Are relatives taking up space in your house like old leftovers? Well, DON’T throw them in the trash. Instead, let me take your mind off your troubles with 10 terrific ways to make money in the alternative energy space.

I’m talking investment ideas in solar, wind, hydro, geothermal, uranium — even hydrogen. And I have a couple electric vehicle (EV) ideas in there to boot!

Check them out!

1. The Battle Over Our Battery-Powered Future

While EVs are the most common alternative fuel systems for cars and will likely win the race to replace gasoline and diesel vehicles … you could argue that HYDROGEN fuel cells are a better system.

Geothermal is one of the cleanest energy sources available. Furthermore, most geothermal power plants recycle the steam and water used by injecting it back into the Earth … helping to renew the resource!

Still, geothermal accounts for less than 1% of U.S. energy supplies, but it has the potential to produce as much as 8% by 2050, according to the U.S. Department of Energy.

Wave power is a means of producing electricity by converting energy from Earth’s oceans into clean energy. Oceans cover more than 70% of the planet’s surface. On a typical day, 23 million square miles of tropical seas absorb the radiation equal in heat content to roughly 250 billion barrels of oil.

And this past July, the U.S. Department of Energy (DOE) — in support of the Biden administration’s efforts to build a clean-energy economy by 2050 — announced $27 million in federal funding for research and development of commercial wave energy.

4. A ‘Dam’ Good Way to Power up Dividends

Hydropower is expected to remain the world’s largest source of renewable power through 2024, according to the International Energy Agency (IEA). And I have a couple of hydropower picks that pay big dividends.

5. Put Some Wind in Your Investment Sails

The Biden administration announced a plan to build seven mega wind farms in the Gulf of Mexico, the Gulf of Maine and off the coasts of the Carolinas, California, Oregon and the Mid-Atlantic states.

It’s all part of an effort to provide clean energy to over 10 million households by 2030. And I have some great ideas on how to play it.

Costs are falling, installations are booming and the sky’s the limit on solar-powered profits.

7. Energy Metals Send Up the BATT Signal

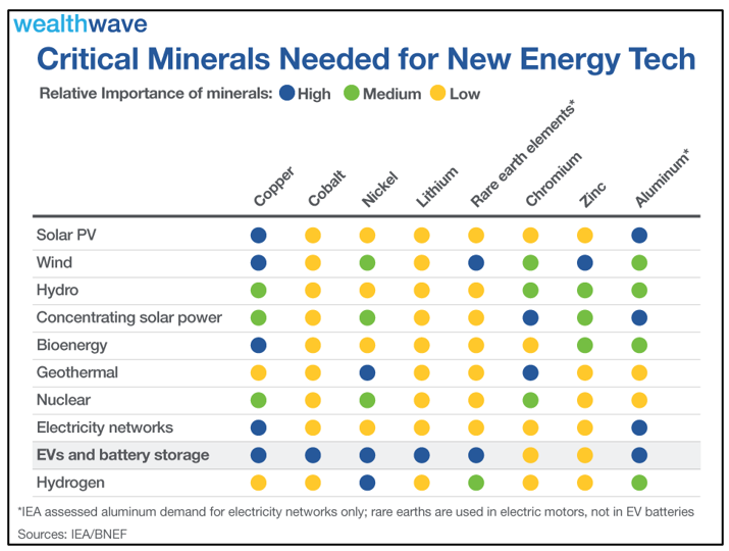

Battery and car manufacturers are frantically trying to lock in supply of battery metals. Why? Because they see charts like this one:

|

In order to bring the world in line with the stated policy goals in the legally binding Paris Climate Accords — which include a 50% reduction in emissions by 2030 and a 90% reduction by 2050 — we’re going to need A LOT of battery metals.

8. The U-Boat Is Setting Sail for Profits

Are you onboard the uranium boat yet? Or are you going to be left on the dock as the rest of us sail uncharted waters to potentially enormous wealth?

9. You Can’t Afford to NOT Buy an EV

Currently, EV market share in the U.S. is only 2.5%. President Biden wants that up to 100% by 2035. That is a HUGE gap of opportunity.

If all of President Biden’s proposed tax breaks for EVs are enacted, the government will be footing the bill for up to one-third of a new EV. Putting it plainly, you won’t be able to afford to NOT buy an EV.

10. 3 EV Speed Bumps & 3 Potential Profits

Sure, there are obstacles to an EV future. But overcoming them could prove very profitable for smart investors.

Next week, we’ll have fresh new ideas on how to protect your portfolio and potentially profit. Until then, I hope you’re having a great Thanksgiving weekend.

All the best,

Sean