Many stocks are in a bear market … but not gold miners. They’re doing just fine. Better than fine. Today, I’m going to give you the top forces driving gold and miners higher — and how to play it.

Force #1: Fed Rate Hikes are Toast!

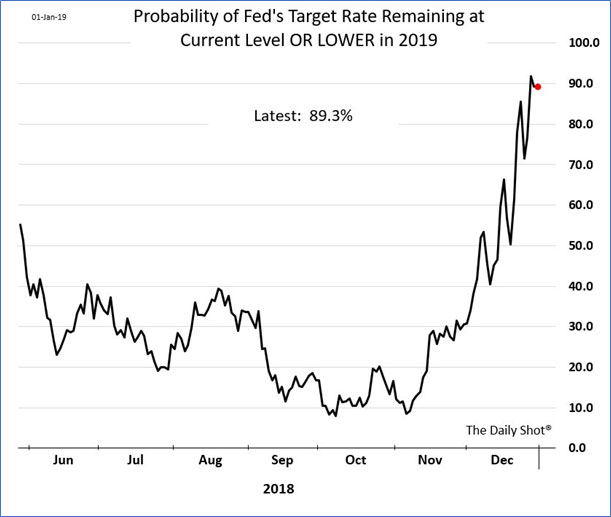

Money markets have been paring back expectations of rate hikes as economic data weakens and equities whipsaw. Last week, traders started pricing in no hike in the Federal Funds rate this year and better-than-even odds of a rate cut in 2020.

This week … well, this week the market is REALLY sure the Fed is done hiking rates.

|

Source: Wall Street Journal

Why does this matter for gold? Because gold is priced in U.S. dollars, and rate hikes make the dollar stronger. For a long time, the market anticipated dollar strength, which weighed on gold. Now, the tables have turned. The market is pricing an 89% probability that the Fed will not hike rates this year.

Force #2: Fear!

Gosh, traders are afraid. And who can blame them? The stock market is facing lower growth forecasts, surging corporate and government debt, a trade war with China, a partial shutdown of the U.S. government, and more. No wonder people are afraid.

Well, in a fear-filled environment, gold shines like a beacon. Gold is the ultimate safe harbor. And it’s acting like that safe harbor right now.

Force #3: The Chart!

Sure, charts can lie. As the old saying goes, “every sunken ship as a chart.” But charts can also be roadmaps to riches. And guess what the map of gold is saying now?

|

Gold isn’t in a bear market. Gold is VERY bullish. It’s blasted through two levels of resistance like they were rice paper. On the bottom of the chart, I’ve put a momentum indicator I use a lot called “The Force Index.”

The Force is with gold right now. And it’s setting its sights a lot higher.

You could certainly ride this move with the VanEck Vectors Gold Miners ETF (NYSE: GDX). It’s stuffed full of miners that are leveraged to the metal. Just remember that individual miners have the potential to outperform the index.

My Supercycle Investor subscribers know this, because they own five gold miners right now — including the best-performing gold miner of last year. I’ll be adding more soon. And as the market gasps, we laugh and step on the gas. I strongly suggest that you get on board now, before it’s too late.

If you’re doing this on your own, please be careful. Do your own due diligence. But don’t ignore this big move in gold.

All the best,

Sean