Hello from Sarasota. I’m here because my mother, Tess, just had knee replacement surgery and she’s stuck in rehab for a while. It’s always a pleasure to visit Mom, and now she can’t run away from me. Ha!

Anyway, though I’m on the road, I am still watching the markets. And you know how I’ve pounded the table recently about how the Fed will have to stop raising rates sooner rather than later.

Well, over the weekend, someone with a lot of heft in this market started agreeing with me …

The U.S. Federal Reserve has hiked interest rates relentlessly since 2016. This has pushed up the U.S. dollar, and weighed on gold. But is that going to continue? I can tell you right now, bond traders are losing faith in the Fed, big-time.

And that means a profit opportunity if you want to get ahead of the curve …

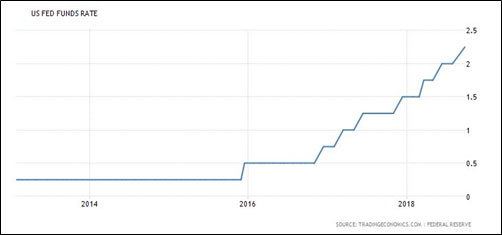

First, here’s a chart showing how the Fed has hiked rates.

|

That’s a pretty steep rate-hike schedule. And the Fed had more in mind. Until recently, the Fed was telegraphing another rate hike in December (to make three this year) and three more next year.

The key word there is “recently.”

Let’s look at what bond traders are anticipating now …

|

Looking at the chart, you can see that traders cut bets on rate hikes in 2019 at the end of last week. Markets are now factoring in fewer than two quarter-point hikes for next year. Compare that to the three rate hikes that policymakers project.

Sure, part of this is the carnage in the markets last week. But that’s only a small part of the picture. We can also add in that the housing market is tanking.

Last week, the Census Bureau reported new home sales fell for the fourth-straight month in September. In fact, they hit the lowest point in almost two years. The median sales price was also down from one year ago.

That’s bad for the whole economy, because home sales have a ripple effect. They drive sales of washing machines, kitchen appliances and other large consumer goods. Americans also tend to spend more when home prices are appreciating.

Now, there is no guarantee that the Fed will indicate it will take a pause on rate hikes, or that it will do that sooner rather than later.

But you know what’s going to take off when it does, right? I’ll spot you the “G” — you can guess the other three letters.

Silver will do well, too. And the stocks that are leveraged to these metals have zoom-zoom potential.

I’m recommending gold miners to my Supercycle Investor subscribers one after another. I just sent my Wealth Supercycle subscribers another precious metals pick on Friday. If you’re doing on this on your own, please be careful. And if you are willing to accept lower rewards to lower your risk, you can just buy the VanEck Vectors Gold Miners ETF (NYSE: GDX). It looks quite tasty right now.

Well, it’s time to visit Mom again. I just brought her a Carl Hiaasen novel, Razor Girl, yesterday, but she’s a voracious reader. I’ll get her thumbs up or down on the book and hand her a new one. I need to find one about a crime-fighting grandmother who solves mysteries in a rehab facility. That’s the ticket!

And thinking of Mom reminds me that while I do like gold a lot, there’s something much more important: Your health. And family, too. All our golden idols pale in comparison to those two.

I hope you have both good health and family, my friends. You might need them in the wild days ahead, if the Fed ignores the warning signs that the market is flashing at it desperately.

All the best,

Sean

Neil Mann October 30, 2018

Sean,

First off, I really like and enjoy the service you provide and relate to your sense of humor and ‘style’, so please keep below comment in context.

I am having trouble correlating the cycle chart trends with the some of the rhetoric and advice provided in Supercycle and Wealth Wave updates

Let me explain my current state of confusion. For both the Gold & Junior Miner charts, the Edelson model predicts about a 15% price drop between Nov 7th & Nov 30th, followed by about a 10% increase from there until mid-December.

I am confused because I do not get that sense from your Supercycle updates. Also confused about why the cycle charts are never referenced in the updated, or even mentioned.

I understand that all Supercycle subscribers may not be Edelson Institution members, so that part easy to understand, but where is the support for the cycle charts for the Edelson membership?

Seems to me that the cycle charts are intended to be a powerful tool for the membership to better gauge market trends when deciding whether to increase or decreases a position in that sector.

However, based on the non-user friendly format of chart cycle hyperlink attachments, it is time consuming and difficult to print them, especially without losing useful information, never mind difficulty of not having data points or scaleable

Lastly, even if all the above is not your call, could you please confirm that I’m not misunderstanding the information in the cycle chart plots, and that is the model prediction of prices for next few weeks.

Then forward this email to Martin Weiss, I want him to see there is at least one legacy Edelson member that does not like how his sales pitch emphasizes the importance of these cycle charts, but then you never hear about them again after you make a financial commitment to the service.

That is not right!

Best regards, and please keep up the otherwise excellent service.

Neil

Dawn P at Weiss Ratings November 1, 2018

Hi there, Neil. Thanks for your loyalty and for your feedback. We always want to hear what’s working and what we can do to give you the best subscriber experience possible.

Larry Edelson’s family has been very generous in letting us continue to share his cycle charts with his biggest fans. They appreciate that many of you have come to rely on them. The current team does not alter those charts in any way; we simply update them each week and let you have access to them for free instead of behind a paywall, like in the old days.

As those relate to Wealth Supercycle and Supercycle Investor, they are one of many tools in our trading toolbox. We use whichever tools are working, The overarching trends are the same — it’s the different tools that help us navigate the shorter-term trends that develop within them.

Thank you again for being a member of the family, and feel free to drop us a note anytime.

— Dawn