My Supercycle Investor subscribers just grabbed 104% gains on the green energy megatrend. We have plenty more positions to ride this trend, and I’m looking to add more. Here’s the best part: YOU can scoop up some of this profit potential as well.

After all, this megatrend is massive.

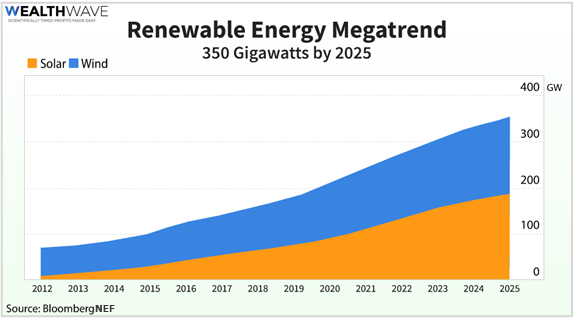

Just look at this chart of projected U.S. solar and wind installations.

According to a Bloomberg article, America will add 13.4 gigawatts (GW) of onshore wind and 10 gigawatts of utility-sized solar power this year alone. That will bring the combined capacity of U.S. solar and wind to more than 200 GW.

Looking down the road, we should have 350 GW of solar and wind in 2025. That’s just five years away. That’s 75% growth!

Why is this happening? Well, for one thing, solar photovoltaic (PV) power now offers some of the cheapest electricity ever produced. That’s according to the International Energy Agency (IEA). Its World Energy Outlook says:

“Solar PV is now consistently cheaper than new coal- or gas-fired power plants in most countries, and solar projects now offer some of the lowest cost electricity ever seen.”

In fact, the average cost per unit of energy for solar PV declined from 38 cents per kilowatt-hour in 2010 to 7 cents per kilowatt-hour in 2019. That’s a FIVE-FOLD decrease.

“I see solar becoming the new king of the world’s electricity markets,” said Fatih Birol, executive director of the IEA.

And the cost of onshore wind power is dropping like a rock, too.

Why is this happening? Well, the technology is getting much better. And manufacturing is scaling up. As that happens, costs go down.

How cheap could it get? Considering that solar energy is now 20-50% cheaper today than the IEA estimated in last year’s outlook, prices could fall even further. It has to stop at some point. You can’t give away energy for free. But it sure makes solar and wind competitive with coal.

And with solar and wind, you don’t have to put up with dirty air like you do with coal. In fact, another international study says new solar and wind projects are undercutting the cheapest and least sustainable of existing coal-fired plants.

The International Renewable Energy Agency (IRENA) says that by 2021 — next year — up to 1200 gigawatts of existing coal-fired capacity would cost more to operate than new utility-scale solar PV would cost to install.

And that’s leading to another massive trend: Utilities replacing coal power — and to a lesser extent, natural gas — with solar and wind. It is happening for one simple reason. Not because utilities all selflessly decide to “go green” — but because renewables are cheaper than what they’re using now.

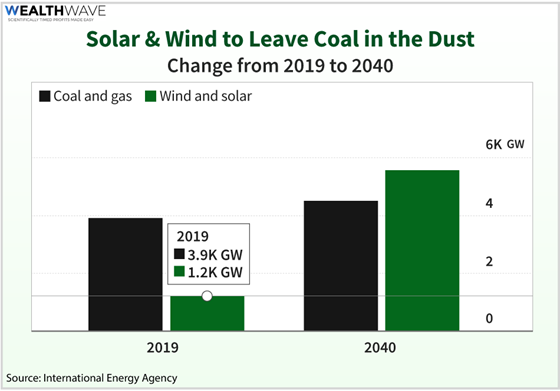

Take a look at this next chart …

This is the IEA’s forecast of utility energy use through 2040. By 2040, the IEA expects we’ll see 5,600 GW of wind and solar, compared to just 4,600 GW of coal and gas. That’s a big change from last year, which saw 3,900 GW of coal and gas to 1,200 GW of wind and solar.

The trend looks clear to me.

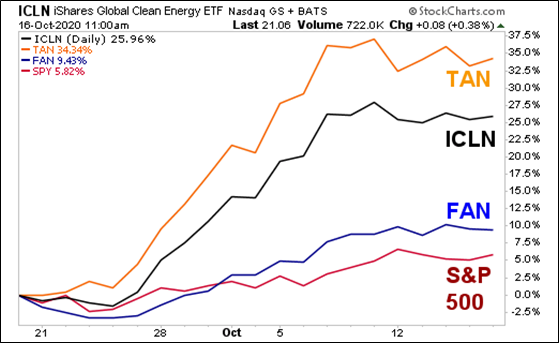

When I last wrote about this megatrend a month ago, I mentioned three funds that should profit from this megatrend: The iShares Global Clean Energy ETF (Nasdaq: ICLN, Rated B-), the Invesco Solar ETF (NYSE: TAN, Rated B-), and the First Trust Global Wind Energy ETF (NYSE: FAN, Rated C+).

Let’s look at a chart of how these three funds have performed since I mentioned them …

FAN is up the least 9.43% — but that’s still nearly double the gain in the S&P 500. ICLN is up 25.96%. TAN leads the pack at 34.34%. That’s nearly SIX times the performance of the S&P.

This shows one thing: It’s sure nice to have a megatrend on your side.

Is the party over for renewables? Hardly! I think I’ve made a good case today for why it’s just getting started. You can use one of these funds or buy individual stocks. Soon, you’ll be joining me and my Supercycle Investor subscribers with potential 100%+ gains.

All the best,

Sean