The shock and damage done to the world’s economies by the pandemic has caused contractions in gross domestic product (GDP) unparalleled in modern history … weighed down by demand destruction in various industries, such as automotive, construction, electronics and more.

Making matters worse, raw materials costs went up as shutdowns dried up important supplies. And the pandemic also raised the cost of shipping things around the world. All this came on top of cyclical factors.

And potentially faster-spreading variants of the coronavirus is increasing concern just as vaccines are being disseminated.

The variant causing the most alarm showed up in southeast England, prompting new lockdowns with travel bans from the U.K. to some other countries.

There are no confirmed cases of this variant in the U.S., though Dr. Anthony Fauci, director of the National Institute of Allergy and Infectious Diseases, said recently that it’s likely already here.

But he also said, “It doesn’t seem at all to have any impact on the virulence, or what we call the deadliness, of the virus. It doesn’t make people sicker. And it doesn’t seem to have any impact on the protective nature of the vaccines that we’re currently using.”

Even though it may take a while before mass vaccinations are available worldwide, governments are better positioned for economic recovery.

Both the U.S. Federal Reserve and the European Central Bank indicate they will be supporting the economy with loose monetary policy for the next three years.

Meanwhile, the International Monetary Fund is encouraging countries which can afford it to borrow, taking advantage of record low interest rates to promote economic growth.

And a new infrastructure boom could light a fire under the world economies when they need it most.

In the latest World Economic Outlook, the IMF estimates that during periods of uncertainty — like pandemics — 1% of GDP spent on public infrastructure could generate 2.7% in GDP growth and raise employment by 1.2% after two years … and boost private investment.

The real infrastructure story currently is going on halfway around the world in China, which announced $700 billion worth of new infrastructure and urbanization last summer.

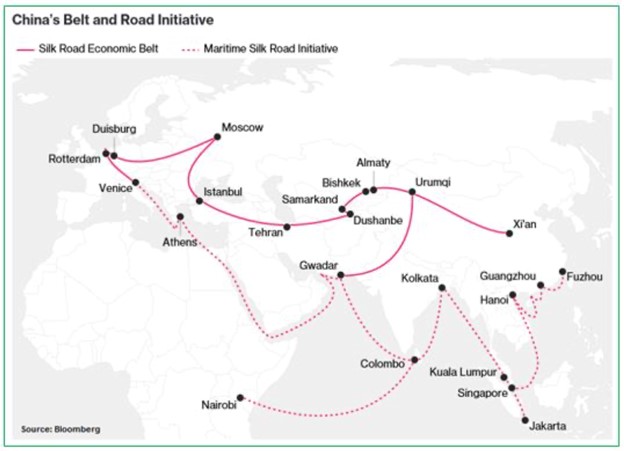

My friend and colleague Larry Edelson wrote extensively about China’s New Silk Road … an ambitious plan to rebuild ancient trade routes connecting the Middle Kingdom to Europe by land and sea. It’s the “Belt and Road Initiative” and it involves infrastructure spending the likes of which President-elect Joe Biden can only dream about.

Nevertheless, as part of his “Build Back Better” agenda, Biden has big plans as well …

He proposes a whopping $2.6 trillion to be spent on his version of the “Green New Deal”, including:

- 500,000 electric vehicle charging stations,

- New battery-storage and transmission infrastructure,

- Next-generation electric grid transmission and distribution systems,

- Ramped-up research in technology for permanently sequestering (or utilizing) captured carbon emissions,

- Upgrading 4 million buildings and weatherizing 2 million homes over four years,

- Protecting watersheds and clean-water infrastructure from man-made and natural disasters.

Other infrastructure spending would include:

- Universal, reliable, affordable high-speed internet for all Americans,

- Modernizing schools in line with the Rebuild America’s Schools Act,

- Adding 1.5 million homes and public housing units to address the affordable housing crisis,

- Repairing or replacing water pipelines and sewer systems,

- Upgrading treatment plants.

(Of course, these things have to be paid for. Even after accounting for the benefits of a stronger economy resulting from these policies, Moody’s projects the increase in the annual deficit by 2030 of around $2.6 trillion.)

So, how can you play this global infrastructure boom?

Here are the top three infrastructure ETFs …

1. iShares U.S. Infrastructure ETF (BATS: IFRA) tracks the NYSE FactSet U.S. Infrastructure Index, which provides exposure to a range of infrastructure companies, including railroads and utilities, materials and construction companies and more.

The fund’s top three holdings include Olin Corp. (NYSE: OLN), a manufacturer of chemicals and ammunition products; Fluor Corp. (NYSE: FLR), a provider of oil and gas infrastructure construction services; and Allegheny Technologies Inc. (NYSE: ATI), a producer of specialty materials such as titanium, nickel-based alloys, and more.

2. FlexShares STOXX Global Broad Infrastructure Index Fund (NYSE: NFRA) tracks the STOXX Global Broad Infrastructure Index. This ETF focuses on large-cap companies that derive at least half of their revenue from one or more of the following segments: energy, communications, utilities, transportation and government outsourcing, such as hospitals, prisons and postal services.

The fund is weighted towards North American equities, followed by Japan, Australia, Spain and others. Its top three holdings are Canadian National Railway Co. (CNR: TSE), Verizon Communications Inc. (NYSE: VZ) and class A shares of Comcast Corp. (Nasdaq: CMCSA).

3. ProShares DJ Brookfield Global Infrastructure ETF (NYSE: TOLZ) tracks the Dow Jones Brookfield Global Infrastructure Composite Index. The focus is on large-cap equities in developed markets with exposure to companies whose primary business is owning and operating infrastructure projects. These companies have high barriers to entry (i.e. “moats”) that limit competition. Companies that supply services, like construction and engineering, are excluded.

Its top three holdings are American Tower Corp. (NYSE: AMT), a real estate investment trust (REIT) that owns, operates and develops multi-tenant communications real estate; Crown Castle International Corp. (NYSE: CCI), a REIT that provides access to wireless infrastructure; and Enbridge Inc. (NYSE: ENB), a Canada-based energy transportation company.

My subscribers have access to SIX infrastructure-related plays in my Wealth Megatrends portfolio …

The most recent addition trades at 1.07 times sales and 2.16 times book value. Not bad for a company with $25 million in free cash flow per quarter. Plus, insiders have been snapping up this stock since May. I see a 30% short-term upside, with even higher gains likely.

Bonus: Many of these picks do a lot of international business. That means they can rally due to global forces even if the U.S. stays mired in political loggerheads.

If you want a closer look at what my Megatrends subscribers are seeing and hearing from me, click here.

If not, take a good look at those three ETFs and be prepared for the infrastructure megatrend to start gaining traction.

All the best,

Sean