Vroom! Vroom! 2 Bargain Car Stocks Leaving Tesla in the Dust

I’ve been banging the drum about EVs for a few years now … and 2020 saw them shift into higher gear.

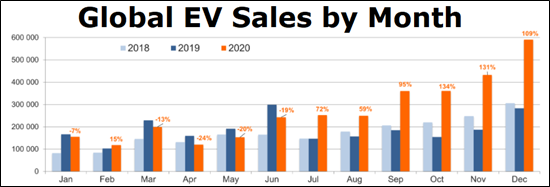

Just check out this monthly sales chart …

Sales of electric cars topped 3.24 million in 2020, up from 2.26 million in 2019. This, despite the fact that sales of all kinds of vehicles (including internal combustion vehicles) were down 20% year-over-year.

Sure, this is starting from a small base. Even with record sales, electric cars accounted for about 3% of global vehicle sales in 2020, according to Bernstein Research. But for investors, this is great news. This bull market is still a baby. It has a LONG way to go.

So, what ride should we choose for that journey? In the U.S., the first stock that comes to mind is Tesla, Inc. (Nasdaq: TSLA). After all, it’s cutting edge, right? Well, I’m going to tell you about two U.S. automakers that are putting the pedal to the medal to gain market share in EVs. And they’re MUCH better values than Tesla.

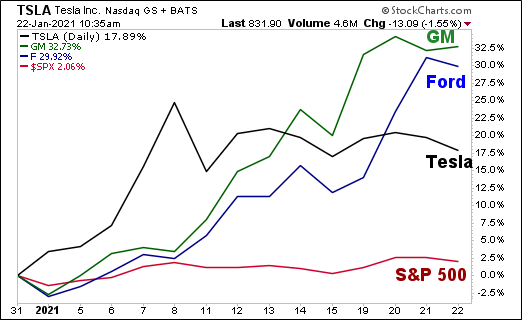

The smart money is probably onto this. Because the two stocks I’m talking about are Ford Motor Company (NYSE: F) and General Motors Co. (NYSE: GM). And so far in 2021, they’re leaving Tesla in the dust …

You can see that since the start of the year Ford is up 29.92% and GM is up 32.73%. That’s much better than Tesla, which is up 17.89%. And that performance is running rings around the S&P 500, up 2.06%.

But these old guard car manufacturers missed the bus on EVs, didn’t they? Nope. They’re playing catch-up, sure. But they’re shifting into higher gear.

For example, GM is boosting its spending on electric vehicles by about one-third, to $27 billion through mid-decade. And it just started a new business unit to sell electric vans.

Ford, meanwhile, has its own plans for an electric cargo van and a plug-in version of its popular F-150 pickup truck. Ford also recently began selling its first U.S. electric model, the Mustang Mach-E sport-utility vehicle.

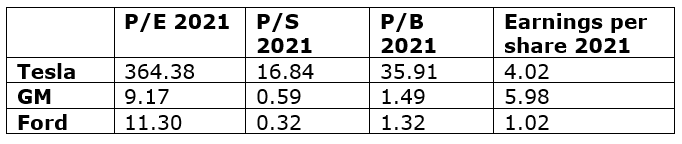

Now, let’s look at Tesla, GM and Ford on some common metrics, looking into next year. After all, EVs are a longer-term story.

GM and Ford are all cheaper on price-to-earnings, price-to-sales and price-to-book. And when it comes to earnings, GM is projected to earn more than Tesla in 2021, too.

I can see the real bargain in this comparison … and it isn’t Tesla.

If you want to ride along with the EV trend, and you prefer not to have single-stock risk, you can buy the Global X Autonomous & Electric Vehicles ETF (NYSE: DRIV). I recommended it to my Supercycle Investor subscribers a month ago and they’re already up about 20%.

Whether you buy a single stock or an ETF, don’t miss out on this opportunity. EVs are a megatrend that will shape the 21st Century. And you should be on that road to riches.

All the best,

Sean