financial system, Bitcoin may become even more of a safe haven.

2. Aiming for Gains in Guns

Protests are turning into riots. No wonder sales of guns and ammo are soaring. And it’s not just the usual suspects. Reuters reports that a new rush of first-time buyers are many women, minorities and liberals.

And this could go on long after the election. For one thing, I worry that more violence will break out which causes more people to buy more guns. For another, remember that during President Obama’s two terms in office, sales of firearms and ammunition increased sharply from the presidency of George W. Bush.

According to Aegis Capital analyst Rommel Dionisio, “Should we see a Biden-Harris administration get elected, I would anticipate a surge in sales of modern sporting rifles, high-capacity magazines and corresponding ammunition.”

Potential winners include firearms manufacturers Sturm, Ruger & Co., Inc. (NYSE: RGR, Rated C+) and Smith & Wesson Brands, Inc. (Nasdaq: SWBI, Rated D+) and ammunition manufacturers Vista Outdoor Inc. (NYSE: VSTO, Rated D+) and Olin Corp. (NYSE: OLN, Rated D+). Here’s how they have performed in the past month as the public has focused on the election.

RGR, SWBI and VSTO are not doing that well — yet — though they have outperformed the S&P 500. Only Olin is leaping higher, helped by a good earnings report.

So, unlike Bitcoin, gun manufactures are something you would buy with an eye toward future gains.

You know what else is in that category? Gold.

3. Going for the Gold

The yellow metal is falling this week and silver is going along for the ride, yelling “panic” all the way. The metals are getting trounced because the dollar is strengthening due to rising fears (that again!) and also the failure of Washington to pass its most recent attempt at a stimulus package.

So, why buy gold? Because this is a short-term dip. All the fundamental forces that pushed gold higher are still in play. The U.S. budget deficit soared to a record $3.1 trillion for fiscal 2020. That was more than triple fiscal 2019 and easily surpassed the previous record of $1.4 trillion recorded in 2009.

Do you think Washington will end its free-spending ways after the election, whoever gets elected? I’d say not likely.

In fact, if we are facing more civil unrest — and that’s what those studies I told you about are forecasting — then the government will likely have to spend more, not less.

That means the electronic money printing machines will kick into overdrive. Heck, they might make the jump to light speed. You can print all the money you want, but you can’t print gold.

And in the big picture of things, gold is just consolidating after a recent breakout.

In this big bull market for gold, pullbacks can be bought. Buying it now means you are buying it on the cheap. And if civil unrest hits the fan, you can bet that people will turn to the gold. It’s the ultimate harbor of safety.

The bottom line is we hope for the best but prepare for the worst. These investment ideas I’ve laid out are not for happy times. But they may get you through the tough times, and even better than you started.

All the best,

Sean