Do you feel like making money? Potentially a lot of money? Good. I have three charts for you. Charts that will let you take a swing at huge profits. And potentially punch the lights out.

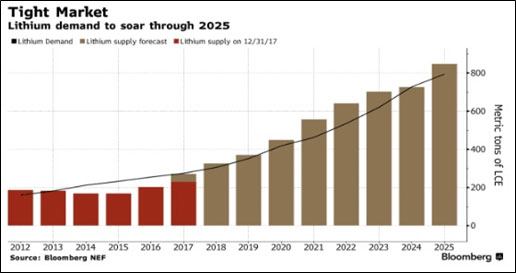

Here’s a chart of projected lithium supply and demand through 2025. See if you can spot the trend …

The black line is demand; the bars are FORECAST supply.

Funny thing about that forecast, though. It requires that every project planned makes it through to production on time. And as any miner will tell you, there is a Grand Canyon of difference between a mine plan and actual production.

Things go wrong. You’re lucky if it’s just an equipment failure. Sometimes government or quasi-government agencies get involved. Then, God help you.

Sometimes processes don’t work as planned. And that can throw the whole mine plan into question. Sometimes you just get the math wrong. There’s a world of difference between hope and hard numbers.

Let’s just say that I’m less sure of forecast supply than some of the big banks. But when it comes to demand, here’s the thing …

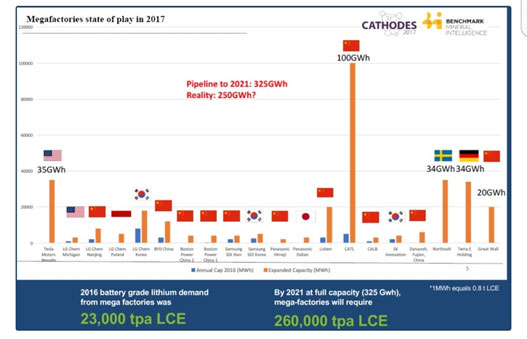

Those battery plants that are hoovering up all that lithium? They’re getting bigger. Month after month after month, somebody announces newer, bigger plants to produce batteries for electric vehicles.

As the chart from Benchmark Mineral Intelligence says, 325 gigawatts (GW) of mega-factories are planned to be in operation by 2021. That’s a huge jump from today. And you can bet more battery mega-factories will hit the drawing boards.

And that’s just the beginning. Now, utilities are talking about building energy storage to replace coal and gas-fired power plants. California utility PG&E wants to build a 300-megawatt (MW) storage plant and a 182.5-MW storage plant.

As more and more utilities around the world do that, well, that’s a game-changer. There are now 696 projects, with a total of 3,682 megawatts of battery storage, planned around the world.

So, if anything, there will likely be a supply squeeze. Indeed, Wang Xiaoshen, vice chairman of Ganfeng Lithium, says the Big Squeeze could start in 2023. That’s not that far away. You know the market will discount it in advance.

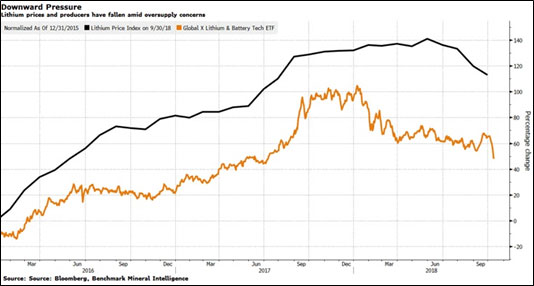

Now, let’s look at chart No. 3. This one, from Bloomberg, shows the opportunity.

Sure, we’ve seen lithium prices pull back. The price of lithium carbonate fell to $14,500 per metric ton in September, from a record high of $15,750 per ton in June. That’s pullback of 8%. In the big scheme of things, not a lot. But lithium stocks, as a group, are down 25% from highs hit earlier this year.

All the optimism has “WHOOSHED” out of this industry. This just shows that leverage can work for you, just like it can work against you. And therein lies your opportunity.

Go and look at that first chart again. The trend is huge. Unmistakable. And potentially very profitable.

An easy way to play this is with the Global X Lithium ETF (NYSE: LIT). But individual miners, explorers and developers have more leverage … and potentially much more upside. The good ones, anyway.

There’s your opportunity.

Now, do you have the big brass ones it takes to buy something when it’s on sale? Or will you let this “Wham, bam, thank you, ma’am” pass you by?

The choice is up to you.

All the best,

Sean