At the Las Vegas Money Show earlier this week, I interviewed the CEOs of some up-and-coming cannabis companies.

Something they both discussed was edibles. They see it as a booming part of the cannabis market.

And one thing seems clear: For investors, edibles are a key ingredient in the recipe for pot-stock riches.

According to a report from Zion Market Research, the global cannabis edibles market is expected to generate around $11.6 billion in revenue by 2025, indicating a compound annual growth rate (CAGR) of around 25.4%.

Meanwhile, as a whole, the cannabis industry is projected to see a CAGR of about 17.5%.

That’s very good — but the growth in edibles looks even better.

With that in mind, let me show you some video interviews from my time in Las Vegas with two companies that are cooking up profits.

Body and Mind: Pretzels to Help You Untwist from Stress

My first interview was with Body and Mind (CSE: BAMM; OTCQB: BMMJ), a multi-state operator (MSO) you may not have heard of because it’s smaller than most of the companies in our portfolio. Body and Mind operates in California, Nevada, Arkansas and Ohio.

One of Body and Mind’s products selling like hotcakes are cannabis-infused pretzel bites.

These pretzel bites are just one of numerous offerings from Body and Mind, which sells a full range of products from cannabis flower to tinctures to other edibles. CEO Michael Mills sat down with me to explain what the company is doing right.

When I looked at the company last week, I liked it so much I picked up some shares.

However, be aware that in the U.S., the stock only trades on the OTCQB, which can see thinner volumes than many investors are comfortable with.

Anyway, that’s a company with some great edibles. How about a company that is FOCUSED on edibles?

Indiva: The Willy Wonka Chocolate Factory for Cannabis

If there were a Willy Wonka’s Chocolate Factory for cannabis, it would be Indiva (TSX-V: NDVA; OTCQX: NDVAF).

With a market cap of just $50 million, this company has an outsized portion of the Canadian cannabis edibles market. In this video interview, CEO Niel Marotta gives us the scoop on his company’s recipe for success:

Indiva has a lot going for it. This small company’s grabbed just over 50% of Canada’s edibles market, and its revenues and margins are both growing by leaps and bounds.

Beyond Edibles: Cannabis Stocks Are the Value Play of the Decade

While edibles caught my eye at the Las Vegas MoneyShow, there’s value across the cannabis industry if you look at the right stocks. In fact, while cannabis stocks remain under pressure, they’re showing resilience that may indicate a bottom is coming.

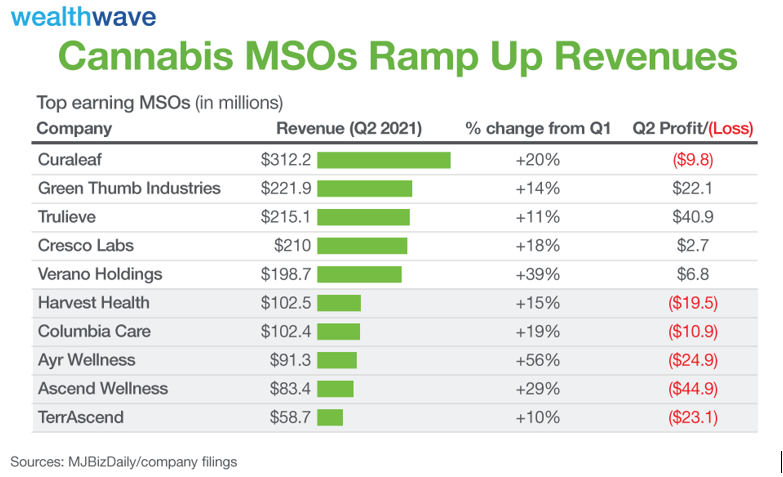

Here’s a chart that speaks to that by illustrating the revenues (and sometimes profits) of top U.S. MSOs in the last quarter:

You can see that U.S. MSOs are experiencing rip-roaring growth and turning profitable in a hurry. In fact, Curaleaf (OTCPK: CURLF) would be profitable if it wasn’t spending so much on rapid expansion in New York, which is going to be another cash cow.

And it’s not just New York …

• Mature markets are averaging 26% year-over-year sales growth.

Newer states are averaging 136% growth year over year. Sure, they’ll slow down eventually. But cannabis isn’t even federally legal yet.

• This tells us the best days are still ahead for this sector.

Heck, while I was at the Vegas conference, mega-investor Doug Kass, the president of Seabreeze Partners, told Bloomberg Radio that cannabis shares are at a “generational low.”

• Kass said buying cannabis shares now may be like buying the S&P 500 Index when it hit a low in March 2009 amid the financial crisis.

“Cannabis could be the greatest reward-vs.-risk of any sector I’ve encountered within the last decade,” Kass stated. “I’m accumulating shares aggressively.”

I believe he’s right.

ETFs Are a Safer Way to Play This Industry

There’s no question that individual stocks will give you bigger reward for your investment buck — but individual stocks also carry higher risk.

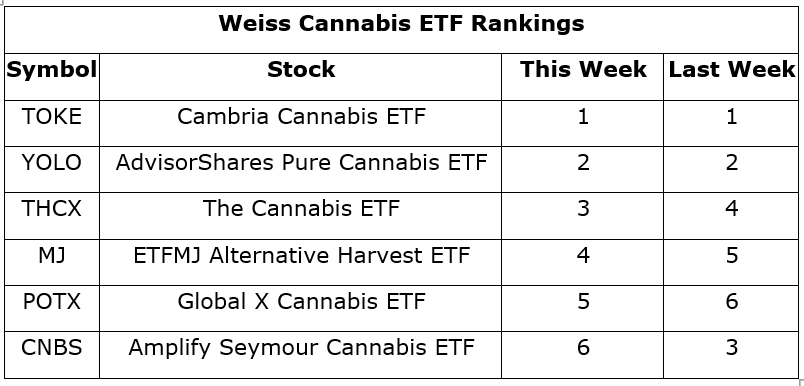

One way to lower your risk is to use exchange-traded funds (ETFs) that hold a basket of stocks in an industry or sector. Another is to use the Weiss Cannabis Stock Rankings that we use in our Marijuana Millionaire Portfolio as part of our stock selection process.

This system is proving the worth of its million-dollar price tag, guiding subscribers to gains even when the cannabis industry as a whole has been under pressure for months.

And today, as a treat, here’s a list of leading (but not all) cannabis stock ETFs, according to the Weiss Cannabis Rankings:

To be sure, the rankings do change from week to week. And these ETFs vary in what stocks they hold more than you might think.

So, if you’re not subscribing to Marijuana Millionaire Portfolio, you should definitely do your own research. But we are at a “generational low” in cannabis stocks.

Anyone in Vegas would like those odds.

All the best,

Sean